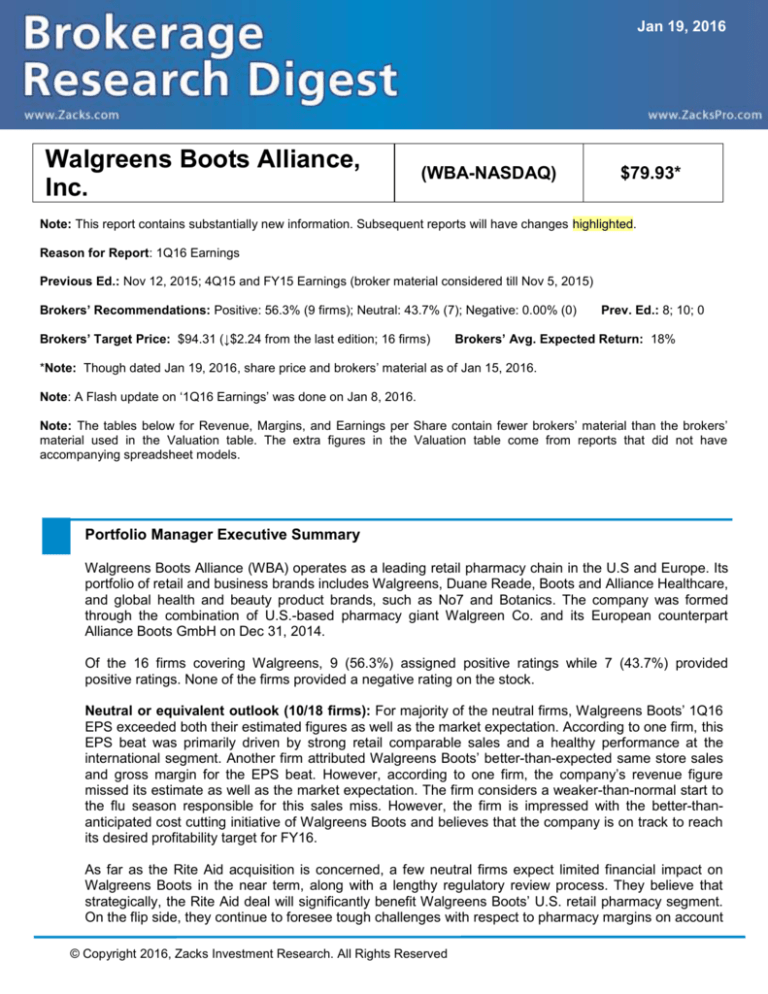

Jan 19, 2016

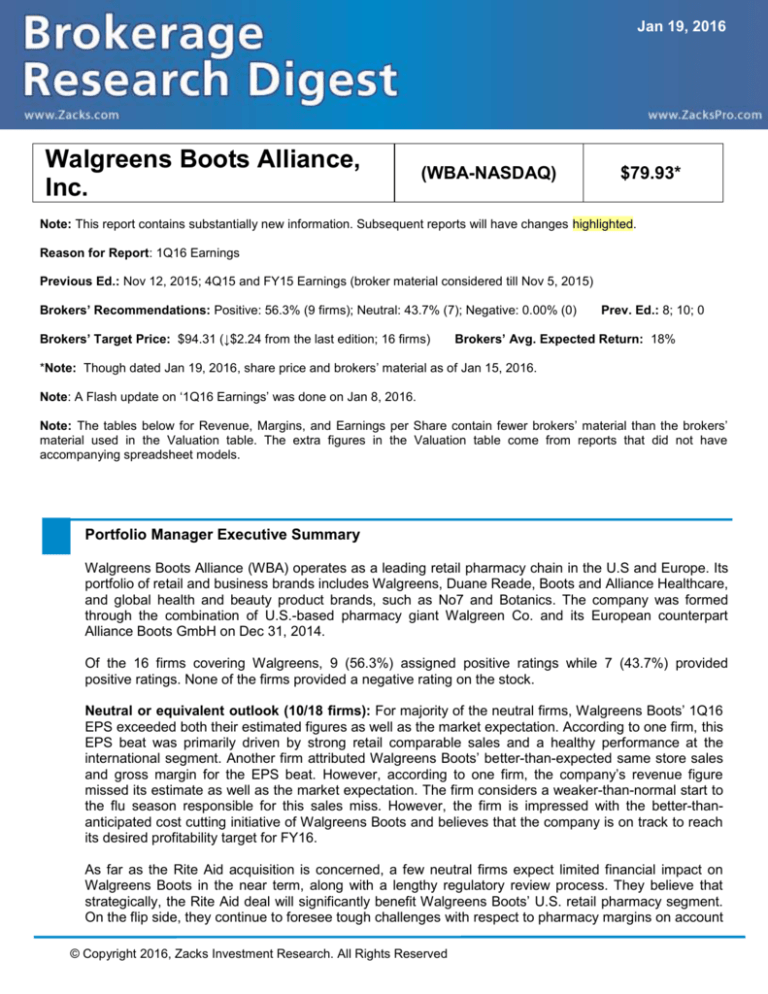

Walgreens Boots Alliance,

Inc.

(WBA-NASDAQ)

$79.93*

Note: This report contains substantially new information. Subsequent reports will have changes highlighted.

Reason for Report: 1Q16 Earnings

Previous Ed.: Nov 12, 2015; 4Q15 and FY15 Earnings (broker material considered till Nov 5, 2015)

Brokers’ Recommendations: Positive: 56.3% (9 firms); Neutral: 43.7% (7); Negative: 0.00% (0)

Brokers’ Target Price: $94.31 (↓$2.24 from the last edition; 16 firms)

Prev. Ed.: 8; 10; 0

Brokers’ Avg. Expected Return: 18%

*Note: Though dated Jan 19, 2016, share price and brokers’ material as of Jan 15, 2016.

Note: A Flash update on ‘1Q16 Earnings’ was done on Jan 8, 2016.

Note: The tables below for Revenue, Margins, and Earnings per Share contain fewer brokers’ material than the brokers’

material used in the Valuation table. The extra figures in the Valuation table come from reports that did not have

accompanying spreadsheet models.

Portfolio Manager Executive Summary

Walgreens Boots Alliance (WBA) operates as a leading retail pharmacy chain in the U.S and Europe. Its

portfolio of retail and business brands includes Walgreens, Duane Reade, Boots and Alliance Healthcare,

and global health and beauty product brands, such as No7 and Botanics. The company was formed

through the combination of U.S.-based pharmacy giant Walgreen Co. and its European counterpart

Alliance Boots GmbH on Dec 31, 2014.

Of the 16 firms covering Walgreens, 9 (56.3%) assigned positive ratings while 7 (43.7%) provided

positive ratings. None of the firms provided a negative rating on the stock.

Neutral or equivalent outlook (10/18 firms): For majority of the neutral firms, Walgreens Boots’ 1Q16

EPS exceeded both their estimated figures as well as the market expectation. According to one firm, this

EPS beat was primarily driven by strong retail comparable sales and a healthy performance at the

international segment. Another firm attributed Walgreens Boots’ better-than-expected same store sales

and gross margin for the EPS beat. However, according to one firm, the company’s revenue figure

missed its estimate as well as the market expectation. The firm considers a weaker-than-normal start to

the flu season responsible for this sales miss. However, the firm is impressed with the better-thananticipated cost cutting initiative of Walgreens Boots and believes that the company is on track to reach

its desired profitability target for FY16.

As far as the Rite Aid acquisition is concerned, a few neutral firms expect limited financial impact on

Walgreens Boots in the near term, along with a lengthy regulatory review process. They believe that

strategically, the Rite Aid deal will significantly benefit Walgreens Boots’ U.S. retail pharmacy segment.

On the flip side, they continue to foresee tough challenges with respect to pharmacy margins on account

© Copyright 2016, Zacks Investment Research. All Rights Reserved

of a less favorable generic launch pipeline as well as reimbursement pressure. Higher generic drug

costs also added to the woes in the reported quarter and are expected to continue in the near term as

well.

Positive or equivalent outlook (8/18 firms): For the majority of the bullish firms, Walgreens Boots’

1Q16 EPS figure exceeded their estimates as well as the market expectation. According to one firm,

Walgreens Boots’ cost transformation and Boots synergy initiatives outweighed gross margin pressure

on the company’s overall business, driven by specialty mix and growth in Medicare Part D exposure.

This in turn drove the EPS beat. The firm was also impressed with the company raising the lower end of

its EPS guidance range for FY16, despite anticipating a significant foreign exchange headwind.

According to another firm, in addition to the positive impact from the Alliance Boots merger, a strong

growth in retail comparable stores drove solid year-over-year growth in the retail pharmacy USA

division. The firm was also upbeat about the company’s front-end operations in 1Q16, which according

to it benefited from a deliberate strategy to move mix to core focus Health & Beauty categories.

While discussing the retail pharmacy international division, one of the firms was upbeat on Walgreens

Boots’ focus on selling lower volumes of higher margin products, which according to it contributed to the

strength of this division. The firms also speak highly about the company’s continued progress on its

previously stated goal of $1 billion in combined net synergies in FY16, in addition to other cost

management efforts, like the AmerisourceBergen generic sourcing initiative and lower SG&A expenses.

Jan 19, 2016

Overview

Headquartered in Deerfield, IL, Walgreens Boots Alliance is the first global pharmacy-led, health and

wellbeing enterprise in the world, with over 13,100 stores in 11 countries. Walgreens Boots was formed

through the combination of U.S.-based pharmacy giant Walgreen Co. and its European counterpart

Alliance Boots GmbH on Dec 31, 2014. In Jun 2012, Walgreens had entered into a long-term partnership

with Alliance Boots under which the former acquired 45% equity ownership of the latter. On Dec 31, the

remaining acquisition of Alliance Boots was completed and the new company, Walgreens Boots Alliance,

Inc. was formed, of which legacy Walgreens is now a wholly-owned subsidiary. The company’s website is

www.walgreensbootsalliance.com.

Currently, Walgreens Boots has a presence in over 25 countries, with an employee structure of more

than 370,000 people and is the largest retail pharmacy, health and daily living destination in the U.S. and

Europe. It is the largest global pharmaceutical wholesale and distribution network with over 350

distribution centers delivering to more than 200,000 pharmacies, doctors, health centers and hospitals

each year in 19 countries.

Post completion of the merger on Dec 31, 2014, Walgreens Boots realigned its operations into three

reportable segments: Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical

Wholesale. Segmental reporting includes the allocation of synergy benefits, including WBAD results, and

the combined corporate costs for periods subsequent to Dec 31, 2014.

Walgreens Boots began recording revenue and expense transactions for the new segments effective Jan

1, 2015. Beginning Jan 1, synergy benefits including Walgreens Boots’ operations have been allocated to

the Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale segments on a

"source of procurement benefit" basis. Under this method, the synergy benefits are allocated to the

segment whose purchase gave rise to the benefit.

The company’s fiscal year ends on Aug 31; all calendar references differ from the fiscal year.

Zacks Investment Research

Page 2

www.zackspro.com

The firms identified the following factors for evaluating the investment merits of WBA:

Key Positive Arguments

Health & Wellness Division: Walgreens is

strengthening its health and wellness division

with acquisitions and is growing its presence in

specialty pharmacy, which has substantial growth

potential.

Key Negative Arguments

Declining Margins: Over the past few years, increased

reimbursement pressure and generic drug cost inflation

has been hampering legacy Walgreens’ margin, on a

significant level. The management does not expect this

situation to improve in the near term.

Initiatives:

The

company is

constantly

introducing strategic initiatives to boost long-term

growth. Many firms believe that Walgreens’

recent partnership with WebMed will elevate its

position in the digital market. Besides, it also has

the potential to drive foot traffic at its stores.

Regulations: The continued efforts of health maintenance

organizations (HMOs), managed care organizations,

PBMs, and other third party payors, including government

agencies such as Medicaid, to cut costs by reducing

prescription drug costs and reimbursement rates could

pose a threat to Walgreens’ future operating performance.

Strong Balance Sheet: Buoyed by a strong

balance sheet, the company regularly returns

value to shareholders through dividends and

share repurchases. Moreover, a strong cash

balance augurs well for acquisitions.

Low Generic Drugs Introduction Rate: Walgreens Boots

expects the trend of low introduction rate of new generic

drugs to continue in FY16.

Improved Supply Chain: The long-term deal

with AmerisourceBergen is another upside. The

firms are sanguine about improved supply chain

performance in the next fiscal. Moreover, they

are encouraged by the expected accretion from

this deal.

Jan 19, 2016

Long-Term Growth

For the long term, Walgreens Boots has structured its growth and expansion plan on three strategic

pillars. First, Walgreens Boots will seek and seize further synergy opportunities, while continuing to

optimize its cost base across the enterprise. Second, management seeks to drive the company’s organic

growth by making the most of a well integrated wholesale-retail model and its brands. Last, Walgreens

Boots will pursue to generate and seize relevant merger and acquisitions and strategic investment

opportunities in mature and emerging markets.

Notably, emerging markets represent another longer-term strategic opportunity that the company plans to

capitalize on in pursuance of Walgreens Boots’ future growth. Management believes the company is well

placed to serve as a catalyst of change in the substantial Chinese market. Moreover, its recent

acquisitions in Mexico and Chile position it well to eventually become an influential player in the Latin

American market. These markets should create further opportunities for Walgreens Boots to advance the

health and wellbeing of communities around the globe.

Post-merger, Walgreens Boots’ first priority as a combined entity is to understand the business fully,

along with its interdependency and its differentiation. Currently, management focuses on delivering as

per the needs of Walgreens Boots’ customers in a dependable yet innovative manner that will provide the

company with sustainable and growing income across all parts of its business.

Management aims to achieve this through a combination of efficient practice, research, and insight,

investment in Walgreens Boots’ co-business, and innovation in the business model. The company

believes there lies significant scope to enhance the performance of its pharmacies by refreshing and

Zacks Investment Research

Page 3

www.zackspro.com

differentiating the stores, improving customer experience, delivering proven services to customers and

patients, and introducing new offerings through innovative partnerships.

In late Oct 2015, Walgreens Boots announced its plan to acquire U.S. retail pharmacy chain –

Rite Aid – for a total enterprise value of $17.2 billion, including acquired net debt. The

combination of these two retail giants will allow Walgreens Boots to further expand its business

realm in the U.S. in the long term, where it already enjoys the position of the largest retail drug

store giant. Management expects this buyout to accelerate Walgreens Boots’ strategy by

completing its network; providing a larger and more comprehensive portfolio, with which it will

deploy more knowledge and skill; creating a more comprehensive and strong platform for the

development of the company’s brand presence and overall future growth of its business.

Per one neutral firm, while concerns loom large pertaining to the regulatory approval for the Rite Aid

buyout by Walgreens Boots, it believes this deal should eventually gain clearance. However, the approval

depends upon the number of stores Walgreens Boots will close as there is some degree of overlap

between Rite Aid and Walgreens Boots’ locations in several markets. Nevertheless, most of the firms feel

that the geographic expansion and cost-saving opportunities that this takeover will offer have the

potential to balance this risk.

Jan 19, 2016

Target Price/Valuation

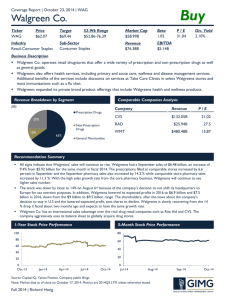

Rating Distribution

Positive

56.3%↑

Neutral

43.7%↓

Negative

0.00%

Avg. Target Price

$94.31↓

Maximum Target

$102.00↓

Minimum Target

$81.00

No. of Analysts with Target price/Total

16/16

Upside from current

18%

Maximum Upside from current

27.6%

Minimum Downside from current

1.3%

Risks to the target price include lower-than-expected growth in the retail business, increased

industry regulation or changes to the existing health care law, or a material loss of business,

weak front-end business compelling the company to take a promotional stance, or inability to

meet the synergy goals.

Zacks Investment Research

Page 4

www.zackspro.com

Recent Events

On Jan 7, 2016, Walgreens Boots reported fiscal 1Q16 results. Highlights are as follows:

Walgreens Boots reported adjusted EPS of $1.03 in 1Q16, up 32.1% y/y.

Revenues in 1Q16 increased 48.5% y/y to $29 billion.

Guidance: Walgreens Boots now expects to earn adjusted EPS in the $4.30–$4.55 range in FY16,

narrower than the earlier guided band of $4.25–$4.55.

Other Events

Revenue

Walgreens Boots recorded total sales of $29 billion in 1Q16, reflecting an increase of 48.5% y/y; largely

due to the inclusion of Alliance Boots’ consolidated results for 1Q16.

Segments in Detail

Historically, the legacy Walgreens used to report as one segment, which comprised the performance of

Walgreens in the U.S.; its corporate costs and synergies from the Walgreens Boots Alliance

Development joint venture, also known as WBAD; and equity earnings from Alliance Boots on a threemonth lag. Following the combination of Alliance Boots and the legacy Walgreens, Walgreens Boots

eliminated the three-month reporting lag and recast prior period results with no lag.

As Walgreens Boots, management now reports results in three segments: Retail Pharmacy USA, Retail

Pharmacy International, and Pharmaceutical Wholesale.

Retail Pharmacy USA

The Retail Pharmacy USA segment consists of the legacy Walgreens business, which includes the

operation of retail drugstores and convenient care clinics, in addition to providing specialty and infusion

and respiratory pharmacy services. Revenues for this segment are principally derived from the sale of

prescription drugs and a wide assortment of general merchandise, including non-prescription drugs,

beauty products, photo finishing, seasonal merchandise, greeting cards and convenience foods.

In 1Q16, revenues from the Retail Pharmacy USA division, whose principal retail pharmacy brands are

Walgreens and Duane Reade, increased 4.2% y/y to $20.4 billion. Total sales in comparable stores

(those open for at least a year) jumped 5.8% y/y, driven by strong pharmacy volume and mix. Total sales

growth was lower than comparable-store sales primarily due to the sale of Walgreens Boots’ infusion

business and store closures during 2015. Retail comparable store sales dropped 0.6% in 1Q16 due to a

reduction in unprofitable promotions and the transitioning of seasonal items away from holiday

decorations and toward higher quality, giftable items.

Pharmacy sales, which accounted for 68.4% of division sales in 1Q16, climbed 6.7% y/y, while pharmacy

sales in comparable stores increased 9.3%. Management attributed the increase in pharmacy sales in

part to growth in Medicare Part D and greater focus on pharmacy customer care. The division filled 231

Zacks Investment Research

Page 5

www.zackspro.com

million prescriptions (including immunizations) on a 30-day adjusted basis in 1Q16, reflecting an increase

of 4.1% y/y, even in the face of the y/y 10.7% lower reported incidence of flu across the U.S. (according

to IMS Health). During 1Q16, the company witnessed an increase in comparable-store scripts on account

of its Medicare Part D growth strategy, having recently expanded its market share therein coupled with a

greater focus on customer care.

Prescriptions filled in comparable stores were up 4.7% y/y. For 1Q16, the division’s retail prescription

market share in the U.S., on a 30-day adjusted basis, increased 20 basis points y/y to 19.2%, as reported

by IMS Health. Further, Walgreens Boots’ new U.S. fulfillment agreements with Valeant Pharmaceuticals

International Inc., announced on 15 Dec 2015, are expected to enhance the division’s pharmacy market

share growth as the agreements are rolled out in calendar year 2016.

As of Nov 30, 2015, the division operated 8,192 locations (8,182 drugstores) across all 50 states, the

District of Columbia, Puerto Rico and the US Virgin Islands – reflecting 138 locations (47 stores) lesser

compared to the 1Q15 figure.

Retail Pharmacy International

The Retail Pharmacy International segment includes primarily the legacy Alliance Boots pharmacy-led

health and beauty stores, optical practices, and related contract manufacturing operations. Stores are

located in the UK, Mexico, Chile, Thailand, Norway, Republic of Ireland, The Netherlands and Lithuania.

Revenues for this segment are principally derived from the sale of prescription drugs and retail health,

beauty, toiletries and other consumer products.

Revenues from this division, whose principal retail brands are Boots in the UK, Thailand, Norway, the

Republic of Ireland and The Netherlands; Benavides in Mexico and Ahumada in Chile, grossed $3.5

billion in 1Q16.

As the businesses included in this Retail Pharmacy International division were acquired as part of the

merger with Alliance Boots, no comparable information is included in the Walgreens Boots consolidated

results.

On a pro forma constant-currency basis, comparable pharmacy sales grew 3.8% y/y, driven by good

growth in dispensing and pharmacy services in the U.K. and Mexico. On the other hand, pro forma

constant currency comparable store sales grew 2.2% in 1Q16. Comparable retail sales increased 1.3%

y/y, reflecting strong growth in Ireland.

Comparable pharmacy sales in Boots UK were up 3.5%, primarily driven by additional high-value drugs

dispensed in its hospital pharmacies, higher average volume, higher average item value, and growth in

pharmacy services such as flu vaccinations. Comparable retail sales growth at Boots UK was 80 basis

points in 1Q16, growth coming mainly from Boots.com, albeit at a lower rate than in the previous

quarters.

Moreover, cosmetics were the best performing retail category in the UK, led by a strong performance in

premium, No7, and Liz Earle, which Walgreens Boots acquired in July. In November, the company added

another exciting brand to its portfolio, Sleek MakeUP, which has a young and ethnically diverse customer

base.

Outside the UK, the company delivered particularly strong comparable sales growth in Mexico and in the

Republic of Ireland. At Benavides in Mexico, the company currently has a lower operating margin

business than Boots and aims business expansion therein. Management is also working hard to find

innovative ways to accelerate its store opening program.

Zacks Investment Research

Page 6

www.zackspro.com

Management had earlier expressed its enthusiasm about the company’s buyout of the award winning

premium skin care brand – Liz Earle Beauty Co. Ltd – from Avon. Notably, Liz Earle is recognized as one

of the leading botanical brands in the UK.

Pharmaceutical Wholesale

The Pharmaceutical Wholesale segment comprises the legacy Alliance Boots pharmaceutical

wholesaling and distribution businesses. Wholesale operations are located in France, UK, Germany,

Turkey, Spain, Russia, The Netherlands, Egypt, Norway, Romania, Czech Republic and Lithuania.

Revenues at the segment are principally derived from wholesaling and distribution of a comprehensive

offering of brand-name pharmaceuticals (including specialty pharmaceutical products) and generic

pharmaceuticals, health and beauty products, home healthcare supplies and equipment, and related

services to pharmacies and other healthcare providers.

Revenues from this division, which mainly operates under the Alliance Healthcare brand, reached $5.8

billion in 1Q16.

Similar to Retail Pharmacy International, Walgreens Boots’ Pharmaceutical Wholesale division was

acquired through the merger with Alliance Boots, and hence, no figures were reported in the comparable

period. However, on a pro forma constant-currency basis and excluding acquisitions and dispositions,

comparable sales increased 3.1% y/y.

Walgreens Boots witnessed strong sales growth in this segment, particularly in Norway, where its

wholesale business won a major new contract (around the start of calendar year 2015). This was slightly

ahead of the company’s estimated market growth, on account of its country wholesale sales. During

1Q16, Walgreens Boots also achieved solid sales growth in Germany and Turkey, two of the division’s

largest markets.

Recent Strategic Developments:

On Nov 10, 2015, Walgreens Boots, in collaboration with MDLIVE, announced an expansion of the

Walgreens mobile app, offering MDLive’s telehealth services to users in 20 additional states, now totaling

25, as well as the launch of an updated telehealth experience within the app, providing better functionality

and integration.

On Nov 5, 2015, Walgreens Boots announced that its Healthcare Clinics will soon transition to the Epic

electronic health record (EHR) platform, to further enhance care coordination among providers, while

also supporting the long-term growth plan for its clinic business. The move to the new EHR, EpicCare,

will begin in early calendar year 2016.

On Nov 5, 2015, Walgreens Boots announced that Walgreens Balance Rewards members can now

seamlessly use their account through Apple Pay, without separately scanning a Balance Rewards card or

barcode. More than 85 million active Balance Rewards members will have the ability to earn and redeem

loyalty points via Apple Pay, the easy, secure and private way to pay.

On Oct 27, 2015, Walgreens Boots announced that it has entered into a definitive agreement with Rite

Aid Corporation, under which Walgreens Boots will acquire all outstanding shares of Rite Aid, a U.S.

retail pharmacy chain, for $9.00 per share in cash, for a total enterprise value of approximately $17.2

billion, including acquired net debt. The purchase price represents a premium of 48 percent to the closing

price per share on 26 Oct 2015, the day before the agreement was signed.

Loyalty Card: On Sep 16, 2012, the legacy Walgreens had launched a complete customer loyalty

program ‘Balance Rewards' to stimulate spending through points and rewards earned by customers. This

program includes over 7,900 legacy Walgreens and Duane Reade stores in the U.S. and offers multichannel access to join the program. At the end of FY14, legacy Walgreens’ Balance Rewards loyalty

Zacks Investment Research

Page 7

www.zackspro.com

program had 82 million active members. The company had integrated its award winning Paperless

coupons into this program and had nearly 1.5 million people enrolled in Balance Rewards for healthy

choices program.

Outlook: The company continues to expect to reach at least $1.0 billion in combined net synergies in

FY16.

Margins

Walgreens Boots’ gross profit increased 41.7% y/y to $7.50 billion in 1Q16, while adjusted gross profit

improved 41.1% to $7.55 billion. However, per management’s expectation, adjusted gross margin

contracted 130 basis points (bps) to 26%.

Within the Retail Pharmacy USA division, gross margin contracted 30 bps to 27% in 1Q16, on account of

lower pharmacy reimbursement rates, an increase in Medicare Part D prescriptions and the mix of

specialty medications.

The LIFO provision was $33 million in 1Q16 versus $34 million in 1Q15.

Adjusted selling, general and administrative (SG&A) expenses declined 38.6% to $5.8 billion in 1Q16.

Adjusted operating income increased 11.2% to $1.2 billion. Consequently, adjusted operating margin

expanded 20 bps to 5.9%.

Please refer to the Zacks Research Digest spreadsheet on WAG for total forward margin estimates and details.

Earnings per Share

In 1Q16, Walgreens Boots reported adjusted EPS of $1.03, up 32.1% y/y. This improvement was

primarily driven by the full consolidation of Alliance Boots’ operations, increased sales and lower selling,

general and administrative expenses as a percentage of sales in Walgreens Boots’ Retail Pharmacy USA

division and a lower effective income tax rate. However, these positive factors were partially offset by

lower Retail Pharmacy USA gross margins and a higher interest expense.

Including one-time items, Walgreens Boots posted net income of $1.1 billion or $1.01 per share, a

significant improvement of 30.6% or 13.5% respectively, compared to 1Q15. Per management, overall

earnings growth was primarily driven by the cost cutting initiatives recently adopted by Walgreens Boots

and improved adjusted operating income margins.

Outlook: Walgreens Boots has raised the lower end of its earlier provided EPS guidance range for FY16

by $0.05. The company currently expects to earn adjusted EPS in the $4.30–$4.55 band in FY16,

narrower than the earlier guided range of $4.25–$4.55.

This guidance continues to assume no material accretion from Walgreens Boots’ agreement to acquire

Rite Aid, the previously announced suspension of the balance of the $3 billion share buyback program,

continuation of the company’s normal anti-dilutive buyback program relating to stock incentives and no

significant changes in currency exchange rates.

Buoyed by the company’s better-than-expected bottom-line performance and updated EPS outlook, one

of the neutral firms has also raised its FY16 EPS guidance for Walgreens Boots.

Please refer to the Zacks Research Digest spreadsheet on WBA for additional details on EPS forecasts.

Zacks Investment Research

Page 8

www.zackspro.com

Jan 19, 2016

Analyst

Aparajita Dutta

Content Ed.

Anindita Sinha

No. of brokers reported/Total

brokers

16/16

QCA

Aniruddha Ganguly

Lead Analyst

Urmimala Biswas

Reason for Update

Earnings Update

Zacks Investment Research

Page 9

www.zackspro.com