Notes 5 - Spears School of Business

advertisement

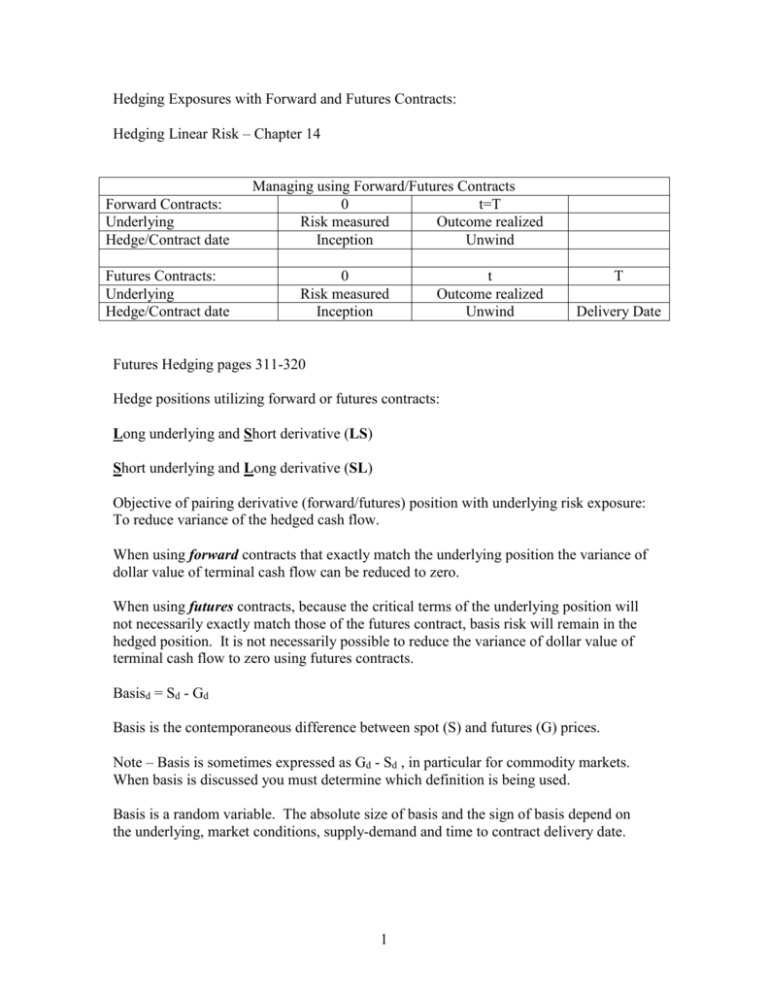

Hedging Exposures with Forward and Futures Contracts: Hedging Linear Risk – Chapter 14 Forward Contracts: Underlying Hedge/Contract date Futures Contracts: Underlying Hedge/Contract date Managing using Forward/Futures Contracts 0 t=T Risk measured Outcome realized Inception Unwind 0 Risk measured Inception t Outcome realized Unwind T Delivery Date Futures Hedging pages 311-320 Hedge positions utilizing forward or futures contracts: Long underlying and Short derivative (LS) Short underlying and Long derivative (SL) Objective of pairing derivative (forward/futures) position with underlying risk exposure: To reduce variance of the hedged cash flow. When using forward contracts that exactly match the underlying position the variance of dollar value of terminal cash flow can be reduced to zero. When using futures contracts, because the critical terms of the underlying position will not necessarily exactly match those of the futures contract, basis risk will remain in the hedged position. It is not necessarily possible to reduce the variance of dollar value of terminal cash flow to zero using futures contracts. Basisd = Sd - Gd Basis is the contemporaneous difference between spot (S) and futures (G) prices. Note – Basis is sometimes expressed as Gd - Sd , in particular for commodity markets. When basis is discussed you must determine which definition is being used. Basis is a random variable. The absolute size of basis and the sign of basis depend on the underlying, market conditions, supply-demand and time to contract delivery date. 1 The law of one price guarantees that at the contract delivery date BT = ST – GT = 0. However, on date t < T, the size of basis is a random variable. LS hedge positions are long basis. LS hedge positions benefit when basis increases. LS position value and 0 S $0.713 G 0.714 B -0.001 S -G S - G impact of basis volatility t t t $0.710 $0.710 $0.710 0.713 0.711 0.707 -0.003 -0.001 0.003 -0.003 -0.003 -0.003 0.001 0.003 0.007 -0.002 0.000 0.004 SL hedge positions are short basis. SL hedge positions benefit when basis decreases. SL position value and impact of basis volatility 0 t t t S $0.713 $0.710 $0.710 $0.710 G 0.714 0.713 0.711 0.707 B -0.001 -0.003 -0.001 0.003 0.003 0.003 0.003 -S -0.001 -0.003 -0.007 G 0.002 0.000 -0.004 -S + G Hedged cash flow LS positions: S0 + S – h* G Hedged cash flow SL positions: -S0 - S + h* G Where; S = St – S0 G = Gt – G0 h = hedge ratio, i.e. quantity contracted in futures market per unit of underlying. Assume h = 1: Hedged cash flow LS positions: S0 + S – h* G = (St – Gt) + G0 = Bt + G0 Hedged cash flow SL positions: -S0 - S + h* G = -(St – Gt) – G0 = -Bt + G0 2 Variance minimizing hedge ratio: Same in absolute value for both LS and SL hedge positions. Hedged cash flow LS positions: S0 + S – h* G Variance(Hedge cash flow) = Variance(S – h* G) Variance(Hedge cash flow) = Variance(S)+h2Variance(G)-2*h*Covariance(S, G) To find the value of h that minimizes Variance(Hedge cash flow): Take first derivative Variance(Hedge cash flow) with respect to h. Set this derivative equal to zero and solve for h. The variance minimizing hedge ratio is; h Co var iance(S , G) Variance(G) The variance minimizing hedge ratio may be estimated from a regression of S on G. S a h G The estimated slope coefficient from such a regression, ĥ , is the volatility minimizing hedge ratio over the estimation period. The R2 statistic from the regression results is the proportion of the variance S explained by the linear relationship, â + ĥ*G. Consequently 1-R2 is the proportion of the variance of S remaining in the hedged position. The volatility remaining in the hedge position can be found from the original naked volatility and the result above. H N 1 R2 If implementing the iid-Normal methodology the risk reduction produced by the hedge position can be found directly. VaRH = normsinv(c)*H < VaRN = normsinv(c)*N notes5.xls contains an evaluation for application to price risk exposure resulting from positions in Swiss Franc. 3 Data sources for example: Daily, weekly, monthly and annual timeseries: Interest rates, foreign exchange rates, monetary aggregates available at: http://www.federalreserve.gov/releases/ Daily Update The weekly release is posted on Monday. Daily updates of the weekly release are posted Tuesday through Friday on this site. H.10 DAILY UPDATE: WEB RELEASE ONLY For immediate release FOREIGN EXCHANGE RATES January 29, 2004 The Board of Governors of the Federal Reserve System is advised that the Federal Reserve Bank of New York has certified for customs purposes the following noon buying rates in New York City for cable transfers payable in foreign currencies: (Rates in currency units per U.S. dollar except as noted) MONETARY COUNTRY UNIT Jan. 26 Jan. 27 Jan. 28 Jan. 29 *AUSTRALIA DOLLAR 0.773 0.7805 0.7788 0.7585 BRAZIL REAL 2.843 2.865 2.88 2.945 CANADA DOLLAR 1.313 1.3048 1.3218 1.334 CHINA, P.R. YUAN 8.2771 8.2771 8.2771 8.277 DENMARK KRONE 5.9345 5.893 5.898 6.02 *EMU MEMBERS EURO 1.2552 1.2643 1.262 1.2389 HONG KONG DOLLAR 7.767 7.7644 7.768 7.775 INDIA RUPEE 45.36 45.38 45.36 45.29 JAPAN YEN 106.15 105.56 105.52 106.09 MALAYSIA RINGGIT 3.8 3.8 3.8 3.8 MEXICO PESO 10.934 10.88 10.897 11.097 *NEW ZEALAND DOLLAR 0.6727 0.6795 0.6785 0.6673 NORWAY KRONE 6.864 6.813 6.9197 7.073 SINGAPORE DOLLAR 1.6943 1.695 1.6914 1.7035 SOUTH AFRICA RAND 7.1926 7.08 6.92 7.0735 SOUTH KOREA WON 1181 1180 1172 1173 SRI LANKA RUPEE 98.2 97.5 97.6 97.48 SWEDEN KRONA 7.308 7.245 7.249 7.41 4 SWITZERLAND FRANC 1.2484 1.2389 1.243 1.2621 TAIWAN DOLLAR 33.73 33.51 33.33 33.36 THAILAND BAHT 39.32 39.13 39.12 39.28 *UNITED KINGDOM POUND 1.82 1.8277 1.837 1.8112 VENEZUELA 1600 1600 1600 1600 BOLIVAR MEMO: Jan. 26 Jan. 27 Jan. 28 Jan. 29 UNITED STATES DOLLAR 1)BROAD JAN97=100 2)MAJOR CURRENCY MAR73=100 JAN97=100 3)OITP 112.99 84.99 112.5 112.74 113.88 84.45 84.79 85.88 142.63 142.39 142.36 143.31 For more information on exchange rate indexes for the U.S. dollar, see "New Summary Measures of the Foreign Exchange Value of the Dollar," Federal Reserve Bulletin, vol. 84 (October 1998), pp. 811-18 (http://www.federalreserve.gov/pubs/bulletin/). Weights for the broad index can be found at http://www.federalreserve.gov/releases/H10/Weights; weights for the major currencies index and the other important trading partners (OITP) index are derived from the broad index weights. The most recent annual revision of the currency weights and dollar indexes took effect with the December 16, 2003, release of this report. * U.S. dollars per currency unit. 1) A weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners. 2) A weighted average of the foreign exchange value of the U.S. dollar against a subset of the broad index currencies that circulate widely outside the country of issue. 3) A weighted average of the foreign exchange value of the U.S. dollar against a subset of the broad index currencies that do not circulate widely outside the country of issue. The euro is reported in place of the individual euro-area currencies. These currency rates can be derived from the dollar/euro rate by using the fixed conversion rates (in currencies per euro) given below: 1 EURO = 13.7603 AUSTRIAN SCHILLINGS = 40.3399 BELGIAN FRANCS = 5.94573 FINNISH MARKKAS = 6.55957 FRENCH FRANCS = 1.95583 GERMAN MARKS = .787564 IRISH POUNDS 5 = 1936.27 ITALIAN LIRE = 40.3399 LUXEMBOURG FRANCS = 2.20371 NETHERLANDS GUILDERS = 200.482 PORTUGUESE ESCUDOS = 166.386 SPANISH PESETAS = 340.750 GREEK DRACHMAS http://www.cme.com/ Contract terms Chicago Mercantile Exchange Swiss Franc Futures contract: Ticker Symbol Sample Quote Contract Size Minimum Price Fluctuation (Tick) Price Limit Contract Month Listings Trading Hours Last Trading Day Final Settlement Rule Position Limits/ Accountability Trading Venue Clearing=E1; Ticker=SF; GLOBEX=6S; AON=LS; (20 Threshold)& Sample Quote = .6004 USD/SF 125,000 Swiss francs Floor: Regular - 0.0001=$12.50; Calendar Spread - 0.00005=$6.25; All or None - 0.00005=$6.25 GLOBEX®: Regular - 0.0001=$12.50; Calendar Spread 0.00005=$6.25 Floor:No limits GLOBEX®:No limits Six months in the March Quarterly cycle, Mar, Jun Sep, Dec. See notes +++, ** Floor: 7:20 a.m.-2:00 p.m. LTD(9:16 a.m.)^ GLOBEX®: Mon/Thurs 5:00 p.m.-4:00 p.m. Sun & Hol 5:30 p.m.-4:00 p.m. Trading ceases at 9:16 a.m. Central Time on the second business day immediately preceding the third Wednesday of the contract month (usually Monday). Final settlement price is determined by the Trading Floor Pit Committee. Contract is physically delivered. A person owning or controlling more than 10,000 contracts net long or net short in all contract months combined shall provide, in a timely fashion, upon request by the Exchange, information regarding the nature of the position, trading strategy, and hedging information if applicable. For positions involving options on Swiss franc futures, this rule is superseded by the option position accountability rule. Floor, GLOBEX® Futures data contained in the file notes5.xls were obtained at: http://www.econstats.com/fut/xcb__d73.htm http://www.econstats.com/econstats.htm 6