UNITED STATES SECURITIES AND EXCHANGE COMMISSION

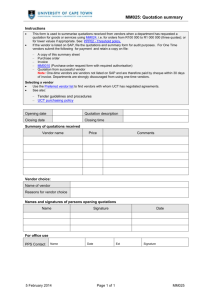

advertisement