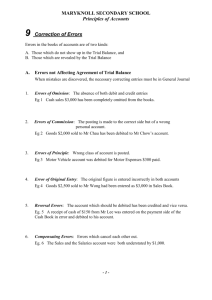

error of original entry

advertisement

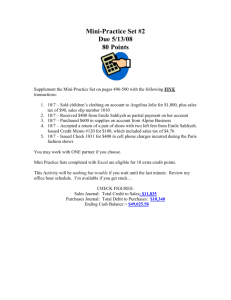

WHAT DO I DO IF I MADE A CARELESS MISTAKE IN MY MATHS PROBLEM SUM? WHAT DOES MY TEACHER DO WHEN HE MARKS A QUESTION WRONGLY? WHAT DOES THE CASHIER DO IF SHE GIVES ME THE WRONG CHANGE? WHAT DOES THE UNCLE AT THE GROCERY SHOP DO WHEN HE ADDS UP WRONGLY FOR MY GROCERIES? 1. EXPLAIN & CORRECT ERRORS WHICH DO NOT AFFECT THE AGREEMENT OF THE TRIAL BALANCE TOTALS. 2. EXPLAIN AND CORRECT ERRORS WHICH AFFECT THE AGREEMENT OF THE TRAIL BALANCE TOTALS BY USING A SUSPENSE ACCOUNT. 3. RE-CALCULATE PROFITS AFTER ERRORS HAVE BEEN CORRECTED. 4. REVISE THE BALANCE SHEETS TO RECTIFY THE ERRORS. Errors of omission Errors of commission Errors of principle Errors of original entry Compensating errors Errors of omission of one entry Errors in name of customer/ supplier Errors in account category Errors in amount Complete reversal of entries Errors on debit side connected with errors on credit side Posting to the wrong side of an account When a transaction has been completely omitted from the books. By making a double-entry to record the transaction. Main An entry has been posted to the wrong account of the same category. To reverse the entry in the wrong account and to post the correct entry. Main An entry has been posted to the wrong account of a different category. To reverse the entry in the wrong account and to post the correct entry. Main A wrong amount is recorded in a book of original entry or a document such as an invoice and subsequently posted to the ledger accounts. To correct the difference in the correct and wrong amount accordingly. Main An error on the debit side is compensated by an error of equal amount on the credit side. To reverse the error on both debit and credit sides of the accounts concerned. Main When recording a transaction, the debit and credit entries are reversed. By making the necessary posting of an amount double the amount of the original error. Main Forgetting to either debit or credit one side of a transaction. By making the necessary posting which has been omitted against an entry in the Suspense Account. Main Mistakes made in calculation. To account for either the overcast or undercast of figures. Main The amount debited and the amount credited are different. To account for either the overcast or undercast of figures accordingly. Main Causing one side of the ledger to be more than the other by twice the value of the error. To make the necessary adjustments against Suspense Account. Main A cash payment of $2,000 for purchases has been omitted from the books. Cash Purchases Account $ 2,000 Cash Account Main Purchases Journal entry $ 2,000 A sale of $1,000 to Carrefour has been posted to Cold Storage Causeway Point. Sales Cold Storage - Causeway Point $ $ Carrefour 1,000 1,000 Carrefour Main $ Journal entry Cold Storage Causeway Point ERROR MADE CORRECTION MADE 1,000 Repairs to vehicles amounting to $3,000 has been posted to Vehicles Account. Cash Vehicles Account $ Repairs 3,000 Repairs Account Main Journal entry $ Vehicles ERROR MADE CORRECTION MADE 3,000 $ 3,000 A purchase of $2,100 from Pokka Corporation Limited by Carrefour has been entered in the Purchases Journal and posted to the ledger as $2,010. Purchases Account $ Pokka Corporation Limited 2,010 Pokka Corporation Limited 90 Main Journal entry ERROR MADE CORRECTION MADE Pokka Corporation Limited Purchases Purchases $ 2,010 90 Rent received $340 is correctly debited to the Cash Account but posted as $350 to Rent Revenue Account. Similarly, wages paid a sum of $590, is correctly credited to the Cash Account but posted as $600 to Wages Account. Rent Revenue Account Wages Cash Wages Account $ Main Journal entry $ 10 Cash ERROR MADE CORRECTION MADE 600 Rent received $ 350 $ 10 A payment of $700 to a creditor, Carrefour, should be debited to Carrefour’s account and credited to the Cash Account, but the entries are reversed. Cash Account Carrefour Carrefour Carrefour $ Main Journal entry $ 700 Cash ERROR MADE CORRECTION MADE 1,400 Cash $ 1,400 $ 700 A cash payment of $2,000 for purchases has been omitted from the Purchases Account. Cash Main Journal entry CORRECTION MADE Purchases $ 2,000 Suspense Account $ Purchases $ $ 2,000 A purchase of $2,100 from Pokka Corporation Limited by Carrefour has been entered in the Purchases Journal as $2,010. The amount shown on the other account is correct. Suspense Purchases $ 90 $ Main Journal entry CORRECTION MADE Suspense Account $ Purchases $ 90 Rates paid $210 was entered correctly in the Cash Book but wrongly entered as $120 in the Rates Account. Suspense Main Journal entry CORRECTION MADE Rates Account $ 90 Suspense Account $ Rates Account $ $ 90 Discount received $100 posted to the debit side of the Discount Received Account. Discount Received Main Journal entry CORRECTION MADE Suspense Account $ 200 Discount Received Account $ Suspense Account $ $ 200 P.S. The suspense account would be self-balancing when all the errors made are detected and corrected, otherwise, it would either have a credit or debit balance when closed! Correcting Net Profit Figure Errors made in the accounts would affect the figures in our final accounts. Errors that affect the Gross Profit and Net Profit figures are items that are transferred to the Trading and Profit and Loss Accounts ultimately. E.g. Sales, Rent, Commission Received etc. Errors of items found in the Balance Sheet will not affect the profit figure, instead, they will overstate or understate the assets and liabilities figures. E.g. Furniture, motor vehicles, loan, bank overdraft etc. Statement of Corrected Net Profit $ Net Profit before COE Add Expenses overcast Revenue undercast $ 1,700 XX XX XX XX Less Expense undercast Revenue overcast Adjusted Net Profit XX XX XX XX Note: Overcast means showing more than there actually is Undercast means showing less than there actually is