Appendix to circular no. 6/2006: Listing requirements

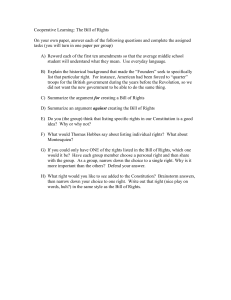

advertisement

Listing requirements and check-list Appendix to report dated: Company: Manager: Legal counsel: Ref. to listing rules: Listing requirements (the minimum requirements for stock-exchange-listing follows the stock exchange regulation section 2-1. The requirements are detailed in the Listing rules) Are the conditions clearly Reference to fulfilled on the description in the report time of the report? (YES/NO) General conditions 2.1.1 Public interest, regular trading and suitability for listing Shares issued by a public limited liability company or an equivalent foreign company may be admitted to stock exchange listing provided the shares are assumed to be of public interest and are likely to be subject to regular trading. When making this decision, Oslo Børs will also attach importance to the company’s financial condition and other factors of significance for whether the shares are suitable for listing. 2.1.2 Company’s legal standing The company’s legal standing must satisfy the formal requirements applicable to the company in terms of both its incorporation and the business purpose set out in its articles of association. Commercial criteria 2.2.1 Market value The market value of the shares for which admission to listing is sought must be assumed to be at least NOK 300 million for listing on the Main List and at least NOK 8 million for listing on the SMB List. If the market value cannot be estimated, the company’s balance sheet equity capital in the last published annual accounts must be of at least the required value. If the company has issued an interim report since its last published annual accounts and Oslo Børs deems the report to be satisfactory, the book equity shown in the interim report may be used. 2.2.2 Equity capital The company’s equity capital situation must be satisfactory in the view of Oslo Børs. When evaluating the company’s equity capital situation, Oslo Børs will take into account the normal situation for companies in the same industry, covenants set out in the company’s loan agreements and any other matters that Oslo Børs may consider relevant to the company in question. 2.2.3 Liquidity High-growth companies and companies in a precommercial phase must have secure access to sufficient liquid assets to continue the business activities in accordance with their planned scale of operation for at least 18 months. Other companies must demonstrate that 429502 they will have sufficient liquidity to continue the business activities in accordance with their planned scale of operation for at least 12 months. 2.2.4 Annual accounts and interim accounts The company must have published annual accounts and annual reports for the last three years. The company must have produced an interim report in accordance with the requirements set out in section 5.1 of Continuing Obligations for the most recent quarter before the application for admission to listing is submitted. If the company is applying for a primary listing on Oslo Børs, the most recent interim report must be subject to a limited scope audit. If the company is applying for a secondary listing on Oslo Børs, the most recent interim report must be subject to a limited scope audit if Oslo Børs so requires. This will be particularly relevant in situations where the company has undergone significant changes since the last published annual accounts, for example through merger, demerger or other significant changes to its activities. 2.2.5 Positive operating result For admission to listing on the Main List, the company must have reported a positive operating result for at least one of the last three years. In exceptional circumstances, a company may be admitted to listing on the Main List even if it has not reported a positive operating result for at least one of the last three years. The Board of Oslo Børs may, upon application, grant an exemption from the requirement in respect of a positive operating result where it deems that this is in the interest of the general public and investors, and where investors have access to sufficient information to make a well-informed assessment of the company, its activities and the shares for which admission to listing is sought. The Board may take into account factors including the expected liquidity of the shares, the spread of ownership and the company’s market value when considering whether to grant such an exemption. 2.2.6 Auditor’s report A company will not normally be admitted to listing if the auditor’s report on the most recent annual accounts expresses a qualified opinion. If the auditor’s report does not express a qualified opinion but includes comments on specific points, Oslo Børs will consider whether these comments are of such a serious character that the company cannot be deemed suitable for listing. Requirements for the company’s activities and management 2.3.1 The company must have existed for at least three years The company must have existed for at least three years prior to the date of the application for admission to listing. The Board of Oslo Børs may grant an exemption from the requirement in the first paragraph if the company can demonstrate continuity in its actual activities for at least three years and its activities are presented by way of pro forma accounts. The pro forma accounts must be reviewed by the auditor and be accompanied by the auditor’s statement. Oslo Børs reserves the right in such cases to require the company to produce a soundly based forecast for the next year’s earnings. The first paragraph does not apply if the Board of Oslo Børs has granted an exemption for the requirement for three years’ activity set out in section 2.3.2. 429502 2.3.2 Requirement for three years’ activity The company must have operated the major part of its activities for at least three years prior to the date of the application for admission to listing. The Board of Oslo Børs may grant an exemption from the requirement in the first paragraph where it deems that this is in the interest of the general public and investors, and where investors have access to sufficient information to make a well-informed assessment of the company, its activities and the shares for which admission to listing is sought. If such an exemption is granted, Oslo Børs may require the company to produce pro forma accounts. The pro forma accounts must be reviewed by the auditor and be accompanied by the auditor’s statement. Oslo Børs will decide the number of years for which such pro forma accounts and auditor’s statements shall be produced. Oslo Børs reserves the right in such cases to require the company to produce a soundly based forecast for the next year’s earnings 2.3.3 Management The individual members of the company’s board of directors and executive management must not be persons who, through their previous conduct or activities, have acted in such a manner as to make them unfit to participate in the management of a listed company. There should be sufficient continuity in the company’s management for the market to expect organisational stability in the period immediately following the company’s admission to listing. The company must have sufficient expertise to satisfy the requirements for the correct and proper management and distribution of information. The company should also be organised so that Oslo Børs has access at all times to the officer of the company responsible for contact with Oslo Børs or some other representative of the company’s management, and should ensure that the persons in question can be reached without undue delay. The company must have procedures in place and be organised to ensure that the company’s management and the officer responsible for disclosing information to the market become aware of essential information without undue delay. Moreover, the company must have sufficient technical expertise to produce financial accounts, including interim accounts, which satisfy the requirements of the Stock Exchange Regulations, the Oslo Børs Rules and relevant accounting regulation. The company must in addition organise its internal financial management to ensure that financial reporting is produced with sufficient quality and with sufficient speed. The company must normally have appointed a chief executive officer before making application for admission to listing. 2.3.4 Composition of the board of directors Companies that apply for admission to listing on Oslo Børs are expected to have an independent board of directors in accordance with the Norwegian Code of Practice for Corporate Governance. The composition of a company’s board should be such as to allow it to operate independently of special interests. 2.3.5 Management companies If the company’s management functions are entrusted to another party, the company may be admitted to stock exchange listing subject to the following conditions: The company shall through its organisation, articles of association, agreement or other necessary action ensure that the party responsible for the company’s activity, or 429502 for any part of it, is under an obligation to comply with Section 5–7 of the Stock Exchange Act and with any other rules to which the company would have been subject had the company itself conducted its activity or operations. The company shall guarantee that any breach of the Stock Exchange Act and the Stock Exchange Regulations which is caused by the party responsible for its operation or activity shall for the purposes of Section 5–12 and Section 5–13 of the Stock Exchange Act be treated as if the breach had been committed by the company. The company must provide an account of which management functions will be carried out by the management company and which will be carried out by the company making the application for listing. Oslo Børs will evaluate the competence of the management company to satisfy the requirements for proper information management and disclosure as well as the access to and availability of the contact person where such services are provided by the management company in the same way as it assesses the requirements for a company applying for admission to listing. Any interdependence or relationships between the management company and the members of the company’s board of directors must be identified in the statement issued by the company pursuant to section 2.3.4. Where a company that applies for admission to listing intends to entrust its routine management to a management company, both the company applying for admission to listing and the management company must enter into a contractual agreement with Oslo Børs to regulate the responsibilities and duties of the issuing company and the management company vis-à-vis Oslo Børs. Shares 2.4.1 25% spread of share ownership At least 25% of the shares for which admission to listing is sought must be distributed among persons who are neither associated with the company nor hold, individually or together with their close associates, more than 10% of the share capital or voting capital of the company (“large shareholders”). Persons deemed to be associated with the company include members of the company’s executive management and board of directors and their close associates. 'Close associates' means such persons and companies as mentioned in Section 1-4 of the Securities Trading Act. Oslo Børs may waive the 25% threshold for admission if the required spread of share ownership can be expected within a short period of time, or if the shares are nonetheless deemed suitable for listing because the company has issued a large number of shares of the same class that are widely distributed among the public. 2.4.2 Spread of share ownership - number of holders of at least one round lot The company’s shares must, at a minimum, be held by the following number of shareholders each holding at least one round lot. Main List SMB List Primary Capital Certificate List Round Lot 1,000 round lot holders 100 round lot holders 200 round lot holders Shares equivalent to approximately NOK 10,000 cf. Norex Member Rules 5.4.1 Shareholders that are associated with the company, cf. section 2.4.1, cannot be included in the number of round lot holders stipulated above. 429502 2.4.3 Shares in the same share class An application for admission to stock exchange listing must include all shares in the share class for which listing is sought. If the company has more than one class of shares, the criteria for admission to listing must be satisfied for each class of shares for which listing is sought. 2.4.4 Free transferability of shares Shares listed on Oslo Børs shall in principle be freely transferable. If the company pursuant to its articles of association, law or regulations made pursuant to law, has been given a discretionary right to bar a share acquisition or to impose other trading restrictions, such right may only be exercised if there is sufficient cause to bar the acquisition or to impose other trading restrictions and such imposition does not cause disturbances in the market. 2.4.5 Voting rights for shares If the company pursuant to its articles of association, law or regulations made pursuant to law, has been given a discretionary right to bar the exercise of voting rights, such discretionary right may only be exercised if there is sufficient cause. 2.4.6 Minimum price at the time of admission to listing The shares for which admission to listing is sought must have an expected share price at the time they are admitted to listing of at least NOK 10. 2.4.7 Registration of share capital with a securities registry The Company’s shares must be registered with the Norwegian Central Securities Depository (“Verdipapirsentralen”) or another securities registry approved by Oslo Børs. Additional conditions 2.6 Application for a new issue/distribution sale Any share issue/distribution sale carried out in connection with admission to listing must be carried out before the shares are admitted to listing. This means that the increase in share capital must be registered with the Register of Business Enterprises and entered into the securities registry. 2.7 Listing of shares prior to a new issue (“If issued” and “When issued” listings) Oslo Børs may agree to admit new shares to listing after they have been allotted but before they are fully paid-up and registered with the Register of Business Enterprises and the securities registry. Admission to listing in such a situation is conditional on: The entire amount to be raised by the share issue must be fully underwritten. The underwriting guarantee must be unconditional save for normal force majeure exemptions. The company must specify when the transfer of shares to the accounts of successful subscribers will take place with the securities registry following payment subsequent to the date of listing. The invitation to subscribe for shares must include a description of the risks associated in the event that agreed trades have to be reversed. The company must publish a stock exchange announcement that provides further details on technical 429502 settlement arrangements, including details of any differences in settlement arrangements for different types of investors and any other matters of significance for the listing of the shares and trading. The company registration certificate or equivalent document, together with a legal opinion if so requested, must be submitted to Oslo Børs as soon as it is available. Admission to listing in such a situation is also conditional on Oslo Børs being satisfied that there is only a very small risk that the share issue will not be successful, and that admission to listing will be in the interest of investors. A company considering an “If issued” or “When issued” listing must consult Oslo Børs as early as possible in the process of applying for admission to listing. Oslo Børs may agree exemptions from the conditions set out above in special circumstances. The provisions of this section 2.7 shall also apply to the issue of interim certificates and depository receipts to the extent applicable. 4 Specific requirements for primary listing of foreign companies Foreign companies may apply for a primary listing on Oslo Børs. The conditions for admission to stock exchange listing apply in an equivalent manner to foreign companies. Foreign companies must enter into a standard listing agreement for a primary listed company with Oslo Børs before the company’s shares can be admitted to listing. Foreign companies with a primary listing on Oslo Børs should normally register the entire share capital that is to be listed on Oslo Børs with the Norwegian Central Securities Depository or another securities registry approved by Oslo Børs. The listing prospectus must include information on legal matters that are of significance for the company, including the legislation and regulations that apply to the foreign company and its shareholders. Before shares in a foreign company can be listed, the company must provide a legal opinion addressed to Oslo Børs. The legal opinion must confirm that the company’s shares are validly and legally issued, non-assessable, fully paid-up and correctly registered with the relevant securities registry, and must also confirm that the listing agreement is binding on the company and that there are no formal obstacles to the foreign company performing its obligations pursuant to this agreement. The wording of the legal opinion must be approved in advance by Oslo Børs. 5 Specific requirements for a secondary listing A Norwegian or foreign company that has a primary listing on a stock exchange or other regulated market recognised by Oslo Børs can apply for a secondary listing on Oslo Børs. The conditions for admission to stock exchange listing apply in an equivalent manner to companies seeking a secondary listing. The company must enter into a standard listing agreement for a secondary listed company with Oslo Børs before the company’s shares can be admitted to listing In the case of a secondary listing, the requirement for spread of shares set out in section 2.4.2 applies to the whole company, but such that a minimum of 100 shareholders holding at least one round lot must have their shares registered with the securities registry. The 429502 requirement set out in section 2.4.6 for a minimum share price of NOK 10 does not apply to companies with a secondary listing on Oslo Børs. If the company in question is a foreign company, the listing prospectus must include information on legal matters that are of significance for the company, including the legislation and regulations that apply to the foreign company and its shareholders. Before shares in a foreign company can be admitted to listing, the company must provide a legal opinion addressed to Oslo Børs. The legal opinion must confirm that the company’s shares are validly and lawfully issued, fully paid-up and correctly registered with the relevant securities registry, and must also confirm that the listing agreement is binding on the company and that there are no formal obstacles to the foreign company performing its obligations pursuant to this agreement. The wording of the legal opinion must be approved in advance by Oslo Børs. Additional factor # 1: Related parties An evaluation is to be carried out – comprehensive report presented. Additional factor # 2: Company that contracts to acquire or dispose of significant asset or activity in the application period, or is under merger/demerger An evaluation is to be carried out. Additional factor # 3: Legal proceedings If the company is involved, or has been notified that it may become involved, in legal proceedings that may be of significant importance to the company if it is decided in the company’s disfavour, information must be provided and a special evaluation carried out . 429502