ABX 1 26 Overview

advertisement

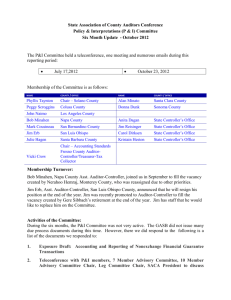

Assembly Bill x1 26 - Dissolution Act Thomas P. Clark, Jr., Special Counsel to the City of Santa Ana Acting and Serving as Successor Agency to the Community Redevelopment Agency of the City of Santa Ana 1 Suspension & Dissolution AB x1 26 Assembly Bill x1 26 added Parts 1.8 and 1.85 to Division 24 of the California Health & Safety Code (“Dissolution Act”) December 29, 2011 decision issued by California Supreme Court in petition California Redevelopment Association v. Matosantos, Case No. S194861; Supreme Court upheld the Dissolution Act (invalidated AB x1 27) All redevelopment agencies in California were dissolved as of and on February 1, 2012 2 Suspension of Agency Powers From June 28, 2011 to January 31, 2012 all Agency powers were suspended, with limited exceptions as to Enforceable Obligations No New Debt No New or Amended Contracts No New or Amended Plans 3 Authorized Acts during Suspension and before Dissolution Pay or Perform Enforceable Obligations Preserve Assets Decide whether to become Successor Agency Prepare and Adopt Enforceable Obligations Payment Schedule (EOPS) and Initial Recognized Obligation Schedule (ROPS) City election re housing functions and assets 4 Agency – City Agreements Not Enforceable – with Limited Exceptions Exceptions: • • Agreements entered into prior to 12/31/10 providing security for debt City loans made within 2 years of original Creation/Activation of Agency 5 ABx1 26 Timeline January through March By January 13 If City does not want to serve as the “successor agency” to its redevelopment agency, then it must submit a resolution to that effect to the County-Auditor Controller by this date. If a city wishes to serve as the “successor agency,” no action is required. February 1 Redevelopment agencies are dissolved. By February 1 Successor agency must create Redevelopment Obligation Retirement Fund. By February 1 Successor agency must decide whether to retain affordable housing function of the redevelopment agency. If successor agency does not elect to retain this function, it is transferred to the housing authority, or, if no housing authority exists, to the State Housing and Community Development Agency. By February 1 Successor agency must review the Enforceable Obligation Payment Schedule (EOPS) adopted by the redevelopment agency last fall, modify it if necessary, and readopt. The successor agency may only make payments for those obligations identified in the EOPS until a Recognized Obligation Payment Schedule (ROPS) is approved. By March 1 Successor agency must prepare a Recognized Obligation Payment Schedule (ROPS). This is a permanent schedule of obligations that replaces the interim EOPS once the ROPS has been approved by the Oversight Board. The County Auditor-Controller will allocate property tax increment to successor agencies to pay debts listed on ROPS. 6 ABx1 26 Timeline April through July By April 1 Successor agency reports to the County Auditor-Controller whether the total amount of property tax available to the agency will be sufficient to fund its ROPS obligations over the next six-month fiscal period. By April 15 Successor agency must send the adopted ROPS to the State Controller and the State Department of Finance for approval. The ROPS is also subject to approval by the Oversight Board. By May 1 Oversight Boards begin operations, files report of membership with State Department of Finance. Starting May 1 Successor agency may only pay those obligations listed in the EOPS until the ROPS is approved. The approved ROPS replaces the EOPS. By May 11 DOF requests second ROPS (for July 1 - December 31, 2012) as approved by Oversight Board be submitted to DOF and County Auditor-Controller (and presumably State Controller). By May 16 and continuing thereafter as specified The County Auditor-Controller transfers property tax to the successor agency in an amount equal to the cost of the obligations specified in the ROPS. This amount is transferred into the successor agency’s Redevelopment Obligation Retirement Fund, and payments from this fund are used to satisfy the obligations identified in the ROPS. June 1 Dissolution Act calls for Auditor-Controller to make Trust Fund distributions to Successor Agencies for the period of July 1 - December 31, 2012. July 1 County Auditor-Controller to have audited all former Agency’s assets and liabilities. 7 Dissolution – Successor Agencies ABx1 26 All California Redevelopment Agencies Dissolved on and as of February 1, 2012 Successor Agency is City of Santa Ana Acting and Serving as Successor Agency If City had not elected to become Successor Agency, then role to 1st Taxing Agency that volunteered or Governor appoints 3-Member Designated Local Authority (e.g., Los Angeles) 8 Role of Successor Agency Pay and perform Enforceable Obligations as shown on approved ROPS Dispose of Agency Assets and Wind Down Affairs of former Agency 9 Housing Functions City had right to elect to retain housing assets & functions City declined and selected the Housing Authority of the City of Santa Ana to assume housing assets and function of former Agency as of February 1, 2012 If no local housing authority then transfer would be to HCD Includes all rights, powers, duties and obligations Excludes unencumbered Housing Fund balance 10 Oversight Board 7 members Appointed By Board of Supervisors (2) Mayor (1) County Superintendent of Education (1) Chancellor of CA Community Colleges (1) Largest Special District (1) Former Agency employee (appointed by Mayor) (1) 11 Role of Oversight Board Approves most actions of Successor Agency Approves Successor Agency Administrative Budget and ROPS Most actions subject to review by State Department of Finance (DOF) May negotiate with City for City to acquire assets May terminate contracts with payment of compensation Has a fiduciary responsibility to holders of enforceable obligations and to the taxing entities that benefit from distribution of property tax and other revenue 12 Role of Auditor-Controller Audit all former Agencies assets and liabilities by July 1, 2012 Audits to be reviewed by DOF and State Controller’s Office (SCO) Determine annually amount of (former) Tax Increment and Deposit in Redevelopment Property Tax Trust Fund Administer Trust Fund for benefit of bondholders and taxing entities 13 Redevelopment Property Tax Trust Fund Pay Pass -Throughs Pay Successor Agency amount required to pay Enforceable Obligations on approved ROPS Pay Successor Agency amount to pay allowed administrative costs 5% TI allocated FY 2011-12 3% TI allocated FYs thereafter 14