§ 3.50 Gain or Loss on Sale of Real Estate

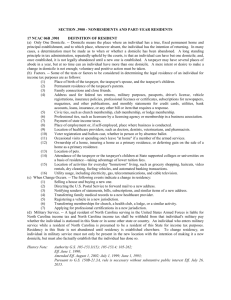

advertisement

131T0C Time of Request: Sunday, March 21, 2010 Client ID/Project Name: Number of Lines: 454 Job Number: 2862:211115572 Research Information Service: Terms and Connectors Search Print Request: Current Document: 834 Source: Combined Source Set 1 Search Terms: foreclosure Send to: NN/L, 131T0C LN TRIAL ID - CFM LEGAL 9393 SPRINGBORO PIKE MIAMISBURG, OH 45342 15:36:08 EST Page 1 834 of 1273 DOCUMENTS Texas Real Estate Guide Copyright 2009, Matthew Bender & Company, Inc., a member of the LexisNexis Group. I TRANSACTIONS: SALES, EXCHANGES, AND OTHER TRANSFERS OF TITLE CHAPTER 3 SALES CONTRACTS PART II. LEGAL BACKGROUND D. Tax Considerations 1-3 Texas Real Estate Guide § 3.50 § 3.50 Gain or Loss on Sale of Real Estate [1] Classification of Real Property For income tax purposes, all property, including real property, generally is divided into three classes: (1) capital assets; (2) noncapital assets; and (3) Section 1231 assets used in trade or business. As applied to real property, a capital asset is any property not held by the taxpayer primarily for sale to customers in the ordinary course of trade or business [I.R.C. § 1221(a)(1)], and not defined as Section 1231 property used in trade or business [I.R.C. § 1221(a)(2)]. Real property is a Section 1231 asset used in trade or business if it was (1) held by the taxpayer for more than one year, (2) used in the taxpayer's trade or business, and (3) not held primarily for sale to customers in the ordinary course of that trade or business [I.R.C. § 1231(b)(1)]. All other real property, that is, real property held primarily for the sale to customers in the ordinary course of the taxpayer's trade or business, is a "noncapital asset" [see Rabkin & Johnson, Current Legal Forms with Tax Analysis, Ch. 21 (Matthew Bender)]. For real property to be considered a noncapital asset, the single dominant purpose of the seller must be to sell the property rather than to hold it as an investment; if its sale is only one of several substantial reasons the seller held the property, it is a noncapital asset [ Malat v. Riddell, 383 U.S. 569, 571-572, 86 S. Ct. 1030, 16 L. Ed. 2d 102 (1966) ]. The Taxpayer Relief Act of 1997 [Pub. L. No. 105-34] enacted a reduction in the tax rate on net capital gains for individuals. The actual tax rate depends on the time the capital asset was held and other specified factors [see I.R.C. § 1(h); see also I.R.C. § 1(a)-(d)]. In contrast, corporate capital gains are taxed at the same rate as ordinary income [see I.R.C. §§ 11(b), 1201]. Depending on whether the taxpayer is an individual or a corporation, the characterization of an item as short-term or long-term capital gain or loss, or as ordinary income or loss, may have important tax consequences [see I.R.C. §§ 1221-1223]. The parties should pay attention to the differences among capital, ordinary, and Section 1231 gains. In addition, capital losses are allowed only to the extent of capital gains (in the case of a corporation) or capital gains plus limited amounts of ordinary income (in the case of an individual taxpayer) [see I.R.C. § 1211]. Even though the tax rate for individual capital gains is lower than the tax rate for ordinary income, in some situations a taxpayer will prefer to have losses classified as ordinary losses, not capital losses, and will seek capital gains treatment only for the purpose of using other capital losses the taxpayer might otherwise be unable to use fully [see I.R.C. § 1211]. In addition, carry-back and carry-forward rules for unused capital losses must be considered [see I.R.C. § 1212(a), (b)], and Section 1231 losses may be allowed in full [see I.R.C. § 1231(a)(4)]. For these reasons, the appropriate characterization of property, and of gains and losses from that property, has considerable importance. [2] Sale of Capital Assets Page 2 1-3 Texas Real Estate Guide § 3.50 Any gain or loss realized by the seller on the sale of a capital asset is a capital gain or loss [I.R.C. § 1222]. If the capital asset has been held by the seller for not more than one year, the resulting gain or loss is a short-term capital gain or short-term capital loss [I.R.C. § 1222(1), (2)]. If the capital asset was held by the seller for more than one year, the resulting gain or loss on its sale is a long-term capital gain or loss [I.R.C. § 1222(3)-(4)]. A taxpayer's short-term capital gains in a given year are reduced by short-term capital losses for the same year to determine net short-term capital gain or loss [I.R.C. § 1222(5)-(6)]. The taxpayer's long-term capital gains during the year are reduced by long-term capital losses for the year to determine net long-term capital gain or loss [I.R.C. § 1222(7)-(8)]. If net long-term capital gain exceeds net short-term capital loss, the difference is net capital gain [I.R.C. § 1222(11)]. For an individual, the tax rate on capital gains generally is 15 percent, although the actual tax rate depends on the time the capital asset was held and other specified factors [see I.R.C. § 1(h)(1)(C)--effective generally for tax years ending on or after May 16, 2003, and before 2009; see Pub. Law No. 108-27, §§ 301, 303; see also I.R.C. § 1(a)-(d), (i)(2)]. In contrast, corporate capital gains are taxed at the same rate as ordinary income [see I.R.C. §§ 11(b), 1201]. Capital losses are limited in offsetting other income. Corporate taxpayers may use capital losses to offset only capital gains [I.R.C. § 1211(a)]; however, with certain exceptions, a net capital loss may be carried back three years [I.R.C. § 1212(a)(1)(A)] and carried forward up to five years [I.R.C. § 1212(a)(1)(B)]. Noncorporate taxpayers may offset up to $3,000 of ordinary income with capital losses [I.R.C. § 1211(b)] and may carry over the unused capital losses to succeeding years [I.R.C. § 1212(b)(1)]. Even though property is a capital asset, the gain on its sale will be taxed as ordinary income if the property is depreciable and the sale is between related persons, i.e., between the taxpayer and any entity he or she controls, or between the taxpayer and any trust in which the taxpayer (or spouse) is a beneficiary unless the beneficial interest is a remote contingent interest [I.R.C. § 1239]. [3] Sale of "Section 1231" Assets Any gain realized by the seller on the sale of a "Section 1231 asset" (that is, an asset used in trade or business) is treated as a capital gain realized on the sale of a capital asset, with the exception that any gain realized on the sale must be treated as ordinary income to the extent of the losses from these transactions over the five preceding years [I.R.C. § 1231(c)]. Any loss realized by a seller on the sale of a Section 1231 asset, however, is treated as an ordinary loss fully deductible against other taxable income in the year of the sale [I.R.C. § 1231(a)]. [4] Sale of Noncapital Assets Any gain realized by the seller on the sale of noncapital assets is treated as ordinary income [see I.R.C. §§ 1(a) (e), 11(b), 1201(a)]. However, any loss by the seller on the sale of a noncapital asset is fully deductible against other income in the year of the loss [I.R.C. §§ 61, 165(c)]. [5] Determining Gain or Loss The amount of gain or loss realized by a seller on the sale of any property is determined by deducting the seller's adjusted income tax basis for the property and the expenses of making the sale [see I.T. 2340 , VI-1 C.B. 43 (1927); see also Chapin v. Commissioner, 12 T.C. 235, 238 , aff'd, 180 F.2d 140 (8th Cir. 1950) ] from the full sales price (including the fair market value of any notes received or any mortgages or deeds of trust the buyer assumed) [I.R.C. § 1001]. The adjusted income tax basis of the property to the seller is the seller's cost of acquiring the property (including any mortgages or deeds of trust the seller assumed or took the property subject to), plus the costs of any capital improvements since made to the property, minus any depreciation deductions allowed in prior years because of the property [I.R.C. §§ 1011, 1012, 1016(a)]. Land is not depreciable, but depreciation deductions can be taken for buildings and improvements placed on the land if they are used for the production of income [I.R.C. § 167]. When a residence is converted from personal use to business or income-producing use, for purposes of calculating loss or depreciation, but not for purposes of calculating gain, the basis of the property on the date of its conversion is the lower of its adjusted basis or fair market value on that date. This basis must thereafter be adjusted for depreciation after conversion [Treas. Reg. § 1.167(g)-1]. Page 3 1-3 Texas Real Estate Guide § 3.50 When depreciated realty is sold, it may be subject to depreciation recapture, which means that part or all of the gain realized on the sale of the realty may be taxed (recaptured) as ordinary income, if accelerated depreciation methods were used [see I.R.C. § 1250]. However, because residential rental property and nonresidential real property placed in service after December 31, 1986, generally are restricted to straight-line depreciation methods [see I.R.C. § 168], there is no "additional" depreciation [see I.R.C. § 1250(b)--additional depreciation defined]. Consequently, the recapture provisions will not apply [see I.R.C. § 1250(a)(1)]. The seller's holding period for the property being sold begins on the earlier of the following dates: the day after title to the property passed to the seller, or the day after possession of the property was delivered to the seller and he or she assumed the burdens and privileges of ownership of the property [ Rev. Rul. 54-607, 1954-2 C.B. 177 ]. Similarly, the sale is complete and the buyer's holding period for the property begins either when title passes to the buyer [ Commissioner v. Segall, 114 F.2d 706, 709 (6th Cir. 1940) ] or when possession of the property is delivered to the buyer under an installment contract of sale [ Helvering v. Nibley-Mimnaugh Lumber Co., 70 F.2d 843, 845 (D.C. Cir. 1934) ]. Just as recognized gains are included in the taxpayer's gross income, losses the taxpayer sustains are generally deductible [I.R.C. § 165(a)]. However, for individuals, only three types of losses are deductible: (1) losses that are connected with a trade or business; (2) losses that are incurred in a transaction entered into for profit; and (3) casualty losses [I.R.C. § 165(c)]. Therefore, there is no deduction for a loss sustained on the sale of residential property purchased or constructed by the taxpayer for personal use as a residence and used by the taxpayer for this purpose up to the time of sale. However, if prior to sale, the property is rented or otherwise appropriated to income-producing purposes and is used for these purposes up to the time of sale, a loss sustained on the sale is allowed as a deduction [Treas. Reg. § 1.165-9(b)--adjusted basis for determining loss is lesser of fair market value of property at time of conversion or adjusted basis at time of conversion, adjusted for period subsequent to conversion of property to income-producing purposes]. No deduction is allowed for losses from a sale or exchange between certain related taxpayers [I.R.C. § 267(a)]. The following are related taxpayers: Members of the seller's family, i.e., spouse, brothers and sisters (of the whole or half blood), ancestors, and lineal descendants [I.R.C. § 267(a), (b)(1), (c)(4)]; A taxpayer and the taxpayer's controlled corporation, and a fiduciary and a corporation controlled by the trust or grantor. Control is direct or indirect ownership of more than 50 percent in value of the outstanding stock [I.R.C. § 267(b)(2), (8)]; Corporations that are members of the same controlled group of corporations [I.R.C. § 267(b)(3)]; A corporation and a partnership if the same persons own more than 50 percent in value of the outstanding stock of the corporation and more than 50 percent of the capital interest or the profits interest in the partnership [I.R.C. § 267(b)(10)]; S corporation and another S corporation if the same persons own more than 50 percent in value of the outstanding stock of each corporation [I.R.C. § 267(b)(11)]; S corporation and a C corporation if the same persons own more than 50 percent in value of the outstanding stock of each corporation [I.R.C. § 267(b)(12)]; An estate and a beneficiary of that estate, except in the case of a sale or exchange in satisfaction of a pecuniary bequest [I.R.C. § 267(b)(13)]; The grantor and the fiduciary of a trust, the fiduciary and the beneficiary of a trust, the fiduciaries of two different trusts with the same grantor, a fiduciary of one trust and the beneficiary of another trust with the same grantor, and a trust fiduciary and a corporation when more then 50 percent in value of the Page 4 1-3 Texas Real Estate Guide § 3.50 outstanding stock of the corporation is owned directly or indirectly by or for the trust or its grantor [I.R.C. § 267(b)(4)-(8)]; A person and an exempt organization controlled directly or indirectly by that person or the members of the person's family [I.R.C. § 267(b)(9)]. In applying the related taxpayer rules, ownership of stock is attributed to the taxpayer as follows [I.R.C. § 267(c); Treas. Reg. § 1.267(c)-1]: A stockholder is considered to own a proportionate share of the stock owned by the corporation; A partner is considered to own a proportionate share of the stock owned by the partnership; If an individual owns some stock in a corporation, he or she is considered the owner of stock owned by his or her partner; A beneficiary is considered to own a proportionate share of the stock owned by the trust or estate; An individual is considered to own stock owned by members of his or her family, whether or not he or she is the actual owner of stock in the same corporation. A related buyer is allowed to reduce his or her gain on property the buyer resells at a gain by the loss disallowed to the buyer's seller if (1) a loss deduction was barred under the rules on related taxpayers, (2) the resale or exchange is at a gain and the property is either the property on which the loss was disallowed or property the basis of which is determined by reference to the basis of that property, and (3) the loss deduction on the original sale to the taxpayer was not barred under the wash sale rules [I.R.C. § 267(d); Treas. Reg. § 1.267(d)-1]. For example, assume a husband sells to his wife for $5,500, farmland having an adjusted basis for determining loss to him of $8,000; the loss of $2,500 is not allowable to husband. Wife subsequently exchanges the farmland, held for investment purposes, with an unrelated individual or two city lots, also held for investment purposes. The basis of the city lots in the wife's hands ($5,500) is a substituted basis determined by reference to the basis of the farmland. If the wife later sells the city lots for $10,000, her realized gain is $4,500, but her recognized gain is only $2,000, which is the excess of the realized gain of $4,500 over the loss of $2,500 not allowable to the husband [Treas. Reg. § 1.267(d)-1, Ex. 4]. [6] Sale of Principal Residence [a] Exclusion Allowed A taxpayer who sells or exchanges a principal residence and meets certain ownership and use requirements may exclude up to $250,000 ($500,000 for joint returns) of gain from gross income [I.R.C. § 121(a), (b)]. This exclusion may be applied to a sale or exchange of a principal residence only once every two years [I.R.C. § 121(b)(3)]. If the taxpayer acquired the residence in a like-kind exchange under I.R.C. § 1031, the exclusion is allowed only if the taxpayer has held the property for at least five years [I.R.C. § 121(d)(10)]. The exclusion does not have to be elected (except for sales of remainder interests) [see I.R.C. § 121(d)(8)]; it automatically applies unless the taxpayer makes an election not to have the exclusion apply [I.R.C. § 121(f)]. This exclusion replaces the rollover provisions of former Internal Revenue Code Section 1034 and the $125,000 exclusion for persons over 55 under former Internal Revenue Code Section 121. The exclusion of gain under I.R.C. § 121 is generally effective for sales and exchanges after May 6, 1997 [Pub. L. No. 105-34, § 312(d), (e)]. It is available without regard to the taxpayer's age [I.R.C. § 121(a)], but is not available to certain expatriates [I.R.C. § 121(e); see I.R.C. § 877(a)(1)--"expatriate" defined]. The exclusion is only available for the taxpayer's principal residence. If a taxpayer uses more than one property as a residence during the year, only the property that is the taxpayer's principal residence is covered by the exclusion. The Page 5 1-3 Texas Real Estate Guide § 3.50 facts and circumstances in each case determine whether a property qualifies as the principal residence. The residence that the taxpayer uses a majority of the time during the year is considered to be the taxpayer's principal residence [Treas. Reg. § 1.121-1(b)(2)--listing factors that may aid in identifying property as principal residence]. A principal residence may be a house, condominium, stock held by a tenant-shareholder in a cooperative housing corporation, mobile home, or houseboat [Treas. Reg. § 1.121-1(b)(1)]. The exclusion applies to the sale or exchange of vacant land that the taxpayer has owned and used as part of his or her principal residence if the sale or exchange of the dwelling unit occurs within two years before or after the sale or exchange of the vacant land. The vacant land must be adjacent to land on which the dwelling unit is situated, and the sale or exchange of the vacant land must satisfy all of the requirements of I.R.C. § 121 [Treas. Reg. § 1.121-1(b)(3)]. The I.R.S. will not issue advance rulings or determination letters on the issue of whether property qualifies as a taxpayer's principal residence for purposes of I.R.C. § 121 [ Rev. Proc. 2005-3, 2005-1 C.B. 118 ]. [b] Ownership and Use Requirements The principal residence for which the exclusion is claimed must have been owned and used as a principal residence by the taxpayer for periods totaling two or more years of the five years preceding the sale or exchange [I.R.C. § 121(a)]. The required two years of ownership and use need not be continuous [I.R.C. § 121(a); Treas. Reg. § 1.121-1(c)]. The ownership and use requirements are satisfied if the taxpayer owned and used the property as a principal residence for a total of 730 days (365 x 2) during the five-year period before the sale or exchange. Seasonal absences or temporary absences for vacations are counted as periods of use, even if the taxpayer rents or leases the property during those periods [Treas. Reg. § 1.121-1(c)(1), (2)]. The ownership and use requirements may also be satisfied at different times, i.e., during different two-year periods, as long as these requirements are met during the five-year period before the date of the sale or exchange [Treas. Reg. § 1.121-1(c)(2)(i)]. A taxpayer who uses part of the property for residential purposes and part for business purposes is treated as using the entire property as the taxpayer's principal residence for purposes of satisfying the two-year use requirement, provided the residential and business portions of the property are within the same dwelling unit [Treas. Reg. § 1.121-1(e); see § 3.50[7] for discussion of special rules applicable to dual use property]. In some cases, taxpayers may be treated as the owners of a residence for purposes of I.R.C. § 121 even though title to the residence is held by another entity. For example, a residence whose title is held by a partnership or grantor trust, may be treated as owned by the taxpayers for purposes of satisfying ownership and other requirements of I.R.C. § 121 [Treas. Reg. § 1.121-1(c)(3)(i)--if residence is owned by trust for period that taxpayer is treated under I.R.C. §§ 671-679 as owner of trust or owner of portion of trust that includes residence, taxpayer will be treated as owning residence for purposes of satisfying two-year ownership requirement; Rev. Rul. 85-45, 1985-1 C.B. 183--sale of trust property used by beneficiary as primary residence qualified for exclusion under former I.R.C. § 121; Rev. Rul. 66-159, 1966-1 C.B. 162--gain from sale of residence in grantor trust qualified for rollover of gain into replacement residence under former I.R.C. § 1034; but see Ltr. Rul. 200029045 (residence owned by partnership or limited partnership is not eligible for exclusion under I.R.C. § 121); Ltr. Rul. 200119014 (same rule applies even if grantor trust owns nearly all of partnership interests)]. A taxpayer serving (or whose spouse is serving) on qualified official extended duty as a member of the uniformed services or Foreign Service may elect to suspend the running of the five-year period of ownership and use of the property specified in I.R.C. § 121(a) for up to 10 years. The election may be made with respect to only one property at a time [I.R.C. § 121(d)(9); Treas. Reg. § 1.121-5(a), (d)--examples]. The taxpayer makes the election by filing a return for the taxable year of the sale or exchange that does not include the gain in the taxpayer's gross income [Treas. Reg. § 1.121-5(b)]. [c] Joint Returns Married taxpayers may exclude up to $500,000 on the sale of a principal residence if (1) they file a joint return, (2) either spouse meets the ownership requirements with respect to the residence, (3) both spouses meet the use requirements with respect to the residence, and (4) neither spouse claimed an exclusion within the preceding two years [I.R.C. § 121(b)(2)(A)]. If the spouses do not meet these requirements, they may claim the sum of any exclusion for which they Page 6 1-3 Texas Real Estate Guide § 3.50 would qualify if they had not been married. For this purpose ownership by either spouse is attributed to both [I.R.C. § 121(b)(2)(B); see § 3.50[6][d] for prorated exclusion requirements]. If married taxpayers jointly own a principal residence, but file separate tax returns, each taxpayer may exclude from gross income up to $250,000 of gain that is attributable to each taxpayer's interest in the property, as long as the requirements of I.R.C. § 121 have otherwise been met [Treas. Reg. § 1.121-2(a)]. [d] Prorated Exclusion A prorated exclusion may be allowed when the ownership and use requirements are partially met or there was a sale or exchange less than two years before if the cause of the sale or exchange is a change in place of employment, health reasons, or, to the extent provided in regulations, unforeseen circumstances. The maximum allowable exclusion is reduced in proportion to the time the requirements are met over the time required [I.R.C. § 121(c)(1), (2)]. A sale or exchange occurs by reason of a change in the place of employment if the primary reason for the transaction is a change in the location of a qualified individual's employment [Treas. Reg. § 1.121-3(c)(1)]. A sale or exchange is deemed to be by reason of a change of employment if the change occurs during the period of the taxpayer's ownership and use of the property as a principal residence and if the new place of employment is at least 50 miles farther from the residence than was the former place of employment or, if there was no former place of employment, the distance between the new place of employment and the residence is at least 50 miles [Treas. Reg. § 1.121-3(c)(2)-(4)--examples]. A sale or exchange occurs by reason of health if the primary reason for the transaction is to obtain, provide, or facilitate the diagnosis, cure, mitigation, or treatment of disease, illness, or injury of a qualified individual, or to obtain or provide medical or personal care for a qualified individual suffering from a disease, illness, or injury. A sale or exchange that is merely beneficial to the individual's general health or well-being is not a sale or exchange by reason of health [Treas. Reg. § 1.121-3(d)(1), (3)--examples]. A sale or exchange is deemed to be by reason of health if a physician recommends a change of residence for reasons of health [Treas. Reg. § 1.121-3(d)(2)]. A sale or exchange occurs by reason of unforeseen circumstances if the primary reason for the transaction is the occurrence of an event that the taxpayer could not reasonably have anticipated before purchasing and occupying the residence. A sale or exchange does not qualify for the reduced maximum exclusion if the primary reason for the transaction is a preference for a different residence or an improvement in financial circumstances [Treas. Reg. § 1.121-3(e)(1)]. Unforeseen circumstances include the involuntary conversion of the residence, natural or man-made disasters or acts of war or terrorism resulting in a casualty to the residence, a qualified individual's death, termination of employment which results in eligibility for unemployment compensation, a change in employment or self-employment status that results in the taxpayer's inability to pay housing costs and reasonable basic living expenses for his or her household, divorce or legal separation under a decree of divorce or separate maintenance, or multiple births resulting from the same pregnancy [Treas. Reg. § 1.121-3(e)(2)-(4)--examples]. For purposes of these provisions, a "qualified individual" means the taxpayer, the taxpayer's spouse, a co-owner of the residence, or a person whose principal place of abode is in the same household as the taxpayer [Treas. Reg. § 1.121-3(f)]. Factors that may be relevant in determining the taxpayer's primary reason for the sale or exchange include the extent to which [Treas. Reg. § 1.121-3(b)]: The sale or exchange and the circumstances giving rise to it are proximate in time. The suitability of the property as the taxpayer's principal residence materially changes. The taxpayer's financial ability to maintain the property is materially impaired. The taxpayer uses the property as his or her residence during the period of his or her ownership of the property. Page 7 1-3 Texas Real Estate Guide § 3.50 The circumstances that give rise to the sale or exchange are not reasonably foreseeable if the taxpayer begins using the property as his or her principal residence. The circumstances that give rise to the sale or change occur during the period of the taxpayer's ownership and use of the property as his or her principal residence. The maximum gain that can be excluded is a fraction of the full $250,000 or $500,000 exclusion, equal to the fraction of two years that the basic requirements are met [I.R.C. § 121(c)(2)]. The fraction thus derived must be applied to the relevant exclusion amount and not to the amount of the realized gain. For example, an unmarried taxpayer who owns and uses a principal residence for one year (i.e., one-half of the required ownership period) and then sells it at a realized gain of $ 500,000 may exclude $ 125,000 of gain (one-half of $ 250,000 statutory exclusion), not $ 250,000 (one-half of the realized gain). Similarly, an unmarried taxpayer who owns and uses a principal residence for one year then sells at a realized gain of $ 100,000 may exclude the entire $ 100,000 because the gain is less than one-half of $ 250,000. The exclusion is not limited to $ 25,000 (one-half of the $ 50,000 realized gain). In addition, the Act provides that if a married couple filing a joint return does not qualify for the $ 500,000 maximum exclusion, the amount of the maximum exclusion that may be claimed by the couple is the sum of each spouse's maximum exclusion determined on a separate basis. For example, if a married couple purchased a new home for $350,000 and sold it one year later for $450,000, there would be a gain of $100,000. Based on their aggregate years in the home, they would be eligible for up to one half of the $500,000 exclusion that they would have qualified for if they had lived in the home for two years before selling it: $500,000 x 1/2 = $250,000. No tax would be owed on the gain of $100,000 because that amount is less than $250,000. [e] Ownership and Use Period Substitutes In general, the full exclusion applies only if the taxpayer owned the home and used it as a principal residence for at least two of the five years ending on the date it is sold [I.R.C. § 121(a)]. However, under the following circumstances, a taxpayer may tack on another's ownership and use period to the taxpayer's ownership and use period: An unmarried individual whose spouse [sic] was deceased on the date the home is sold may tack the decedent's ownership and use period to his or her own ownership and use period [I.R.C. § 121(d)(2)]; An individual who receives a home in a transaction under I.R.C. § 1041(a)--a tax-free transfer from one spouse to another--may tack on the transferor's ownership period to his or her own ownership period [I.R.C. § 121(d)(3)(A)]; For purposes of the exclusion, an individual is treated as using a home as his or her principal residence during any period of ownership that the individual's spouse or former spouse is granted use of the property under a divorce or separation instrument [I.R.C. § 121(d)(3)(B)]. A relief provision applies to a taxpayer who becomes physically or mentally incapable of caring for himself or herself and, during the five-year period ending on the date the home is sold, owns and uses the home as a principal residence for periods aggregating at least one year. The taxpayer is treated as having used the home as a principal residence during any time in the five-year ownership period when the taxpayer actually lived in a facility, including a nursing home, licensed by a state or political subdivision to care for someone in the taxpayer's condition [I.R.C. § 121(d)(7)]. For purposes of the ownership and use tests, a taxpayer whose purchase of a replacement residence resulted in deferral of gain under the former I.R.C. § 1034 roll-over rules that applied to sales and exchanges before May 7, 1997, may tack on his or her ownership and use of the old residence to the taxpayer's ownership and use of the replacement residence [I.R.C. § 121(g)]. Page 8 1-3 Texas Real Estate Guide § 3.50 For individuals dying after 2009, the home-sale exclusion is extended to their estates, heirs, and qualified revocable trusts in existence immediately before the decedent's death, i.e., they will be allowed to take into account the decedent's ownership and use of the home [I.R.C. § 121(d)(11); see § 3.50[6][g]]. The home-sale exclusion also applies to: Tenant-stockholders in cooperative housing corporations. The holding requirements are applied to the holding of the stock, and the use requirements are applied to the house or apartment that the taxpayer's stock ownership and proprietary lease entitle the taxpayer to occupy [I.R.C. § 121(d)(4)]; An involuntary conversion or destruction of the property, which is treated as a sale of the property [I.R.C. § 121(d)(5)(A)]. The amount realized from the sale or exchange is treated as being the amount determined without regard to I.R.C. § 121, reduced by the amount of gain not included in gross income by reason of that section [I.R.C. § 121(d)(5)(B)]. If the taxpayer takes a carryover basis under I.R.C. § 1033(b) in the property acquired after the involuntary conversion, the holding and use periods of the converted property are taken into account with respect to the acquired property [I.R.C. § 121(d)(5)(C)]; A remainder interest in a principal residence, unless the sale or exchange is to a related party. The exclusion does not apply to any other interest in the residence that is sold or exchanged separately [I.R.C. § 121(d)(8)]. If spouses in a community property state transfer their home to a revocable trust that becomes irrevocable on the death of the first spouse, a portion of the home sale exclusion may be lost to the surviving spouse who thereafter moves into an assisted living facility. In one instance, under the trust's terms, the surviving spouse had a so-called "five or five" power: the power to withdraw from the principal of the trust in each calendar year an amount not to the exceed the greater of $5,000 or 5% of the then aggregate market value of all property included in the trust. Because the surviving spouse was treated as the owner of the trust only to the extent of his five or five power, he could exclude from income only that portion of the gain attributable to his five or five power [Letter Rul. 200104005]. [f] Depreciation The exclusion does not apply to gain attributable to depreciation after May 6, 1997 (effective date of I.R.C. § 121), claimed for rental or business use of a principal residence [I.R.C. § 121(d)(6)]. This limitation only applies to depreciation that is allocable to the portion of the property to which the exclusion applies [Treas. Reg. § 1.121-1(d)(1)]. [g] Property Acquired from a Decedent For estates of decedents dying after December 31, 2009, the exclusion applies to property sold by a decedent's estate, any person who acquired the property from a decedent under the modified carryover basis rules [see I.R.C.§ 1022], and a trust established by the decedent that was a qualified revocable trust under the rules for electing to treat a trust as part of an estate for income tax purposes [see I.R.C. § 645(b)(1)]. Eligibility for the exclusion will be determined by taking into account the decedent's ownership and use of the property [I.R.C. § 121(d)(11)]. [7] Disposition of Principal Residence in Like-Kind Exchange [a] Application of Revenue Procedure 2005-14 The IRS has issued a pro-taxpayer revenue procedure that provides guidance when both I.R.C. § 121 [see § 3.50[6]] and I.R.C. § 1031 [see Ch. 71, Exchanges] apply to a single exchange of property [ Rev. Proc. 2005-14, 2005-1 C.B. 528 ]. Neither statute addresses their dual application to a single exchange of property. Both provisions can apply because Section 121 does not require the property to be the taxpayer's principal residence on the date of the sale or exchange. All that is required is that the taxpayer must use the house as a principal residence for at least two years during the five-year period before the exchange [I.R.C. § 121(a); see § 3.50[6][b], [e]]. If those requirements are met, and all or a portion of the property has been converted to use in a trade or business (including a home office) or is held for investment at the time of the exchange, I.R.C. § 1031 may also come into play. Page 9 1-3 Texas Real Estate Guide § 3.50 Revenue Procedure 2005-14 indicates that, in certain cases, a homeowner may benefit from both the home-sale exclusion and the like-kind deferral. To benefit from both provisions, the property must have been used consecutively or concurrently as a home and a business at the time of the exchange. The Revenue Procedure applies only if the property meets the ownership and use requirements of I.R.C. § 121, and at least a portion of the property is used in a trade or business (or is held for investment) at the time of the exchange [see Rev. Proc. 2005-14 , § 3, 2005-1 C.B. 528 ]. The Revenue Procedure sets forth [ Rev. Proc. 2005-14 , § 4, 2005-1 C.B. 528 ]: An ordering rule for applying I.R.C. §§ 121 and 1031. An application of I.R.C. § 1031 to depreciation recapture amounts that are not excluded under I.R.C. § 121. The manner in which boot is taken into account in applying I.R.C. § 1031. A method for computing the basis of replacement property received in an exchange. The application of the rules vary, depending on whether (1) the entire house is a rental property, (2) the property contains a home office, or (3) the business property is separate from the dwelling unit or a part of it. The Revenue Procedure also provides six detailed examples with these factual variations, illustrating the treatment of gain recognition, depreciation, and boot [ Rev. Proc. 2005-14 , § 5, 2005-1 C.B. 528 ]. [b] Computation of Gain Under Revenue Procedure 2005-14, gain on an exchange is computed as follows [ Rev. Proc. 2005-14 , § 4, 2005-1 C.B. 528 ]: I.R.C. § 121 is applied to realized gain before applying I.R.C. § 1031. I.R.C. § 1031 is then applied to gain attributable to depreciation. The principal residence exclusion does not apply to gain attributable to depreciation deductions for periods after May 6, 1997, claimed with respect to the business or investment portion of a residence [I.R.C. § 121(d)(6)]. Nevertheless, I.R.C. § 1031 may apply to that gain. In applying I.R.C. § 1031, cash or other non-like-kind property (boot) received in exchange for property used in the taxpayer's trade or business (or held for investment) (the relinquished business property), is taken into account only to the extent that the boot exceeds the gain excluded under I.R.C. § 121 with respect to the relinquished business property. [c] Computation of Basis In determining the basis of the property received in the exchange to be used in the taxpayer's trade or business (or held for investment) (the replacement business property), any gain excluded under I.R.C. § 121 is treated as gain recognized by the taxpayer. Under I.R.C. § 1031(d), the basis of the replacement business property is increased by any gain attributable to the relinquished business property that is excluded under I.R.C. § 121 [ Rev. Proc. 2005-14 , § 4, 2005-1 C.B. 528 ]. [8] Sale of Subdivided Property Certain noncorporate taxpayers who subdivide real property for sale are allowed capital gain treatment under limited circumstances [I.R.C. § 1237]. When a noncorporate taxpayer who is an actual investor (or was so when the property was acquired) sells lots or parcels from a tract of land, the sales will not be treated as property held primarily for sale to customers in the ordinary course of trade or business solely because the taxpayer subdivided the tract for sale, or en- Page 10 1-3 Texas Real Estate Guide § 3.50 gaged in activity incident to the subdivision or sale of the property, as long as all of the following conditions are met [I.R.C. § 1237]: The property must not have been held by the taxpayer primarily for sale in the ordinary course of business at any previous time, unless the special subdivision provisions applied to that circumstance, nor may any other real property be so held during the taxable year in which the sale occurred; The taxpayer cannot have made any substantial improvement that substantially enhances the value of the parcel or lot sold; The lot or parcel, except when acquired by inheritance or devise, must have been held by the taxpayer for at least five years. If these requirements are met, the taxpayer may sell up to five lots or parcels from a tract and treat the proceeds as amounts received for property not held primarily for sale to customers in the ordinary course of business, such that the proceeds will be treated as capital gains and not as ordinary income. However, if the taxpayer sells a sixth lot (or more) in the same taxable year, the gains will be deemed to have been realized in the ordinary course to the extent of five percent of the selling price [I.R.C. § 1237(b)(1)]. [9] Repossession of Mortgaged Real Estate When real property is sold and the sale gives rise to a debt to the seller that is secured by the property, e.g., a purchase-money mortgage, and the seller later repossesses the property through voluntary transfer or foreclosure because of the buyer's actual or imminent default, no loss results to the seller from the repossession or reacquisition [I.R.C. § 1038]. The seller's gain on repossession is limited to the money and the value of other property, except the repossessed property, the seller receives with respect to the original sale to the extent these amounts have not already been reported as income. The resulting gain cannot exceed the gain on the original sale [I.R.C. § 1038]. If a home seller's gain is not recognized under the exclusion rules explained in § 70.50[6], and the seller repossesses the home and then resells it within one year after the date of the repossession, the resale of the home is treated as part of the transaction constituting the original sale of the property and the general rules governing taxation on repossession do not apply [I.R.C. § 1038(e)]. Legal Topics: For related research and practice materials, see the following legal topics: Tax LawFederal Income Tax ComputationSales & ExchangesBusiness Property (IRC secs. 1031, 1221, 1231)General OverviewTax LawFederal Income Tax ComputationSales & ExchangesBusiness Property (IRC secs. 1031, 1221, 1231)Property Held for Productive Use & InvestmentTax LawFederal Income Tax ComputationSales & ExchangesCapital Gains & Losses (IRC secs. 1201-1202, 1211-1212, 1221-1223, 1231-1260, 1271-1278, 1281-1288, 1291-1298)Capital AssetsTax LawFederal Income Tax ComputationSales & ExchangesCapital Gains & Losses (IRC secs. 1201-1202, 1211-1212, 1221-1223, 1231-1260, 1271-1278, 1281-1288, 1291-1298)Long Term & Short Term Gains & LossesTax LawFederal Income Tax ComputationSales & ExchangesCapital Gains & Losses (IRC secs. 1201-1202, 1211-1212, 1221-1223, 1231-1260, 1271-1278, 1281-1288, 1291-1298)Treatment of GainsTax LawFederal Income Tax ComputationSales & ExchangesInstallment Sales (IRC secs. 1001, 1031, 1231)General OverviewTax LawFederal Income Tax ComputationSales & ExchangesInstallment Sales (IRC secs. 1001, 1031, 1231)Recognition of Gains & Losses 131T0C ********** Print Completed ********** Time of Request: Sunday, March 21, 2010 Print Number: 2862:211115572 Number of Lines: 454 Number of Pages: Send To: NN/L, 131T0C LN TRIAL ID - CFM LEGAL 9393 SPRINGBORO PIKE MIAMISBURG, OH 45342 15:36:08 EST