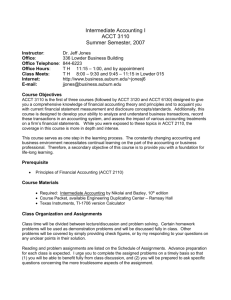

ACCT 3110 Intermediate Accounting I Fall Semester, 2006

advertisement

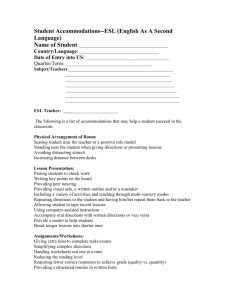

ACCT 3110 Intermediate Accounting I Fall Semester, 2006 Instructor: Office: Office Telephone: Office Hours: Class Meets: Internet: GTA: Email: Dr. C. Wayne Alderman 342 Lowder Business Building 844-6209 T H 10:45 – 11:45; and by prior appointment T H 8:00 - 9:15 a.m. in Lowder 015 T H 9:30-10:45 a.m. in Lowder 015 http://www.business.auburn.edu/~alderman Harrison Lewis; lewish@auburn.edu alderman@business.auburn.edu Course Objectives ACCT 3110 is designed to give the student comprehensive knowledge of financial accounting theory and principles and to acquaint the student with current financial statement measurement and disclosure concepts/standards. Additionally, this course is designed to develop the student’s abilities to analyze and understand business transactions, record these transactions in an accounting system, and assess the impact of various accounting treatments on a firm’s financial statements. Prerequisites Principals of Financial Accounting (ACCT 2110) 2.2 GPA Course Materials Required: Intermediate Accounting by Nikolai, Bazley and Jones; 10th edition Texas Instruments, T1-1706 version Calculator Recommended: Financial Accounting: Exam Questions and Explanations, Gleim and Collins (to practice multiple choice questions) Class Organization and Assignments Class time will be divided between lecture/discussion and problem solving. Certain homework problems will be used as demonstration problems and will be discussed fully in class. Most problems will be covered by simply providing check figures, or by responding to your questions on any unclear points in the solution. Reading and problem assignments are listed on the Schedule of Assignments. Advance preparation for each class is expected. Assigned problems should be completed on a timely basis so that (1) you will be able to benefit fully from class discussion, and (2) you will be prepared to ask specific questions concerning the more troublesome aspects of the assignment. Course Requirements and Grades ־Four exams will be given on the dates specified on the Schedule of Assignments. The dates scheduled for these exams will not be changed for any reason, although the coverage for any given exam may be changed if necessary. Any coverage changes will be announced in class. Exam Exam Exam Exam 1 2 3 4 (final) (comprehensive) 100 100 100 100 400 points - Exams consist of multiple-choice questions, which require a green scantron sheet, and problems. ־ A make up exam will only be given if a student misses an exam with an acceptable excuse as outlined in the Tiger Cub and the instructor must be notified in writing in advance. Otherwise, a student will receive a zero for that exam. Makeup Exams are scheduled for Friday afternoons and are administered through the School of Accountancy. ־ Students may use a T1-1706 calculator during the exam. Any other calculator will be taken up during the exam. ־ After each exam, students will be allowed to view the exam both in class and outside of class for a specified time period. The time and places for these opportunities will be announced in class. No additional reviews will be allowed. Academic Honesty Each student is expected to comply with the University’s policy on academic dishonesty. Any student who engages in any form of academic dishonesty is subject to the maximum allowed disciplinary action. General Points ־ ־ ־ ־ ־ ־ Drop policies dictated by the Auburn University Bulletin and the Tiger Cub Student Handbook will be strictly followed. The drop date is October 6, 2006. Any student, who, because of a disability, may require some special arrangements in order to meet the course requirements, should contact me as soon as possible to make the necessary accommodations. Smoking, eating, and drinking (other than water) in class are prohibited. Students must have an overall 2.2 GPA to take upper-division business courses. This prerequisite is strictly enforced. No cell phones can be active in class. Solutions to the textbook problems and exercises are on my website. You will need the following information: Username: student Password: accounting Suggested Study Approach for ACCT 3110: ־ ־ ־ ־ ־ Before a lecture, read the assigned material in order to be familiar with concepts. Attempt the homework assignments and in a timely manner. Come to class and listen to the lecture on the assigned material. Ask questions regarding any unclear points. Work the homework assignments while referring back to the text, the lecture, and the examples in the chapter. Study for the exam - start at least 1 week ahead of time. Practice! Practice! Practice! You need to understand the material; not just mechanically memorize it. Exams are designed to measure your understanding. Disclaimer The instructor reserves the right to change deadlines, the course schedule, and classroom procedures and policies if circumstances dictate. Any such changes will be announced in class in advance. Acct 3110 Dr. Wayne Alderman Fall Semester, 2006 Date Chapter Class Intro & 1 8/17 H 8/22 T 2 8/24 H 3 8/29 T 8/31 H 3 4 9/5 9/7 4 T H 5 9/19 T 9/21 H 5 7 9/28 H 10/3 10/5 8 8 9 10/10 T 10/12 H 10/17 T 9 10/24 T The Balance Sheet and the Statement of Changes in Stockholder’s Equity C2-1,C2-2,C2-5,C2-12, C2-13, C2-14,C2-15 E3-2,E3-3,E3-5,E3-6, E3-7,E3-8,E3-10,P3-1, P3-3,P3-4,P3-9,P3-10 E4-5,P4-1,P4-5,P4-8, P4-9,P4-11,P4-13 Review Exam 1 The Income Statement and Statement of Cash Flows E5-4,#5-6,35-9, E5-13,35-15,p5-3, P5-5,P5-10,E7-18 Cash and Receivables E7-9,E7-10,E7-18, E7-21,P7-4,P7-5,P7-18 Inventories: Cost Measurement and Flow Assumptions E8-3,E8-8,E8-10,E812,P8-1,P8-5,P8-8,P811 Inventories: Special Valuation Issues E9-1,E9-3,E9-6,E97,E9-11,E9-13,P9-2,P96, P9-7,P9-9.P9-11 7 + Appendix T H 10/19 H The Environment of Financial Reporting pp. 1-15 Financial Reporting: Its Conceptual Framework pp. 26-54 Review of the Accounting Process Suggested Homework Assignment C1-2,C1-4 EXAM 1-Ch. 1,2,3,4 9/12 T 9/14 H 9/26 T Topic EXAM 2 – Ch. 5,7,8,9 Review Exam 2+ Appendix to Ch. 6 and 14 14 Long-Term Liabilities and Receivables E-14-1,E14-4,E14-6, E14-7,E14-9,E14-14, E14-17 E14-18,E14-24, E14-29,E14-30,E1432,P14-4 10/26 H 10/31 T 14 15 Investments E15-2,E15-4,E15-5,E157,E15-14,E15-15,E1517,E15-18 11/2 H 11/7 T 11/9 H 15 15 18 Revenue Recognition E18-2,E18-3,E18-6, E18-9,P18-1,P18-6, P18-6,P18-9 11/14 T 11/16 H Nov. 20-24 18 EXAM 3 -Ch.14,15,18 11/28 T THANKSGIVING BREAK Review Exam 3 11/30 H 23 12/5 T 23 Accounting Changes and Errors E221,3,5,8,9,10,11,12, 13,P22-2,5,9,11,13,14 FINAL EXAM--- 8:00 a.m. Class, 2:00 p.m., Wednesday, December 13th 9:30 a.m. Class, 2:00 p.m., Saturday, December 9th