File

advertisement

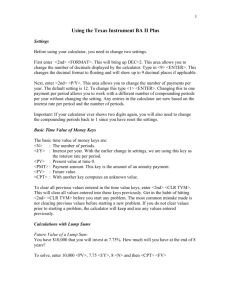

Time Value of Money Keys on Financial Calculator The TI BAII Plus calculator is an important tool for any student taking finance courses. Most professors point out early on that this calculator will become your best friend, so it is important to know it well. Mastering your ability to operate the Time Value of Money keys will be the first step in the essentials of finance. These instructions will show you how to set up your calculator and how to operate the TVM keys through various problems. A basic understanding of financial vocabulary will help to understand what the example questions are asking. Step One: Change the number of decimal places displayed. Be sure to read the “Notes” written below if you have trouble finding certain keys. Set up for 6 decimal places: -These keys are listed in the exact order they should be entered. Enter the pictured keys in order: Press: 2nd, FORMAT, 6, ENTER, 2nd, QUIT Note: The FORMAT key is also the ( . ) key along the bottom row. The QUIT key is also the CPT key at the top left. Step Two: Set your calculator to add interest to the principal once a year. (annual compounding) Set up for annual compounding: -Enter these keys in the exact order shown. Press: 2nd, I/Y, 1, ENTER, 2nd, QUIT Note: The I/Y key is one of the Time Value of Money or TVM keys in the third row. Step 3: How to input numbers into the TVM keys. 5 TVM Keys N = total number of payments I/Y = annual interest rate PV = present value PMT = payment amount FV = future value Note: When inputting a number for any TVM key, always type the number prior to selecting the key. Example: If N = 2, then you will press “2” and then the “N” key. First: Then: Step 4: How to enter a negative number for a TVM key. Note: When entering a negative number, you will type the number first and then the “+/-” key. The “+/-” is the symbol for a sing change located below the “3” key. This key is not the minus sign. PV = -1000 First: Example: If the Present Value is -1000, then you will enter “1000” and then the “+/-” key before pressing “PV”. Then: Step 5: Clear your TVM worksheet. You MUST do this before every new problem. Press: 2nd, CLR TVM, 2nd, QUIT Note: The CLR TVM key is also the FV key on the TVM row. Always clear TVM worksheet before inputting new data. Step 6: Enter data in the TVM keys to find an unknown variable. After all of your given information is entered, press the “CPT” key and then the TVM key of the variable that you are solving for. Note: The “CPT” key is often confused with the “=” key. The compute “CPT” key is at the top left. Example: If all other data is entered and you are solving for the Present Value or “PV”, then you will press “CPT” and First: Then: then “PV”. Step 7: Practice entering the data in the order given for these problems below. There is one example problem for each of the 5 variables. When there are problems including values for Present Value and Future Value, you will have to enter one of them as a negative. The calculator must see a sign change between the two. If you are only given one of them, then you can enter that number as a negative to make your solution a positive. When Payments are involved, if you are making payments then PMT will be a negative. If you are receiving payments, then PMT is a positive. Lump sum problems will not have payments and the “PMT” will equal 0. If you encounter an ERROR sign or any other issues, then look on the last page of these instructions for suggestions and quick fixes. Clear TVM worksheet (2nd, CLR TVM, 2nd, QUIT) Example: Present Value of a single amount (PV = ?) You want to receive $500 in 1 year. How much should you invest for 6% interest compounded annually. (This is a lump sum problem, therefore, there are no payments and your PMT = 0). Given Enter Solution N=1 “1” “N” I/Y = 6 “6” “I/Y” PMT = 0 “0” “PMT” FV = 500 “500” “FV” PV = ? “CPT” “PV” -471.70 Note: The answer will appear as a negative because the calculator needs a sign change between the Present Value and Future Value. Your answer should be written as $471.70. Clear TVM worksheet (2nd, CLR TVM, 2nd, QUIT) Example: Future Value of a single amount (FV = ?) You invest $500 today at 12% compounded annually. What is value in 5 years? (Your Present Value will be entered as a negative number because you have invested $500). Given Enter Solution N=5 “5” “N” I/Y = 12 “12” “I/Y” PV = -500 “500” “+/-” “PV” PMT = 0 “0” “PMT” FV = ? “CPT” “FV” 881.17 Note: To input a negative number, enter the number first and then press the “+/-” key. Clear TVM worksheet (2nd, CLR TVM, 2nd, QUIT) Example: Find interest compounded annually (I/Y = ?) Given that your Present Value is $5,000 and your Future Value is $10,000. What will your Annual Interest Rate be over the course of five years? (You can enter either PV or FV as a negative. Both options will give the same interest rate). Given Enter Solution N=5 “5” “N” PV = -5,000 “5,000” “+/-” “PV” PMT = 0 “0” “PMT” FV = 10,000 “10,000” “FV” I/Y = ? “CPT” “I/Y” 14.87 Note: The computed value is an interest rate and is given as a percentage. (14.87%) Clear TVM worksheet (2nd, CLR TVM, 2nd, QUIT) Example: Calculate number of periods (N = ?) If the Present Value is $100, how many periods will it take for the Future Value to be $200 at 10% interest? (Either PV or FV can be entered as a negative. But, intuitively, it should make sense for the Present Value to be the negative value entered). Given Enter Solution I/Y = 10 “10” “I/Y” PV = -100 “100” “+/-” “PV” PMT = 0 “0” “PMT” FV = 200 “200” “FV” N=? “CPT” “N” 7.27 Note: The solution is given in years. (7.27 years) Clear TVM worksheet (2nd, CLR TVM, 2nd, QUIT) Example: Find Payment amount (PMT = ?) How much will your monthly payments be if you take out a 60 month $25,000 loan at 6% interest? Note: This question requires the interest to be converted into a monthly percentage since there are 60 payment periods over 60 months. This is done by dividing the interest rate by the number of periods in a year. (There are 12 months in 1 year, the interest will be 6/12 or .5). Given Enter Solution N = 60 “60” “N” I/Y = 6/12 or .5 “.” “5” “I/Y” PV = -25,000 “25,000” “+/-” “PV” FV= 0 “0” “FV” PMT = ? “CPT” “PMT” 483.32 Common Issues ERROR 5: If this shows up on your screen, then you are missing a sign change. Check your entered values for the Present Value “PV” and the Future Value “FV”. If there is no sign change between these two then the ERROR 5 message will continue to appear. Answer is a NEGATIVE: You haven’t necessarily done anything wrong here. The number computed, whether it is shown as a negative or a positive, is the correct answer as long as you write is as a positive. If you are solving for the Future Value, then you can enter your Present Value as a negative and your FV will be computed as a positive. The calculator requires a sign change between the FV and PV. You should naturally be able to recognize when a number should be negative by thinking of it as either a cash flow in or a cash flow out. For example, an investment in an asset would be a cash flow out because you have lost the opportunity to spend that money on something else. Note: In the future, when solving for problems that involve payments towards loans and annuities, you can always remember that PMT should be negative when making payments towards a loan and PMT should be positive when payments are received from an annuity. TVM worksheet keeps DISAPPEARING: Make sure you are hitting the “CPT” key to compute the unknown value and NOT the “=” key. After you have hit the “CPT” key, you should then press the TVM key of the value that you are looking for.