CE-202 Corporate Accounting

advertisement

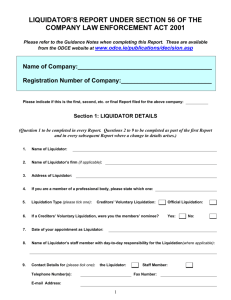

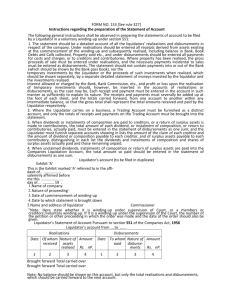

C U Shah Commerce College Ashram Road, Ahmedabad 380014 Semester III CE - 202 (A) Corporate Accounting Unit-IV Liquidation of Company • Meaning of Liquidation or winding up (Concepts only) • Methods of Liquidation (Concepts only) • Compulsory Winding up by National Law Tribunal • Voluntary Winding up • Consequences of Winding up (Concepts only) • Preferential Payments • Overriding Preferential Payment as per the companies (Amendment) Act , 1985 section 529A • Powers and Duties of Liquidators (Concepts only) • Order of disbursement to be made by Liquidator as per latest statutory revision: Preparation of Liquidator’s Final Statement of Account as per latest statutory revision Introduction: • Business organisations are formed by people. Sole trading business organisations are formed by a single person, while other forms of business organisations are formed by group of people. Sole trading and partnership business organisations are comparatively easier to start than the company form of organisations. • Companies are creation of law, viz., Companies Act, 1956. Statutory provisions are there to form a company. In the same way, for liquidation or winding up of a company, there are certain provisions in the Act. Meaning of Liquidation: • A company is an artificial person which comes into existence through a process of law. Therefore its life can also be brought to an end only through the process of law. Since a company has a separate existence from its members, its life span is not affected by the life span of any of its members. One of the ways to dissolve a company is to resort to the process of winding up or liquidation. Therefore, when the process of winding up commences, the company is said to be in liquidation. When the directors or members want to liquidate the company, they will have to follow the procedure stated in the company law. • Liquidation of a company is the process whereby its life is ended and its property administered for the benefit of its creditors and members. An administrator, called a liquidator, is appointed and he takes control of the company, realises its assets, pays its debts and finally distributes any surplus among the members in accordance with their rights as per the company law. The term ‘Liquidation’ and ‘Winding up’ has been used synonymously. Definition of 'Liquidation' 1. When a business or firm is terminated or bankrupt, its assets are sold and the proceeds pay creditors. Any leftovers are distributed to shareholders. 2. Creditors liquidate assets to try and get as much of the money owed to them as possible. They have first priority to whatever is sold off. After creditors are paid, the shareholders get whatever is left with preferred shareholders having preference over common shareholders. 3. The process of terminating the affairs of a business firm, etc., by realizing its assets to discharge its liabilities Winding Up Winding up refers to the procedure followed for distributing or liquidating any remaining company assets after dissolution. Winding up also provides a priority-based method for discharging the obligations of the company, such as making payments to non-owner creditors and then to the owners. Methods of Liquidation 1 Voluntary Owner Liquidation 2 Voluntary Creditor Liquidation 3 Secretary of State-Ordered Liquidation 4 Court-Ordered Liquidation Meaning of Liquidator: A liquidator is a person who is entrusted the duty of winding up of a company. He is appointed to administer and to take control of the company. He realises the company’s assets, pays its debts and finally distributes any surplus among the members in accordance with their rights as per the company law. For the appointment of a person as liquidator following provisions are to be followed. (1) An Official Liquidator may be – (a) appointed from a panel of professional firms of chartered accountants, advocates, company secretaries, cost and works accountants or firms having a combination of these professionals, which the Central Government shall constitute for the Tribunal; or (b) a body corporate consisting of professionals approved by the Central Government; or (c) a whole time or part-time officer appointed by the Central Government. The official liquidator conducts winding up and performs such other duties as the Tribunal may impose. (2) The remuneration of Liquidator: The normal rule that in case of appointment of any person for any job, the appointing authority fixes the remuneration, is also applicable in case of liquidator. (i) Compulsory winding up: In case of compulsory winding up, the remuneration of the liquidator is fixed by the Tribunal and the amount is payable to the Tribunal. The Tribunal will pay him the remuneration. (ii) Voluntary winding up: In case of voluntary winding up, the remuneration is fixed by the meeting which appoints the liquidator. The amount of remuneration is directly paid to the liquidator. Preferential Payments: Section 530 of the Companies Act contains a list of preferential payments. Preferential payments are those payments which by virtue of provisions in the Act are to be paid in priority to all other debts. These are listed below in order of preference. (i) All revenues, taxes, cesses and rates due to the Central or a State Government or to a local authority. The amount should have become due and payable within twelve months before the winding up. (ii) All wages or salary of any employee not exceeding Rs. 20,000 (w.e.f. 1-3-97) in respect of services rendered to the company and due for a period not exceeding four months within the said twelve months before the date of winding up order. For this purpose employees shall include officers and administrative staff member but it shall not include workman and managing director. (iii) All accrued holiday remuneration becoming payable to the employee or in case his death, to any other person in this right, on termination of his employment before the effect of the winding up. (iv) All amount due in respect of contributions payable during the twelve months under the Employees’ State Insurance Act, 1948 or any other law. (v) All amount due in respect of any compensation or liability for compensation under the Workmen’s Compensation Act, 1923 in respect of death or disablement of any employee of the company. (vi) All sums due to any employee from a provident fund, a pension fund, a gratuity fund or any other fund for the welfare of the employees, maintained by the company. (vii) The expenses of any investigation held in pursuance of Section 235 or 237 in so far as they are payable by the company. After retaining sums necessary for meeting the costs and expenses of winding up, the above debts have to be discharged forthwith so far as assets are sufficient to meet them. Liquidator’s Final Statement of _______ Co Ltd. As on __/__/____. (_____ liquidation on __/__/__) Receipts 1 Cash on hand & Bank Balances 2 Surplus received from the Secured Creditors 3 Consideration received on sale of Assets & Receivables 4 Final call received from (Partly paid) Equity Shareholders IC OC Payments (1) Payment of secured creditors and dues to workmen up to their claim or up to the amount of securities held by secured creditors as per section 529. The balance of secured creditors left unsatisfied (i.e., when the claims of the secured creditors are more than the amount realized by sale of assets or securities) will be added to unsecured creditors. (2)Liquidation Expenses (3)Liquidator’s Remuneration A Salary B Commission on Receipts and/or Payments (4) Debentures (with floating charge on Company’s assets) IC OC Total + Outstanding Interest up to the date of liquidation + Interest for the additional period (Date of liquidation to date of actual payment) only when ‘Unsecured creditors are being paid fully’ (5) Preferential Creditors (I) All revenues, taxes, cesses and rates due to the Central or a State Government or to a local authority. The amount should have become due and payable within twelve months before the winding up. (II) Amount due in respect of contributions payable during the twelve months under the Employees’ State Insurance Act, 1948 or any other law. (III) All amount due in respect of any compensation or liability for compensation under the Workmen’s Compensation Act, 1923 in respect of death or disablement of any employee of the company. (IV) All sums due to any employee from a provident fund, a pension fund, a gratuity fund or any other fund for the welfare of the employees, maintained by the company. (V) Per employee, 4 months’ salary (from last 12 months) or Rs 20,000, which-ever is less (6) Unsecured Creditors (7) Preference Share Capital + Declared but unpaid Preference Dividend + Unpaid Dividend of Cumulative Preference Share Capital (8) Paid to Equity Shareholders (see note) Total Note: 1 If the Equity Share Capital is partly paid-up and the liquidator has insufficient fund to pay up-to no 7, he will ask the equity shareholders to pay ‘Final Call’ (Un-subscribed amount OR the amount required, whichever is low). 2 After paying up-to no 7, the liquidator has some amount to pay: (A) Remaining amount will be distributed equally when the Company had issued ‘Single type of Equity Share Capital’ (B) Remaining amount will be distributed in the ‘proportion of the total face value’, when the Company had issued ‘more than one type of Equity Share Capital and they are fully paid’ (C) Remaining amount will be distributed as per the following calculation, when the Company had issued ‘more than one type of Equity Share Capital, Some of them are fully paid and remaining are partly paid’: 1 Particulars X Ltd Y Ltd Z Ltd Total Face Value Rs x + y + z - Available amount Total = (x+y+z) - _____ = Total Capital Loss = 2 Distribute the ‘Capital Loss’ in the ratio of ‘Total Face Value’ 3 Particulars X Ltd Y Ltd Z Ltd Total Total Paid-up Share Capital - Capital loss (x) + (y) + (z) = (x+y+z) - * - * - * - (*+*+*) +/- Difference in ‘+’ indicates payment to be made Difference in ‘–’ indicates the final call to be received 4 When the liquidator is entitled to get commission the payment made to the equity shareholders, his/her commission and the amount payable to the equity shareholders will be calculated as follows For example: The rate of commission is 5 % and he has Rs 10,500 to pay to the equity shareholders: If Rs 105 is available : His commission will be Rs 5 On available amount of Rs 10,500 : What will be his commission? (10,500 * 5) / 105 = Rs 500; remaining Rs 10,000 will be paid to the equity shareholders Prepared by: Asso Prof Manesh Gandhi mmgandhi2011@gmail.com

![FORM NO. 157 [See rule 331] COMPANIES ACT. 1956 Members](http://s3.studylib.net/store/data/008659599_1-2c9a22f370f2c285423bce1fc3cf3305-300x300.png)