Cash-flow models

advertisement

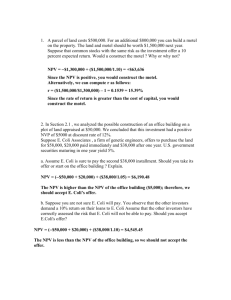

Cash-flow models.

r = annual interest rate

x = current investment

After n years, discrete annual compounding yields

Net value of the investment = NFV = Net Future Value

yn x(1 r ) n

Examples. Compute NFV for a cash-flow x after every t

units of time for a finite period.

x

t=0

x

t=1

x

t=2

x

t=3

Interest rate: r per annum investment: x every year

Compute the worth of the investment after n years.

NFV of the cash-flow = NFV (stream)

x(1 r )n 1 x(1 r )n 2 ... x(1 r ) x

x

(1 r ) n 1

r

If y dollar is available n years from now under a constant

annual compounding interest rate of r , present value of y

is

PV ( y) y(1 r ) n Discounted cash

2. Compute the current worth (the Net Present Value) of

the following cash-flow

x

t=0

x

t=1

x

x

t=2

t=3

NPV ( stream) x x(1 r )1 x(1 r ) 2 ...x(1 r )( n 1)

NFV ( stream)

(1 r )( n 1)

3. Continuous compounding/discounting

Annual interest rate = r

If q units of time in the year, effective interest rate per unit

r

time =

q

Since there are q periods in a year, x invested now has a

Future Value after 1 year

q

r

FV ( x) x 1

q

when q , FV ( x) xer

r

r

Proof: Let z (1 )q . Then ln z q ln(1 )

q

q

r r

r

Since 0 as q , ln 1

q q

q

ln z r z er

Thus,

and ,

FV ( x) xer for continuous compounding

PV ( y ) xe r for continuous discounting

For a horizon of n years,

Continuous compounding

FVn ( x) xenr

PVn ( x) xe nr Continuous discounting

4. For a continuous stream of cash-flow with continuous

discounting:

L

NPV ( stream) x(t )e rt dt

Return

s

0

t=L

t=0

Time

Similarly for future values.

5. Internal rate of return for an investment.

= IRR (Internal rate of Return) if NPV of a cash-flow

using interest rate is zero.

X

y1

t=0

t=1

y3

y2

t=2

t=3

NPV ( stream) x y1 (1 ) 1 y2 (1 ) 2 ... 0

This means,

X

n 1

yk (1 ) k

k 1

Given two investments, we should

■ choose the one that gives higher

rate of return

■ * , some threshold parameter

6. Equivalent average rate of return

NPV ( x, ) Net Present Value of a policy x for some

Define R

1

NPV ( x, )

R is the equivalent average rate of return.

An infinitely long cash-flow with return R after every t has

same NPV as that of the policy x.

R

R

R

R

NPV(Equivalent Stream) =

R R(1 )1 R(1 ) 2 ... R

= NPV ( x, )

1

7. NPV of an infinite stream (continuous discounting

model)

After every L units of time, return is Rt

NPV(infinite stream) =

Rt et

t

If all Rt are same, say, R ,

NPV =

R

1 e L

8. A typical model. An equipment replacement policy, or

variations of this!

R(t ) revenue generated at time t

E (t ) operating expense on machine at time t

S(L) salvage value of machine at time L

cost of a new machine

r continuous rate of discount

A. Single replacement model. NPV of replacing the

machine at time L.

Salvage

Value

Time

Operating

cost

Time

NPVsin ( L)

L

rL

rt

R(t ) E (t ) e dt + S ( L) e

0

L must be such that NPVsin ( L) is maximum at L* , i.e.

d

NPVsin ( L) 0

dL

L*

B. Infinite chain replacement policy. Assume no

technological change.

Operating

Expense

Age

L

2L

3L

Assume R constant. Then

L

NPV ( L)

Re

rt

0

1 e

t

dt

rL

rt

rL

E (t )e dt ( S ( L))e

0

1 e rL

The second term C (L) is the cost term, and the first term

R

reduces to .

r

Approximation. Assume, E (t ) E0 t , both E0 and

positive.

Then

E0 S ( L)e rL Le rL

C ( L)

rL

r r2

r 1 e rL

1 e

If S (L) is a constant, optimality condition is

( S )

r

L

*

r

2

(1 e

rL*

)0

For rL* 1

1

S ) 2

2(

L*

New machine at time t 0 , and then after every L units of

time.

C. Technological change over time

In this case, we might take the cost function to be like

E (t ) E0 t L

This is Terborgh model. {G. Terborgh, “Dynamic

Equipment policy, McGraw Hill, 1949}

Optimality condition for S (L) constant

( S )

( ) * ( )

rL*

L

(

1

e

)0

2

r

r

For rL* 1,

1

S ) 2

2(

L*

9. Model for keeping a lossy capacitor charged. Dynamic

memory recharging system.

A normal capacitor loses its charge exponentially; so does a

memory cell or a pixel on a monitor-screen. Single

capacitor discharge:

q q0 e kt

Voltage

across

Capacitor

Time

How about injecting charge after every T units of time so

that the level is maintained above some threshold?

Charge

Time

Suppose q0 is injected after every T units. Therefore,

q (T ) q0 q0 e kT

q(2T ) q0 q (T )e kT = q0 q0 e kT q0 e 2 kT

…

q(nT ) q0 {1 e kT e 2 kT ... e nkT }

At t , the amount of charge on the cell, is

q c q0

want to maintain.

1

1 e kT

.

q c is the desired level we