CHAPTER 13 Accounting for Partnerships and Limited Liability

advertisement

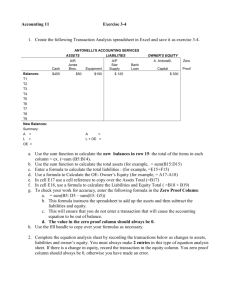

CHAPTER 13 Accounting for Partnerships and Limited Liability Corporations EXERCISES Ex. 13–1 TENDER HEART GREETING CARDS INC Statement of Stockholders’ Equity For the Year Ended December 31, 2006 Paid-In Common Capital in Stock, Excess Treasury Retained $2 Par of Par Stock Earnings Balance, Jan. 1, 2006 ... Issued 50,000 shares of common stock .... Purchased 10,000 shares as treasury stock ........................ Net income .................... Dividends ...................... Balance, Dec. 31, 2006 . $500,000 $400,000 100,000 45,000 — $1,075,000 $1,975,000 145,000 $(25,000) $600,000 Total $445,000 $(25,000) (25,000) 240,000 240,000 (50,000) (50,000) $1,265,000 $2,285,000 Ex. 13–2 Cash ..................................................................................... Accounts Receivable .......................................................... Merchandise Inventory ....................................................... Equipment............................................................................ Allowance for Doubtful Accounts ................................ Todd Jost, Capital .......................................................... 6,000 91,000 76,500 90,000 8,000 255,500 Ex. 13–3 a. b. c. d. ........................................................................................ ........................................................................................ ........................................................................................ ........................................................................................ 1 Moore Knell $60,000 80,000 57,600 55,000 $60,000 40,000 62,400 65,000 e. ........................................................................................ 61,000 59,000 Details Moore Knell Total a. Net income (1:1) .......................................... $60,000 $60,000 $120,000 b. Net income (2:1) .......................................... $80,000 $40,000 $120,000 c. Interest allowance ....................................... Remaining income (2:3) ............................. Net income .................................................. $24,000 33,600 $57,600 $12,000 50,400 $62,400 $ 36,000 84,000 $120,000 d. Salary allowance ......................................... Remaining income (1:1) ............................. Net income .................................................. $40,000 15,000 $55,000 $50,000 15,000 $65,000 $ 90,000 30,000 $120,000 e. Interest allowance ....................................... Salary allowance ......................................... Excess of allowances over income (1:1) .. Net income .................................................. $24,000 40,000 (3,000) $61,000 $12,000 50,000 (3,000) $59,000 $ 36,000 90,000 (6,000) $120,000 Moore Knell Ex. 13–4 a. b. c. d. e. ........................................................................................ ........................................................................................ ........................................................................................ ........................................................................................ ........................................................................................ $ 90,000 120,000 81,600 85,000 91,000 $90,000 60,000 98,400 95,000 89,000 Details Moore Knell Total a. Net income (1:1) ................................................ $ 90,000 $90,000 $180,000 b. Net income (2:1) ................................................ $120,000 $60,000 $180,000 c. Interest allowance ............................................. Remaining income (2:3) ................................... Net income ........................................................ $ 24,000 57,600 $ 81,600 $12,000 86,400 $98,400 $ 36,000 144,000 $180,000 d. Salary allowance ............................................... Remaining income (1:1) ................................... Net income ........................................................ $ 40,000 45,000 $ 85,000 $50,000 45,000 $95,000 $ 90,000 90,000 $180,000 e. Interest allowance ............................................. $ 24,000 $12,000 $ 36,000 2 Salary allowance ............................................... Remaining income (1:1) ................................... Net income ........................................................ 40,000 27,000 $ 91,000 50,000 27,000 $89,000 90,000 54,000 $180,000 Ex. 13–5 Salary allowances .......................................... Remainder ($120,000)(net loss, $20,000 plus $100,000 salary allowances) divided equally .......................................... Net loss ........................................................... Jane Williams Y. Osaka $ 40,000 $ 60,000 $ 100,000 (60,000) $ (20,000) (60,000) $ 0 (120,000) $ (20,000) Total Ex. 13–6 The partners can divide net income in any ratio that they wish. However, in the absence of an agreement, net income is divided equally between the partners. Therefore, Jim’s conclusion was correct, but for the wrong reasons. In addition, note that the salary allowances have no impact on the division of income. Ex 13–7 a. Net income: $106,000 Salary allowance ............................................ Remaining income ......................................... Net income ...................................................... Bennings Hodges Total $32,000 12,600 $44,600 $53,000 8,400 $61,400 $ 85,000 21,000 $106,000 Bennings remaining income: ($106,000 – $85,000) × (3/5) Hodges remaining income: ($106,000 – $85,000) × (2/5) b. (1) Income Summary ................................................................ L. Bennings, Member Equity ......................................... L. Hodges, Member Equity ............................................ 3 106,000 44,600 61,400 (2) L. Bennings, Member Equity .............................................. L. Hodges, Member Equity ................................................. L. Bennings, Drawing .................................................... L. Hodges, Drawing ....................................................... 32,000 53,000 32,000 53,000 Note: The reduction in members’ equity from withdrawals would be disclosed on the statement of members’ equity but does not affect the allocation of net income in part (a) of this exercise. Ex 13–8 a. Salary allowance ...................... Interest allowance (8%) ............ Total allowances....................... Remaining income (4:3:3)........ Net income ................................ WXXY Radio Partners John Higgins Daily Call Newspaper, LLC $ 12,800 $ 12,800 217,840 $230,640 $125,000 7,600 $132,600 163,380 $295,980 $ 20,000 $ 20,000 163,380 $183,380 Total $125,000 40,400 $165,400 544,600 $710,000 b. Dec. 31, 2006 Dec. 31, 2006 Income Summary.......................................... WXXY Radio Partners, Member Equity . John Higgins, Member Equity ................ Daily Call Newspaper, LLC, Member Equity .................................................. 710,000 WXXY Radio Partners, Member Equity ....... John Higgins, Member Equity ..................... Daily Call Newspaper, LLC, Member Equity WXXY Radio Partners, Drawing ............. John Higgins, Drawing ........................... Daily Call Newspaper, LLC, Drawing ..... 12,800 132,600 20,000 230,640 295,980 183,380 12,800 132,600 20,000 c. MEDIA PROPERTIES, LLC Statement of Members’ Equity For the Year Ended December 31, 2006 WXXY Radio Partners Daily Call John Newspaper, Higgins LLC Total Members' equity, January 1, 2006 ......... $160,000 $ 95,000 $250,000 $ 505,000 4 Additonal investment during the year ... 50,000 50,000 $210,000 $ 95,000 $250,000 $ 555,000 Net income for the year .......................... 230,640 295,980 183,380 710,000 $440,640 $390,980 $433,380 $1,265,000 Withdrawals during the year .................. 12,800 132,600 20,000 165,400 Members' equity, December 31, 2006 .... $427,840 $258,380 $413,380 $1,099,600 Ex. 13–9 a. (1) (2) Income Summary ......................................................... Walt Bigney, Capital ............................................... Dan Harris, Capital .................................................. 160,000 Walt Bigney, Capital ..................................................... Dan Harris, Capital ....................................................... Walt Bigney, Drawing ............................................. Dan Harris, Drawing................................................ 72,000 84,000 80,000 80,000 72,000 84,000 b. BIGNEY AND HARRIS Statement of Partners’ Equity For the Year Ended December 31, 2006 Capital, January 1, 2006................................. Additional investment during the year ......... Net income for the year ................................. Withdrawals during the year ......................... Capital, December 31, 2006 ........................... Walt Bigney Dan Harris Total $ 80,000 10,000 $ 90,000 80,000 $170,000 72,000 $ 98,000 $ 95,000 — $ 95,000 80,000 $175,000 84,000 $ 91,000 $175,000 10,000 $185,000 160,000 $345,000 156,000 $189,000 Ex 13–10 a. Jan. 31 Partner Drawing ................................... Cash ................................................ 20,000,000 Income Summary................................. Partner Capital................................ 200,000,000 20,000,000 b. Dec. 31 5 200,000,000 c. Dec. 31 Partner Capital ..................................... Partner Drawing ............................. 240,000,000* 240,000,000 *12 months × 20,000,000 d. Dec. 31 Cash...................................................... Partner Capital................................ 40,000,000 40,000,000 During the year, the partners withdrew 40 million pounds more than what was earned. This represents a distribution of capital beyond the current year’s earnings. According to the operating agreement, this difference must be returned to the partnership. Ex. 13–11 a. and b. Kirk, Capital ................................................................... McCoy, Capital.......................................................... 30,000 30,000 Ex. 13–12 a. $811,000 ($1,840,000,000 2,270), rounded b. $132,000 ($300,000,000 2,270), rounded c. A new partner might contribute more than $132,000 because of goodwill attributable to the firm’s reputation, future income potential, a strong client base, etc. Ex. 13–13 a. b. (1) Susan Yu, Capital.................................................... Ben Hardy, Capital .................................................. Ken Mahl ............................................................ 25,000 18,000 (2) Cash ......................................................................... Jeff Wood, Capital ............................................. 35,000 Susan Yu ....................................................................... Ben Hardy ..................................................................... Ken Mahl ....................................................................... Jeff Wood ...................................................................... 75,000 72,000 43,000 35,000 6 43,000 35,000 Ex. 13–14 a. b. Cash .............................................................................. Cecil Jacobs, Capital ................................................... Maria Estaban, Capital ................................................. Lee White, Capital .................................................... 45,000 5,000 5,000 Cecil Jacobs ................................................................. Maria Estaban ............................................................... Lee White ...................................................................... 56,000 54,000 55,000 55,000 Ex. 13–15 a. Conway, Member Equity ................................................ Patel, Member Equity...................................................... Medical Equipment .................................................... 1$14,000 2$14,000 5,6001 8,4002 14,000 2/5 = $5,600 3/5 = $8,400 b. 1. Cash ............................................................................ Conway, Member Equity ...................................... Patel, Member Equity ........................................... Truet, Member Equity........................................... 340,000 20,080 30,120 289,800 Supporting calculations for the bonus: Equity of Conway ...................................... Equity of Patel............................................ Contribution by Truett ............................... Total equity after admitting Truett ........... Truett’s equity interest after admission .. Truett’s equity after admission ................ $294,400 331,600 340,000 $966,000 30% $289,800 Contribution by Truett ............................... Truett’s equity after admission ................ Bonus paid to Conway and Patel ............. $340,000 289,800 $ 50,200 Conway: $50,200 2/5 = $20,080 Patel: $50,200 3/5 = $30,120 b. 2. Cash ............................................................................ Conway, Member Equity ........................................... Patel, Member Equity ................................................ Truet, Member Equity........................................... Supporting calculations for the bonus: Equity of Conway ...................................... 7 $294,400 190,000 8,864 13,296 212,160 Equity of Patel............................................ Contribution by Truett ............................... Total equity after admitting Truett ........... Truett’s equity interest after admission .. Truett’s equity after admission ................ Contribution by Truett ............................... Bonus paid to Truett ................................. 331,600 190,000 $816,000 26% $212,160 190,000 $ 22,160 Conway: $22,160 2/5 = $8,864 Patel: $22,160 3/5 = $13,296 Ex 13–16 ANGEL INVESTOR ASSOCIATES Statement of Partnership Equity For the Year Ended December 31, 2006 Jan Strous, Capital Cara Wright, Capital Michael Black, Capital Total Partnership Capital Partnership Capital, January 1, 2006 ........ $ 31,500 $ 58,500 $ $ 90,000 Revaluation of assets ................................ (3,500) (6,500) (10,000) Admission of Michael Black ...................... 2,800 5,200 22,000 30,000 Salary allowance ........................................ 12,000 12,000 Remaining income ..................................... 44,800 83,200 32,000 160,000 Less: Partner withdrawals ......................... (28,400) (41,600) (16,000) (86,000) Partnership Capital, December 31, 2006 .. $ 59,200 $ 98,800 $ 38,000 $196,000 Supporting Calculations Income-sharing ratio prior to admitting Black: Jan Strous: $31,500 = 35% $90,000 Cara Wright: $58,500 = 65% $90,000 Revaluation of assets: Jan Strous: $10,000 35% = $3,500 reduction in capital account Cara Wright: $10,000 65% = $6,500 reduction in capital account 8 Ex. 13–16 Concluded Admission of Michael Black: Equity of initial partners prior to admission ................. Contribution by Black ..................................................... Total.................................................................................. Black's equity interest after admission ......................... Black's equity after admission ....................................... $ 80,000 30,000 $110,000 20% $ 22,000 Contribution by Black ..................................................... Black's equity after admission ....................................... Bonus paid to Strous and Wright .................................. $ 30,000 22,000 $ 8,000 The bonus is distributed to Strous and Wright according to their income-sharing ratio prior to admitting Black: Strous: $8,000 35% = $2,800 Wright: $8,000 65% = $5,200 Net income distribution: The revised income-sharing ratio is equal to the proportion of the capital balances after admitting Black according to the partnership agreement: Jan Strous: $30,800 = 28% $110,000 Cara Wright: $57,200 = 52% $110,000 Michael Black: $22,000 = 20% $110,000 Alternatively, the original income-sharing ratios for Strous and Wright could be multiplied by 80% (100% less the 20% sold to Black) to obtain 28% and 52%, respectively. Leaving 20% for Black. These ratios can be multiplied by the $160,000 remaining income ($172,000 – $12,000 salary allowance to Strous) to distribute the earnings to the respective partner capital accounts. Withdrawals: Half of the income distribution for Wright and Black and half of the income distribution plus salary allowance for Strous. Strous need not take the salary allowance as a withdrawal but may allow it to accumulate in the member equity account. 9 Ex. 13–17 a. b. Merchandise Inventory ................................................ Allowance for Doubtful Accounts ......................... Glenn Otis, Capital .................................................. Tammie Sawyer, Capital ......................................... Joe Parrott, Capital ................................................. 15,000 Glenn Otis, Capital ....................................................... Cash ......................................................................... Notes Payable ......................................................... 205,100 3,100 5,100 3,400 3,400 55,100 150,000 Ex. 13–18 a. The income-sharing ratio is determined by dividing the net income for each member by the total net income. Thus, in 2005 the income-sharing ratio is as follows: Golden Properties, LLC: Aztec Holdings, Ltd.: $50,000 = 40% $125,000 $75,000 = 60% $125,000 Or a 2:3 ratio b. Following the same procedure as in (a): Golden Properties, LLC: Aztec Holdings, Ltd.: Jason Fields: Ex. 13–18 c. $106,880 = 32% $334,000 $160,320 = 48% $334,000 $66,800 = 20% $334,000 Concluded The member withdrawal ratios do not match the income-sharing ratio, shown as follows: $32,000 Golden Properties, LLC: = 24.6% $130,000 10 Aztec Holdings, Ltd.: Jason Fields: $48,000 = 36.9% $130,000 $50,000 = 38.5% $130,000 Clearly, the distribution to Jason Fields is disproportionably higher while the distributions to Golden Properties and Aztec Holdings are lower than their respective income-sharing ratios. Distributions need not be in the same proportion as the income-sharing ratio. Members may make withdrawals from the business as long as their member equity remains positive and the operating agreement allows such withdrawals. d. Jason Fields provided a $183,750 cash contribution to the business. The amount credited to his member equity account is this amount plus his bonus ($20,000), or $203,750. e. The negative entries to Golden Properties and Aztec Holdings are the result of a bonus paid to Jason Fields. f. Jason Fields acquired a 20% interest in the business, computed as follows: Jason Fields’ member equity after admission .. Golden Properties, LLC, member equity ........... Aztec Holdings, Ltd. member equity .................. Total ...................................................................... $ 203,750 332,000 483,000 $1,018,750 Fields’ ownership interest after admission ($203,750 ÷ $1,018,750) ....................................... 20.00% Ex. 13–19 a. Cash balance ................................................. Sum of capital accounts ............................... Loss from sale of noncash assets ............... $ 20,000 25,000 $ 5,000 b. and c. Capital balances before realization .............. Division of loss on sale of noncash assets Balances ......................................................... Cash distributed to partners......................... 11 Hires Bellman $ 5,000 2,500 $ 2,500 2,500 $ 20,000 2,500 $ 17,500 17,500 Final balances ................................................ $ 0 $ 0 Ex. 13–20 Capital balances before realization .................... Division of loss on sale of noncash assets ($97,000 – $67,000) ........................................... Capital balances after realization........................ Cash distributed to partners ............................... Final balances ...................................................... Goldburg Luce $ 57,000 $ 40,000 15,000 $ 42,000 42,000 $ 0 15,000 $ 25,000 25,000 $ 0 Ex. 13–21 a. Deficiency b. $60,000 ($20,000 + $57,500 – $17,500) c. Cash ............................................................................... Nell, Capital ............................................................... Capital balances after realization ....... Receipt of partner deficiency ............. Capital balances after eliminating deficiency........................................ 17,500 17,500 Bakki Towers Nell $ 20,000 $ 57,500 $(17,500) Dr. 17,500 $ 20,000 $ 57,500 $ 0 Ex. 13–22 a. Cash should be distributed as indicated in the following tabulation: Capital invested ................................ Net income ........................................ Capital balances and cash distribution .................................... b. Meyer Ball David Total $ 175 + 100 $ 125 + 100 $ — + 100 $ 300 + 300 $ 275 $ 225 $ 100 $ 600 David has a capital deficiency of $60, as indicated in the following tabulation: Capital invested ................................ Net loss ............................................. 12 Meyer Ball David Total $ 175 – 60 $ 125 – 60 $ — – 60 $ 300 – 180 Capital balances ............................... $ 115 $ 65 $ 60 Dr. $ 120 Ex. 13–23 Capital balances after realization.............. Distribution of partner deficiency ............. Capital balances after deficiency distribution ........................................... 13 Duncan Tribe Ho $(15,000) 15,000 $ 50,000 (10,000) $ 40,000 (5,000) $ $ 40,000 $ 35,000 0 Ex. 13–24 GIBBS, HILL, AND MANSON Statement of Partnership Liquidation For the Period Ending July 1–29, 20— Capital Cash Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ........................................ Distribution of cash to partners ...... Final balances .................................. + Noncash Assets = Liabilities + Gibbs (3/6) + Hill (2/6) + Manson (1/6) $ 11,000 $ 85,000 $ 30,000 $ 24,000 $ 28,000 $ 14,000 + 61,000 $ 72,000 – 30,000 – 85,000 $ 0 — — $ 30,000 – 30,000 – 12,000 $ 12,000 — – 8,000 $ 20,000 — – 4,000 $ 10,000 — $ 42,000 – 42,000 $ 0 $ 0 $ 0 $ $ 12,000 – 12,000 $ 0 $ 20,000 – 20,000 $ 0 $ 10,000 – 10,000 $ 0 — $ 0 — 0 Ex. 13–25 a. CITY SIGNS, LLC Statement of LLC Liquidation For the Period March 1–31, 2006 Member Equity Cash Noncash + Assets = Liabilities + 14 Ellis (2/5) + Roane (2/5) + Clausen (1/5) Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ........................................ Distribution of cash to members .... Final balances .................................. $ 4,000 $125,000 $ 44,000 $ 28,000 $ 45,000 $ 12,000 + 96,000 $100,000 – 44,000 –125,000 $ 0 — — $ 44,000 – 44,000 – 11,600 $ 16,400 — – 11,600 $ 33,400 — – $ 5,800 6,200 — $ 56,000 – 56,000 $ 0 $ $ $ 16,400 – 16,400 $ 0 $ 33,400 – 33,400 $ 0 $ – $ 6,200 6,200 0 0 — $ 0 — 0 $ 0 b. Ellis, Member Equity ...................................................... Roane, Member Equity .................................................. Clausen, Member Equity ............................................... Cash ........................................................................... 15 16,400 33,400 6,200 56,000 PROBLEMS Prob. 13–6A 1. IMHOFF, BAXTER, AND WISE Statement of Partnership Liquidation For Period May 3–29, 2006 Capital Cash Balances before realization ............. Sale of assets and division of gain ........................................... Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Distribution of cash to partners ...... Final balances .................................. Noncash + Assets = Liabilities + Imhoff (1/5) + Baxter (2/5) + Wise (2/5) $ 10,000 $ 285,000 $ 55,000 $ 30,000 $ 90,000 $ 120,000 + 345,000 $ 355,000 – 55,000 – 285,000 $ 0 — — $ 55,000 – 55,000 + 12,000 $ 42,000 — + 24,000 $ 114,000 — + 24,000 $ 144,000 — $ 300,000 – 300,000 $ 0 $ 0 $ 0 $ $ 42,000 – 42,000 $ 0 $ 114,000 – 114,000 $ 0 $ 144,000 – 144,000 $ 0 — $ 16 0 — 0 Prob. 13–6A Continued 2. IMHOFF, BAXTER, AND WISE Statement of Partnership Liquidation For Period May 3–29, 2006 Capital Cash Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Distribution of cash to partners ...... Final balances .................................. + Noncash Assets = Liabilities + Imhoff (1/5) + Baxter (2/5) + Wise (2/5) $ 10,000 $ 285,000 $ 55,000 $ 30,000 $ 90,000 $ 120,000 + 175,000 $ 185,000 – 55,000 – 285,000 $ 0 — — $ 55,000 – 55,000 – 22,000 $ 8,000 — – 44,000 $ 46,000 — – 44,000 $ 76,000 — $ 130,000 – 130,000 $ 0 $ $ $ – $ $ 46,000 – 46,000 $ 0 $ 76,000 – 76,000 $ 0 0 — $ 0 17 0 — $ 0 8,000 8,000 0 Prob. 13–6A Concluded 3. IMHOFF, BAXTER, AND WISE Statement of Partnership Liquidation For Period May 3–29, 2006 Capital Cash Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Receipt of deficiency ....................... Balances ........................................... Distribution of cash to partners ...... Final balances .................................. Noncash + Assets = Liabilities + Imhoff (1/5) + Baxter (2/5) + Wise (2/5) $ 10,000 $ 285,000 $ 55,000 $ 30,000 $ 90,000 $ 120,000 + 105,000 $ 115,000 – 55,000 – 285,000 $ 0 — — $ 55,000 – 55,000 – 36,000 – 72,000 $ 6,000 (Dr.) $ 18,000 — — – 72,000 $ 48,000 — $ 60,000 + 6,000 $ 66,000 – 66,000 $ 0 $ 0 $ 0 $ 0 $ + $ 0 $ 0 $ $ 48,000 — $ 48,000 – 48,000 $ 0 — $ — — $ 18 0 — 6,000 (Dr.) 6,000 0 — 0 $ 18,000 — $ 18,000 – 18,000 $ 0 Prob. 13–1B 1. May 1 1 Cash ..................................................................... Merchandise Inventory ....................................... Crystal Hall, Capital ....................................... 10,500 36,500 Cash ..................................................................... Accounts Receivable .......................................... Equipment ........................................................... Allowance for Doubtful Accounts ................ Accounts Payable.......................................... Notes Payable ................................................ Doug Tucker, Capital..................................... 12,000 18,000 40,000 47,000 1,000 14,000 15,000 40,000 2. HALL AND TUCKER Balance Sheet May 1, 2005 Assets Current assets: Cash .................................................................... Accounts receivable .......................................... Less allowance for doubtful accounts ............. Merchandise inventory ...................................... Total current assets ..................................... Plant assets: Equipment .......................................................... Total assets ............................................................. Liabilities Current liabilities: Accounts payable .............................................. Notes payable..................................................... Total liabilities ......................................................... Partners’ Equity Crystal Hall, capital ................................................. Doug Tucker, capital ............................................... Total partners’ equity .............................................. Total liabilities and partners’ equity ...................... 19 $ 22,500 $ 18,000 1,000 17,000 36,500 $ 76,000 40,000 $ 116,000 $ 14,000 15,000 $ 29,000 $ 47,000 40,000 87,000 $ 116,000 Prob. 13–1B Concluded 3. Apr. 30 30 Income Summary ................................................ Crystal Hall, Capital ....................................... Doug Tucker, Capital..................................... 72,700 Crystal Hall, Capital ............................................ Doug Tucker, Capital .......................................... Crystal Hall, Drawing..................................... Doug Tucker, Drawing .................................. 20,000 26,000 35,200* 37,500* 20,000 26,000 *Computations: Hall Interest allowance .............................................. Salary allowance ................................................ Remaining income (1:1) .................................... Net income ......................................................... $ 4,700 18,000 12,500 $ 35,200 Tucker $ 4,000 21,000 12,500 $ 37,500 Total $ 8,700 39,000 25,000 $ 72,700 Prob. 13–2B (1) $90,000 Plan a. b. c. d. e. f. .................................................... .................................................... .................................................... .................................................... .................................................... .................................................... (2) $240,000 Garland Driscoe Garland Driscoe $45,000 60,000 30,000 51,000 36,000 36,000 $45,000 30,000 60,000 39,000 54,000 54,000 $120,000 160,000 80,000 126,000 111,000 96,000 $120,000 80,000 160,000 114,000 129,000 144,000 Details $90,000 Garland $240,000 Driscoe Garland Driscoe a. Net income (1:1) ........................ $ 45,000 $ 45,000 $ 120,000 $ 120,000 b. Net income (2:1) ........................ $ 60,000 $ 30,000 $ 160,000 $ 80,000 c. Net income (1:2) ........................ $ 30,000 $ 60,000 $ 80,000 $ 160,000 d. Interest allowance ..................... $ 24,000 Remaining allowance (1:1) ....... 27,000 $ 12,000 27,000 $ 24,000 102,000 $ 12,000 102,000 20 e. f. Net income ................................. $ 51,000 $ 39,000 $ 126,000 $ 114,000 Interest allowance ..................... $ 24,000 Salary allowance ....................... 30,000 Excess of allowances over income (1:1) ........................... (18,000) Remaining income (1:1) ............ Net income ................................. $ 36,000 $ 12,000 60,000 $ 24,000 30,000 $ 12,000 60,000 $ 54,000 57,000 $ 111,000 57,000 $ 129,000 Interest allowance ..................... $ 24,000 Salary allowance ....................... 30,000 Bonus allowance ....................... Excess of allowances over income (1:1) ........................... (18,000) Remaining income (1:1) ............ Net income ................................. $ 36,000 $ 12,000 60,000 $ 24,000 30,000 $ 12,000 60,000 30,000 42,000 $ 96,000 42,000 $ 144,000 (18,000) (18,000) $ 54,000 Prob. 13–3B 1. DIXON AND FAWLER Income Statement For the Year Ended December 31, 2006 Professional fees.................................................................. Operating expenses: Salary expense .............................................................. Depreciation expense—building .................................. Property tax expense .................................................... Heating and lighting expense ...................................... Supplies expense .......................................................... Depreciation expense—office equipment ................... Miscellaneous expense ................................................ Total operating expenses ......................................... Net income ............................................................................ Peter Dixon Division of net income: Salary allowance ........................................ Interest allowance ...................................... Remaining income ..................................... Net income ....................................................... *$75,000 12% **($55,000 – $5,000) 12% 21 $ 30,000 9,000* 41,000 $ 80,000 $285,650 $80,500 10,500 8,000 7,900 2,850 2,800 6,100 118,650 $167,000 May Fawler Total $ 40,000 $ 70,000 6,000** 15,000 41,000 82,000 $ 87,000 $ 167,000 2. DIXON AND FAWLER Statement of Partners’ Equity For the Year Ended December 31, 2006 Capital, January 1, 2006.................................. Additional investment during the year .......... Net income for the year .................................. Withdrawals during the year .......................... Capital, December 31, 2006 ............................ Prob. 13–3B Peter Dixon May Fawler Total $ 75,000 — $ 75,000 80,000 $ 155,000 60,000 $ 95,000 $ 50,000 5,000 $ 55,000 87,000 $ 142,000 75,000 $ 67,000 $ 125,000 5,000 $ 130,000 167,000 $ 297,000 135,000 $ 162,000 Concluded 3. DIXON AND FAWLER Balance Sheet December 31, 2006 Assets Current assets: Cash ............................................................ Accounts receivable .................................. Supplies ...................................................... Total current assets ............................. Plant assets: Land ............................................................ Building ...................................................... Less accumulated depreciation .......... Office equipment........................................ Less accumulated depreciation .......... Total plant assets ............................ Total assets ..................................................... $ 22,000 38,900 1,900 $ 62,800 $ 25,000 $ 130,000 69,200 60,800 $ 39,000 21,500 17,500 Liabilities Current liabilities: Accounts payable ...................................... Salaries payable ......................................... Total liabilities ................................................. Partners’ Equity 22 103,300 $ 166,100 $ 2,100 2,000 $ 4,100 Peter Dixon, capital ......................................... May Fawler, capital.......................................... Total partners’ equity ...................................... Total liabilities and partners’ equity .............. $ 95,000 67,000 162,000 $ 166,100 Prob. 13–4B 1. Apr. 30 Asset Revaluations ......................................... Accounts Receivable ................................ Allowance for Doubtful Accounts ............ *[($22,500 – $1,900) 5%] – $550 2,380 30 Merchandise Inventory ................................... Asset Revaluations ................................... 2,500 30 Accumulated Depreciation—Equipment....... Equipment .................................................. Asset Revaluations ................................... 65,000 30 Asset Revaluations ......................................... Tom Denney, Capital ................................. Cheryl Burks, Capital ................................ 20,120 1 Cheryl Burks, Capital...................................... Sara Wold, Capital ..................................... 20,000 1 Cash ................................................................. Sara Wold, Capital ..................................... 20,000 2. May Prob. 13–4B 1,900 480* 2,500 45,000 20,000 10,060 10,060 20,000 20,000 Concluded 3. DENNEY, BURKS, AND WOLD Balance Sheet May 1, 2006 Assets Current assets: Cash ............................................................ Accounts receivable .................................. $ 20,600 Less allowance for doubtful accounts ..... 1,030 Merchandise inventory .............................. Prepaid insurance ...................................... Total current assets ............................. Plant assets: 23 $ 27,900 19,570 53,100 1,650 $ 102,220 Equipment .................................................. Total assets ..................................................... Liabilities Current liabilities: Accounts payable ...................................... Notes payable............................................. Total liabilities ................................................. 100,000 $ 202,220 $ 12,100 10,000 $ 22,100 Partners’ Equity Tom Denney, capital ....................................... Cheryl Burks, capital....................................... Sara Wold, capital ........................................... Total partners’ equity ...................................... Total liabilities and partners’ equity .............. 24 $ 90,060 50,060 40,000 180,120 $ 202,220 Prob. 13–5B 1. BOOTH, OWEN, AND RAMARIZ Statement of Partnership Liquidation For Period May 3–29, 2006 Capital Cash Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Receipt of deficiency ....................... Balances ........................................... Payment of liabilities........................ Balances after payment of liabilities Cash distributed to partners ........... Final balances .................................. 2. + Noncash Assets = Liabilities + Booth (50%) Owen (25%) + + Ramariz (25%) $ 1,900 $ 62,000 $ 30,000 $ 20,000 $ 3,900 $ 10,000 + $ + $ – $ – $ 26,000 27,900 5,100 33,000 30,000 3,000 3,000 0 – 62,000 $ 0 — $ 0 — $ 0 — $ 0 — $ 30,000 — $ 30,000 – 30,000 $ 0 — $ 0 – 18,000 $ 2,000 — $ 2,000 — $ 2,000 – 2,000 $ 0 – $ + $ 9,000 5,100 (Dr.) 5,100 0 — 0 — 0 – $ $ $ $ $ – $ 9,000 1,000 — 1,000 — 1,000 1,000 0 The $5,100 deficiency of Owen would be divided between the other partners, Booth and Ramariz, in their incomesharing ratio (2:1 respectively). Therefore, Booth would absorb 2/3 of the $5,100 deficiency, or $3,400, and Ramariz would absorb 1/3 of the $5,100 deficiency, or $1,700. 25 Prob. 13–6B 1. EWING, JOHNSON, AND LANDRY Statement of Partnership Liquidation For Period October 1–30, 2006 Capital Cash Balances before realization ............. Sale of assets and division of gain ........................................... Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Distribution of cash to partners ...... Final balances .................................. Prob. 13–6B Noncash + Assets = Liabilities + Ewing (2/5) Johnson + (2/5) Landry + (1/5) $ 20,000 $ 250,000 $ 50,000 $ 100,000 $ 90,000 $ 30,000 + 330,000 $ 350,000 – 50,000 – 250,000 $ 0 — — $ 50,000 – 50,000 + 32,000 $ 132,000 — + 32,000 $ 122,000 — + 16,000 $ 46,000 — $ 300,000 – 300,000 $ 0 $ 0 $ 0 $ $ 132,000 – 132,000 $ 0 $ 122,000 – 122,000 $ 0 $ 46,000 – 46,000 $ 0 — $ 0 — 0 Continued 2. EWING, JOHNSON, AND LANDRY Statement of Partnership Liquidation For Period October 1–30, 2006 Capital Cash Noncash + Assets = Liabilities + 26 Ewing (2/5) Johnson + (2/5) Landry + (1/5) Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Distribution of cash to partners ...... Final balances .................................. Prob. 13–6B $ 20,000 $ 250,000 $ 50,000 $ 100,000 $ 90,000 $ 30,000 + 120,000 $ 140,000 – 50,000 – 250,000 $ 0 — — $ 50,000 – 50,000 – $ 52,000 48,000 — – 52,000 $ 38,000 — – 26,000 $ 4,000 — $ 90,000 – 90,000 $ 0 $ $ $ – $ 48,000 48,000 0 $ 38,000 – 38,000 $ 0 $ – $ 0 — $ 0 — 0 $ 0 4,000 4,000 0 Concluded 3. EWING, JOHNSON, AND LANDRY Statement of Partnership Liquidation For Period October 1–30, 2006 Capital Cash Balances before realization ............. Sale of assets and division of loss............................................ Balances after realization ................ Payment of liabilities........................ Balances after payment of liabilities ................................... Receipt of deficiency ....................... Balances ........................................... Distribution of cash to partners ...... Final balances .................................. Noncash + Assets = Liabilities + Ewing (2/5) Johnson + (2/5) Landry + (1/5) $ 20,000 $ 250,000 $ 50,000 $ 100,000 $ 90,000 $ 30,000 + 50,000 $ 70,000 – 50,000 – 250,000 $ 0 — — $ 50,000 – 50,000 – 80,000 $ 20,000 — – 80,000 $ 10,000 — – 40,000 $ 10,000 (Dr.) — $ + $ – $ $ $ $ 20,000 — $ 20,000 – 20,000 $ 0 $ 10,000 — $ 10,000 – 10,000 $ 0 $ 10,000 (Dr.) + 10,000 $ 0 — $ 0 20,000 10,000 30,000 30,000 0 0 — $ 0 $ 0 $ — $ 27 0 — 0 — 0