File

advertisement

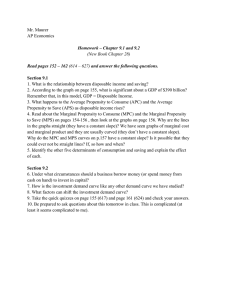

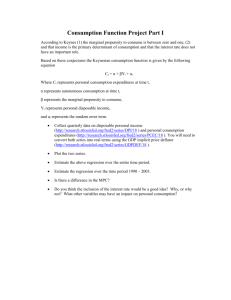

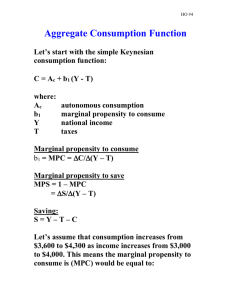

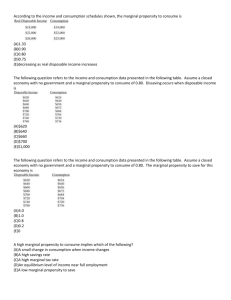

Introduction: The Aggregate Expenditure Model The Basic Macroeconomic Relationships Why do we Learn the Aggregate Expenditures Model • We learn the aggregate expenditures model so that we can better predict changes in the business cycle and GDP. • We can do this because in our model the amount of goods and services produced depends directly on the level of total spending. They are equal. Aggregate Expenditures and GDP • Total Spending Must Equal Total Output at Equilibrium GDP. Remember (G + C + Ig + Xn) Total Spending GDP Basic Tools of the Aggregate Expenditure Model Consumption Schedule Savings Schedule Investment Schedule Savings and Consumption • Personal Savings is the part of Disposable Income that is not consumed. Consumption Savings Disposable Income What Determines Consumption and Savings? • DI is the main determinant of both C and S. Consumption Schedule • Shows the direct consumption (C) to disposable income (DI) relationship. C rises as DI rises. • Households must spend a larger percentage if their DI is low. More wealth = More Savings • Break-Even Income is when C = DI • This means that households consume their entire income, but do not go in debt. Here, C intersects the 45 degree line on the previous slide. Saving Schedule • Savings = Disposable Income – Consumption • Dissaving is when you consume more than your disposable income. • You do this by either liquidating accumulated wealth or borrowing money. • We save a larger proportion of our disposable income as it increases. This can cause a snowball effect as more accumulated wealth creates more DI. Average Propensity to Consume Average Propensity to Save Average Propensity to Consume (APC): the total percentage of DI consumed. APC = Consumption / Disposable Income Average Propensity to Save (APS): the total percentage of DI saved. APS = Saving/ Disposable Income APC APS 1 Marginal Propensity to Consume Marginal Propensity to Save MPC (marginal propensity to consume): the change in consumption divided by the change in income. • Delta C / Delta DI MPS (marginal propensity to save): the change in savings divided by the change in income. • Delta S / Delta DI MPC MPS 1 Test Preparation • Numbers Two and Five on Pages 222 and 223 • Work in groups of four. After discussion and consultation, have each member write down the answer in their notebooks.