File

advertisement

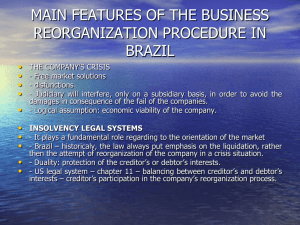

WELCOME TO U ALL FOR ONE DAY GUEST LECTURE ON SIFD INTRODUCTION Investment Decisions: Traditional Approach or NDCF Modern or DCF Decisions under Risk & Uncertainty NDCF OR TRADITIONAL PAY BACK METHOD ACCOUNTING RATE OF RETURN OR AVERAGE RATE OF RETURN MODERN OR DCF NET PRESENT VALUE METHOD INTERNAL RATE OF RETURN METHOD PROFITABILITY INDEX METHOD DEPRECIATION STRIGHT LINE METHOD % METHOD WTRITTEN DOWN VALUE METHOD EQUIVALENCE OF NPV OR IRR These two methods will give same results in respect of conventional and independent projects. Conventional – Investment followed by series of cash inflows. Independent – which does not depend on other projects. Profitability Index PI = PV / C0 EPVI- Excess present value indexonly decision making can be done. CHAPTER - VIII FINANACIAL DISTRESS: When a firm is unable to meet scheduled payment or cash flows position indicate that it will soon be unable to do so. Issues faced by a firm in Financial Distress Is the in ability of the firm to meet scheduled debt payment or a temporary cash flows problem. Or it is a permanent problem caused by asset value having fallen below an obligation. If it is temporary the agreement with creditors that gives the firm to recover. However if it s long run asset value have truly delivered then economic loss have occurred. “Worth more dead than achieve” business is more valuable if it were maintained and continued in operation or liquidated and sold off in piece. Should control the firm while it is being liquidated or rehabilitated should the present management be replaced or trustee be replaced. BANKRUPTACY When a company finds it self in the worst possible situation with a poor competitive position in an industry with a few prospectus ,management has only a few alternatives all of them dissatisfiers. Because no one is interested for buying a weak co. Causes of financial distress Lawyer’s fees Accountant Fees Court fees Management Time Employee Morale Low Productivity Increase labor turnover. Effects of financial distress -Ve effect on firms value Relationship with stake holders will damages. Stop or cut short credit availability Direct relationship between customer an vendor will improve. LIQUIDATION It is a legal term refers the procedure through which affairs of a company are wound up by law. Appointment of a liquidator. Collects the assets and pays the debts. Distribution of surplus in accordance with the rights of the members. Types of liquidation Compulsory winding up of the court Voluntary winding up by the members or creditors. Winding up under the supervision of the court. LIQUIDATION Liquidation and insolvency are different A solvent company can also be liquidated SETTLEMENTS OR ORDER OF PAYMENTS Expenses of winding up including liquidators remuneration Creditors (debentures) secured by a floating charge on the assets of the company. Preferential creditors. In secured creditors Surplus if any among others. RE ORGANIZATION Formal reorganization Informal reorganization is should be handled informally because informal reorganization is faster and less costly than formal bankruptcy. Formal reorganization involves so many cost like courts fees, auditors fees, legal charges, mangers remuneration, disruption that occur customer, suppliers & employees> Informal reorganization: it is easy to reorganize it informally if the problems are temporary by using “workouts” CHAPTER - II RISK: The variability ;in the return over a period of time is known as risk. Ex: Government securities and company TYPES OF RISKS 3 TYPES THEY ARE: Certainty or No risk. Uncertainty: It is a situation where the probability of the particular event are not known and the future cannot be foreseen. Chances of future loss can be foreseen because of past experience . Uncertainty factors Date of completion Level of capital oyutlay required Level of selling rice Level of revenue Level of operating costs. Taxation notes. RISK ANALYSIS INPROJECT SELECTION Acceptability depends on cash flows and risk. Cash flows means operational cash receipts less operation expenditures. Risk related to the volatility of the expected outcome. Greater the risk greater the return. RISK METHODS A) General Techniques: i. Risk Adjusted Rate of return ii. Certainty equipment coefficient. B) Quantitative Techniques i. Sensitivity Analysis ii. Probability analysis iii. Std Deviation. iv. Coefficient of variation v. Decision Tree Risk Adjusted Rate of Return This is is on e of the method of incorporating risk into CBD. It is based on the assumption that the investor except a higher rate of return on risk projects as compared to less risky projects. RADR is a composite that takes into account of both risk and time factors. RADR = Risk free rate of return + risk premium. Like NPV and IRR it will accept. Certainty Equilant Coefficient Method The estimated cash flow are reduced to conservative level by aplying a correction factor termed as sCE coefficient. CE Coefficient = Risk less cash flows Risky Cash flows Probability of Analysis The probability of a particular out come of an event is simply preparation of times this outcome would occur if the event were repeated a greater number of times. Ex: throwing a die, possibility of head or trial. Decision Tree Analysis It is a graphic display of relationship between a resent ;decision and possible future events future decision and their consequences. In other words it is as pictorial representation in tree form which indicates the magnitude, probability and inter relationship to all possible outcomes. It links the event chronological. Chapter - III Critical analysis of appraisal techniques Why to do investment appraisals Cash is invested in most profitable projects Realistic project’s budgets are established Measures can be taken to eliminate risk. Discounted Pay Back period Conventional pay back period does not take into account the time value of money. Def: It is the ratio between initial cash outlays and discounted annual cash inflows DPB = Initial cash outlays/Discounted annual cash inlflows. Discounted Pay Back period Advantages: Address time value of money. Easy to understand, it does not accept negative NPV projects/investments. It is biased towards liquidity. Disadvantages: It still ignores cash flows beyond the payback period. Large cash flows projects should be rejected. Post Pay Back It is a type of Break-even measure. The economic life beyond the pay back period is referred to as the postpay back duration. If post-pay back is zero the investment is worthiness. Zero post pay back duration means that the present value of the future cash flows is less than the projects initial investment. Bail-Out pay back It is the time that a project will take care for the cumulative cash flows from operations plus the disposal value of the equipment in a particular period equal the initial investment. It considers the differences in the behavior of the disposal values of projects investment and it is a useful risk indicator. Return on Investment It is also called as return on capital employed. ROI = PBIT/ Capital Employed * 100 Gross Capital Employed: Fixed Assets+ Current Assets Net Capital Employed: Total AssetsCurrent Liabilities Owners capital employed: FA+CA-Out side liabilities (Both long-term and short-term) Equivalent annual cost It is a time-adjusted method of calculating an equal annual cost over the life of an investment. It discounts and compounds cost amounts at a specified interests rate in such a way as to convert them all into annuity amounts. EAC= Capital recovery and return+ interest on salvage+ Other costs. Terminal value method Under this method it is assumed that each cash flow is reinvested in another projects at certain rate of interests. It is also assumed that each cash flows is reinvested elsewhere immediately until the termination of the project. Valuation: Terminal value is liquidated TV of an ongoing form. TV of debt, Common stock. NPV Mean Variance It is applied during pre-feasibility stage of the project acceptance. Projects can be compared by graphing the NPV probability functions. The decision maker will have to decide what weights to apply to higher mean NPV versus greater risks. Hertz Model It is also called as method of statistical trials. It involves first the random selection of an outcome for each variable of interests, the combining of these outcomes with any fixed amounts and calculation if necessary to obtain one trial outcome in terms of the desired answer. Hertz Model It is utilized nine variables and later on combined into three different variables. Such as 1. market analysis 2. investment cost analysis 3. operating and fixed cost analysis. Information and data bank in project selection Initial stage: About product description. About feasibility study. Concept document. Project charter Planning Stage: Execution Stage: Control Stage: Scope of control, schedule of control, cost control, quality control, risk control. THANK YOU