GRADE 10 LESSON 8 SOLE TRADER ACCOUNTING EQUATION

advertisement

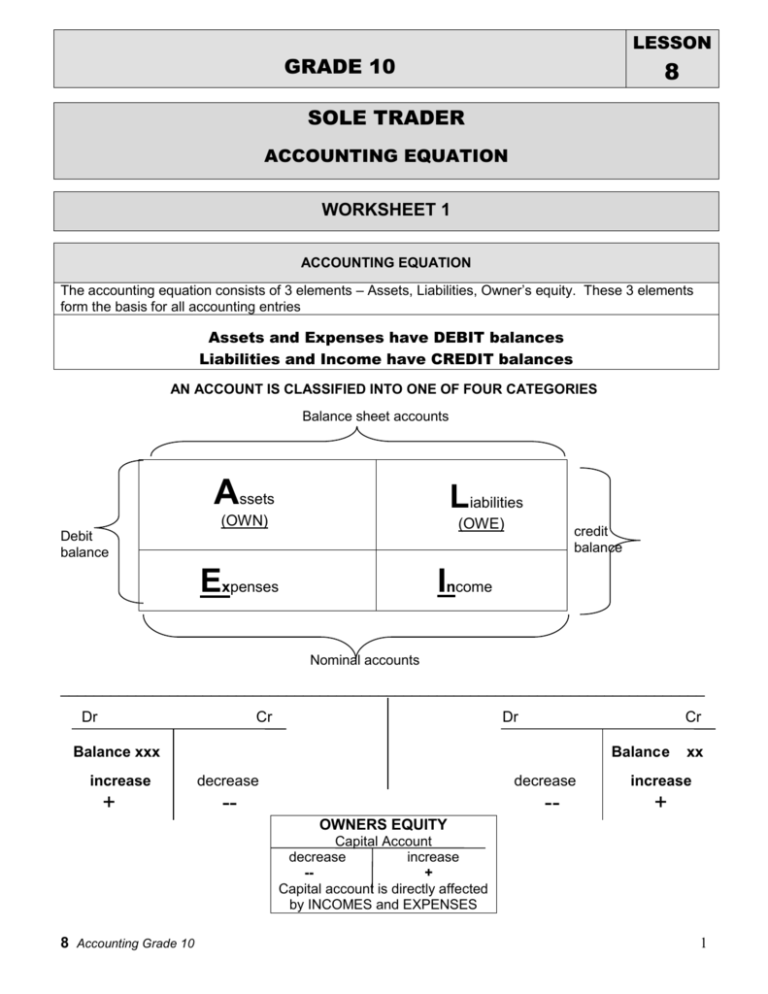

LESSON GRADE 10 8 SOLE TRADER ACCOUNTING EQUATION WORKSHEET 1 ACCOUNTING EQUATION The accounting equation consists of 3 elements – Assets, Liabilities, Owner’s equity. These 3 elements form the basis for all accounting entries Assets and Expenses have DEBIT balances Liabilities and Income have CREDIT balances AN ACCOUNT IS CLASSIFIED INTO ONE OF FOUR CATEGORIES Balance sheet accounts Assets Liabilities (OWN) (OWE) Debit balance Expenses credit balance Income Nominal accounts _____________________________________________________________________________ Dr Cr Dr Cr Balance xxx increase + Balance decrease decrease -- -- xx increase + OWNERS EQUITY Capital Account decrease increase -+ Capital account is directly affected by INCOMES and EXPENSES 8 Accounting Grade 10 1 ACCOUNTING EQUATION A = OE Assets + - - NON-CURRENT ASSETS 1 Fixed/Tangible assets Land and buildings Vehicles Equipment ASSETS + 8 Accounting Grade 10 + 1 Capital +/ increase (credit) 2 Drawings -/ decrease (debit) 3 Profit / Loss Cr Expenses - CURRENT ASSETS 1 Inventories Trading stock 2 Debtors 3 Cash Bank (favourable / debit balance) Cash float Petty cash increase L Liabilities Dr 2 Financial assets Fixed deposit Investment Dr + Owners Equity Cr decrease - Cost of sales Interest expense Rent expense Salaries Wages Stationery Fuel Packing material Repairs Insurance Advertising Discount allowed Telephone Water & electricity Income + - + NON-CURRENT LIABILITIES Loan (long term – more than 12 months) Mortgage bond CURRENT LIABILITIES Creditors Bank overdraft (unfavourable / credit balance) Short-term loan (less than 12 months) Sales Current/fee income Interest income Rent income Discount received Dr LIABILITIES decrease - Cr increase + 2 Steps to follow 1 2 3 4 Determine the two accounts involved in the transaction Each transaction has TWO accounts Determine what type accounts they are – assets, liabilities, expenses, income Determine the effect on the accounting equation (increase / decrease) Check if A = OE + L TO HELP YOU REMEMBER If you pay you CRy – therefore the entry in the bank account will go on the CRedit side. Assets = Owner’s Equity + Liabilities Example – Accounting equation Complete the following: A No Transaction Account debited Account credited Assets + - = OE + Owners equity - + L Liabilities + Capital -Drawings Profit - expense + income 1 The business pays the telephone account R200 Telephone Bank - 200 - 200 0 Explanation Follow the steps 1 determine the two accounts involved in the transaction 2 Bank & Telephone determine what type accounts they are – assets, liabilities, expenses, income 3 Bank is Asset (we own the money) Telephone is Expense (money paid out for the day-to-day running of the business) determine the effect on the accounting equation (increase / decrease) 4 Bank decreases – money is paid out (money becomes less) Expenses decreases the profit – therefore decreases Owners equity Liabilities = 0 effect Check if A = OE + L - 200 = -200 + 0 8 -Accounting Grade 10 3 ACTIVITY 1 Complete the following: A No Transaction Account debited Account credited Assets + - = OE Owners equity + Capital - Drawings + Profit + L Liabilities + - expense + income 1 2 3 4 5 6 The owner invests personal cash in the business, R200 000 The owner withdraws cash for personal use, R30 000 Buy stationery and pay by cheque R200 Receive a cheque for rent R500 The business purchases equipment for cash, R50 000 Receive R50 000 from AB Bank for a loan R40 000. 8 -Accounting Grade 10 4 ACTIVITY 2 Complete the following: A No 1 2 3 4 5 6 Transaction Bought a vehicle and paid by cheque R50 000 Issued a receipt for rent received R700 Buy Packing material and pay by cheque R500 Receive a cheque for rent Services rendered R1 200 The business purchases trading stock for and paid by cheque R60 000 Receive R100 000 from XZ Bank for a loan R80 000 8 -Accounting Grade 10 Account debited Account credited Assets = OE Owners equity + L Liabilities 5 ANSWERS 8 ACTIVITY 1 No 1 2 3 4 5 6 Transaction The owner invests personal cash in the business, R200 000 The owner withdraws cash for personal use, R30 000 Buy stationery and pay by cheque R200 Receive a cheque for rent R500 The business purchases equipment for cash, R50 000 Receive R50 000 from AB Bank for a loan Account debited Account credited Assets Owners equity Liabilities Bank Capital + 200 000 +200 000 0 Drawings Bank - 30 000 -30 000 0 Stationery Bank -200 -200 0 Bank Rent Income +500 +500 0 Equipment Bank +50 000 -50 000 0 0 Bank Loan : AB Bank +50 000 0 +50 000 Assets Owners equity Liabilities 0 0 +700 +700 0 -500 -500 0 +1 200 +1 200 0 0 0 0 +80 000 ACTIVITY 2 No 1 2 3 4 5 6 Transaction Bought a vehicle and paid by cheque R50 000 Issued a receipt for rent received R700 Buy Packing material and pay by cheque R500 Receive a cheque for rent Services rendered R1 200 The business purchases trading stock for and paid by cheque R60 000 Receive R100 000 from XZ Bank for a loan R80 000 8 -Accounting Grade 10 Account debited Account credited Vehicle Bank Bank Rent Income Packing material Bank Bank Services rendered Trading stock Bank Bank Loan: XZ Bank +50 000 -50 000 +60 000 -60 000 +80 000 6 CHALKBOARD SUMMARY OWNER’S EQUITY ASSETS + - NON-CURRENT Land & Buildings Vehicles Equipment Investment CURRENT Trading stock Debtors Bank (cash) 8 -Accounting Grade 10 - OWNER’S EQUITY Capital (Drawings) Net Profit Incomes – Expenses + LIABILITIES - + NON-CURRENT Mortgage Bond Loan CURRENT Creditors Bank Overdraft 7