Intermediate Accounting, Seventh Canadian Edition

INTERMEDIATE

ACCOUNTING

Seventh Canadian Edition

KIESO, WEYGANDT, WARFIELD, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA

Northern Alberta Institute of Technology

C H A P T E R

14

Current Liabilities and

Contingencies

Learning Objectives

1. Define liabilities and differentiate between financial and other liabilities.

2. Define current liabilities, describe how they are valued, and identify common types of current liabilities.

3. Explain the classification issues of short-term debt expected to be refinanced.

4. Identify and account for the major types of employee-related liabilities.

Learning Objectives

5. Explain the accounting for common estimated liabilities.

6. Explain the recognition, measurement and disclosure requirements for asset retirement obligations.

7. Explain the accounting and reporting standards for loss contingencies and commitments.

8. Indicate how current liabilities, and contingencies and commitments are presented and analysed.

Current Liabilities and

Contingencies

•

•

•

•

•

What is a liability?

What is a current liability?

Estimate liabilities

Contingencies, commitments, and guarantees

Presentation and analysis

Liabilities in General

•

•

Liabilities are:

• Obligations of an enterprise

• Arising from past transactions or events

• The settlement of which may result in the transfer of assets, provision of services, or other yielding of economic benefits in the future

Defined in Section 1000 of CICA Handbook

Liabilities in General

Three essential characteristics of a liability are:

1.

Obligation to be settled on a determinable date or on the occurrence of an event, requiring the transfer or use of an asset or provision of a good or service

2. There is little or no discretion to avoid the obligation

3. Obligation arises from a transaction or event which has already occurred

Financial Liabilities

• Contractual obligation to deliver cash or other financial asset, or to exchange financial instruments under conditions that are potentially unfavourable

• Distinction more significant as accounting model begins to measure financial assets and liabilities at fair value instead of historic cost

Current Liabilities

• Current liability described as ( not defined in

CICA Handbook) :

“Amounts payable within one year from the date of the balance sheet or within the normal operating cycle where this is longer than a year.”

Current Liabilities

Common current liabilities include:

1. Bank indebtedness and credit facilities

2. Accounts Payable

3. Notes payable

4. Current maturities of longterm debt

5. Short-term debt expected to be refinanced

6. Dividends payable

7. Returnable deposits

8. Unearned revenues

9. Sales taxes payable

10. Goods and Services Tax

11. Income taxes

12. Employee-related liabilities

13. Rents and royalties

Bank Indebtedness

• Line-of-credit (revolving debt)

• Amounts are advanced as required up to a negotiated limit

• Repayments made whenever there are sufficient funds available

• Amount borrowed reported on balance sheet; availability of funds and restrictions given note disclosure

Accounts Payable

• Amounts owed for goods or services purchased on open account

• Liability recorded when title has passed

• Recorded at cost

Notes Payable

• Notes payable may be interest-bearing or zero-interest-bearing (non-interest-bearing)

• In both cases interest expense is determined whenever financial statements are prepared

• For zero-interest-bearing notes , the difference between the present value of the note and the face value of the note represents the discount on the note payable and the related interest

• The discount is the interest expense chargeable to future periods

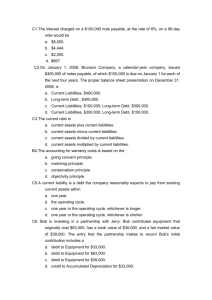

Interest-Bearing

Notes Payable

Given:

Landscape Corp. borrows $100,000

Signs a 4-month, 12% note on March 1

Journal Entries to record

• Signing of note

• Interest accrual at June 30 year end and

• Note repayment

Interest-Bearing

Notes Payable

March 1:

Cash 100,000

Notes Payable 100,000

June 30:

Interest Expense 4,000

Interest Payable 4,000

(100,000 x 12% x 4/12)

July 1:

Notes Payable 100,000

Interest Payable 4,000

Cash 104,000

Zero-Interest-Bearing

Notes Payable

Given:

Landscape Corp. issues a $104,000, 4-month, zero-interest-bearing note on March 1

Present value (PV) of note and cash received is

$100,000

Journal entries to record the signing and repayment of the note

Zero-Interest-Bearing

Notes Payable

March 1:

Cash 100,000

Discount on Note Payable 4,000

Notes Payable 104,000

In effect: $100,000 borrowed for four months and $4,000 interest = $104,000 maturity value

Zero-Interest-Bearing

Notes Payable

June 30:

Interest Expense 4,000

Discount on Note Payable 4,000

July 1:

Note Payable

Cash

104,000

104,000

•

•

•

Current Maturities of

Long-Term Debt

The portion of long-term debt maturing within 12 months from the balance sheet date is reported as a current liability

Long-term debts should not be reported as current liabilities if:

1.

they are retired by assets not classified as current assets

2.

3.

they are refinanced or retired by new issues of debt they are converted into share capital

Any liability due on demand is reported as a current liability

Short-Term Debt Expected to be

Refinanced

•

•

Short-term debt may be excluded from current liabilities if:

• there is intent to refinance on a long-term basis, and

• the entity demonstrates the ability to complete the refinancing

The entity has the ability to refinance if:

• the debt is actually refinanced before issue of the financial statements, or

• the entity enters into a refinancing agreement

Short-Term Debt Replaced by Long-

Term Debt (Illustration 14-2)

Liability

$40,000

How to classify?

Liability of

$40,000 paid off

Issues long-term debt of

$100,000

Liability of

$40,000 classify as current

Dec. 31,

2005

Balance sheet date

Jan. 17,

2006

Feb. 3, 2006 Mar. 1,

2006

Balance sheet issued

Dividends Payable

• Cash Dividend

– Becomes legal obligation on declaration date

– Classified as current liability

• Dividends in Arrears

– Cumulative preferred dividends that have not been declared require note disclosure

• Stock Dividends

– Not a liability; does not meet criteria

– Recorded only through equity accounts

Unearned Revenues

• When cash is received before the product or service is rendered

– Examples include gift certificates, prepayment for subscription

• Current liability is created by the transaction

• When cash is received :

Dr. Cash; Cr. Unearned Revenue

• When revenue is earned (service or good is provided)

Dr. Unearned Revenue; Cr. Revenue

Goods and Services Tax (GST)

• GST Payable

– Represents amount collected on eligible sales

• GST Recoverable

– GST paid on eligible purchases

• Net amount remitted to (due from) CRA

Employee-Related Liabilities

• Employee-related liabilities include the following:

• salaries or wages owed to employees at end of the accounting period

• payroll deductions owed to CRA and others

• compensated absences obligations

• bonuses

• Reported as current liabilities

Payroll Deductions

• Payroll deductions include statutory and discretionary deductions

• Statutory (mandatory) deductions include:

• Canada (Quebec) Pension Plan [CPP/QPP]

• Employment Insurance (EI)

• Income Tax Withholding (Federal and Provincial)

• Discretionary deductions might include:

• Medical insurance

• Union dues

Compensated Absences

•

•

•

Compensated absences are absences from employment for which employees are paid

•

•

A liability for such absences must be accrued if:

• employer’s liability relates to services already rendered by employees

• the liability relates to employee’s vested or accumulated rights payment of the compensation is probable, and the amount can be reasonably estimated.

The liability is recognized in the year it is earned by employees

Estimated Liabilities

• Recognized in the current period as it is likely that an obligation will result

– Obligation is derived from revenue that is recognized in the current period

Product Guarantee and

Warranty Obligations

•

•

•

Warranty - promise made by a seller to a buyer to make good on a deficiency (quantity, quality, or performance)

Warranties entail future “post-sale costs”

Warranty accounting dependent on how the warranty is “sold”

– Warranty provided as part of the product price

– Warranty sold as a separate item

Warranty Embedded in Sales

Price of Product

• Considered an estimated cost/liability

• Accounted for using the expense warranty method

– Warranty costs expensed in year of sale

– Warranty liability recognized

– Two available methods for accounting

Warranty Embedded in Sales

Price of Product

Method A

• Warranty costs charged to the expense as incurred

• Adjusting entry required at period end to accrue remaining estimated liability and expense on current period sales

• Warranty liability reported for the estimated amount of outstanding claims

•

•

•

Method B

Total estimated warranty expense and liability recognized and recorded at the point of the sale

Warranty costs charged against liability as incurred

Warranty liability reported for the estimated amount of outstanding claims

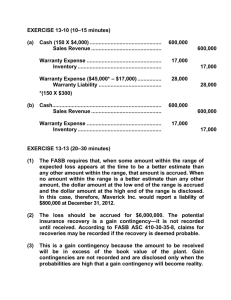

Expense Warranty Method:

Example

Given:

• Units sold in 2005 : 100 units at $5,000

• Expected repair cost (under 1-year warranty) per unit:$200

• Actual repair costs incurred in 2000: $4,000

• The entity has the calendar year as its fiscal year

Record the warranty expense for 2005

Expense Warranty Method:

Example (Method A)

Warranty Expense Recognition (Time of Sale):

No entry made

Actual Warranty Costs in 2005:

Warranty Expense 4,000

Cash/Inventory/Payroll 4,000

Year-end adjusting entry, Dec. 31, 2005:

Warranty Expense 16,000

Estimated Warranty Liability 16,000

Expense Warranty Method:

Example (Method B)

Warranty Expense Recognition (Time of Sale):

Warranty Expense 20,000

Estimated Warranty Liability 20,000

100 units @ $200

Actual Warranty Costs in 2005:

Estimated Warranty Liability 4,000

Cash/Inventory/Payroll 4,000

Year-end adjusting entry, Dec 31, 2005:

No entry required

Product Guarantee and Warranty

Obligations-Use of Cash Basis

• Warranty costs charged to the period in which the costs are paid

– No estimated liability recorded or reported

• Acceptable for accounting purposes when:

– Warranty costs are immaterial, or

– Warranty period is relatively short

• Required for income tax purposes

Warranty Sold Separately

• Applies to extended product warranties; or warranties sold as separate product

• Accounted for using sales warranty method

– Revenue from warranty sale deferred

– Recognized over life of the warranty using straight-line method

Sales Warranty Method: Example

You have just purchased a new vehicle and an extended warranty on your new vehicle

• Cost of the vehicle: $20,000

– Vehicle has a 3-year warranty (included in price of car)

• Cost of the extended warranty: $600

• Extended Warranty period: 3 years or beginning in Year 4

Entries to record this warranty:

Sales Warranty Method: Example

Record the initial sale:

Cash

Sales

20,600

20,000

Unearned Warranty Revenue 600

Entries in Year 4, 5 and 6:

Unearned Warranty Revenue 200

Warranty Revenue

($600

3 years)

200

Premiums, Coupons, Rebates, and Loyalty Points

• Costs of these offers expensed in the period benefitting the period of the underlying sale

• Costs of outstanding offers estimated and recorded/reported as current liability

Asset Retirement Obligations

(ARO)

• CICA Handbook, Section 3110 requires a company to recognize an existing legal obligation associated with the retirement of a tangible long-lived asset that results from its acquisition, construction, development, or normal operations, in the period it is incurred, provided a reasonable estimate can be made of its fair value

Asset Retirement Obligations

(ARO)

• Existing legal obligations include those related to:

1. Decommissioning nuclear facilities

2. Dismantling, restoring, and reclamation of oil and gas properties,

3. Certain closure, reclamation, and removal costs of mining facilities, and

4. Closure and post-closure costs of landfills

ARO Measurement and

Recognition

• Initial measurement at fair value

– Amount paid in an active market to settle ARO

– Estimate based on market prices of similar liabilities

– Estimate based on PV calculations

• Recognition and allocation

– Capitalized ARO costs are not recorded in separate account

• No future economic benefit of costs alone

• Part of the underlying asset cost

– ARO costs amortized over underlying asset’s useful life

ARO – An Example

• Oil Platform erected January 1, 2005

• Platform must be dismantled at the end of the useful life: 5 years

• Estimated cost of dismantling:

$1,000,000

• Discount rate: 10%

• PV of the dismantling cost (ARO):

$620,920

ARO – An Example

Journal entry to recognize ARO, Jan 1, 2005:

Drilling Platform 620,920

ARO 620,920

(Drilling Platform is the underlying asset account)

Year-end Adjustment journal entries (2005 – 2009):

Amortization Expense 124,184

Accumulated Amortization 124,184

($620,920

5 years = $124,184)

ARO – Increase Due to interest

• Interest on the ARO must also be recorded

– Because the ARO is initially recorded and reported at PV

• Interest cost may not be classified as interest expense

– Generally called accretion expense

• Accretion amount calculated using the same rate used to calculate the PV (the discount rate)

ARO – An Example

Year-end Accretion Amount:

Accretion Expense 62,092

ARO

($620,920 x 10% = $62,092)

62,092

Record ARO Settlement, January 2010:

ARO 1,000,000

Gain on Settlement of ARO 5,000

Cash 995,000

Assuming that the actual cost of the dismantling and removal was $995,000

ARO – Reporting and Disclosure

• Must report description of the ARO and the underlying asset

• Assumptions used in determining reported amounts

• Reconciliation of the liability (opening and closing balance)

• Fair value of legally restricted assets for settling ARO

Contingency: Definition

A contingency is (CICA Handbook, Section

3290) :

An existing condition or situation involving uncertainty as to possible gain (gain contingency) or loss (loss contingency)… that will ultimately be resolved when one or more future events occur or fail to occur

Loss Contingencies: General

•

•

•

Loss contingencies involve situations of possible loss at the balance sheet date

A liability incurred as a result of a loss contingency is a contingent liability

The likelihood of occurrence of the future event may be:

•

• Likely (high chance)

Unlikely (slight chance)

• Not determinable (the chance of the event occurrence cannot be determined)

Loss Contingencies: Accrual

•

•

Estimated losses from loss contingencies are accrued as liabilities if both of the following conditions are met:

• it is likely that a future event will confirm that a liability has been incurred, at the balance sheet date and

• the amount of loss can be reasonably estimated

It is not necessary that the exact payee or the exact date of payment be known

Accounting and Reporting

Standards for Loss Contingencies

Probability

Likely

Loss can be reasonably estimated?

Yes No

Accrue Notes

Not Likely No Disclosure No Disclosure

Not Determinable Notes* Notes*

* Disclose the nature of the contingency and either an estimate of the amount or an explanation that an estimate cannot be made

Litigation, Claims, and

Assessments

•

•

To determine whether a liability should be recorded , evaluate:

– the time period in which the underlying cause of action occurred

–

– the probability of an unfavorable outcome* the ability to make a reasonable estimate of loss

*Consider:

– nature of litigation and progress of case

–

– opinion of legal counsel

Experience in similar cases

– response by management

Guarantees

• New AcG-14 “Disclosure of Guarantees”

• Supplements contingencies, contractual obligations, financial instruments

• Disclose additional information about risks assumed by guarantees made, even if likelihood of having to make good is remote

• Example: Standby letter of credit guaranteeing another’s payment of a loan

Contractual Obligations

• Not liability as at balance sheet date, but do represent a commitment of future funds

• CICA Handbook, Section 3280 highlights contractual obligations that require disclosure

1. Unusual high speculative risk involved

2. Expenditures high relative to size of business

3. Involve share issue

4. Level 1 of expenditure dictated for a long period of time

Presentation of Current

Liabilities

• Disclose separately: bank loans, trade creditors and accrued liabilities, taxes, dividends, deferred revenue, future income taxes, amounts owing from related parties

• Identify secured liabilities and related assets pledged

Analysis of Current Liabilities

Current Ratio:

Current Assets

Current Liabilities

Acid-Test Ratio:

Cash + Marketable Securities + Net Receivables

Current Liabilities

Days Payables Outstanding:

Average Trade Accounts Payable

Average Daily Cost of Goods Sold

COPYRIGHT

Copyright © 2005 John Wiley & Sons Canada, Ltd.

All rights reserved.

Reproduction or translation of this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is unlawful. Requests for further information should be addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his or her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages caused by the use of these programs or from the use of the information contained herein.