Stewart M. Presser - NYU Wagner

advertisement

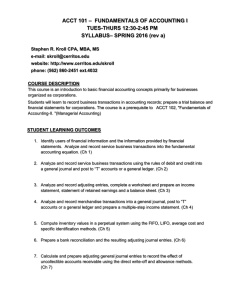

New York University Robert F. Wagner Graduate School of Public Service P11-4130 (2 Credits) FINANCIAL ACCOUNTING SPRING 2009 Silver, Room 802 8:35 p.m. – 10:15 p.m. Professor: Stewart M. Presser, Vice President, Greater New York Hospital Association The purpose of this course is to provide students with essential skills of financial accounting. P11.1021, the school's core course in Financial Management for Public, Non-profit and Health Organizations provides students with the tools necessary to understand and use financial information. However, that course does not delve into many of the specific techniques related to generating financial information. In many careers pursued by graduates of the Wagner School, knowledge of such technical details will be useful, and in some cases it may be necessary. This course seeks to fill that need. Topics covered include debits and credits, the recording process (including double entry accounting, T accounts, journal entries, adjusting entries, closing entries, and financial statement preparation), accounts receivable (including allowances for bad debts and aging schedules), inventory (including LIFO/FIFO, periodic vs. perpetual, and lower of cost or market) and standard depreciation methods. Text: Horngren, et al, Financial Accounting, Ninth edition, Prentice Hall, Englewood Cliffs, NJ. LECTURES Class 1 January 22, 2009 Chapter 1: Accounting: The Language of Business--Types of entities and Balance Sheet transactions. Chapter 2: Measuring Income to Assess Performance--Income Statement transactions, concepts of recognition, matching, and cost recovery to record revenues and expenses. Income statement preparation and how it relates to the balance sheet. These chapters are combined, as they contain some overlap with P11.1021. Class 2 January 29, 2009 Class 3 February 5, 2009 Chapter 3: Recording Transactions--Double entry accounting (debts and credits); analyze and journalize transactions; posting journal entries to ledger accounts; prepare and use a trial balance; use T accounts to analyze accounting relationships. Chapter 3 continued. Review journalizing and posting process and review homework assignments for chapter 3. Class 4 February 12, 2009 Class 5 February 19, 2009 Class 6 February 26, 2009 Chapter 4 - Accrual Accounting and Financial Statements—Prepare adjustments for the expiration of assets, accrual of unrecorded expenses, accrual of unrecorded revenues. Preparation of a classified balance sheet and a single/multi-step income statement will be discussed. TAKE HOME FINAL PORTION OF FINAL WILL BE GIVEN OUT. Chapter 6 - Accounting for Sales--Recognize revenue items on the income statement, account for cash and credit sales and estimate and interpret uncollectible accounts receivable balances. Chapter 7 - Inventories and Cost of Goods Sold—Types of inventory methods, calculate the cost of merchandise acquired, and inventory valuations. Chapter 8 - Long-Lived Assets and Depreciation—Measure acquisition costs of tangible assets, compute depreciation and compute gain/loss on disposal of fixed assets. Final Exam Review. Class 8 March 5, 2009 FINAL EXAMINATION IN CLASS, PART 2 and SUBMISSION OF PART ONE OF THE FINAL EXAM. Assignments There will be weekly assignments given, see hand out. Students are expected to complete the assignments on dates indicated and handed in for review. We will go over the problems in class. The homework assignments are an integral part of the class work and will comprise a portion of the final grade. Grading Class participation, attending lectures and completion of assignments will count for 20% of the final grade and the FINAL exams will count for the remaining 80%. The final will be in two (2) parts: Part one, a take home problem and part two, will be given in class. The take home will account for (25% and the in-class, 75%) of the 80% of the final exam portion of the grade. Office Hours You may reach me during the day at my office, (212) 506-5444 or via e-mail at PRESSER@GNYHA.ORG. I will be available to meet with any student on an individual basis if necessary. Please contact me via e-mail to set up an appointment.