P__I_Update_for_October_2012_Conference

advertisement

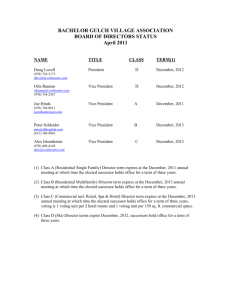

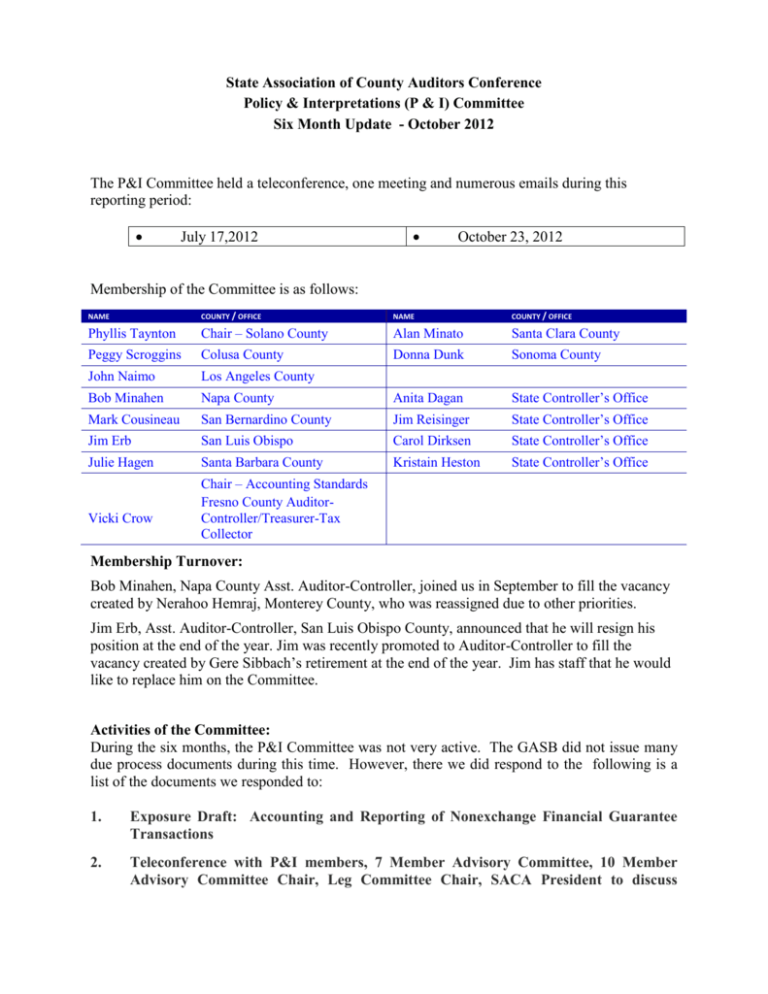

State Association of County Auditors Conference Policy & Interpretations (P & I) Committee Six Month Update - October 2012 The P&I Committee held a teleconference, one meeting and numerous emails during this reporting period: July 17,2012 October 23, 2012 Membership of the Committee is as follows: NAME COUNTY / OFFICE NAME COUNTY / OFFICE Phyllis Taynton Chair – Solano County Alan Minato Santa Clara County Peggy Scroggins Colusa County Donna Dunk Sonoma County John Naimo Los Angeles County Bob Minahen Napa County Anita Dagan State Controller’s Office Mark Cousineau San Bernardino County Jim Reisinger State Controller’s Office Jim Erb San Luis Obispo Carol Dirksen State Controller’s Office Julie Hagen Santa Barbara County Kristain Heston State Controller’s Office Vicki Crow Chair – Accounting Standards Fresno County AuditorController/Treasurer-Tax Collector Membership Turnover: Bob Minahen, Napa County Asst. Auditor-Controller, joined us in September to fill the vacancy created by Nerahoo Hemraj, Monterey County, who was reassigned due to other priorities. Jim Erb, Asst. Auditor-Controller, San Luis Obispo County, announced that he will resign his position at the end of the year. Jim was recently promoted to Auditor-Controller to fill the vacancy created by Gere Sibbach’s retirement at the end of the year. Jim has staff that he would like to replace him on the Committee. Activities of the Committee: During the six months, the P&I Committee was not very active. The GASB did not issue many due process documents during this time. However, there we did respond to the following is a list of the documents we responded to: 1. Exposure Draft: Accounting and Reporting of Nonexchange Financial Guarantee Transactions 2. Teleconference with P&I members, 7 Member Advisory Committee, 10 Member Advisory Committee Chair, Leg Committee Chair, SACA President to discuss Update from Policy & Interpretations (P & I) Committee – October 2012 accounting and reporting of Successor Agencies. Specifically, the procedures for the SCO Financial Transactions Reports and Successor Agencies. After discussions, teleconference participants concurred that Successor Agencies were impacted by AB 1484’s new “separate public entity” language only in a legal sense, but would not impact the original guidance provided in the white paper on the accounting and reporting for Successor Agencies due to their legislatively mandated and limited operational scope to strictly wind down activities and pay down now dissolved redevelopment agency debt, essentially operating in a custodial capacity. It was further proposed the Successor Agency should report as originally recommended as an expendable Private Purpose Trust Fund in a county or city’s CAFR. Since including the Successor Agency Trust Fund data in the SCO FTR’s would not be extractable and rather would be “lumped” in with other fiduciary fund data due to reporting system limitations, it was proposed the Successor Agency data not be incorporated into the SCO FTR’s as there would be no value added and would skew the data if anything. Upon further discussion, the State Controller’s Office concurs with the above assessment and will request that local governments NOT include ANY Successor Agency data in the SCO FTR’s. Therefore, Redevelopment Property Tax Trust Funds (RPTTF) as an Agency Fund of the County, Successor Agency balance sheet information, operations activity, etc. should NOT be reported in SCO’s reports. We were unable to response to the following due to resource availability: Exposure Draft on Government Combinations and Disposals of Government Operations (comment deadline: June 15, 2012). Items discussed at this morning’s meeting: 2011 Realignment OSHPD – reporting for hospitals Prop 172 – changing the allocation for Public Safety due to new agency County Auditors Conference Page 2