Allow for uncollect 45.00

advertisement

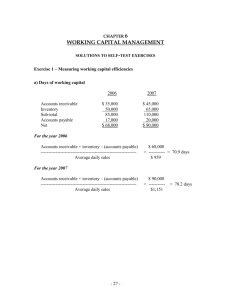

INTERMEDIATE ACCOUNTING 321 NOV. 16, 2015 CASH - ACCOUNTS RECEIVABLE - INVENTORY TAD MILLER TEST 03. 2158 Cash 1. CASH Calculate the correct cash balance for cash and cash equivalents. Checking account $ 6,750 Cash on hand 405 Undeposited checks from customers 552 .$ 9,207.00 US Treasury bill 90 day US Treasury bills mature in 6 months , $ 1,500 3,000 2. BANK RECONCILIATION Calculate the correct cash balance? Balance per the Gen. Ledger $35,276 in addition, you are given the following information 35,276.00 -80.00 120.00 -2,187.00 80.00 bank service charge check #4217 was recorded as $300 when it was actually $180, the check was for rent expense 3,985.00 Deposit in transit 2,187.00 NSF returned check 5,536.00 Outstanding checks 33,129.00 3. BANK RECONCILIATION Calculate the correct cash balance. Balance per Bank Statement $34,680 in addition, you are given the following information 34,680.00 3,985.00 -5,536.00 80.00 bank service charge check #4217 was recorded as $300 when it was actually $180, the check was for rent expense 3,985.00 Deposit in transit 2,187.00 NSF returned check 5,536.00 Outstanding checks 33,129.00 . 4. Bank Reconciliation Given the information in the two previous problems, prepare the entry you would need to make as a result of the bank reconciliation. bank expense 80 cash 80 cash 120 rent expense 120 Accounts Receivable 2,187 Cash 2,187 Accounts Receviable 5. TRADE DISCOUNTS Prepare the entry to record the following sale. On Oct. 15th Tracy Co. sold 100 air conditioners to SLO Cooling. The units have a list price of $600 each, but SLO Tracy Co. offered a 30% Trade Discount. Each unit cost Tracy $300. Accounts receivable Sale Cost of goods sold Inventory 42,000 42,000 30,000 30,000 . RECEIVABLES – NET METHOD On Oct. 5th we sold 60 units of merchandise having an invoice price of $24,000 (or $400 per unit) with terms 1/15 n/30. Prepare the following three entries (round to the nearest cent). 6. On Oct. 5th to record the sale (net method) 7. On Oct. 19th when we receive a $10,000 check from the customer 8. On Oct. 27th when the customer pays the remaining balance in their account Accounts receivable Sales Cash Accounts receivable Cash Interest income Accounts receivable 23,760.00 23,760.00 10,000.00 10,000.00 13,898.99 138.99 13,760.00 9. BAD DEBT EXPENSE / ALLOWANCE FOR DOUBTFUL ACCOUNTANTS CCS ended the year with accounts receivable of $574 and a $54 debit balance in Allowance for Doubtful Accounts. Credit Sales totaled $2,620. Historically, 3% of credit sales have proven to be uncollectible. Prepare the adjusting entry for Bad Debt Expense? What will be the Net Realizable Value of Accounts Receivable after this adjustment? Bad debt expense 78.60 Allowance for uncollectible accounts 78.60 NRV = 78.60 – 54.00 10. BAD DEBT EXPENSE / ALLOWANCE FOR DOUBTFUL ACCOUNTS Prepare the entry to record Allowance for Doubtful Accounts if MMC ages accounts receivables to estimate uncollectible accounts. Below are several account balances: $1,200,000 305,000 24,000 amount credit sales Accounts Receivable Allowance for Doubtful Accounts age est % uncollectibe Bad debt expense 1,500 allow for uncollectible 220,000 < 30 5.0% 11,000 50,000 60-90 10.0% 5,000 25,000 91-120 20.0% 5,000 10,000 > 120 45.0% 4,500 305,000 1,500 25,500 requitred balance 24,000 existing credit balance 1,500 adjustment 11. WRITE OFF Prepare the entry to write off Kate Lancaster’s account which has a balance of $45. Allow for uncollect Accounts receivable 45.00 45.00 12. What effect does the previous entry have on Total Current Assets? What dollar effect does the entry have on Net Income? Current Assets $________ increase no effect on CA decrease Net Income $________ increase no effect on NI decrease NOTES RECEIVABLE – On July 1st we sold merchandise to a customer for $60,000. In payment, we accepted a 6% note requiring the payment of interest and principle on March 31, 2016. Prepare the following three entries 13. On July 1st to record the note and the sale 14. On Dec. 31st 15. On Mar. 31, 2016. 7/1/15 12/31/15 3/31/16 Note receivable Sales Interest receivable Interest income Interest receivable Interest income Cash Note receivable Interest receivable 60,000.00 60,000.00 1,800.00 1,800.00 900.00 900.00 62,400.00 60,000.00 2,700.00 NON INTERESET BEARING NOTES RECEIVABLE – On June 30th we sold merchandise to a customer. In payment we agreed to accept a $10,000 noninterest bearing note. The appropriate discount rate is 8%. The note requires a $10,000 payment on March 31, 2016. Prepare the following entries 16. On June 30th to record the note and the sale 17. On Dec 31st Note receivable Discount on Note Sales Discount on Note Interest income Discount on Note Interest income Cash Accounts receivable 10,000.00 600.00 9,400.00 400.00 400.00 200.00 200.00 10,000.00 10,000.00 18. ASSIGNED ACCOUNTS RECEIVABLE Prepare the journal entry for the following transaction. On Oct. 1st when STG CO. borrowed $500 and signed a promissory note at Local Bank. Interest is 10% and payable monthly. STG CO. assigned $600 of its receivables as collateral for the loan. Local Bank charges a finance fee equal to 1.5% of the accounts receivable assigned. Accounts receivable – assigned Accounts receivable 600 Cash Bank expense Note payable 491 6 600 500 19. FACTORING ACCOUNTS RECEIVABLE WITHOUT RECOURSE Prepare the journal entry for the following transactions. On Oct 16th MMC factored accounts receivable having a book value of $600 to Factor Bank. The sale was made without recourse. Factor Bank charges a fee equal to 4% of the amount factored. In addition, to the fee Factor Bank retains 6% to provide a cushion for sales discounts and sales returns. Factor Bank immediately pays MMC cash equal to 90% of the factored receivables. Cash Loss on sale Receivable from Factor Bank Accounts receivable 540 24 36 600 PURCHASES – GROSS METHOD – PERIODIC INVENTORY SYSTEM On Oct. 31st, OUR COMPANY purchased merchandise with an invoice price of $40,000 having terms 3/15 n/30 fob shipping point, which the supplier shipped on Nov. 2nd. We received the merchandise on Nov. 4th. Prepare the following entries using the gross method to record purchases in a periodic inventory system. 20. Prepare the entry to record the purchase and include the appropriate date on which we should record the purchase. 21. On Nov. 8th we returns goods having an invoice price of $6,000 22. On Nov. 9th when we pay our account in full 11/2 11/8 11/9 Purchases Accounts payable Accounts payable Purchase returns Accounts payable Purchase discount Cash 40,000.00 40,000.00 6,000.00 6,000.00 34,000.00 1,020.00 32,980.00 PURCHASES – NET METHOD – PERPETUAL INVENTORY SYSTEM On Oct. 13th, OUR COMPANY ordered merchandise with an invoice price of $70,000 having terms 3/15 n/30 fob destination, which the supplier shipped on Oct. 15th and we received the merchandise on Oct. 18th. Prepare the following entries using the net method to record purchases in a perpetual inventory system. 23. Prepare the entry to record the purchase AND indicate the date on which we should we record the purchase 24. On Oct. 22nd when we write a $30,000 check to pay on our account 25. On Nov. 9th when we write a check to pay the remaining balance in our account 10/18 10/22 11/09 Inventory Accounts payable Accounts payable Cash Accounts payable Purchase discount lost Cash 67,900.00 67,900.00 30,000.00 30,000.00 37,900.00 1,172.17 39,072.17 COST FLOW ASSUMPTIONS - PERIODIC OUR COMPANY. sold 40 units for $20 each. Use the following information for the next three problems 26. Prepare the closing entry, using Average Cost / Periodic to calculate Cost of Goods Sold and ending Inventory. 27. Use FIFO - Periodic to calculate Cost of Goods Sold and ending Inventory. 28. Use LIFO - Periodic to calculate Cost of Goods Sold and ending Inventory. qty 10/1 beginning 10/14 purchase 10/24 purchase 10 35 20 available sold inventory 65 40 25 cost 15.00 13.00 12.00 CoGS Inventory Inventory Purchases average sold 10 30 0 150.00 455.00 240.00 845.00 FIFO $13.00 520.00 325.00 520.00 325.00 150.00 695.00 LIFO end 5 20 540 sold 0 20 20 end 10 15 500 305 345 COST FLOW ASSUMPTIONS - PERPETUAL Use the information presented below for the next two problems 29. LIFO - PERPETUAL. Calculate Cost of Goods Sold for the month using LIFO perpetual Qty 10/1 Purchases Cost 10 15 150 35 13 455 20 12 240 10/4 10/14 5 10/15 10/24 10/29 Sales price qty 20 qty 5 @ $15 average cost inv CoGS $75 75.00 40 25 15 20 20 0 @ $15 530.00 331.25 25 @ $13 $325 15 @ $180 $580 $12 FIFO 30. Use AVERAGE COST - PERPETUAL to prepare the entry for the Oct.15th sale of 25 units at $20/unit (only the sale on Oct 15th). Cash (or Acc Rec) Sales Cost of goods sold Inventory 500.00 500.00 331.25 331.25 Use this information to calculate ratios for the following problems 12/31/15 12/31/14 Sales Cost of goods sold Gross profit Accounts receivable Inventory 4,800.00 2,880.00 1,920.00 600.00 450.00 average 4,750.00 3,000.00 1,750.00 583.60 510.00 13.15068 /day 7.890411 /day 591.80 average 480.00 average 591.80 8.110848 turns 480.00 6 13.15068 45.00146 days in 7.890411 60.83333 31. ACCOUNTS RECEIVABLE Calculate the 1) average collection period and 2) receivables turnover ratio. 32. INVENTORY Calculate the 1) average days in inventory and 2) inventory turnover ratio. Ave Acc Rec (600.00 + 583.60 )/2 591.80 Sales / day 4800 / 365 days 13.15 / day Sales 4,800 4,800 Ave Acc Rec (600.00 + 583.60 )/2 591.80 Ave Inv (450.00 + 510.00 )/2 480 CoGS 2,880 / 365 days 7.89 / day CoGS 2,880 2,880 Ave Inv (450.00 + 510.00 )/2 480 45.00 days in Acc Rec 8.11 turns 60.83 days in INV 6.00 turns