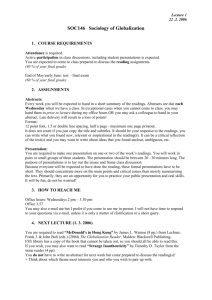

Syllabus - Spears School of Business

advertisement

OSU COLLEGE OF BUSINESS ADMINISTRATION, Department of Finance FIN 6053 Financial Theory and Corporate Policy Course Syllabus Fall, 2006 Instructor: Dr. Betty J. Simkins Office and Phone: 336 Business Building; (405) 744-8625 Office Hours: Mon/Wed, 11:00-11:45am and Tuesdays, 2:00-3:30pm or by appointment. E-Mail: simkins@okstate.edu Webpage: spears.okstate.edu/~simkins Class Webpage: spears.okstate.edu/~simkins /FIN6053/fin6053.htm Textbooks/Materials: Required: #1 Financial Theory and Corporate Policy, by Copeland, Weston, & Shastri, Pearson/AddisonWesley, 4th edition, 2005. Required: #2 The Chicago Guide to Your Academic Career, by CopelandGoldsmith, Komlos, and Gold, University of Chicago Press, ISBN 0-226-30151-6, 2001. Readings: Available on course webpage (see password protected section) Additional texts for reference purposes (recommend particularly for finance PhD students): To be announced in class Course Description: This is a foundation theory class for PhD students and advanced masters students. The course is designed in the lecture-discussion format. That is, you must be prepared to discuss the material assigned for each meeting period. To facilitate this, a list of the textbook assignments and readings are included with this syllabus. You must anticipate the readings for each class and be thoroughly prepared to be an active participant. Upon successful completion of this course, a student should be able to read, with a critical eye, most practitioner oriented financial research and be able to follow the development of more advanced theoretical research in finance and related areas. The course will trace the evolution of financial thought from its origins in economics to the basis of modern day financial theory. Specifically, the seminar will cover a broad range of topics beginning with an introduction to capital markets, investment decisions, and utility theory and then proceeding into more advanced topics such as portfolio theory, CAPM, APT, efficient capital markets, agency theory, capital structure theory and evidence, dividend policy theory and evidence, and international financial management. Theoretical and empirical papers on the above topics will also be covered. Finally, the course will conclude with coverage of unsolved issues in financial economics and a discussion of the future of financial research. Grading Procedures: Homework Assignments, class participation, etc. Research Paper & Article Presentation Midterm & Final Exams Total Grading will be based on the following scale: 90% or Below is failing. 20% 20% 60% 100% above = A; 80-89%=B; 70-79%=C; 60-60%=D. Course Policies: You are expected to attend and take part in each class period. It is part of the grading procedure. You are expected to read all material before the class session in which it is discussed. Late homework will be accepted if turned in by the following class period it was due, but will be counted off ½. Work not turned in during class the day it is due is considered late. Students with Disabilities: If any member of the class believes that s/he has a physical, emotional, or psychological disability and needs accommodations of any nature, the instructor will work with you and the university Office of Student Disability Services (Stillwater: SU 315, 744-7116 v/t; Tulsa: 103 North Hall, 594-8354) to provide reasonable accommodations to ensure that you have a fair opportunity to perform in this class. Please advise the instructor of such disability and the accommodations as soon as possible. You will need to also contact the Student Disability Services office in order to receive accommodations. No accommodations will be made without prior notification. Academic Dishonesty: University policy will be followed and strictly enforced. FIN 6053: FINANCIAL THEORY AND CORPORATE POLICY FALL 2006 TENTATIVE SCHEDULE Week Date SUBJECT/ ASSIGNMENT Articles are available on the course webpage, unless otherwise indicated. All chapters are from Copeland, Weston, and Shastri unless otherwise noted. 1 Aug. 23 Course introduction "The Streams of Financial Research and Their Interrelationships: Evidence from the Social Sciences Citation Index", Financial Practice and Education 1994 by Borokhovich, Bricker, and Simkins, 110-123. “Agency Costs of Overvalued Equity” by Michael C. Jensen (paper, slides & videostreaming file) Chapter 1: Introduction: Capital Markets, Consumption, and Investment Homework Due Next Week: Problems 1-3 from Ch. 1 and Answer the following questions from the Jensen video & article: 1(a) What is the agency problem (hint: see Ch.2); (b) What is overvalued equity and what are the agency costs of overvalued equity? 2(a) What is Managerial Heroin? (b) Give examples of companies that fit this concept. 3. What are potential solutions to the problems that Jensen discusses? 4. How do his words of wisdom relate to financial economics research? List your ideas. Discuss how this may relate to specific streams of financial research. 2 Aug. 30 3 Sept. 6 4 Sept. 13 5 Sept. 20 6 Sept. 27 7 Oct. 4 Chapter 2: Investment Decisions: The Certainty Case (Questions 3, 10) Readings – “What’s Wrong with Modern Capital Budgeting” by Rene Stulz, Financial Practice and Education, Fall/Winter 1999, pages 7-11 Homework Due Next Week: Write the 5 Axioms of Uncertainty on an index card. Also, write the two stochastic dominance laws with descriptions of stochastic dominance on another index card. Write a one page summary of the Stulz article. Include how the article improves our “real world” understanding of Chapter 2 concepts. View videostreaming file about doing research and tips on academic careers (2) Read Ch. 3 “The Mentor” from The Chicago Guide to Your Academic Career Chapter 3: The Theory of Choice: Utility Theory Given Uncertainty Homework Due Next Week: Ch. 3 Problems 5, 8, 9, 16 Chapter 4: State Preference Theory Homework Due Next Week: Ch. 4 Problems 2 & 6 and read the articles assigned Read Ch. 4 “Writing a Dissertation” from The Chicago Guide to Your Academic Career Chapter 5: Objects of Choice: Mean-Variance Portfolio Theory Homework Due Next Week: Ch. 5 Problems 6, 8abc, 9. What does QED stand for? Answer questions on the article by Markowitz Chapter 6: Market Equilibrium: CAPM and APT Homework/Readings – to be announced Homework Due Next Week: Ch. 6 Problems 2, 4, 5, 9. Go over “Deriving the Minimum Variance Set” handout and understand. Read article by Sharpe. Read Ch. 5 “Landing an Academic Job” from The Chicago Guide to Your Academic Career Chapter 10: Efficient Capital Markets: Theory Homework Assignment: Ch. 10 Problems 1, 2, 5, 7 Reading: to be announced Oct. 11 FALL BREAK ON MONDAY AND TUESDAY OF THIS WEEK. No class because Monday classes meet this day 8 Oct. 18 Complete any uncovered material Midterm Exam 10 Oct. 25 Chapter 10: Efficient Capital Markets: Theory Chapter 11: Efficient Capital Markets: Evidence Ch. 11 P1 Read Ch. 6 “The Life of the Assistant Professor” from The Chicago Guide to Your Academic Career 11 Nov. 1 Chapter 12: Information Asymmetry and Agency Theory Homework/Readings – (1) Explain if 'Invasion" Excel file contradicts theories of mkt efficiency, (2) Ch. 11 P2,3,4, (3) Read Jensen and Meckling, 1976, Journal of Financial Economics, and be prepared to discuss PowerPoint SLIDES (4) Read Ch. 12 Excel files illustrating market efficiency/reactions Excel file (invasion of FranceMay 10 1940) Excel WWII Handout reading: Carter “The Market’s Reaction to Unexpected, Catastrophic Events: The Case of Airline Stock Returns and the September 11th Attacks” Dave Carter and Betty Simkins, Quarterly Review of Economics and Finance Vol. 44 (No. 4, Fall), 2004, 539-558. 12 Nov. 8 Chapter 15: Capital Structure and the Cost of Capital: Theory and Evidence Ch. 15 Problems 2,3,5,7,19 Reading: “The theory and practice of corporate finance: evidence from the field” by Graham and Harvey, JFE, 2001. “Job Market Signaling” by Michael Spense, QJE Vol. 87 (3), 1973, pgs. 355-374. “The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism”, QJE Vol. 84 (3), 1970, pgs. 288-500. “Agency Costs of Free Cash Flows, Corporate Finance, and Takeovers”, by Michael Jensen, 1976, American Economic Review. 13 Nov. 15 14 Nov. 22 15 Nov. 29 Chapter 16: Dividend Policy: Theory and Empirical Evidence Homework/Readings – to be announced Read Ch. 7 “Teaching and Research” from The Chicago Guide to Your Academic Career This class is the evening before Thanksgiving. We will discuss a class makeup procedure. I do not want to hold class if any of you are traveling this evening and must miss class. Chapter 19: International Financial Management Homework/Readings – P 1, 10b Readings: “An Introduction to Exchange Rates and Currency Risk Management” by Paul Laux 16 Dec. 6 Chapter 20: Unsolved Issues, Undiscovered Territory, and the Future of Finance Homework/Readings – none Videostreaming file on Behavioral Finance (Terry Odean) Read Ch. 8 “Tenure” from The Chicago Guide to Your Academic Career