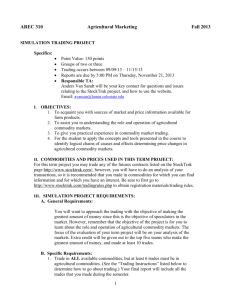

factors effecting commodities market

advertisement