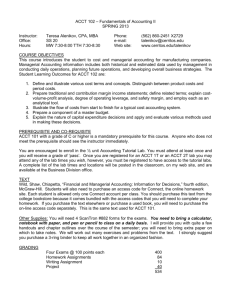

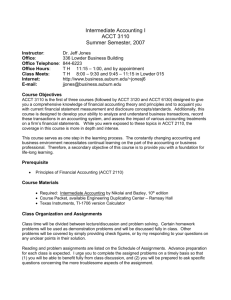

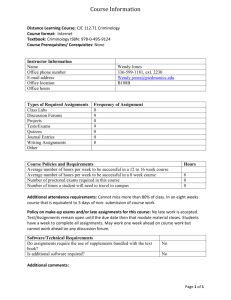

Syllabus

advertisement

ACCOUNTING 303 INTERMEDIATE ACCOUNTING I Spring 2009 PROFESSOR OFFICE PHONE E-MAIL Dr. David Kirch CPA, Ph.D. 326 Copeland Hall 593-9321 (Office) kirch@ohiou.edu OFFICE HOURS Monday thru Thursday: 2-4 PM. I am here most of the time and, if I am here, feel free to stop by. MATERIALS REQUIRED A recent intermediate accounting text Texas Instruments BA II Plus calculator (same as Acct 101) CLASS: Mon and Weds, 10-12 p.m. PREREQUISITE: ACCT 102 DATABASE: Website: Dr. Kirch Acct 303 593-5400 (Home, before 10 p.m.) (00696, A01, 118 Copeland) http://asc.fasb.org/home COURSE OBJECTIVES ACCT 303 continues to refine the analytical, decision-making, and written and oral communication skills needed for a successful business career. This course seeks to prepare students for careers in both private and public accounting, finance, and business consulting. Specifically, it is intended to … (1) simulate the decisions and tasks confronted by accountants (2) promote technical competency (3) help develop life-long research skills (4) advance critical thinking (5) foster communication skill development COURSE DESCRIPTION ACCT 303 represents an intensive study and application of generally accepted accounting principles (GAAP) for asset and liability valuation, income measurement, and financial statement presentation for business organizations and the processes through which these principles evolve. The course builds on introductory financial accounting by covering, in detail, topics that are essential to preparing, reading, understanding, interpreting, and using financial statements that are prepared in accordance with GAAP. ACCT 303 is the first in a sequence of courses using the Business Activity Model (a.k.a. BAM). Working in teams, students will analyze the financial records of a company and address various accounting issues. Specifically, teams will correct financial statements prepared by a company’s management, and deal with issues such as income recognition, start-up costs, capital asset vs. expense, common stock, EPS, income taxes, cash flow computations, net present value, and disclosures. Upon completion of the course, students should be able to prepare, read, understand, explain, and critically evaluate information contained in the financial statements of a small to medium-sized company. ACCOUNTING 303 RESOURCE MATERIALS No specific textbook is required for this course. While a textbook is one source of information for issues and topics addressed in this course, your primary resource will be the professional pronouncements of the Financial Accounting Standards Board. Access to the pronouncements will be discussed throughout the intermediate sequence. Students will select any recent “intermediate” accounting text, from any source such as on-line sites or a local bookstore in your hometown. Follett’s has agreed to order texts on demand. That is, books may not be available in the bookstore on a walk-in basis. The following textbooks have been used in the past, all of which are entitled “Intermediate Accounting.” Kieso, Weygandt & Warfield/Wiley/12th Edition Spiceland, Sepe, & Tomassini/ McGraw-Hill/ 4th Edition. Stice, Stice, & Skousen/South-Western/16th Edition. 2 Spring 2009 designated group (G), each group is to work independently of all other groups. Your group should neither assist nor accept assistance from other groups, including those who have taken the course before. You are expected to report any occurrences of such behavior by others. Any information obtained from outside sources MUST be footnoted to indicate the source. Because of the nature of this course, academic dishonesty also includes obtaining or providing copies of materials used in the course from anyone or to anyone other than the professor. This includes obtaining materials from previous ACCT 303 classes or providing any material used in this course to future ACCT 303 classes, either directly or indirectly. Any student who cheats or who assists another in cheating will earn a grade of “0” for the assignment and will be required to meet with the Director of the School of Accountancy. If the facts warrant further action, such student may be dismissed from the class and/or may be subjected to further sanctions by the School, the College, or the University. POLICIES ACADEMIC DISHONESTY: The accounting profession is based on the integrity and independence of the accountant. There is no place in the accounting profession for dishonesty. You will sign a pledge of honesty on each exam and assignment as a reminder of the vital importance of maintaining your integrity. Three examinations and certain assignments are designated as individual (I) and must be your own work. You can neither provide nor receive assistance from others, including those who have taken the course before. For assignments DISABILITY: Every reasonable attempt will be made to remove any physical barrier that hampers the ability of an individual to learn in this classroom. Anyone with a physical or learning limitation that would have an adverse impact on attendance, preparation, participation, or timely completion of assignments should discuss this limitation with me. The College of Business and its faculty are committed to supporting efforts for a quality education. For additional assistance, students should call Handicapped Student Services at 593-2620. ACCOUNTING 303 3 Spring 2009 STUDENT EVALUATION INDIVIDUAL PERFORMANCE Take Home Quizzes (2 @ 30 each) Memos (3 @ 10 each) ***Midterm Exams (2 @ 100 each) ***Final Exam Kona Coffee Company Journal and Adjusting Entries Trial Balance and Spreadsheet Balance Sheet Income Statement Statement of Shareholders’ Equity Cash Flow Statement Participation Total Individual Performance POINTS 60 30 200 100 10 5 12.5 7.5 5 10 50 20 460 ***IMPORTANT NOTE*** You must earn an average of 55% on the three in-class examinations in order to move on to Accounting 304. GROUP PERFORMANCE (Subject to Peer Evaluation Scores) The Bounce Company Trial Balance and Spreadsheet Formatting Journal and Adjusting Entries Balance Sheet Income Statement Statement of Shareholders’ Equity Cash Flow Statement Financial Statement Analysis Presentation of Accounting Topic Hydromaint Case - Year 1 Engagement Letter Questions Adjusting Entries Review Report Financial Statements Notes Total Group Performance TOTAL 5 15 5 10 5 10 5 15 15 5 45 15 50 15 15 100 180 640 We will discuss the group projects in greater detail as we approach them. The Kona Coffee Company and the Bounce Company assignments require extensive use of Excel spreadsheets including advanced formatting techniques. Brush up if you need to. ACCOUNTING 303 4 Spring 2009 ASSESSMENTS All assignments are due at the BEGINNING of class unless otherwise noted. Late assignments (i.e., during/after class) will be penalized 20 percent if turned in the day they are due, and 50 percent if turned in the day after they are due. While all assignments must be turned in, no credit will be given for assignments turned in two days past the due date. MEMOS: The memos address current “Hot” topics facing the accounting profession and require students to take a position on the issues. As you support your position, you must cite all sources used. These important topics present a backdrop for the next three quarters. While each memo is worth 10 points, they are not optional. Memos more than one week late will receive -10 points, two weeks, -20, etc. It is in your best interest to complete the memos on a timely basis. Each memo must be submitted to turnitin.com before grading. Guidelines will be posted: a 12-point serif font must be used. EXAMS: Exams are where students demonstrate their mastery of the material. Exams are cumulative in the sense that the material builds on prior topics Healthy debate and honest disagreements are encouraged. However, it is important to be respectful when others are contributing to the discussion. This means, among other things, avoiding side conversations when another is speaking. Students should ask questions and seek clarification when confused; others may have similar concerns. Participation points may be reduced based on attitude concerns. ATTENDANCE: The most important ingredient to success in this course is keeping up with the schedule. You are expected to attend class, come prepared, and actively participate in class discussions. You are responsible for any material presented in any class that you miss. Much of the material covered is outside the text. Consequently, your class notes will be important in studying for exams -- more important than rereading the text. Absences will strongly affect your grade. If you are not able to attend class, please notify me by e-mail or phone -- a professional courtesy and something you would do in the workplace. Make-up exams must be arranged in advance. Provide at least two weeks notice if possible. Make-up exams for conflicts such as religious observances or University-sponsored activities will be scheduled at mutually agreeable times. PROFESSIONALISM: Ohio University is a community of students, faculty, and administrators who come together to learn, work and grow in moral, ethical, and professional character. Central to the concept of “community” is belief in the importance of honorable behavior for oneself and for the community as a whole. This course is student-centered, where each student is encouraged to achieve personal and academic growth in a supportive environment. CLASS PARTICIPATION: Business professionals must be able to articulate positions and ask ACCOUNTING 303 5 Spring 2009 probing questions. Class participation is important for your professional development and will affect your final grade. Some objective guidelines for points follow. Count on a loss of four points for each unexcused absence. Students must attend at least 60 percent of the 40 contact hours to pass the course. POINTS CRITERIA 20 Attended all classes … unless, if required to be away from class, notified me in advance. Actively participated in discussions. My “Go to Person.” If no one would join the discussion, I could count on him/her to help. Positive attitude. 16 Often contributed to the discussion and positive attitude. Attended all classes. 12 Occasionally contributed to the discussion and positive attitude. Attended all classes. 10 Attend all classes but did not contribute If you miss more than one class, I will deduct 25 points from your total for each class over one missed BONUS OPPORTUNITIES: Attend one Accounting Association/ Beta Alpha Psi meeting and earn four (4) points. Attend a second Accounting Association/ Beta Alpha Psi meeting and earn an additional four (4) points. Other opportunities for bonus points may be announced, which include the annual spring field trip. FINAL GRADE DETERMINATION: Final grades will be determined by the number of points earned out of the total available. In order to receive a grade of “C” or better, you must earn at least 73 percent of the total points available, as found on page 3 of this syllabus. You must earn a “C” or better in this class to take ACCT 304. Grades of “I” are rare, except for hospitalization, death in the family, or military service. The standardized grading scale follows: A AB+ B BC+ 93 - 100% 90 - 92 87 - 89 83 - 86 80 - 82 77 - 79 C CD+ D DF 73 - 76 70 - 72 67 - 69 63 - 66 60 - 62 < 60% All team assignments will be subjected to a peer evaluation system in which individual grades can be increased or decreased from team grades, based on contribution. If a team member fails to contribute, do not put his/her name on the assignment. ACCOUNTING 303 6 Spring 2009