Trust Worksheet - Waupun, WI Accounting / O'Connor, Wells

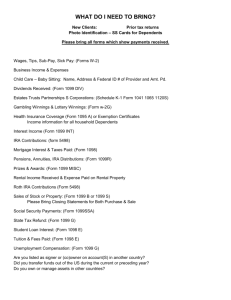

advertisement

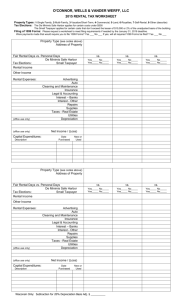

O'CONNOR, WELLS & VANDER WERFF, LLC 2015 TRUST TAX WORKSHEET General Information Name of Trust Fed ID # Name of Trustee Phone Number Street Address of Trustee Apt # City State Zip Interest Income Please enclose copies of all Forms 1099-INT or other documents relating to interest received Savings & Loans, Bank and Other Name of Payer U.S. Bonds and Obligations Tax-Exempt Interest Total Dividend Income Please enclose copies of all Forms 1099-DIV or other documents relating to dividends received Box 1a Total Ordinary Dividends Name of Payer Box 1b Qualified Dividends Box 2a Total Capital Gain Distribution U.S. Bond Interest Amount or % in Box 1a Total Capital Gains or Losses Attach 1099 statements. Include sale or exchange of Non-Business Assets and Personal Residence. A) Cost Basis Reported to IRS on 1099-B _______ Description of Property B) Cost Basis not reported to IRS on 1099-B _______ Date Acquired Date Sold Sales Price C) Neither A nor B _______ Cost Basis Gain/(Loss) Times GP% Total Totals Installment Sales Description Principal Received in 2015 2015 TRUST TAX WORKSHEET (CONTINUED) Rental Property Property Types: 1-Single Family, 2-Mulit-Family, 3-Vacation/Short-Term, 4-Commercial, 5-Land, 6-Royalties, 7-Self-Rental, 8-Other (describe) Tax Elections: The De Minimis Safe Harbor applies for certain costs under $500 The Small Taxpayer applies for certain costs that don’t exceed the lesser of $10,000 or 2% of the unadjusted basis of the building Filing of 1099 Forms: Please request a worksheet to meet filing requirements if needed by the January 31, 2016 deadline. Were payments made that would require you to file 1099 Forms? Yes ___ No ___ If yes, will all required 1099 Forms be filed? Yes ___ No ___ Property Type (see codes above) Address of Property Fair Rental Days vs. Personal Days De Minimis Safe Harbor Tax Elections: Small Taxpayer vs. vs. vs. Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Yes_____ No_____ Rental Income Other Income Rental Expenses: (office use only) Advertising Auto Cleaning and Maintenance Insurance Legal & Accounting Interest – Banks Interest – Other Repairs Supplies Taxes - Real Estate Utilities Depreciation (office use only) Net Income / (Loss) Capital Expenditures: Description Date Purchased New or Used Wisconsin Only: Subtraction for 20% Depreciation Basis Adj. $ __________ Miscellaneous Income Name of Payer Nature of Income Amount Trust Expenses Description Payee & Date Amount State Income Tax Paid This Year Real Estate Taxes on Non-Rental Property Trustee Fees Attorney Fees Accountant Fees Other Expenses Trust Estimated Tax Payments Federal Credit from last year 1st 2nd 3rd 4th Totals Word/Tax Season Worksheets/trust tax worksheet State