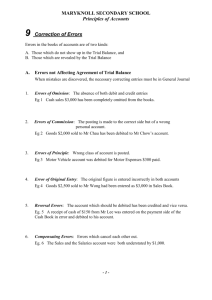

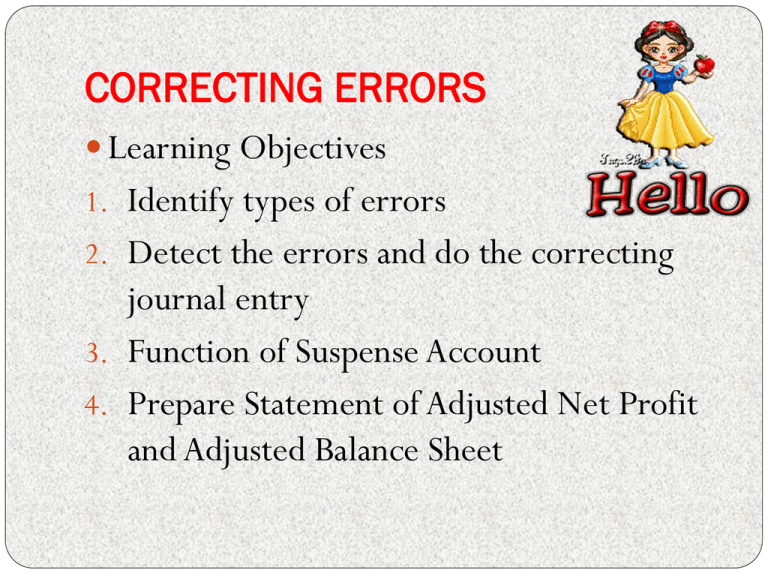

topic 4 correcting errors

advertisement

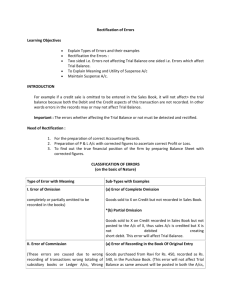

CORRECTING ERRORS Learning Objectives 1. Identify types of errors 2. Detect the errors and do the correcting journal entry 3. Function of Suspense Account 4. Prepare Statement of Adjusted Net Profit and Adjusted Balance Sheet Why A Balanced Trial Balance maybe not free from errors ? Errors Tangible Errors Intangible Errors Intangible Errors Errors of Omission Errors of Posting Errors of Original Entry Compensating Errors Errors of Reversal Errors of Omission – Transaction not yet recorded in any record Eg: A payment of RM1,000 was made to creditor Ar Ltd by cheque. This transaction was not recorded yet. Correcting Journal Entry : Dr Creditor – Ar Ltd CR Bank 1,000 1,000 Errors of Posting amount debited or credited is correct, but recorded in the wrong a/c Eg : Credit sales of RM500 to Pollin was posted to Polly Correcting Journal Entry : Dr Pollin CR Polly 500 500 Errors of Original Entry Wrong amount was recorded, causing posting entry also incorrect Eg : Credit purchase of RM353 from Bestari Ltd was recorded in purchase journal as RM335 Correcting Journal Entry : Dr Purchase CR Creditor-Bestari 18 18 Compensating Errors Errors in debit entry was balanced by errros in credit entry Eg : Commission received RM650 was posted as RM560 and renatl for RM1,190 was debited as RM1,100 Correcting Journal Entry : Dr Rental expenses CR Commission received 90 90 Errors of Reversal Correct accounts were used, but was recorded on the opposite side. Eg : Cash purchase RM1,500 was debited to Cash A/c and credited to Purchase A/c Correcting Journal Entry : Dr Purchase CR Cash 3,000 3,000 Tangible Errors * When does tangible errors happened ? * A suspense a/c will be created temporarily * Suspense A/c – debit side ( Balance Sheet – Asset) * Suspense A/c – credit side ( Balance Sheet – Liab.) Types of Tangible Errors * Incomplete Double Entry *Wrong Posting *Different amount were debited and credited * Transaction recorded by two debit entries or vice versa Incomplete Double Entry Only one entry recorded Eg : Cash sales RM200 was only debited to Cash A/c Correcting Journal Entry : Dr Suspense CR Sales 200 200 Wrong Posting Eg : Sales journal of RM690 was wrongly calculated as RM960 and this wrong amount was posted to sales a/c. Debtors a/c was correctly recorded. Correcting Journal Entry : Dr Sales CR Suspense 270 270 Different amount were debited and credited Eg : Wages of RM1,130 was correctly recorded in Cash Book but wrongly recorded in Wages a/c as RM1,100 Correcting Journal Entry : DrWages CR Suspense 30 30 Transaction recorded by two debit entries or vice versa Eg : Purchase of RM1,380 was credited to Purchase a/c and Creditors a/c Correcting Journal Entry : Dr Purchase (1,380+1,380) CR Suspense How this happen? 2,760 2,760 Effect of Errors On Profit Or Loss Errors In Trading A/c In P&L * Revenue * Expenses In Balance Sheet Effects to Gross Profit/Net Profit Effects Net Profit No effects to Gross/Net Profit Trading account: Sales - Cost of good sold = Gross Profit Sales - (Opening stock + Purchases – Closing stock) = Gross Profit Sales - Opening stock - Purchases + Closing stock = Gross Profit Example of errors Action required on the profit Action required on the balance sheet Purchases undercast Subtract - Purchases overcast Add - Sales undercast Add - Sales overcast Subtract - Income undercast Add - Income overcast Subtract - Expenses undercast Subtract - Expenses overcast Add - Example of errors Action required on the profit Action required on the balance sheet Opening stock undervalued Opening stock overvalued Subtract - Add - Closing stock undervalued Closing stock overvalued Add Increase closing stock Decrease closing stock Subtract Example of errors Action required on the profit Add Action required on the balance sheet Increase prepayments (current assets) Accruals of expenses omitted Subtract Increase accruals (current liabilities) Fixed/current assets undervalued Liabilities understated - Increase fixed/ current asset Increase liabilities Prepayments of expenses omitted -