ACC2205 – Intermediate Accounting II

advertisement

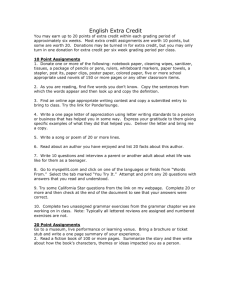

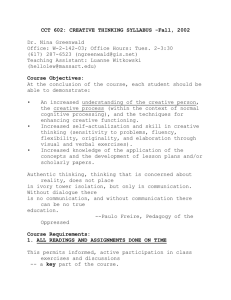

COURSE SECTION INFORMATION Financial, Office & Legal Intermediate Accounting II Business Accounting Professor’s Name: Maria Belanger Course Number: ACC2205 Email: belangm@algonquincollege.com Course Section: 420 Phone: 613-727-4723 ext. 5199 Academic Year: 2010/11 Office: B-412c Out of Class Consultation: Mon: 12–2pm Wed: 2- 3pm OR by appointment. Term: Winter Academic Level: 04 Section Specific Learning Resources TEXT: "Intermediate Accounting"; Volumes 1 and 2, Ninth Canadian Edition; Kieso, Weygandt, Warfield, Young and Wiecek; publisher John Wiley & Sons Canada,Ltd. ONLINE: Wiley Plus – Section 400 Students must register on the Wiley Plus account. The link will be provided in class and on Blackboard. Other related materials will be provided to the student as required. © Algonquin College 1 ACC2205 Learning Schedule Ch 9 10 # of Topic Material Classes 4 INVESTMENTS Pages 530 – 574 (OMIT APPENDIX 9A) - Cost / Amortized cost model - Fair value through net-income model (FV-NI) - Fair value through other comprehensive income model (FVOCI) - GAAP classifications - Impairment - Strategic Investments - Financial statement presentation and disclosure - IFRS and PE GAAP comparison Assignments: Brief Exercises: 9-1, 2, 3, 4, 5, 7, 10, 11, 12, 13, 14 Exercises: 9-1, 3, 5, 6, 8, 9, 10, 14, 17, 18, 19, 23, 24 Problems: 9-1, 5, 14 ACQUISITION OF PROPERTY, PLANT AND EQUIPMENT 4 Pages 604-637 (OMIT APPENDIX 10A) - Measurement of property, plant, and equipment at acquisition Exchange of assets Monetary and non-monetary exchanges Lump-sum purchases Contribution of assets - Understand and apply cost, revaluation, and fair value models - Costs subsequent to acquisition - Natural resources Assignments: Brief Exercises: 10 - 1, 2, 4, 6, 7, 8, 9, 10, 11, 12, 14, 15, 16, 17 Exercises: 10 - 3, 7, 11, 12, 13, 15, 17, 18, 21, 24, 26, 28 Problems: 10 - 3, 5, 8(a) TERM TEST No. 1 on Chapters 9 and 10 © Algonquin College 2 1 ACC2205 11 12 13 DEPRECIATION, IMPAIRMENT AND DISPOSITION 3 Pages 676-716 (INCLUDE APPENDIX 11A) - Factors involved in the depreciation process - Methods of cost allocation - Depletion of natural resources - Impact of changes to depreciation estimates - Account for the derecognition of property, plant, and equipment - Impairments - Financial statement disclosure - Calculation of capital cost allowance Assignments: Brief Exercises:11-2, 3, 4, 6, 7, 8, 9, 11, 13, 14, 16 Exercises: 11-4, 6, 8, 11, 13, 16, 20, 26, 30 Problems: 11-1, 5, 12, 13 INTANGIBLE ASSETS AND GOODWILL 3 Pages 742-779 (OMIT APPENDIX 12A) - Recognition and measurement issues at acquisition - Recognition and measurement of internally developed or generated intangible assets - Measurement after acquisition - Types of intangible assets and deferred charges - Goodwill - Impairment of limited-life and indefinite-life intangibles and goodwill - Presentation Assignments: Brief Exercises: 12 - 2, 3, 5, 6, 9, 12, 16 Exercises: 12 - 1, 6, 9, 16, 18, 19, 20 Problems : 12 - 1, 9 CURRENT LIABILITIES AND CONTINGENCIES Pages 833-875 - Nature and types of current liabilities - Estimated Current Liabilities - Employee-related Liabilities - Guarantees and Customer Program obligations - Decommissioning and Restoration Obligations - Contingencies and Uncertain Commitments - Financial statement presentation Assignments: Brief Exercises: 13 - 5, 9, 10, 11, 12, 13, 14, 15, 17, 18, 20, 21, 24 Exercises: 13-2, 5, 6(a), 7, 8, 11, 13, 15, 16, 18, 20, 22, 23 Problems: 13-1, 2, 4, 6 3 TERM TEST No. 2 on Chapters 11, 12 and 13 1 © Algonquin College 3 ACC2205 14 LONG-TERM FINANCIAL LIABILITIES Pages 908-934 (OMIT LEARNING OBJECTIVE 7) - Nature of long-term liabilities - Measurement and valuation of bonds and notes payable - Special situations such as non-market rates of interest - Derecognition of debt - Reporting long-term debt Assignments: Brief Exercises: 1, 4, 5, 6, 7, 8, 9, 10, 11, 12, 16 Exercises: 1, 2, 3, 4, 5, 6, 8, 10, 12, 13, 15, 16, 17, 20, 30 Problems: 1, 2, 6, 7, 8, 9 15 SHAREHOLDERS’ EQUITY 5 Pages 960-990 (OMIT APPENDICES 15A & 15B) - Overview of corporate form of business entity - Share Capital - Issuance for cash & other considerations - Subscriptions of shares - Lump sum sales of securities - Reacquisition of shares - Retained earnings - Dividends: cash, in kind, participating, cumulative, liquidating and stock - Stock splits and stock dividends differentiated - Contributed surplus and Accumulated other comprehensive income - Financial statement disclosures Assignments: Brief Exercises: 15 - 4, 5, 6, 7, 8, 10, 11, 12, 15, 16 Exercises: 15 - 1, 2, 3, 6, 7, 9, 10, 14, 16 Problems: 15 - 1, 2, 3, 5, 11 1 TERM TEST No. 3 on Chapters 14 and 15 © Algonquin College 4 4 ACC2205 Other Important Information 1) The grading scheme for this course is as follows: Assignments Term Test 1 Term Test 2 Term Test 3 Total 20% 30% 25% 25% 100% NOTE: You must achieve a weighted average grade of 50% (40/80) on the three tests in order to have the assignment marks contribute to your final grade. 2) Students are expected to attend all classes, read the textbook, do all assigned problems and complete assignments by their due dates. Late assignments will not be accepted. If you do not have a valid reason, such as illness or family emergency, for missing tests, then you will receive a “0” on that evaluation. © Algonquin College 5 ACC2205