Rental Tax Worksheet

advertisement

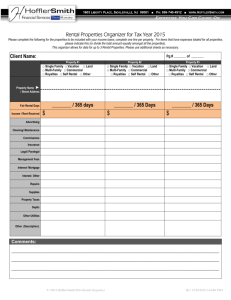

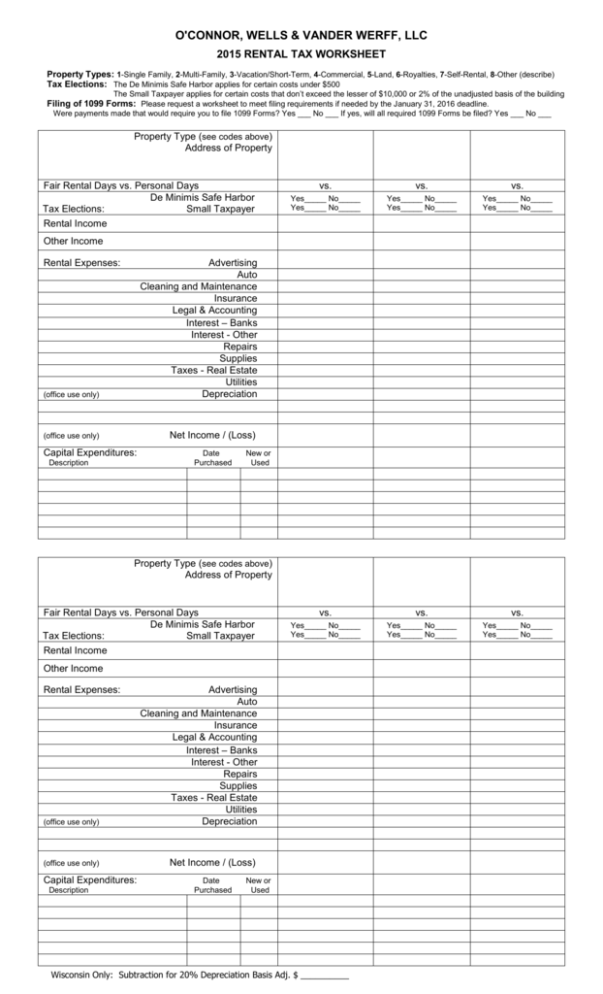

O'CONNOR, WELLS & VANDER WERFF, LLC 2015 RENTAL TAX WORKSHEET Property Types: 1-Single Family, 2-Multi-Family, 3-Vacation/Short-Term, 4-Commercial, 5-Land, 6-Royalties, 7-Self-Rental, 8-Other (describe) Tax Elections: The De Minimis Safe Harbor applies for certain costs under $500 The Small Taxpayer applies for certain costs that don’t exceed the lesser of $10,000 or 2% of the unadjusted basis of the building Filing of 1099 Forms: Please request a worksheet to meet filing requirements if needed by the January 31, 2016 deadline. Were payments made that would require you to file 1099 Forms? Yes ___ No ___ If yes, will all required 1099 Forms be filed? Yes ___ No ___ Property Type (see codes above) Address of Property Fair Rental Days vs. Personal Days De Minimis Safe Harbor Tax Elections: Small Taxpayer vs. vs. vs. Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Rental Income Other Income Rental Expenses: (office use only) Advertising Auto Cleaning and Maintenance Insurance Legal & Accounting Interest – Banks Interest - Other Repairs Supplies Taxes - Real Estate Utilities Depreciation (office use only) Net Income / (Loss) Capital Expenditures: Description Date Purchased New or Used Property Type (see codes above) Address of Property Fair Rental Days vs. Personal Days De Minimis Safe Harbor Tax Elections: Small Taxpayer vs. vs. vs. Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Rental Income Other Income Rental Expenses: (office use only) Advertising Auto Cleaning and Maintenance Insurance Legal & Accounting Interest – Banks Interest - Other Repairs Supplies Taxes - Real Estate Utilities Depreciation (office use only) Net Income / (Loss) Capital Expenditures: Description Date Purchased New or Used Wisconsin Only: Subtraction for 20% Depreciation Basis Adj. $ __________