International Parity Conditions

advertisement

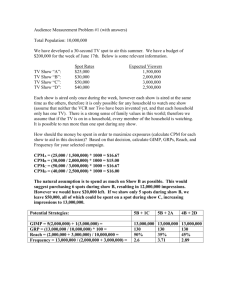

International Parity Conditions International Parity Conditions Some fundamental questions managers of MNEs, international portfolio investors, importers, exporters and government officials must deal with every day are: What are the determinants of exchange rates? Are changes in exchange rates predictable? The economic theories that link exchange rates, price levels, and interest rates together are called international parity conditions. Prices and Exchange Rates Law of one price: If the identical product or service can be sold in two different markets, and no restrictions exist on the sale or transportation costs of moving the product between markets, the products price should be the same in both markets. Comparing prices then, would require only a conversion from one currency to the other: P$ x S = P¥ Where the product price in US dollars is (P$), the spot exchange rate is (S) and the price in Yen is (P¥). Purchasing power parity (PPP): a theory that the price of internationally traded commodities should be the same in every country. The exchange rate between the two currencies should be the ratio of prices in the two countries. ‘Hamburger Standard’ (p135 of text): a Big Mac in Switzerland costs SF6.30, while the same Big Mac in the US is $2.49. According to PPP hypothesis, a purchasing power parity exchange rate will be SF6.30/$2.49 = SF2.5301/$ Compare to SF1.66/$, the actual exchange rate quoted on the exchange rate market, SF in the exchange rate market is overvalued by SF2.5301/SF1.66 = 1.5242 or 52.42% Empirical testing of PPP and the law of one price has been done, but has not proved PPP to be accurate in predicting future exchange rates. PPP holds up well over the very long run but poorly for shorter time periods The theory holds better for countries with relatively high rates of inflation and underdeveloped capital markets Relative purchasing power parity (RPPP): If the spot exchange rate between two countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal but opposite change in the spot exchange rate. S2 (¥/$) / S1(¥/$) = (1+ π¥)/(1+ π$) Or S2 (¥/$) = S1(¥/$) x (1+ π¥)/(1+ π$) $ Where π and π ¥ are the respective inflation rates and S is the spot exchange rate using indirect quotes (¥/$). 1 Example: assuming that the forecasted inflation rates for Japan and the US are 1% and 3%, respectively. The current spot rate, S1, is ¥114/$. According to the relative version of PPP, the spot exchange rate one year from now , S2 , is expected: Interest Rates and Exchange Rates The Fisher effect states that nominal interest rates in each country are equal to the required real rate of return plus compensation for expected inflation. i=r+π Where i = nominal interest rate, r = real interest rate and π = expected inflation. Empirical tests have shown the Fisher effect usually exists for short-maturity government securities (treasury bills and notes). International Fisher effect states that the spot exchange rate should change in an equal amount but in the opposite direction to the difference in interest rates between two countries. S2 (¥/$) / S1(¥/$) = (1+ i¥)/(1+ i$) Or S2 (¥/$) = S1(¥/$) x (1+ i¥)/(1+ i$) $ Where i and i¥ are the respective national interest rates and S is the spot exchange rate using indirect quotes (¥/$). Example International Fisher Effect Assumptions One year interest rate, US dollars One year interest ratre, Euro Zone Value 5.000% 3.000% Current spot exchange rate (euros per US$) 0.8000 International Fisher forecast of future spot rate (euros per US$) Justification for the international Fisher effect is that investors must be rewarded or penalized to offset the expected change in exchange rates. The relationship between the forward rate and the spot exchange The forward rate is calculated for any specific maturity by adjusting the current spot exchange rate by the ratio of interest rates of the same maturity for the two subject currencies. For example, the 90-day forward rate for the Swiss franc/US dollar exchange rate (FSF/$90) is found by multiplying the current spot rate (SSF/$) by the ratio of the 90-day Swiss franc deposit rate (iSF) over the 90-day dollar deposit rate (i$). FSF/$90 = SSF/$ x [1 + (iSF x 90/360)]/ [1 + (i$ x 90/360)] Or FSF/$90 / SSF/$ = [1 + (iSF x 90/360)]/ [1 + (i$ x 90/360)] 2 Assuming SSF/$ is SF1.4800/$, Swiss franc’s 90-day deposit rate (iSF ) is 4% and dollar’s 90-day deposit rate is 8% then FSF/$90 = SSF/$ x [1 + (iSF x 90/360)]/ [1 + (i$ x 90/360)] = 1.4800 x [(1+(0.04x90/360)]/[1+(0.08x90/360)] = 1.4800 x[1.01/1.02] = SF1.4655/$ Forward premium = (1.48 – 1.4655)/1.4655 x 360/90 x 100 = 3.96% The theory of Interest Rate Parity (IRP) states: The difference in the national interest rates for securities of similar risk and maturity should be equal to, but opposite in sign to, the forward rate discount or premium for the foreign currency, except for transaction costs. Using previous example, we can have following relationship among spot exchange rate, forward rate and interest rates FSF/$90 = SSF/$ x [1 + (iSF x 90/360)]/ [1 + (i$ x 90/360)] Or FSF/$90 / SSF/$ = [1 + (iSF x 90/360)]/ [1 + (i$ x 90/360)] A dollar-based investor with 1$ have two ways to invest: Invest the 1$ in a 90-day dollar money market instrument and earn 2% (i$ x 90/360) $1 x (1+0.02) = $1.02 Convert the 1$ to 1.48SF using SSF/$, then invest the 1.48SF in a 90-day SF money market instrument and earn 1% (iSF x 90/360). Simultaneously sell a 90-day SF forward to convert the resulting proceeds of SF investment back to dollars [$1 x SF1.48/$ x (1+0.01) ]/(SF1.4655/$) =SF1.4948 / (SF1.4655/$) = $1.01999 Covered interest arbitrage (CIA) The spot and forward exchange rates are not, however, constantly in the state of equilibrium described by interest rate parity. When the market is not in equilibrium, the potential for arbitrage profit exists. The arbitrager will exploit the imbalance by investing in whichever currency offers the higher return on a covered basis. Classroom problem : U.S. dollar interest (3-month) 3.000% START $ 5,000,000.00 → 1.0075 END → ↓ ↓ $5,037,513.93 $ 13.93 ↓ Spot (kr/$) 7.5000 ↓ kr 37,500,000.00 $ 5,037,500.00 ↑ ---------------> 90 days ---------------> → 1.0125 5.000% Danish kroner interest (3-month) → F-90 (kr/$) 7.5372 ↑ kr 37,968,750.00 Uncovered interest arbitrage (UIA) 3 In this case, investors borrow in countries and currencies exhibiting relatively low interest rates and convert the proceed into currencies that offer much higher interest rates. The transaction is “uncovered” because the investor does no sell the higher yielding currency proceeds forward, choosing to remain uncovered and accept the currency risk of exchanging the higher yield currency into the lower yielding currency at the end of the period. Exhibit 6.8 4