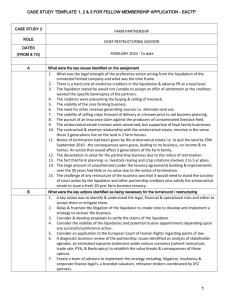

Brochure - Clayton Utz

advertisement

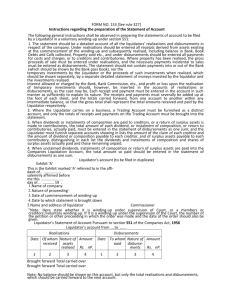

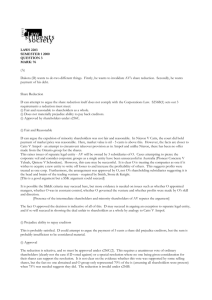

Restructuring & Insolvency Liquidation What and why? Liquidation is a procedure used to bring a company’s existence to an end where: • it has insufficient assets to satisfy all of its liabilities; or • though solvent, it serves no further useful purpose. There are several reasons why liquidation is commonly chosen as a procedure to end the life of a company. It: • ensures that the assets of a company are distributed equitably among creditors • reduces the cost borne by the community in having insolvent companies continue to trade • enables a dormant company to be deregistered • facilitates an independent investigation into the affairs of the company and increases the potential for redress for creditors against those who breached their obligations or the law. The process The procedures available to wind up a company are set out in the Corporations Act 2001. A company can be wound up whether it is solvent or insolvent. A company is “solvent” if it is able to pay its debts as they fall due. A company which is not solvent, is “insolvent”. Winding up a solvent company A solvent company can be liquidated, or wound up, by resolution of its shareholders if the company is able to pay its debts in full within 12 months after the commencement of the winding-up. This is known as a members’ voluntary winding-up. The liquidator, once appointed, is responsible to the members of the company. Winding up an insolvent company Insolvent companies can also be wound up voluntarily, by a resolution of shareholders followed by a resolution of creditors. This is known as a creditors’ voluntary winding-up. The liquidator is, in this case, responsible to the creditors of the company. Insolvent companies are more commonly wound up by order of the court. The Federal Court of Australia and the Supreme Courts of each State and Territory have power to order the winding up of a company where the company is insolvent or it is just and equitable to do so. Most applications to wind up a company in insolvency are based upon a failure to comply with a statutory demand. A statutory demand can only be served where the debt is in excess of $2000. Such a demand, when served, requires a company to pay or compromise the debt to the creditor’s reasonable satisfaction within 21 days. The failure to do so will result in a presumption that the company is unable to pay its debts as they fall due. This presumption will arise even where the debt alleged in the demand is paid, if payment is made after the 21 day period for compliance. While an application to a court to wind up a company in insolvency is most commonly made by a creditor relying on an unsatisfied statutory demand, an application can be brought by the company itself, a secured, contingent or prospective creditor, a shareholder, a director, a liquidator, a provisional liquidator or ASIC. In considering an application to wind up a company in insolvency, the court usually relies on the rebuttable presumption that a company is insolvent if, during or after the three months ending on the day when the application was made: • the company failed to comply with a statutory demand; or • execution or other process was returned wholly or partially unsatisfied; or • a receiver or receiver and manager of the property of the company was appointed pursuant to a power contained in a floating charge or court order; or • a person was appointed or entered into possession or assumed control of such property for the purpose of enforcing a floating charge. The effect of filing an application to wind up a company The filing of an application to wind up a company has several immediate consequences: • any disposition of property made by the company or any transfer of shares or alteration in the status of the members of the company made after the commencement of the winding-up is, unless the court otherwise orders, void • the company cannot, without the leave of the court, resolve that it be wound up voluntarily although it can apply for the appointment of a provisional liquidator or a stay of the winding up order in order to propound a scheme of arrangement under section 411 or a deed of company arrangement. The effect of an application to wind up on a voluntary administration There are a few examples of where an application to wind up may affect a company in voluntary administration: • where an application to wind up is made but not yet determined before the appointment of a voluntary administrator, the filing of the application does not in any way restrict or prohibit the appointment of an administrator to a company by the directors or a secured creditor with a charge over all, or substantially all, of the assets of the company • where proceedings to wind up a company have been commenced prior to the appointment of an administrator, there is no stay on the continuation of those proceedings • where an administrator is already appointed and the winding up application comes on for hearing before the conclusion of the voluntary administration process, the Corporations Act 2001 requires the application to be adjourned where the court is satisfied that it is in the interests of creditors for the company to continue to be under administration • where an administrator is appointed, winding up proceedings can only be commenced against the company with the leave of the court. Likewise, where an administrator has been appointed to a company, the Corporations Act 2001 provides that the company cannot be wound up voluntarily. Where voluntary administration is sought after liquidation Where a liquidator has formed the view that there is a prospect of a greater return to creditors by converting the winding up to a voluntary administration, a liquidator is entitled, pursuant to the Corporations Act 2001, to appoint an administrator or appoint himself, with the leave of the court or approval by a resolution passed at a meeting of the company’s creditors, as the administrator. Where such an application is made to the court there are a number of factors the court will take into account including: • the person’s independence • the term of the proposed appointment • whether it is necessary that the conduct of the administration be subject to independent scrutiny • whether there are any investigations which need to be carried out arising out of the liquidation. The court needs to be satisfied that there were, or would ultimately be, sufficient grounds for the termination of the winding up and will scrutinise very carefully the terms of any proposed deed of company arrangement in order to form a view as to whether the company, as a result of the arrangement, would be in a position where it can be allowed to carry on business as before. The effect of winding up On the company Liquidation primarily affects the status of a company. It transfers the power of management from the directors and members to the liquidator and creditors in general meeting and necessarily involves the discharge of all employees, subject to any decision of the liquidator to trade on briefly in order to maximise asset realisation. Once a resolution has been passed or an order made for the winding up of a company, the company and its creditors can expect the following to occur: • the liquidator will collect company property not claimable by secured creditors • the liquidator will seek to recover property improperly transferred when the company was insolvent • proceedings against the company in liquidation are stayed • a process by which claims against the company may be asserted and quantified operates • an order of priorities for distribution of the company’s property applies. On creditors The primary effect of a liquidation on the unsecured creditors of a company is that they are no longer able to pursue ordinary courses of action to recover their debts. To do so would be inconsistent with the object of liquidation, being the equal satisfaction of liabilities among classes of creditors. Creditors need to consider how their claim would rank as against other claimants if a company were wound up in insolvency. In a liquidation, the property available for distribution among unsecured creditors of a company includes: • the company’s own property • if the company has share capital, any unpaid calls on shares • rights of actions for damages • compensation recoverable by the liquidator from directors or a holding company for insolvent trading • any property previously disposed of by the company and voidable transactions that can be clawed back by the liquidator including: - unfair preferences - uncommercial transactions. The liquidator’s functions and duties The principal function of the liquidator is to collect and realise the company’s assets. This requires the liquidator to determine what claims exist against the assets of the company, to apply the assets to meet those claims and distribute the surplus initially among unsecured creditors and then shareholders. In fulfilling this primary function, the liquidator may engage in the following specific tasks: • lodge relevant notices and reports with ASIC • obtain from the directors a report as to the affairs of the company showing the company’s assets and liabilities, the company’s creditors and any securities held by them • carry out an investigation into the company’s affairs • investigate breaches of the Corporations Act 2001 and any conduct which falls short of the standards of commercial morality • collect the company’s assets and keep proper books. The role of the committee of inspection In order to assist and supervise a liquidator, a committee of inspection is sometimes appointed. That committee consists of representatives of creditors and contributories. Its task is to superintend and assist the liquidator in the performance of his duties. The committee has a number of administrative duties in a compulsory winding up such as setting the remuneration of the liquidator. It can also act as a supervisory body in respect of a liquidator’s actions and provide advice and guidance on questions of policy. The liquidator, in exercising his powers, must have regard to any directions given by the committee in the administration and distribution of property of the company. Priorities Secured creditors are those with proprietary claims over particular assets of a company, e.g. a charge or mortgage. Their claims will have priority over those of unsecured creditors and will be satisfied to the extent that the particular asset over which there is a claim is valuable. To the extent there is a shortfall, secured creditors will rank equally for that shortfall with unsecured creditors. A liquidator’s costs, charges and expenses of the winding up are given first priority, generally followed by employee entitlements and then by the claims of unsecured creditors. Where assets are insufficient to meet the claims of unsecured creditors in full, debts are to rank equally and be paid accordingly. Shareholders will only receive a return after all creditors are paid in full. Restructuring & Insolvency group publications The Restructuring & Insolvency group of Clayton Utz has prepared a series of brochures that provide an outline of the operation of relevant areas of law. The complete set of brochures in the series comprises: • Deed of company arrangement • Company receivers and managers • Third party guarantees • Retention of title clauses • Voluntary administration • Liquidation • Provisional liquidation • Enforcing security rights Treatment of the topic addressed in each brochure though comprehensive is not exhaustive. Moreover, a proper understanding of any particular situation demands an integrated approach. Clayton Utz is available to give advice over the whole range of issues relating to corporate restructuring and insolvency, including the position of secured and unsecured creditors, and the practical issues relating to enforcement of securities and debt recovery, structuring and restructuring transactions and litigation. Copies of this brochure and the others referred to can be obtained free of charge from the Restructuring & Insolvency group of Clayton Utz. Sydney Level 34 No. 1 O’Connell Street Sydney NSW 2000 T +61 2 9353 4000 F +61 2 8220 6700 Melbourne Brisbane Level 18 333 Collins Street Melbourne VIC 3000 T +61 3 9286 6000 F +61 3 9629 8488 Level 28 Riparian Plaza 71 Eagle Street Brisbane QLD 4000 T +61 7 3292 7000 F +61 7 3221 9669 Perth Canberra Darwin Level 27 QV1 Building 250 St. George’s Terrace Perth WA 6000 T +61 8 9426 8000 F +61 8 9481 3095 Level 8 Canberra House 40 Marcus Clarke Street Canberra ACT 2601 T +61 2 6279 4000 F +61 2 6279 4099 17–19 Lindsay Street Darwin NT 0800 T +61 8 8943 2555 F +61 8 8943 2500 www.claytonutz.com Persons listed may not be admitted in all states. This document is intended to provide general information. The contents do not constitute legal advice and should not be relied upon as such. © Clayton Utz 2008