061915

advertisement

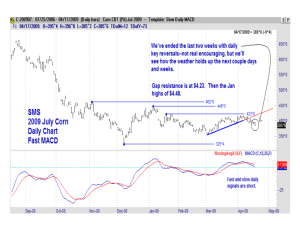

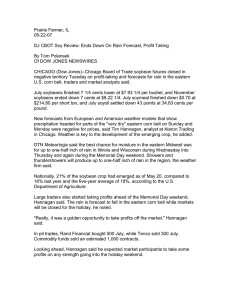

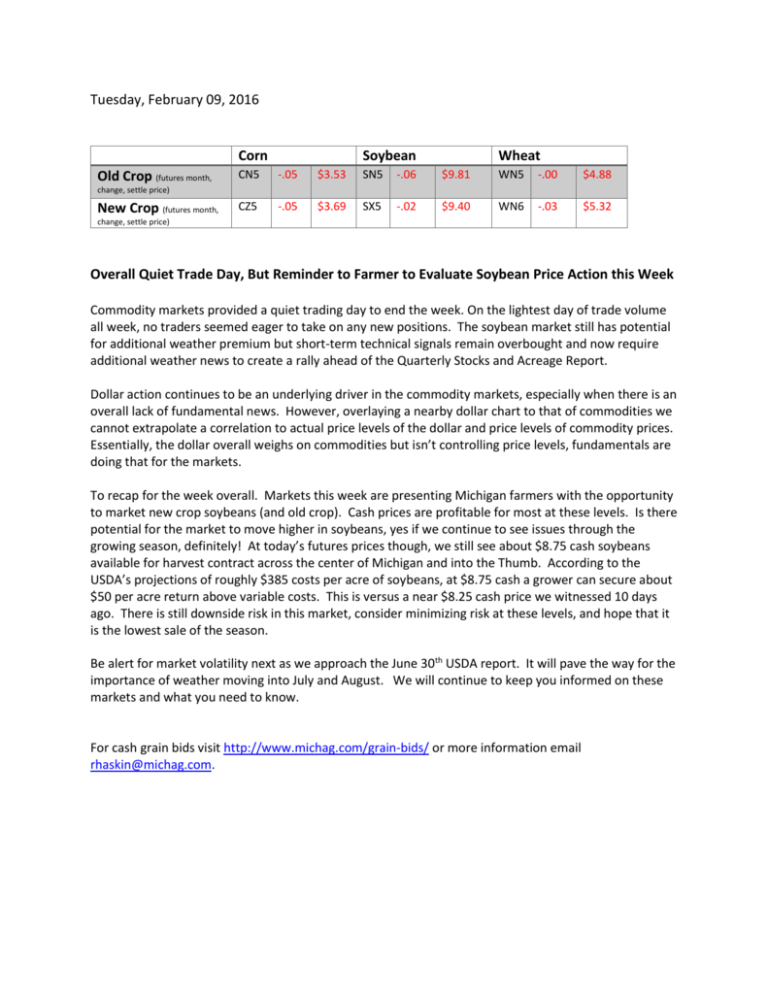

Tuesday, February 09, 2016 Corn Old Crop (futures month, Soybean Wheat CN5 -.05 $3.53 SN5 -.06 $9.81 WN5 -.00 $4.88 CZ5 -.05 $3.69 SX5 -.02 $9.40 WN6 -.03 $5.32 change, settle price) New Crop (futures month, change, settle price) Overall Quiet Trade Day, But Reminder to Farmer to Evaluate Soybean Price Action this Week Commodity markets provided a quiet trading day to end the week. On the lightest day of trade volume all week, no traders seemed eager to take on any new positions. The soybean market still has potential for additional weather premium but short-term technical signals remain overbought and now require additional weather news to create a rally ahead of the Quarterly Stocks and Acreage Report. Dollar action continues to be an underlying driver in the commodity markets, especially when there is an overall lack of fundamental news. However, overlaying a nearby dollar chart to that of commodities we cannot extrapolate a correlation to actual price levels of the dollar and price levels of commodity prices. Essentially, the dollar overall weighs on commodities but isn’t controlling price levels, fundamentals are doing that for the markets. To recap for the week overall. Markets this week are presenting Michigan farmers with the opportunity to market new crop soybeans (and old crop). Cash prices are profitable for most at these levels. Is there potential for the market to move higher in soybeans, yes if we continue to see issues through the growing season, definitely! At today’s futures prices though, we still see about $8.75 cash soybeans available for harvest contract across the center of Michigan and into the Thumb. According to the USDA’s projections of roughly $385 costs per acre of soybeans, at $8.75 cash a grower can secure about $50 per acre return above variable costs. This is versus a near $8.25 cash price we witnessed 10 days ago. There is still downside risk in this market, consider minimizing risk at these levels, and hope that it is the lowest sale of the season. Be alert for market volatility next as we approach the June 30th USDA report. It will pave the way for the importance of weather moving into July and August. We will continue to keep you informed on these markets and what you need to know. For cash grain bids visit http://www.michag.com/grain-bids/ or more information email rhaskin@michag.com.