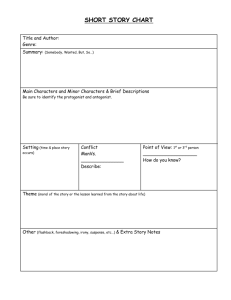

Chapter 9 Corrections of Errors

advertisement

MARYKNOLL SECONDARY SCHOOL Principles of Accounts 9 Correction of Errors Errors in the books of accounts are of two kinds: A. Those which do not show up in the Trial Balance, and B. Those which are revealed by the Trial Balance A. Errors not Affecting Agreement of Trial Balance When mistakes are discovered, the necessary correcting entries must be in General Journal 1. Errors of Omission: The absence of both debit and credit entries Eg 1 Cash sales $3,000 has been completely omitted from the books. 2. Errors of Commission: The posting is made to the correct side but of a wrong personal account. Eg 2 Goods $2,000 sold to Mr Chau has been debited to Mr Chow’s account. 3. Errors of Principle: Wrong class of account is posted. Eg 3 Motor Vehicle account was debited for Motor Expenses $300 paid. 4. Error of Original Entry: The original figure is entered incorrectly in both accounts Eg 4 Goods $2,500 sold to Mr Wong had been entered as $3,000 in Sales Book. 5. Reversal Errors: The account which should be debited has been credited and vice versa. Eg. 5 A receipt of cash of $150 from Mr Lee was entered on the payment side of the Cash Book in error and debited to his account. 6. Compensating Errors: Errors which cancel each other out. Eg. 6 The Sales and the Salaries account were both understated by $1,000. -1- MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 9.1 a) Cash Purchases of $2,500 has been completely omitted from the books. b) Goods $3,500 sold to Mr Wong have been debited to Mr Wan. c) Purchase of Motor Van $6,000 has been debited to Purchases A/C. d) Goods $5,200 sold to Mr Chan have been entered in Sales Day Book as $5,000. e) A receipt of cash of $250 from Mr Cheung was entered on the payment side of Cash Book in error and also wrongly debited to his account. f) Sales A/C was overstated by $1,000 and so was the Salaries A/C. Show the Journal entries necessary to correct the above errors. Ex. 9.2 a) The Purchases A/C was understated by $1,200 and so was the Sales A/C. b) A payment of cash of $500 to Miss Lee was entered on the receipt side of Cash Book in error and was also wrongly credited to her account. c) Purchase of Office Equipment $8,000 has been debited to Purchases A/C. d) Sales of goods $5,000 to Au was wrongly entered in Yeung A/C. e) A credit sale of $800 to Mr Hung has been initially entered in the Sales Journal as $1,000. f) Cash Sales of $3,500 has been completely omitted from the books. Show the Journal entries necessary to correct the above errors. Ex. 9.3 a) A sale of goods $600 to A Hung had been entered in J Hung’s account. b) The purchase of a machine on credit from Joyce Co for $5,600 had been completely omitted from our books. c) The purchase of a Motor Van $8,300 had been entered in error in the Motor Expenses A/C. d) A sale of $3,500 to E Wong had been entered in the books, both debit and credit, as $3,800. e) Commission received $500 had been entered in error in the Sales A/C. f) Discount Allowed $200 had been entered in error on the debit side of the Discount Received A/C. Show the Journal entries necessary to correct the above errors. -2- MARYKNOLL SECONDARY SCHOOL Principles of Accounts B. Errors Affecting Agreement of Trial Balance Those errors which throw the totals of the Trial Balance out of agreement should be made to agree with each other by inserting the amount of the difference between the two sides in a Suspense A/C. 1. Errors in Additions and Computations Eg 7 The total of the Sales Day Book had been overcast by $2,300. 2. Errors in Transposition of Figures Eg 8 Goods $450 sold to Mr Tang had been posted to his account in error as $540. 3. Errors in Posting to Wrong Side of an Account Eg 9 Goods $2,400 sold to Mr So had been posted to the credit side of his account. 4. Error of Omission in Posting Eg 10 Cash payment of $100 wages had not been posted from the Cash Book. -3- MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 9.4 a. The total of Purchases Day Book had been understated by $400. b. The total of Sales Day Book had been overcast by $800. c. Goods sold to Mr Lee had been posted to the credit side of his account. d. Goods $850 sold to Mr Wong had been posted to his account in error as $580. e. Discount Received A/C had been undercast by $200. f. Cash payment of $300 Repairs had not been posted from the Cash Book. g. Goods purchased from Mr Chan had been posted to the debit side of his account. Show the Journal entries necessary to correct the above errors. Ex. 9.5 Your book-keeper extracted a trial balance on 31 December 1997 which failed to agreed by $330, a shortage on the credit side of the trial balance. A Suspense A/C was opened for the difference. In January 1998, the following errors made in 1997 were found: a. Sales Day Book had been undercast by $70. b. Sale of $250 to J Wong had been debited in error to A Wong’s account. c. Rent A/C had been undercast by $70. d. The total of Purchases Day Book had been understated by $400. e. The sale of a Motor Van $4,000 had been wrongly credited to Sales A/C. You are required to show the Journal entries necessary to correct the errors and draw up the Suspense A/C to clear the difference. Ex. 9.6 Your book-keeper extracted a trial balance on 31 December 1997 which failed to agreed by $292, a shortage on the credit side of the trial balance. A Suspense A/C was opened for the difference. In January 1998, the following errors made in 1997 were found: a) $55 received from sales of old Office Equipment has been entered in the Sales A/C. b) Purchases Day Book had been overcast by $60. c) A private purchase of $115 had been included in the business purchases. d) Bank charges of $38 had not been posted from Cash Book. e) A sale of goods to B Tang $690 was entered in the personal account as $960. You are required to show the Journal entries necessary to correct the errors and draw up the Suspense A/C to clear the difference. -4- MARYKNOLL SECONDARY SCHOOL Principles of Accounts Statement of Corrected Net Profit Ex. 9.7 A trial balance was extracted on 31 December 1999. A shortage of $330 appeared on the credit side of the trial balance. A Suspense Account was opened before the final accounts were prepared. The following errors were found in January 2000: a. Sales day book had been undercast by $100. b. Sales of $250 to Mr. Fong had been debited in error to Mr. Kong’s A/C. c. Rent A/C had been undercast by $70. d. Discount Received A/C had been undercast by $300. e. The sale of Motor Vehicle at book value had been credited in error to Sales A/C. Required: a. Specify the effects of the above errors in the trial balance. b. Show the Journal entries necessary to correct the errors. c. Draw up the Suspense A/C after the errors described have been corrected. d. If the Net Profit had previously been calculated at $7,900 for the year ended 31 December 1999, prepare a Statement of Corrected Net Profit. Ex. 9.8 The draft accounts for Rose Limited for the year ended 30 April 1995 showed a net profit of $47,627. At the draft stage, there was a net difference in the trial balance. A suspense account was opened to record this. During subsequent investigations, the following errors were discovered: a. A piece of equipment costing $12,000 and acquired on 1 May 1994 for use in the business had been debited to purchases account. It was the company’s policy to depreciate at 10% on cost. b. Items valued at $1,175 had been completely omitted from the closing stock figure. c. The debit side of wages had been overcast by $10. d. Credit purchases of $2,980 had been correctly debited to the purchases account but had been credited to the supplier’s account as $2,890. e. Trade debtors were shown as $55,210. However, a bad debt of $610 had not been written off. The existing provision for bad debts $1,300 should have been adjusted to 2% of debtors. In addition, a provision of 2% for discounts allowed should have been raised Required a. Show Journal entries to correct the above errors. b. Prepare a statement correcting the draft net profit for the year ended 30 April 1995 c. Draw up the Suspense A/C -5- MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 9.9 The draft accounts for Mable Company Limited for the year ended 30 April 1996 showed a net profit of $129,380. At the draft stage, there was a net difference in the trial balance. A suspense account was opened to record this. During subsequent investigations, the following errors were discovered: a. The debit balance of $1,500 on Sharp Limited’s account had been brought forward as $150. b. A new piece of furniture costing $3,100 had been debited to the purchases account. c. Depreciation of office equipment had been entered in the profit and loss account as $1,683 instead of $1,386. d. A bad debt of $1,300 had been written off from the account of Modern Limited, but the double entry had not been completed. e. No entries had been made in the books in respect of a credit purchase from Allen Limited on 29 April 1996. The invoice price was $650 and a trade discount of $40 had been given by the supplier. Required a. Show Journal entries to correct the above errors. b. Prepare a statement correcting the draft net profit for the year ended 30 April 1996. c. Draw up the Suspense A/C Ex. 9.10 The trial balance of Debbie Limited at 31 March 1998 did not agree. A suspense account was opened to record the net difference. The draft net profit for the year amounted to $14,290. Subsequent checking of the records revealed the following errors: a. $550 received from sales of old Office Equipment has been entered in the Sales A/C. b. Purchases Day Book had been overcast by $600. c. A private purchase of $115 had been included in the business purchases. d. Bank charges of $380 had not been posted from Cash Book. e. Discount Received A/C had been undercast by $800. f. The sale of a Motor Van $4,000 had been wrongly credited to Sales A/C. g. A sale of goods to B Tang $690 was entered in the personal account as $960. Required a. Show Journal entries to correct the above errors. b. Prepare a statement correcting the draft net profit for the year ended 30 April 1996. c. Draw up the Suspense A/C -6- MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 9.11 Tom Tong was in business selling stationery. His Trial Balance at 31 December Year 6 did not agree. He opened a Suspense Account and debited it with the Trial Balance difference of $3,430. Subsequently, the following errors were found: (1) A purchase of a used motor vehicle costing $98,000 had been posted to the Purchases Account (2) Postage of $720 had been posted to the Telephone Account as $270. (3) Discounts received for the month of November, amounting to $1,600, had been posted to the debit of the Discount Allowed Account. (4) Drawings of $10,000 by cheque in December, had been omitted from the books. (5) A payment of $11,200 by cheque, settling a creditor, Paul Ho’s account, had been posted to Paul Hung’s account as $11,020. (6) Furniture purchased for $26,000 had been to the Office Equipment Account. (7) Rates of $7,600, paid in October, had been entered in the Cash Book but no entry had been made in the Rates Account. Required: (a) Prepare Journal entries in Tom Tong’s books, including narrations, to correct the above errors. (b) Prepare Tom Tong’s Suspense Account, starting with the original difference in the Trial Balance, posting the adjustments necessary from above, and establishing the balance still outstanding. Ex. 9.12 The Trial Balance of Richardson Limited at 31 December Year 5 did not balance. A Suspense Account was created in order to achieve the balance. Later, the examination of the books revealed that: (1) Discount allowed of $76 had been credited, in error, to the Discount Received Account. (2) A sale of $1,551 to T Wong had been posted correctly to the personal account but wrongly entered in the Sales Day Book as $1,515. (3) A cheque received from Kan Fok Ltd., entered correctly in the Cash Book as $766, had been posted to the ledger account as $760. (4) The purchase of new furniture for $1,200 had been posted to the Stock Account. (Depreciation is ignored for the year in which furniture is purchased.) (5) A sale of $265 to C Jay had not been posted to his account. (6) A petty cash balance of $100 had been omitted from the Trial Balance. (7) Bank interest charges of $720 were correctly entered in the Cash Book but the other side of the double entry had been omitted. MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 9.11 Herbert Emery, a sole trader, extracted a trial balance at the close of business on 31 October 1984. This did not balance but he prepared a trading and profit and loss account for the year ended 31 October 1984. These showed a net profit of $2,190. Subsequently, Emery discovered he following errors which accounted for the total difference in the trial balance: (a) Salaries paid during the year included an item of $130. The correct entry had been made in the cash book but the double entry had not been completed. (b) A sale of $216 to W. Jones had been entered correctly in the sales day book but the entry in the personal account of Jones was $261. (c) In the sales day book the total at the bottom of one page was $3,460. This had been carried forward to the next page as $3,760. (d) In the trading account the stock in trade at 31 October 1984 was quoted as $2,290. It has now been discovered that due to an error in the stock valuation sheets the figure should have been $2,480. Required: (i) Indicate how each of the above errors affected the original trial balance. Your answer should be in the form of the following table: Error (a) Excess Dr. Excess Cr. If no effect write ‘No effect’ (b) (c) (d) (ii) Calculate the correct net profit. Note: Calculations must be shown. (LCCI/E Autumn 84)