Key Terms

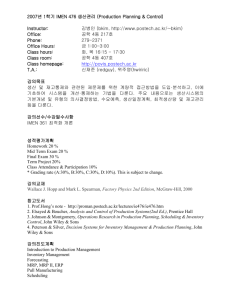

COURSE

ESSENTIAL

STANDARD

OBJECTIVE

ESSENTIAL

QUESTIONS

6312 Accounting II

7.00 C3

Unit C Inventory Control and Cost

Accounting

12% Apply concepts for cost accounting procedures.

7.01 B2 4% Understand cost accounting concepts and practices for a manufacturing business.

How does a manufacturing business differ from other businesses?

What are the elements of manufacturing costs?

What is the purpose of manufacturing inventories and cost ledgers?

UNPACKED CONTENT

I. Types of Business Entities

A. Service businesses – fulfill people’s wants and needs primarily through the efforts of people providing services, not inventory or merchandise

1. Financial statements do not contain Inventory or Purchases accounts.

2. Examples: accounting firms, law firms, medical practices, and beauty/barber shops

B. Merchandising businesses – fulfill people’s wants and needs by providing tangible items called inventory or merchandise

1. These businesses purchase inventory and, without changing the form of the good, resell the products to customers.

2. Financial statements contain Inventory and Purchases accounts.

3. Examples: department stores and grocery stores

C. Manufacturing businesses

– buy materials and use labor and machinery to change the materials into a finished product for sale

1. Sell their finished product to merchandising businesses, who then sell to customers

2. Financial statements contain several Inventory and Purchases accounts:

Raw-Materials Inventory, Work-in-Process Inventory, and Finished-Goods

Inventory.

3. Examples: auto makers, furniture makers, clothing makers

II. Elements of Manufacturing Costs

– all finished products include three cost elements

A. Direct materials

1. Materials that are of significant value in the cost of a finished product and that become an identifiable part of the finished product

2. Includes all items used in the manufacturing process that have sufficient value

B. Direct labor

1. Salaries/wages of factory workers who directly make a product

2. Does not include salaries of supervisors, maintenance workers, and others who do not directly work on the manufacture of a product

C. Factory overhead

1. All expenses other than direct materials and direct labor that apply to making products

6312 Accounting II Summer 2011 Version 2 Page 592

2. Indirect materials a. Materials used in the completion of a product that are of insignificant value to justify accounting for separately b. May include items such as glue, solder, bolts, and rivets c. Materials and supplies used such as cleaning supplies and lubricants

3. Indirect labor a. Salaries/wages of people are not directly involved in making the product b. Examples: supervisory, clerical, and maintenance workers

4. Other indirect costs a. Depreciation of buildings and equipment b. Repairs to factory buildings and equipment c. Insurance on building, equipment, and inventory stock d. Taxes on property owned e. Heat, lighting, and power

III. Manufacturing Inventories and Cost Ledgers

A. Types of manufacturing inventories

1. Materials inventory a. Materials on hand that have not yet been used in making the product b. Includes all products meant for production that have not been used

2. Work-in-process inventory a. Products in the process of being manufactured b. Includes all costs spent on the product to date

3. Finished-goods inventory a. Manufactured products that are fully completed b. Finished products still on hand that have not been sold

4. Perpetual versus periodic inventory a. Perpetual inventory - a system which updates inventory on a continuous basis; an ongoing maintenance of stock b. Periodic inventory – a system which updates inventory on a periodic basis such as monthly, quarterly or annually

B. Subsidiary cost ledgers:

1. Materials ledger – a record of all materials to be used in the manufacturing process

2. Materials requisition

– prepared to request materials, both direct and indirect, for a specific job

3. Job time record – prepared to record employee time for each job

4. Cost sheet

– contains all specific job costs, including materials, direct labor, and overhead, for products manufactured

5. Finished-goods ledger – prepared to account for all finished goods/ products manufactured

6312 Accounting II Summer 2011 Version 2 Page 593

Key Terms

Service business

Merchandising business

Manufacturing business

Direct materials

Direct labor

Factory overhead

Indirect materials/Factory supplies

Indirect labor

Materials inventory

Work-in-process inventory

Finished-goods inventory

Perpetual inventory

Periodic inventory

Materials ledger

Materials requisition

Job cost

Cost sheet

6312 Accounting II Summer 2011 Version 2 Page 594

7.01 Types of Businesses – SUGGESTED KEY

Name of Business

Type of Business (Student answers will vary.)

Doctor’s Office

Dentist ’s Office

Service

Service

School

Hairdresser/Barber Shop

Wal-Mart

Service

Service

Merchandising

Target

Home Depot

Sears

Merchandising

Merchandising

Merchandising

Sara Lee Corporation

High Point Furniture

Manufacturing

Manufacturing

Ford Motor Company Manufacturing

Chevrolet Motor Company Manufacturing

6312 Accounting II Summer 2011 Version 2 Page 595

7.01 Key Terms – DEFINED

Term Definition

Types of Business Entities

Service business

Merchandising business

Manufacturing business

Fulfills people’s wants and needs primarily through the effort of people providing services, not inventory or merchandise

Fulfill people’s wants and needs by providing tangible items called inventory or merchandise

Buys materials and uses labor and machinery to change the materials into a finished product for sale

Manufacturing Costs Elements

Direct materials

Direct labor

Factory overhead

Indirect materials

Indirect labor

Materials that are of significant value in the cost of a finished product and that become an identifiable part of the product

Salaries of factory workers who make a product; as well as salaries of persons working directly on a product

All expenses other than direct materials and direct labor that apply to making products

Materials used in the completion of a product that are of insignificant value to justify accounting for separately

Salaries paid to factory worker who are not actually making products

Manufacturing Inventory and Cost Ledgers

All materials to be used in the production process Materials inventory

Work in process inventory

Finished goods inventory

Periodic inventory

Products that are being manufactured but are not yet complete

Perpetual inventory

Materials requisition

Materials ledger

Job time record

Cost sheet

Finished goods ledger

Manufactured products that are fully completed

A system which updates inventory on a periodic basis such as monthly, quarterly or annually

A system which updates inventory on a continuous basis; an ongoing maintenance of stock

Prepared to request materials, both direct and indirect, for a specific job

A record of all materials to be used in the manufacturing process

Prepared to record employee time for each job

Contains all specific job costs, including Materials, Direct

Labor, and Overhead, for products manufactured

Prepared to account for all Finished Goods/ Products manufactured

6312 Accounting II Summer 2011 Version 2 Page 596

7.01 Chart of Accounts

6312 Accounting II Summer 2011 Version 2 Page 597

7.01 Compare Business Entities – KEY

Service Business

Capital

Drawing

Inventory

Cost of Goods Sold

Purchases

Merchandising

Business

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Accounts Payable

Payables

Income Summary

Sales

Expenses

Raw Materials Inventory

Work-In-Progress Inventory

Finished-Goods Inventory

Factory Supplies Factory

Equipment Factory Building

All 500 accounts

Manufacturing

Business

6312 Accounting II Summer 2011 Version 2 Page 598

7.01 Items Used to Create and Bake a Cake – KEY

Materials and Labor Type of Cost

Cake mix

Eggs

Water

Cooking oil

Two 8

″

round baking pans

1 small bowl

1 large bowl

Cake mixer

Toothpick

Oven

Spoons

Electricity

Icing/Frosting

Soap and water for clean-up

Cake baker

Kitchen

Direct materials

Direct materials

Direct materials

Direct materials

Factory overhead

Factory overhead

Factory overhead

Factory overhead

Factory overhead

Factory overhead

Factory overhead

Factory overhead

Direct materials

Factory overhead

Direct labor

Factory overhead

Types of Costs

Direct materials

Direct labor

Factory overhead

6312 Accounting II Summer 2011 Version 2 Page 599

7.01 Ledgers and Requisitions – Page 1

Textbook page 566

6312 Accounting II Summer 2011 Version 2 Page 600

7.01 Ledgers and Requisitions – Page 2 Text page 568 and 570

6312 Accounting II Summer 2011 Version 2 Page 601

7.01 Ledgers and Requisitions – Page 3

6312 Accounting II Summer 2011 Version 2 Page 602

7.01 Manufacturing Cost Flows Textbook page 562

7.01 Manufacturing Cost Flows

– KEY

Materials

Ledger

Card

Cost Sheet/Ledger

Direct

Materials

Materials

Requisitions

Total DM $

Direct Labor Summary

Job-Time

Records

Total DL $

Direct Materials $

Direct Labor $

Est. Overhead $

Total Costs $

Finished-

Goods

Ledger

Card

6312 Accounting II Summer 2011 Version 2 Page 603

7.01 Prototype Assessment Items – Page 1

These prototype assessment items illustrate the types of items used in the item bank for this objective. All items have been written to match the cognitive process of the understand verb in the objective. These exact questions will not be used on the secure postassessment, but questions in similar formats will be used.

Types of Business Entities

1. Jones Clothing Store sells goods to its customers. The balance sheet contains these accounts: Inventory

– Women’s Swimsuits and Inventory – Children’s

Clothes. How would Jones Clothing Store be classified?

A. Construction Business

B. Manufacturing Business

C. Merchandising Business

D. Service Business

Answer:

Elements of Manufacturing Costs

2. The Tomeka Company makes beach balls. The purchasing agent orders 500 pounds of plastic for use in the production process. How should the plastic be classified?

A. Direct labor

B. Direct materials

C. Indirect labor

D. Indirect materials

Answer:

Manufacturing Inventories and Cost Ledgers

3. The Jones Jeans Company makes jeans out of cotton fiber. They have several containers of cotton fiber that has not been made into jeans. How are the two containers of cotton fiber classified?

A. Finished goods inventory

B. Materials inventory

C. Perpetual inventory

D. Work in process inventory

Answer:

6312 Accounting II Summer 2011 Version 2 Page 604