chapter 8 - Prof Dimond

advertisement

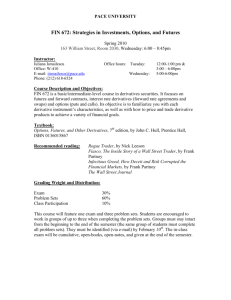

INSTRUCTOR’S MANUAL: MULTINATIONAL FINANCIAL MANAGEMENT, 9TH ED. SUGGESTED SOLUTIONS TO CHAPTER 8 PROBLEMS 1. On Monday morning, an investor takes a long position in a pound futures contract that matures on Wednesday afternoon. The agreed-upon price is $1.78 for £62,500. At the close of trading on Monday, the futures price has risen to $1.79. At Tuesday close, the price rises further to $1.80. At Wednesday close, the price falls to $1.785, and the contract matures. The investor takes delivery of the pounds at the prevailing price of $1.785. Detail the daily settlement process (see Exhibit 8.3). What will be the investor's profit (loss)? ANSWER Time Action Cash Flow ----------------------------------------------------------------------------------------------------------------------------- -------------Monday Investor buys pound futures None morning contract that matures in two days. Price is $1.78. Monday close Futures price rises to $1.79. Contract is marked-to-market. Investor receives 62,500 x (1.79 - 1.78) = $625. Tuesday close Futures price rises to $1.80. Contract is marked-to-market. Investor receives 62,500 x (1.80 - 1.79) = $625. Wednesday close Futures price falls to $1.785. (1) (1) Contract is marked-to-market. (2) Investor takes delivery of £62,500. (2) Investor pays 62,500 x (1.80 -1.785) = $937.50 Investor pays 62,500 x 1.785 = $111,562.50. Net profit is $1,250 - 937.50 = $312.50. 2. Suppose that the forward ask price for March 20 on euros is $0.9127 at the same time that the price of IMM euro futures for delivery on March 20 is $0.9145. How could an arbitrageur profit from this situation? What will be the arbitrageur's profit per futures contract (size is €125,000)? ANSWER. Since the futures price exceeds the forward rate, the arbitrageur should sell futures contracts at $0.9145 and buy euro forward in the same amount at $0.9127. The arbitrageur will earn 125,000(0.9145 - 0.9127) = $225 per euro futures contract arbitraged. 3. Suppose that DEC buys a Swiss franc futures contract (contract size is SFr 125,000) at a price of $0.83. If the spot rate for the Swiss franc at the date of settlement is SFr 1 = $0.8250, what is DEC's gain or loss on this contract? ANSWER. DEC has bought Swiss francs worth $0.8250 at a price of $0.83. Thus, it has lost $0.005 per franc for a total loss of 125,000 x .005 = $625. 4. On January 10, Volkswagen agrees to import auto parts worth $7 million from the United States. The parts will be delivered on March 4 and are payable immediately in dollars. VW decides to hedge its dollar position by entering into IMM futures contracts. The spot rate is $0.8947/€ and the March futures price is $0.9002/€. a. Calculate the number of futures contracts that VW must buy to offset its dollar exchange risk on the parts contract. ANSWER. Volkswagen can lock in a euro price for its imported parts by buying dollars in the futures market at the current March futures price of €1.1109/$1 (1/0.9002). This is equivalent to selling euro futures contracts. At that futures price, VW will sell €7,776,050 for $7 million. At €125,000 per futures contract, this would entail selling 62 contracts (7,776,050/125,000 = 62.21) at a total cost of €7,750,000. 1 CHAPTER 8: CURRENCY FUTURES AND OPTIONS MARKETS b. On March 4, the spot rate turns out to be $0.8952/€, while the March futures price is $0.8968/€. Calculate VW's net euro gain or loss on its futures position. Compare this figure with VW's gain or loss on its unhedged position. ANSWER. Under its futures contract, Volkswagen has agreed to sell €7,750,000 and receive $6,976,550 (7,750,000 x 0.9002). On March 4, VW can close out its futures position by buying back 62 March euro futures contracts (worth €7,750,000). At the current futures rate of $0.8968/€, VW must pay out $6,950,200 (7,750,000 x 0.8968). Hence, VW has a net gain of $26,350 ($6,976,550 - $6,950,200) on its futures contract. At the current spot rate of $0.8952/€, this translates into a gain of €29,434.76 (26,350/0.8952). Upon closing out the 62 futures contracts, VW will then buy $7 million in the spot market at a spot rate of $0.8952/€. Its net cost is €7,790,046.92 (7,000,000/0.8952 - 29,434.76). If VW had not hedged its import contract, it could have bought the $7 million on March 10 at a cost of € 7,819,481.68 (7,000,000/0.8952). This contrasts with a projected cost based on the spot rate on January 10th of €7,823,851.57 (7,000,000/0.8947). However, the latter “cost” is irrelevant since VW had no opportunity to buy March dollars at the January 10th spot rate of $0.8947/€. By not hedging, VW would have paid an extra €29,434.76 for the $7,000,000 to satisfy its dollar liability, the difference between the cost of $7 million with hedging (€ 7,790,046.92) and the cost without hedging (€7,819,481.68). 5. Citigroup sells a call option on euros (contract size is €500,000) at a premium of $0.04 per euro. If the exercise price is $0.91 and the spot price of the euro at date of expiration is $0.93, what is Citigroup's profit (loss) on the call option? ANSWER. Since the spot price of $0.93 exceeds the exercise price of $0.91, Citigroup's counterparty will exercise its call option, causing Citigroup to lose 2¢ per euro. Adding in the 4¢ call premium it received gives Citigroup a net profit of 2¢ per euro on the call option for a total gain of .02 x 500,000 = $10,000. 2 INSTRUCTOR’S MANUAL: MULTINATIONAL FINANCIAL MANAGEMENT, 9TH ED. 6. Suppose you buy three June PHLX call options with a 90 strike price at a price of 2.3 (¢/€). a. What would be your total dollar cost for these calls, ignoring broker fees? ANSWER. With each call option being for €62,500, the three contracts combined are for €187,500. At a price of 2.3¢/€, the total cost is therefore 187,500 x $0.023 = $4,312.50. b. After holding these calls for 60 days, you sell them for 3.8 (¢/€). What is your net profit on the contracts assuming that brokerage fees on both entry and exit were $5 per contract and that your opportunity cost was 8% per annum on the money tied up in the premium? ANSWER. The net profit would be 1.5¢/€ (3.8 - 2.3) for a total profit before expenses of $2,812.50 (0.015 x 187,500). Brokerage fees totaled $10 per contract or $30 overall. The opportunity cost would be $4,312.50 x 0.08 x 60/365 = $56.71. After deducting these expenses (which total $86.71), the net profit is $2,725.79. 7. A trader executes a "bear spread" on the Japanese yen consisting of a long PHLX 103 March put and a short PHLX 101 March put. a. If the price of the 103 put is 2.81 (100ths of ¢/¥), while the price of the 101 put is 1.6 (100ths of ¢/¥), what is the net cost of the bear spread? ANSWER. Going long on the 103 March put costs the trader 0.0281¢/¥ while going short on the 101 March put yields the trader 0.016¢/¥. The net cost is therefore 0.0121¢/¥ (0.028- 0.016). On a contract of ¥6,250,000, this is equivalent to $756.25. b. What is the maximum amount the trader can make on the bear spread in the event the yen depreciates against the dollar? ANSWER. To begin, it should be pointed out that the 103 March put gives the trader the right but not the obligation to sell yen at a price of 1.03¢/¥. Similarly, the 101 March put gives the buyer the right but not the obligation to sell yen to the trader at a price of 1.01¢/¥. If the yen falls to 1.01¢/¥ or below, the trader will earn the maximum spread of 0.02¢/¥. After paying the cost of the bear spread, the trader will net 0.079¢/¥ (0.02¢ - 0.0121¢), or $493.75 on a ¥6,250,000 contract. c. Redo your answers to parts a and b assuming the trader executes a "bull spread" consisting of a long PHLX 97 March call priced at 0.0321¢/¥ and a short PHLX 103 March call priced at 0.0196¢/¥. What is the trader's maximum profit? Maximum loss? ANSWER. In this case, the trader will pay 0.0321¢/¥ for the long 97 March call and receive 0.0196¢/¥ for the short 103 March call. The net cost to the trader, therefore, is 0.0125¢/¥, which is also the trader's maximum potential loss. At any price of 1.03¢/¥ or greater, the trader will earn the maximum possible spread of 0.06¢/¥. After subtracting off the cost of the bull spread, the trader will net 0.0475¢/¥, or $2,968.75 per ¥6,250,000 contract. 8. Apex Corporation must pay its Japanese supplier ¥125 million in three months. It is thinking of buying 20 yen call options (contract size is ¥6.25 million) at a strike price of $0.00800 in order to protect against the risk of a rising yen. The premium is 0.015 cents per yen. Alternatively, Apex could buy 10 three-month yen futures contracts (contract size is ¥12.5 million) at a price of $0.007940 per yen. The current spot rate is ¥1 = $0.007823. Suppose Apex's treasurer believes that the most likely value for the yen in 90 days is $0.007900, but the yen could go as high as $0.008400 or as low as $0.007500. a. Diagram Apex's gains and losses on the call option position and the futures position within its range of expected prices (see Exhibit 8.4). Ignore transaction costs and margins. ANSWER. In all the following calculations, note that the current spot rate is irrelevant. When a spot rate is referred to, it is the spot rate in 90 days. If Apex buys the call options, it must pay a call premium of 0.00015 x 125,000,000 3 INSTRUCTORS MANUAL: MULTINATIONAL FINANCIAL MANAGEMENT, 7TH ED. 4 = $18,750. If the yen settles at its minimum value, Apex will not exercise the option and it loses the call premium. But if the yen settles at its maximum value of $0.008400, Apex will exercise at $0.008000 and earn $0.0004/¥1 for a total gain of .0004 x 125,000,000 = $50,000. Apex's net gain will be $50,000 - $18,750 = $31,250. PROFIT (LOSS) ON APEX CORPORATION'S FUTURES AND OPTIONS POSITIONS OPTION Inflow Outflow Call Premium Exercise Cost Profit FUTURES Inflow Outflow Profit 75 -- 79.4 -- 81.5 $1,018,750 84 $1,050,000 -$18,750 -___________ -$18,750 -$18,750 -__________ -$18,750 -18,750 -1,000,000 __________ $0 -1,000,000 -18,750 __________ $31,250 $937,500 -992,500 __________ -$55,000 $992,500 -992,500 __________ $0 $1,000,000 -992,500 __________ $7,500 $1,050,000 -992,500 __________ $57,500 As the diagram shows, Apex can use a futures contract to lock in a price of $0.007940/¥ at a total cost of .007940 x 125,000,000 = $992,500. If the yen settles at its minimum value, Apex will lose $0.007940 - $0.007500 = $0.000440/¥ (remember it is buying yen at 0.007940, when the spot price is only 0.007500), for a total loss on the futures contract of 0.00044 x 125,000,000 = $55,000. On the other hand, if the yen appreciates to $0.008400, Apex will earn $0.008400 - $0.007940 = $0.000460/¥ for a total gain on the futures contracts of 0.000460 x 125,000,000 = $57,500. b. Calculate what Apex would gain or lose on the option and futures positions if the yen settled at its most likely value. ANSWER. If the yen settles at its most likely price of $0.007900, Apex will not exercise its call option and will lose the call premium of $18,750. If Apex hedges with futures, it will have to buy yen at a price of $0.007940 when the spot rate is $0.0079. This will cost Apex $0.000040/¥, for a total futures contract cost of 0.000040 x 125,000,000 = $5,000. c. What is Apex's break-even future spot price on the option contract? On the futures contract? 4 INSTRUCTOR’S MANUAL: MULTINATIONAL FINANCIAL MANAGEMENT, 9TH ED. ANSWER. On the option contract, the spot rate will have to rise to the exercise price plus the call premium for Apex to break even on the contract, or $0.008000 + $0.000150 = $0.008150. In the case of the futures contract, breakeven occurs when the spot rate equals the futures rate, or $0.007940. d. Calculate and diagram the corresponding profit and loss and break-even positions on the futures and options contracts for the sellers of these contracts. ANSWER. The sellers' profit and loss and break-even positions on the futures and options contracts will be the mirror image of Apex's position on these contracts. For example, the sellers of the futures contract will breakeven at a future spot price of ¥1 = $0.007940, while the options sellers will breakeven at a future spot rate of ¥1 = $0.008150. Similarly, if the yen settles at its minimum value, the options sellers will earn the call premium of $18,750 and the futures sellers will earn $55,000. But if the yen settles at its maximum value of $0.008400, the options sellers will lose $31,250 and the futures sellers will lose $57,500. 5