Burr - Hand Out - Time Value of Money

advertisement

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

The Time Value of Money (TVM)

A fundamental skill that any Chief Financial Officer should have is using the time value of money

to help solve problems and develop information to make decisions.

Money has a time value, not because of inflation but because, just like most other things, it can

be rented. The rent is called “interest.” Because the option of renting it out is always available, it

becomes a fundamental alternative that must be considered and measured in any decision where

the usage of money is being weighed.

Let’s take an example. Suppose a salesman approaches your NPO on a new lighting system,

and claims that it can save you money because it is fully programmable and therefore does not

need a person to attend it during performances. The salesman claims that the savings you’ll get

by laying that person off will more than pay your NPO back for the cost of the system. Sounds

good, but…there’s another factor that must be addressed, and that is the opportunity cost of

using money to buy the system rather than putting that same money in an interest-bearing

savings account (which is always an alternative available to us). So, if the system is to pass the

more complete test, it must not only pay you back for its cost, but also for the interest on that

cost, which you are giving up to buy the system. Using time value of money techniques, we can

measure whether the new system has a chance of meeting this fundamental requirement.

The Types of Time Value of Money Problems

There are 4 basic categories of TVM problems.

1. The present value of an annuity (PVA1)

2. The present value of a single amount (PV1)

3. The future value of an annuity (FVA1)

4. The future value of a single amount (FV1)

The subscript “1” means one dollar, which is merely the profession’s way of saying that all

problems can be solved using $1 as the common amount and then multiplying that answer by the

number of dollars involved in your particular situation. The word “annuity” describes any series of

periodic payments (if you’re on the paying side) or receipts (if you’re on the receiving side). Most

problems in real life deal with this kind of situation (#1 or #3 above). The annuity can be regular

(weekly, monthly, quarterly, annual, etc.), or irregular; and it can be of the same dollar amount

every time, or a different dollar amount each time. For this course, and for most situations, we

usually assume a regular periodicity and the same dollar amount because it greatly simplifies the

computation. Irregular timing and dollar amounts can be dealt with, but the computation takes

longer and is more complicated.

Know 3, Find the 4th

The most common TVM problems have 4 pieces of information. The first 3 you either have to

know or make a good guess at (read that: assume), and then the 4th one can be solved. Let’s

take the familiar example of figuring out the monthly payment on a loan. The 4 pieces of

information are:

1. The loan amount (its Present Value or PV)

2. The interest rate (I)

3. The number of months involved (N)

4. The payment (PMT)

We’ll either know or assume the first 3 pieces of information to solve for the 4 th. For example:

1. PV = $15,000 (known or assumed)

2. I = 9.99% (known or assumed)

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

3. N = 48 (known or assumed)

4. PMT = $380.37 (solved)

This is good news! You only have to get 3 pieces of information for any TVM problem, and you

can always solve for the 4th.

Know, Assume,

or Estimate

Know, Assume,

or Estimate

Know, Assume,

or Estimate

Solve

Present Value of

Annuity

Problems

Payment

Rate

Periods

Present Value

Rate

Periods

Present Value

Payment

Periods

Present Value

Payment

Rate

Present Value

Payment

Rate

Periods

Future Value of

Annuity Problems

Payment

Rate

Periods

Future Value

Rate

Periods

Future Value

Payment

Periods

Future Value

Payment

Rate

Future Value

Payment

Rate

Periods

Present or Future

Value of A Single

Deposit Problems

Present Value

Rate

Periods

Future Value

Rate

Periods

Future Value

Present Value

Periods

Future Value

Present Value

Rate

Future Value

Present Value

Rate

Periods

Compounding and Its Magic

When we talk about compounding we’re talking about compounded interest…or interest on

interest. If we deposit $100 in a savings account that earns 10%, compounded annually, then at

the end of the first year we will have $110 in the account. At the end of the second year we will

have $121 in the account (our original $100 + $10 earned the first year + another $10 earned the

second year + $1 earned the second year on the $10 earned the first year). That last $1 is

compounding; it is interest earned on interest. This is about as close to magic as you can get. It’s

wonderful.

In most of the TVM problems that we’ll discuss here, we’ll assume monthly compounding. That

means that we’ll do our interest computations monthly rather than annually, and we’ll add that

interest to the “pot” at the end of each month. Of course, we won’t use the full annual rate (10% in

the example above), but one-twelfth of that rate (0.83%) since the time involved is a month

instead of a year. The interesting thing is that frequent compounding is better. For example, 10%

on $100 compounded annually yields $10.00 in interest, but 10% on $100 compounded monthly

yields $10.47 in interest. That little extra thrown in the “pot” each month makes the difference.

(We always presume that interest rates are stated annually if there is no additional language to

help us out. If we are given an interest rate of 10%, then we are to assume 10% per year unless

we are told otherwise. At a 10% rate, $100 would earn $10 for the whole year. If we left the $100

on deposit for only one month, then the interest would be $0.83, which is $10 divided by 12

months.)

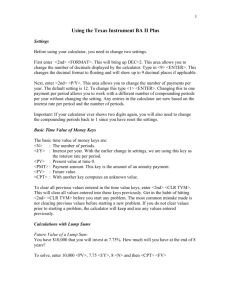

Working The TI BA II Plus Calculator

The Texas Instruments Business Analyst II Plus (TI BA II Plus) calculator can perform all of the

TVM computations that we’ll be doing in this class. We need to understand the specific keys we’ll

be using.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

2nd

You’ll notice that this key is light blue. Whenever you press this key it will set the keyboard up

so that the blue functions just above the various keys are performed rather than what is

indicated on the key itself.

QUIT

This is the blue function above the CPT key. When you are in the 2nd mode and want to get

out of it, you press this key. If you are not in the 2nd mode, then the key functions as the CPT

(compute) key.

P/Y

This is the light blue function above the I/Y key. When you press the 2nd key followed by the

P/Y key, you will see how many compounding periods per year you have specified. Annual

compounding would be “1,” quarterly compounding would be “4,” monthly compounding

would be “12.” To set it to 12, type in 12 and then the SET key (which is normally the ENTER

key).

CLR TVM

This is the light blue function above the FV key. When you are in the 2nd mode you press

this key to clear all of the calculator’s registers (sort of like holding tanks for data). It is

important in most cases to make sure these registers are cleared out, so you will use this

function after solving each problem and before starting on the next one.

N

This is the leftmost key, third row from the top. It registers the number of periods (in all of the

problems in this class, months) for the problem you’re solving. You type in the number of

months, for example 36, and then press this key. Sometimes, though, you may be solving for

N, in which case you would have already entered your 3 known variables. Then you would

press the CPT key (for compute) before you press the N key.

I/Y

This key is just to the right of the N key. It registers the interest rate for the problem you’re

solving. You type in the annual interest rate (no need to convert it to monthly because you’re

setting the P/Y to 12 automatically does that for you), for example 10.75, and then press this

key. Sometimes, though, you may be solving for I/Y, in which case you would have already

entered your 3 known variables. Then you would press the CPT key (for compute) before you

press the I/Y key.

PV

This key is just to the right of the I/Y key. It registers the present value for the problem you’re

solving. You type in the dollar value and then press this key. Sometimes, though, you may be

solving for PV, in which case you would have already entered your 3 known variables. Then

you would press the CPT key (for compute) before you press the PV key.

PMT

This key is just to the right of the PV key. It registers the amount of the periodic payment for

the problem you’re solving. You type in the dollar value and then press this key. Sometimes,

though, you may be solving for PMT, in which case you would have already entered your 3

known variables. Then you would press the CPT key (for compute) before you press the PMT

key.

This key is just to the right of the PMT key. It is the rightmost key, third row from the top. It

registers the future value of the problem you’re solving. You type in the dollar value and then

press this key. Sometimes, though, you may be solving for FV, in which case you would have

already entered your 3 known variables. Then you would press the CPT key (for compute)

before you press the FV key.

This key is on the bottom row, just to the left of the = key. It changes the sign of a number

from positive to negative, or from negative to positive, like a toggle switch. Whenever two of

your three known variables in a TVM problem are dollar values (such as PMT and PV), one

of them must be negative and the other must be positive. You use the +/- key to change the

sign on one of them.

FV

+/-

Clearing Your Calculator

Before every TVM problem, you should clear your calculator of any existing TVM values in any of

the registers. You do this by the following keystrokes.

2nd then QUIT then 2nd then CLR TVM

It’s not a bad idea to repeat this series of keystrokes two or three times in a row before you begin

your next TVM problem, just to make sure the registers are emptied.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Present Value of an Annuity of One (PVA1)

This is the most difficult TVM category to understand, which is why we’ll deal with it first. The best

way to approach it is to examine the fundamental question it answers:

“What single amount am I willing to invest now, at a given interest rate of I, in order to receive (or

alternatively avoid paying) a periodic payment of $X for the next N periods?”

Perhaps the better term should be:

“The Starting Out Amount.” Because you

will find situations in which you need to

compute “Present Value of an Annuity” but

that “answer” is actually in the future. Take

the “Retirement” problem, for example.

In this type of TVM problem, we’ll know or make a good guess at

1. PMT - The payment

2. I – The interest rate

3. N – The number of payments (months)

We punch these three “knowns” into our calculator, press CPT and then PV, and the calculator

will display our solution.

Example: What would we be willing to invest now in an account that pays 10% per year,

compounded monthly, in order to receive (or avoid paying) a monthly payment of $500 for the

next six months? We make the following keystrokes into our calculator:

1.

2.

3.

4.

$500 then PMT

10 then I

6 then N

CPT then PV

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

The calculator displays the solution of $2,914.41. We could then construct a table like the one

below to prove the solution (of course, you don’t need to do this every time).

Balance at Beginning of Month

Interest Earned During Month

Month 1

Month 2

Month 3

Month 4

$2,914.41

$2,438.70

$1,959.02

$1,475.34

Month 5

$987.64

Month 6

$495.87

$24.29

$20.32

$16.33

$12.29

$8.23

$4.13

Subtotal

$2,938.70

$2,459.02

$1,975.34

$1,487.64

$995.87

$500.00

Less Payment Made/Received

($500.00)

($500.00)

($500.00)

($500.00) ($500.00) ($500.00)

Balance at End of Month

$2,438.70

$1,959.02

$1,475.34

$987.64

$495.87

$0.00

So, a single investment of $2,914.41 yields us a monthly cash flow of $500.00, or $3,000.00 over

the six-month period. The power of compounded interest makes up the difference between the

$2,914.41 and the $3,000.00.

What if we could find an account that pays 20% compounded monthly? Would our answer go up

or down? Let’s do the keystrokes.

1.

2.

3.

4.

$500 then PMT

20 then I

6 then N

CPT then PV

The calculator displays the solution of $2,832.50. Our answer goes down because the higher

interest rate works harder for us, allowing us to invest less to get the same result. The table below

demonstrates how the solution would roll out over the six months.

Balance at Beginning of Month

Interest Earned During Month

Subtotal

Month 1

Month 2

Month 3

Month 4

$2,832.50

$2,379.71

$1,919.37

$1,451.36

$975.55

$47.21

$39.66

$31.99

$24.19

$16.26

$8.20

$2,879.71

$2,419.37

$1,951.36

$1,475.55

$991.80

$500.00

($500.00) ($500.00) ($500.00)

Less Payment Made/Received

($500.00)

($500.00)

($500.00)

Balance at End of Month

$2,379.71

$1,919.37

$1,451.36

$975.55

Month 5

$491.80

Month 6

$491.80

($0.00)

By the way, in each of the tables above, you compute the interest earned during the month by

taking the beginning balance and multiplying it times the interest rate, and then dividing that

answer by 12 (because it’s just one month’s worth of interest). Try it and see if you arrive at the

same results.

We can change the problem wording slightly to ask the question, “What is the biggest amount we

would be willing to offer now to ‘buy ourselves’ out of an agreement in which we are obligated to

make payments of $X each for the next N months, assuming an interest rate of I?” A similar

variation is, “What is the biggest amount we would be willing to invest now to achieve a cost

savings (or perhaps a revenue enhancement) of $X per month for the next N months, assuming a

required rate of return of I?” It doesn’t matter whether we talk about the payments from the

incoming side or the outgoing side. We use the exact same keystrokes to solve the problem.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Future Value of an Annuity of One (FVA1)

The fundamental question answered by this type of TVM problem is:

“If I invest $X per month for the next N months at a given interest rate (or rate of return) of I%, to how

much will that accumulate?”

In this type of TVM problem, as in the PVA1 problem, we’ll know or make a good guess at

1. PMT - The payment

2. I – The interest rate

3. N – The number of payments

(months)

We punch these three “knowns” into our calculator, press CPT and then FV, and the calculator

will display our solution.

Example: What if we invest $500 per month for the next 6 months in an account that pays 10%

compounded monthly. What amount would we have in the account at the end of the 6 months?

We make the following keystrokes into our calculator:

1.

2.

3.

4.

$500 then PMT

10 then I

6 then N

CPT then FV

The calculator displays the solution of $3,063.20. We could then construct a table like the one

below to prove the solution.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Month 1

Balance at Beginning of Month

$0.00

Interest Earned During Month

$0.00

Subtotal

$0.00

Month 2

Month 3

Month 4

Month 5

Month 6

$500.00 $1,004.17 $1,512.53 $2,025.14 $2,542.02

$4.17

$8.37

$12.60

$16.88

$21.18

$504.17 $1,012.53 $1,525.14 $2,042.02 $2,563.20

Add Payment Made/Received

$500.00

Balance at End of Month

$500.00 $1,004.17 $1,512.53 $2,025.14 $2,542.02 $3,063.20

$500.00

$500.00

500.00

$500.00

$500.00

Importantly, the FVA1 problem is NOT a “mirror image” of the PVA1 problem, as is the case

with our other two TVM problems: FV1 and PV1.

Present Value of One (PV1)

The fundamental question answered by this type of TVM problem is:

“What single amount (deposit) must I invest now, at a given interest rate of I, if I want to have an amount

of $X at the end of the next N periods?”

In the figure below, the FINISH is known, and we’re solving for the START.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

We’ll know or make a good guess at

1. FV - The future value that is our objective

2. I – The interest rate

3. N – The number of months

We punch these three “knowns” into our calculator, press CPT and then PV, and the calculator

will display our solution.

Example: What amount do we need to deposit now into an account that pays 10% compounded

monthly in order to have $500 in that account 6 months from now? We make the following

keystrokes into our calculator:

1.

2.

3.

4.

$500 then FV

10 then I

6 then N

CPT then PV

The calculator displays the solution of $475.71. We could then construct a table like the one

below to prove the solution.

Month 1

Balance at Beginning of Month

Month 2

Month 3

Month 4

Month 5

Month 6

$0.00

$479.67

$483.67

$487.70

$491.77

Add Deposit

$475.71

$0.00

$0.00

$0.00

$0.00

$0.00

Subtotal

$475.71

$479.67

$483.67

$487.70

$491.77

$495.86

Interest Earned During Month

Balance at End of Month

$495.86

$3.96

$4.00

$4.03

$4.06

$4.10

$4.13

$479.67

$483.67

$487.70

$491.77

$495.86

$500.00

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Future Value of One (FV1)

The fundamental question answered by this type of TVM problem is:

“What amount will I have at the end of N months if I invest a single amount now of $X in account that

pays an interest rate of I?”

In the figure below, the START is known, and we’re solving for the FINISH.

We’ll know or make a good guess at

1. PV - The starting deposit

2. I – The interest rate

3. N – The number of months

We punch these three “knowns” into our calculator, press CPT and then FV, and the calculator

will display our solution.

Example: If I deposit $475.71 now in an account that pays 10% compounded monthly, what

amount will I have in that account at the end of 6 months? We make the following keystrokes into

our calculator:

[Type text]

NAEP Tier II Professional Academy

1.

2.

3.

4.

Burr Millsap

$475.71 then PV

10 then I

6 then N

CPT then FV

The calculator displays the solution of $500.00. Our solution table will be exactly the same as the

one above, indicating that PV1 and FV1 problems are mirror images of each other.

Variations of the TVM Problems

It could be however that we know both dollar amounts and are trying to solve for I (the interest

rate), or N (the number of periods – months for purposes of this class).

In cases like this, one of the dollar amounts that you punch in to your TI BA II Plus

calculator must be negative and the other must be positive. As mentioned above, you

change the sign of the dollar amount before you input it into the problem by pressing the +/- key

(on the bottom row of your calculator). The +/- key acts as a toggle switch, changing the sign of

the amount you have punched in, to negative and then to positive, back and forth, as long as you

keep pressing it.

Example: Our landlord comes to us with a proposal for us to pay her $2,914.41 now in order to

satisfy our obligation to pay her $500.00 per month for the next 6 months. Since $2,914.41 is less

than $3,000.00 ($500.00 X 6), we know it’s worth considering. By figuring out what the implied

interest rate is on her offer, we can have better information. We make the following keystrokes

into our calculator:

1.

2.

3.

4.

$2,914.41 then +/- then PMT

6 then N

$500.00 the PMT

CPT then I/Y

The calculator displays the solution of 10.00% (compounded monthly). If we have the $2,914.41

available in an account which is only paying 6.00% compounded monthly, we will be putting our

money to better use by accepting the landlord’s offer. On the other hand, if our account is paying

14.00%, our money is put to better use by leaving it where it is, and we will either reject the

landlord’s offer, or give her a counter-proposal of a lower amount that beats our current 14.00%

rate of return.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Doing TVM Problems In Excel

Once you become knowledgeable and skilled in using the electronic spreadsheet program,

Microsoft Excel, you can solve TVM problems even quicker and easier.

We learned that TVM problems are generally 4-variable problems and that by knowing (or

sometimes assuming or developing) any 3 variables we can solve the 4th. Here is what we know

(or assume) for your retirement question:

1. i = 4%, compounded monthly (0.33% each month [4% ÷ 12 ] )

2. n = 300 (85 – 60 = 25 years X 12 = 300 months)

3. pmt = $6,154 (your needed before-tax amount assuming a federal income tax rate of 28%

and a state income rate of 7% [$4,000 ÷ { 1 – 0.35} ]

Let’s open an Excel spreadsheet to work out the solution. First, let’s set up the three “knowns” in

the exhibit below.

Having done that, our cursor, in this example, now needs to be in cell D5, the solution cell. Let’s then click

on Excel’s Function Wizard (fx) to find our 4th variable, the Starting-Out Amount of this annuity situation

(remember, “annuity” is simply a periodic payment). This dialog box will appear.

Click on this “down arrow.”

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Click on “Financial”

Scroll down the list and

click on “PV”

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

The next dialog box will appear as shown below

Click in the “Rate” white space in the box, and then click on the monthly rate cell (D2 in this example).

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Then click in the “Nper” white space in the box, followed by a click on the number-of-months cell (D3 in

this example).

Then click in the “Pmt” white space in the box, type in a minus sign, followed by a click on the monthlypayment-needed cell (D4 in this example). Finally, click on “OK.”

(Without the minus sign, Excel will still give us the correct answer, but with a minus sign in front of it. The

explanation for why it works that way is a little too long for our purposes here. Just think of it as a toggle

switch. Typing in the minus sign as instructed above keeps it out of the answer; not typing it in allows the

it to show up in front of the answer. Either way, it’s the absolute value of the answer we’re interested in,

and either way, that value will be the same.)

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

In the solution cell (D5 in this example), Excel returns the value of $1,165,891. Notice also, that in the

formula area, Excel indicates the formula for that cell.

There’s your number! If you retire at age 60, die at age 85, can find an account during your retirement

that will pay an annual rate of 4%, compounded monthly, and need $4,000 a month – after taxes – to live

on…your Starting-Out Amount in that account (the Present Value…yep, that’s what it’s called even

though we’re talking about the future) will need to be $1,165,891. That Starting-Out-Amount – that

Present Value – will allow you to make a withdrawal of $6,154 each month. From that you should be able

to set aside what you’ll need for your federal and state income taxes and live comfortably on what’s left

($4,000). So, what’s the lesson here? Make sure you die on schedule…Just kidding.

[Type text]

NAEP Tier II Professional Academy

Burr Millsap

Buying a Business

Closely related to TVM problems is that of buying a business. There are many professionals who

make an excellent living in the “business valuation” field. At first glance, we may think that valuing a

business is difficult and complex. What is it we’re buying? How do we put a value on the business

activity that the current owner has built up? Surprisingly, the solution is fairly simple.

Fundamentally, when you buy (or sell) a business you are dealing with three components:

The assets of the business

The liabilities of the business

The cash flow generated by the business

The Assets. Putting a price on the assets is relatively straightforward. Typically, you will engage an

appraiser to help you assign a value to the assets that you’re about to acquire. Do you have to pay

what the appraiser estimates? No. The appraiser merely produces for you a reference point from

which you and the seller can start bargaining. Ultimately, the price you pay is decided only by you and

the seller.

The Liabilities. Also, it is not uncommon in some business purchases for the buyer to assume any

liabilities that the seller may owe at the time of sale. The total amount of liabilities you assume as the

buyer is a part of the sale price, and you should factor this into your bargaining strategy with the

seller. That is you will probably want to subtract the amount of the liabilities you’re assuming from the

asset valuation. Basically, the objective is for the seller to receive, and for the buyer to pay, a fair

estimation of seller’s equity (assets minus liabilities) in the assets of the business.

The Cash Flow. Putting a price on the cash flow is also fairly straightforward. Conceptually, investing

in a business is the same as investing in a savings account: giving up the use of money in order to

receive a stream of revenues in the future. Let’s take an example. When you invest $100,000 in a

savings account that pays 10% per year, you’re actually giving up the use of that money in order to

receive $10,000 per year in interest income. When putting a price on the cash flow portion of a

business purchase, you are estimating the value of an already-established pattern of income

(revenues minus expenses). In arriving at the $10,000 interest income above, we multiplied the

investment times the interest rate. ($100,000 X .10 = $10,000). By reversing the math, we can

compute the single amount we would be willing to invest in order to receive the annual income

($10,000 ÷ 0.10 = $100,000). Accordingly, in arriving at an estimate of our price for the cash flow, we

would begin by dividing the business’ average annual cash flow from operations by our required rate

of return. We would NOT want to include cash flow from investing activities or cash flow from

financing activities because these have nothing to do with the cash flow generated by the business’

customers and suppliers, which is what we’re interested in purchasing.

Example: An analysis of the annual cash flow statements of the business we want to buy indicates an

average annual cash flow from operations of $200,000. We’re not interested in investing in the

business unless we can get at least a rate of return of 15%. Therefore the maximum price we would

be willing to pay is computed as follows:

$200,000 ÷ 0.15 = $1,333,333.33

Our best offer to the seller for the cash flow portion of the business purchase would be

$1,333,333.33. As our required rate of return increases, the less we are willing to offer for the cash

flow. If we upped our requirement to 20%, the maximum price we would be willing to pay would be:

$200,000 ÷ 0.20 = $1,000,000.00

So, if we changed our minds during negotiations, we would be faced with reducing our offer to the

seller. The point is that the higher the rate of return required by the buyer for a given average annual

cash flow from operations, the lower the computed maximum offering price. This makes sense

because if a $1 million investment can produce the same $200,000 cash flow as a $1.3 million

investment, then the $1 million investment must be the harder working one. The harder work is

demonstrated by the 20% rate of return versus the 15% one.