Annotative bibliography

advertisement

Annotative bibliography

google

Goldman, Jim.“Google Fuels the Tech Fire” tech check.com

10/15/09 10/15/09

http://www.cnbc.com/id/33329856/site/14081545

CEO Eric Schmidt has made no secret of the ad-spending recovery that Google is

tracking. More recently, the splashy announcement with Verizon [VZ Loading...

() ] and Google's Android mobile operating system generated lots of headlines,

with Google suggesting dozens of handsets using its software will be out by year's end.

Then there was the potential of Android coming to AT&T, first with Ralph de la Vega

telling me his company had reviewed the OS, liked it, and would be supporting it; then

hours later, rumors that Dell [DELL Loading...

() ] would be introducing

its first US smart phone, running Android, available on AT&T [T Loading...

()

] some time next year.

Hille, Kathrin . “Chinese writers seek redress on Google e-books” ft.com 10/22/09

10/26/09

http://www.ft.com/cms/s/0/9f9e0462-bf4d-11de-a69600144feab49a.html?referrer_id=yahoofinance&ft_ref=yahoo1&segid=

03058

A Chinese copyright group is demanding talks with Google over compensation for

Chinese authors who have had their books scanned into the US company’s electronic

library.

The move is a further challenge to a US agreement designed to offer a framework for the

emerging electronic book business.

The agreement has already upset writers and publishers in Europe, prompting

Google to only scan books that have been published for more than than 150 years in that

region. “Some take the view that under US law, Google’s proposed settlement will also

be valid for works by Chinese authors. We reject that view,” Zhang Hongbo, deputy head

of the China Written Works Copyright Society, told the Financial Times. Mr Zhang

added that the government-backed body would send a letter to Google China, perhaps as

early as today demanding negotiations on the issue.

Dow Jones

Depew, Kevin. “How Much Longer Can This Bear Market Rally Last?”

minyanville.com 10/15/09 10/16/09

http://www.minyanville.com/articles/bear-collapse-depression-s%26pbullish-deleverage/index/a/24963/from/yahoo

How long, O Lord, how long? It's always good to remember that the stock market is not

the economy. Every day I come into the office to find literally dozens of emails

complaining that the market is ignoring the relentlessly bearish news flow. But that

doesn't bother me. What will bother me is when we start getting good news. Markets tend

to reach exhaustion on good news, not bad. And these days it's hard to discern between

what's merely bad and what's actually disastrous. So, let's take a look at what the

difference between the two really is, and what it means going forward

Moon, Angela. “Wall St falls on financial, commodity shares” finance.yahoo.com

10/26/09 10/26/09

http://finance.yahoo.com/news/Wall-St-falls-on-financial-rb2127513289.html?x=0&.v=8

NEW YORK (Reuters) - U.S. stocks fell on Monday as financial shares tumbled over

concern that a federal tax credit for homebuyers would expire and as commodity-related

shares lost ground on falling oil prices. The S&P Financials index (^GSPF - News)

dropped 1.7 percent and a Dow Jones index of home builders' stocks (DJI:^DJUSHB News) fell 1.9 percent on market talk that an $8,000 federal tax credit for first-time

home buyers scheduled to expire November 30 would not be extended. Investment

researchers ISI Group said in a Monday note there could be an agreement to phase out the

home buyer tax credit over 13 months, rather than expand it, as some had hoped.

A media report quoted ISI as saying the tax credit probably would not be extended when

it expires at the end of November.

This caused stocks to drop, with major averages falling more than 1 percent, due to

concern the housing market would lose a leg of support that has stabilized that industry of

late.

"Anytime you pull away a bailout, the market doesn't like it," said Joe Saluzzi, comanager of trading at Themis

Trading in Chatham, New Jersey.

The market pared losses after Senator Bill Nelson said an agreement to extend the firsttime home buyer credit should be worked out "later this week."

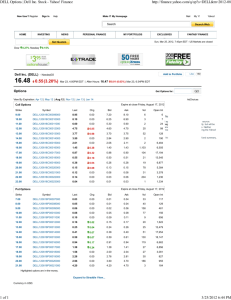

Dell

“Dell to outsource N.C. jobs to Mexico” austin.bizjournals.com 10/16/09 10/22/09

http://austin.bizjournals.com/austin/stories/2009/10/12/daily34.html?a

na=yfcpc\

This plant closing is just another casualty of the short-sighted business and investment

culture in America. In order to maximize SHORT-TERM profits for bankers, brokers,

SOME investors and well placed company executives, many publicly traded American

businesses make decisions which run against the long-term net value and profitability of

the company. This kick-the-can-down-the-road mentality has been very profitable and

building for the last several decades, but I believe we are nearing the end of our ability to

fool the global investor looking for long-term value and our ability to rely on the public

sector to absorb the expensive cleanup following such pump and dump practices. * * *

That is not to say that companies shouldn’t have the right to hire or fire, or to open or

close a plant as they see fit. The only PROBLEM we have here is that many of our public

(and many debt-laden private equity owned) companies here in the US are houses of

cards due to the artificially high returns being sold by the Wall Street machine. It is NOT

sustainable. I happen to know first-hand a lot about that Dell WS1 plant, its processes and

operations. It could have been a much more efficient operation, but for the short sighted,

non-re-investment of Dell’s management and “strategy”. Sure, you can say that Dell is

doing what everyone else is doing and must compete, but we as Americans must realize

that we’re slitting our own collective throats in the long-term by creating a framework

where the incentives are all about short term profits, without respect for long-term

strength. * * * THE SOLUTIONS: 1) It’s certainly not more unions, tariffs, regulation or

protectionism. That just creates even more entitlement and bureaucracy… it’s smarter

INCENTIVES for those creating real VALUE. Corporate managers (as well as boards

and fund managers) should be paid by the AMMORTIZED PROFITABILITY of their

operations. Minimize quick-trick stock games and transactions which line the pockets of

brokers and middlemen bankers. Pay decision makers for the current year’s work as a

portion of company profits (not stock price) over the following 5 years. As we all know,

it takes a long time for actions in a big company to have an effect (if only the same

incentives were available for our lawmakers). 2) Hold our foreign trading partners to the

SAME STANDARDS (or comparable ones) that we adhere to in the US. If China and

others had to PROVE to us that their labor, safety, environmental and fiscal policies were

in line with ours in order to sell goods into the US, then we’d be on a more even playing

field. That’s NOT protectionism, it’s called FAIR play. Why should we break our necks

not to pollute HERE when China gets to dump whatever they like and then sell us cheap

stuff for their profit? * * * Suffice it to say that while WS1’s closure is sad, it is only one

more example of how we in the US are riding our largest economic engines into the

ground while serving the interests of those who would exploit and/or milk the “system”

from the very top as well as from the very bottom.

Ladendorf, Kirk. “Dell seeks a new course in changing PC marketplace”

statesman.com 10/25/09 10/26/09

http://www.statesman.com/search/content//business/stories/technolo

gy/2009/10/25/1025dell.html

Although Michael Dell reclaimed active control of the company he founded nearly three

years ago, the outlines of the new Dell Inc. are only now starting to emerge.

The revamped computer maker is leaner but sells a wider variety of products, some of

which are winning plaudits for design and innovation, not just function or price.

More of those products are being made by international contract manufacturers, not in

Dell's own factories. Customers can buy them through a growing global network of

retailers and resellers, as Dell shifts away from the direct-sales model on which it was

built.

And Dell is about to jump into smart phones, a market that lies well outside the basic

meat-and-potatoes computers that have been its staple products.

Most important, Dell is plunking down $3.9 billion to acquire Perot Systems Corp. in an

effort to become a serious player in advanced information technology services. Dell

already sells basic services tied to installing, repairing or monitoring the computers it

sells. Perot goes further with its services, developing customized processes and software

that enable customers to run their businesses better.

Intel

Equity, Zacks. “Intel Charged in Antitrust Suit” yahoo.com 11/05/09, 11/06/09

http://finance.yahoo.com/news/Intel-Charged-in-Antitrust-zacks2552942269.html?x=0&.v=1

The $6.0 billion payment made by the worlds largest chip maker Intel Corporation

(NasdaqGS: INTC - News) over a five year period through January 2007, to its largest

customer Dell Inc. (NasdaqGS: DELL - News) under programs initially titled

'MOAP' (Mother of all Programs) and then 'MCP’ (Meet Competition Payments) has

backfired on Intel. The aforementioned anecdote is the basis on which an antitrust lawsuit

filed recently by the New York attorney general alleging a long business relationship

between Intel and Dell. The New York Attorney General Andrew M. Cuomo filed a

federal lawsuit against Intel accusing the largest chip maker of paying computer makers

illegal rebates for maintaining its monopoly and preventing another chip maker

Advanced Micro Devices Inc. (NYSE: AMD - News) from gaining business

with PC makers.

Rogers, James. “Microsoft Win 7 Debuts After a Hard Quarter” thestreet.com

10/22/09, 10/22/09

http://www.thestreet.com/_yahoo/story/10615616/1/microsoft-win-7debuts-after-a-hardquarter.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

REDMOND, Wash. (TheStreet) -- Microsoft(MSFT Quote) launched its muchhyped Windows 7 operating system Thursday, although the software giant's quarterly

results may bring it back to earth with a bump. Analysts surveyed by Thomson Reuters

expect Microsoft to report revenue of $12.37 billion when it posts its first-quarter

numbers (subscription required) before the market opens Friday. This would be

a significant drop from sales of $15.06 billion in the same period last year. Microsoft is

expected to earn 32 cents a share, compared to 48 cents a share in the prior year's quarter.

Even in a healthier economy, however,PC weakness remains the biggest cloud

hanging over Redmond. Despite signs of an improving computer market, Collins

Stewart analyst Sandeep Aggarwal warns that demand is unlikely to prevent declining

year-over-year sales.

Lowe’s

Poggi, Jeanine. “Lowe's Is Top Home-Retail Stock: Poll” thestreet.com 10/5/09

10/22/09.

http://www.thestreet.com/_yahoo/story/10606716/1/lowes-is-tophome-retail-stockpoll.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

NEW YORK (TheStreet) -- The housing market saw positive data this week in the

form of improved pending home sales figures and home prices. But this good news could

be important not just for homebuilders and REITs, but for home furnishing retailers as

well. The one poised to gain the most is Lowe's(LOW Quote), according to a vote by

TheStreet users in a weeklong poll. The retailer had 40.3% of the vote, but ended the

week down 5% to $20.03. The specific question the poll posed was: "As the housing

market recovers, which home retailer is poised to profit?"

“Home Updates You Can Do -- Just in the St. Nick of Time” yahoo.com 11/04/09

11/05/09

http://finance.yahoo.com/news/Home-Updates-You-Can-Do-Just-bw723053532.html?x=0&.v=1

MOORESVILLE, N.C.--(BUSINESS WIRE)--There’s no place like home sweet home

for the holidays. And there’s no better time to give a humdrum home a fast and festive

facelift – just in time for family and friends who come calling. From inspiring front entry

ideas, a fresh kitchen facelift, the guest bedroom-turned-junk room in the off season,

affordable ideas abound with a little help and some innovative products from Lowe’s.

Related Quotes

Symbol Price Change

LOW

20.06 +0.55

{"s" : "low","k" : "c10,l10,p20,t10","o" : "","j" : ""}

Welcome home

“Since your front entry is the first thing people see when they arrive, you want to express

your style and make a welcoming statement,” said Elaine Griffin, leading New York

designer and author of Design Rules. She continued, “Hardware can be the diamond

earrings of your front door.” For about $75, you can transform your front door into a

knockout. Choose a Valspar paint color to match the architectural style of your home.

Install a kick plate, dynamic door numbers and door knocker. Flank your door with

matching topiaries at least four feet tall. And the finishing touch? An oversized wreath, to

express your home’s unique personality.

PepsiCo inc

Canavan, Tom. “PepsiCo is cornerstone partner for new stadium”

finacies.yahoo.com 10/22/09 10/22/09

http://finance.yahoo.com/news/PepsiCo-is-cornerstone-apf302677539.html?x=0&.v=1

EAST RUTHERFORD, N.J. (AP) -- PepsiCo signed an agreement to become the fourth

cornerstone partner for the new stadium for the Jets and Giants. The New Meadowlands

Stadium Corporation announced the multiyear deal on Thursday. No contract deals

immediately available.

MetLife, Verizon and Budweiser had previously signed contracts to be cornerstone

partners for the $1.6 billion stadium that is scheduled to open next spring with a concert

by Bon Jovi. The first NFL game will be played in the summer.

The teams are still looking to sell the naming rights to the new stadium, which is being

constructed next to Giants Stadium.

“PepsiCo Releases 2008 Corporate Citizenship Report”

yahoo.com 11/04/09, 11/05/09

http://finance.yahoo.com/news/PepsiCo-Releases-2008-prnews2842860581.html?x=0&.v=1

PURCHASE, N.Y., Nov. 5 /PRNewswire-FirstCall/ -- PepsiCo (NYSE: PEP - News)

announced today the publication of its 2008 Corporate Citizenship Report executive

summary entitled "Performance with Purpose: Creating a Better Tomorrow for Future

Generations." The report details the company's progress in addressing economic,

environmental and social challenges in the 2008 fiscal year. The full report can be found

on http://www.pepsico.com/Purpose/Sustainability/SustainabilityReport.html.

Related Quotes

Symbol Price Change

PEP

61.14 +0.76

{"s" : "pep","k" : "c10,l10,p20,t10","o" : "","j" : ""}

"As one of the world's largest food and beverage companies, we have some distinct

responsibilities," said Indra Nooyi, PepsiCo chairman and CEO. "We have a

responsibility to support economic development, to improve our environmental footprint

and to help work toward solutions to issues such as obesity and undernourishment. This

report captures the progress we have made thus far, and provides a map of where we

intend to go."

Based on Global Reporting Initiative (GRI) Sustainability Reporting Guidelines, the 2008

report remains grounded in PepsiCo's mission of Performance with Purpose - a balance

of achieving continued financial success while bringing purpose to the company's

performance. The report highlights PepsiCo's three areas of influence - human,

environmental and talent sustainability:

Human Sustainability - Nourishing our consumers through the products we offer -- from

treats to healthy eats -- and through our efforts to encourage more active lifestyles.

Environmental Sustainability - Protecting our natural resources and operating in a way

that minimizes our environmental footprint.

Talent Sustainability - Involving and empowering people, helping them to realize their

potential, renew themselves and achieve success.

Some of PepsiCo's notable sustainable development achievements for 2008 include:

The conservation of more than 750,000 megawatt hours of energy and more than 7.5

billion liters of water vs. our 2006 baseline.

The introduction of a new half-liter bottle for Aquafina flavored waters, Lipton Iced Teas

and Tropicana juice drinks that contains 20% less plastic than the previous bottle and the

label is 10% smaller than before.

The launch of PepsiCo University, which offers a blended approach to learning through

both classroom activities and online tools.

News that its Walkers crisps brand reduced its energy use per pack by one-third and its

water use by 42%, following its carbon certification in 2000.

Formation of a $6 million, three-year partnership with The Earth Institute at Columbia

University and the PepsiCo Foundation that includes a series of community-based

activities to address water, agriculture and climate issues.

Development of Sustainability Engineering Guidelines based on LEED standards that

apply to all new construction as well as major remodels of existing buildings globally,

where practical.

Signing of the United Nations' CEO Water Mandate and actively support its activity.

The launch of the Female Talent Development program in our Middle East and Africa

region to focus on workplace equality and increase recruitment of women.