handout - Smart Woman Securities

advertisement

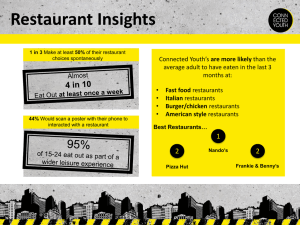

CMG stock pitch march 17, 2007 Chipotle Mexican Grill (CMG) industry overview Restaurants are generally divided into four different categories: casual dining, family dining/buffet, quick service, and specialty, which each have different analyses. Restaurants can be staple stocks, such as McDonald’s (MCD) which offers steady growth and returns, or high-growth stocks, such as Panera Bread (PNRA), which is experiencing high growth as it penetrates the market. As new types of restaurants become popular each year, the high-growth stocks turnover rapidly with the changing trends. Major Factors/Drivers Revenue growth Same store sales Commodity prices, specifically beef prices Demographics Consumer desires Overall economy In 2005, the restaurant industry struggled with companies underperforming the market due to the reporting of dismal sales and EPS by many restaurants for 1H05. May sales were solid, while April and June sales suffered greatly, resulting in lower than expected earnings. The economy in 2005 was also difficult for restaurants as energy, interest rates, and beef prices were all an issue for restaurants. As some relief is coming in these areas, it will likely benefit the industry. EPS reaccelerated in the remainder of 2005 and growth rates were in the mid-teens for 2006. To counteract the impact of higher beef, poultry and dairy prices, most restaurants increased prices substantially in the first half of 2005 with little effect on customer traffic. In the restaurant industry, the casual dining segment remains a bright spot. Older, more affluent customers are increasingly choosing full-service restaurants over fast food chains. With consumers spending more of their discretionary income on dining out, we expect the trend toward more upscale menus to continue. However, higher gas prices could result in a near-term dip in this trend. We expect same-store sales growth and earnings gains at restaurants to moderate over the next two years. The casual dining segment has been the fastest growing segment of the restaurant industry over the past few years. This type of restaurant offers an attractive dining experience coupled with rapid delivery of standardized menu items. This segment of the industry still has significant expansion potential as it accounts for just 2.4% of industry revenue. (The U.S. restaurant industry generated an estimated $476 billion in sales in 2005, or about 4% of GDP.) business overview Chipotle Mexican Grill opened its first store in 1993 and became a subsidiary of McDonald's in 1998. The company operates in the casual dining segment of the restaurant segment and has seen substantial growth over the past 10 years. The company currently operates some 490 stores that offer quick service but maintain classic cooking methods and utilize high-quality ingredients. The company has a tightly focused menu but store design and decor vary by location. The company has been expanding rapidly in recent years as demand for southwestern menu items has spread throughout the United States. An emphasis on cultural cuisine has been rampant in the industry, as seen by P.F. Chang’s and similar concepts, and Chipotle has further capitalized on this trend. Chipotle’s CEO, Steve Ells, has been with the company since inception and has guided it through the rapid growth phase. Attending University of Colorado and the Culinary Institute of America, Ells combines his down-home nature with a savvy for the industry and love of natural ingredients and food. competition Company Cheesecake Factory Inc Starbucks Corp P.F. Chang's China Bistro Inc Brinker International Inc Chipotle Mexican Grill Inc Wendy's International Inc Outback Steakhouse Inc Yum! Brands Inc Darden Restaurants Inc McDonald's Corp EPS Growth % 20.0 19.7 18.9 18.6 18.5 15.4 11.7 10.6 10.3 9.6 P/E 24.8 41.1 27.7 16.3 38.0 22.4 19.3 15.7 17.4 14.4 financials Chipotle Mexican Grill opened more than 180 stores in 2005, and intends to continue to open new locations at an aggressive pace over the next few years. The company has benefited from the increasing popularity and acceptance of Mexican food within mainstream American culture, a trend that should continue over the next decade. Chipotle Mexican Grill has seen operating costs rise rapidly over the past few years but has been able to grow revenue at an even faster pace, thus holding costs as a percentage of revenue in check and even managing to improve margins over the past year. The company generated $470.7 million of sales in 2004 and we believe that sales rose more than 29%, to over $610 million, in 2005. While the company's revenue growth rate is likely to slow as it gains scale, we expect sales to expand at a nearly 20% annual rate through the end of the decade. The company will face higher costs as a result of its new public company status. It will also face rising administrative costs as it becomes more independent of McDonalds. It is likely that McDonald's will distribute its shares of CMG to McDonald's shareholders within the next three years. The company has no long-term debt and nearly $100 million in cash and equivalents following its IPO. The company has total long-term obligations of $724.1 million (from leases) and a very healthy current ratio of 3.8 based on the most recent available numbers. However, company operating margin was just 1.3% in its latest reported full year (2004). Even after considering the rise in operating margins to just over 5% in the first nine months of 2005, this is still only about half the average operating margin for the company's peers. The low operating margin, along with our outlook for higher operating costs, does pose some concern. The company does not pay a dividend on the common stock at this time. We do not expect one to be instituted within the next year as the company will retain cash to fund its expansion. A more in depth analysis of each of the financial statements would be appropriate here, but in an effort to save paper, I have omitted the full analysis. valuation At recent prices, CMG shares appear overvalued on a near-term basis. The shares have a current-year projected P/E of 54.5 compared to a peer average of 26. The CMG shares have a price/book ratio of 3.8, compared to a peer average of 3.5. On a price/sales basis, the shares would have a multiple of 2.5 using a revenue per share and a multiple of 3.2 using the 2004 sales number. These multiples are well above the current peer average of 1.6 using the latest full-year reported sales. The company's margins are also below average, at about half the 9.9% average among the company's closest peers. However, balancing this is CMG's sales growth rate, which is among the highest in the industry (49.2% in 2004 and an estimated 29% in 2005). CMG shares offer the opportunity to invest in the rapidly expanding casual dining segment - with an ethnic cuisine that is itself experiencing rapid growth. With a clean balance sheet, outsized growth and significant expansion potential, investors have viewed the CMG shares very favorably in relation to peers, despite the prospect of higher operating costs that will mute margin expansion over the next few years. investment opportunities CMG is well positioned in the casual dining segment to take advantage of the substantial projected growth. With an aging American population which prefers casual dining restaurants, we expect that the strength of the segment will continue going forward. Moreover, CMG has already demonstrated substantial growth within the sector and flourished while under the management of MCD. With an emphasis on all-natural and organic products, and a movement in that way, we believe that CMG will further capitalize on the growing health trends in the United States. Moreover, the financial metrics of the company and each story are well suited to provide the company with the financial ability to succeed with the high growth it has established. Lastly, positive investor sentiment as seen by the IPO is further reason to support our hypothesis on the stock. investment risks The operations of CMG are subject to shifts in the general economy and in popular eating habits. The company will also continue to face significant execution risk from its rapid expansion and it could experience margin contraction if it is unable to replace the services currently provided by McDonald's at a comparable cost. In addition, the company operates in one of the most highly competitive segments of the already competitive restaurant industry. Operations could also be affected by outbreaks of disease or public perceptions of disease risk. Finally, the company could experience disruptions and/or higher costs if necessary ingredients become unavailable in some areas. With a market capitalization near $1.5 billion, CMG is classified as a small cap growth issue. investment recommendation The shares appear overvalued at recent market prices near $43, though we view the company's market positioning and prospects for growth as outstanding. In the near term, CMG will need to expand margins while absorbing additional operating costs as it completes its separation from McDonald's and faces the costs of being a public company for the first time. In addition, management will have to manage the company's rapid growth to near perfection in order to satisfy the investor expectations that now appear to be built into the stock price. Based on current company fundamentals, we would expect the shares to trade between $35 and $45, and building in a significant growth premium, we would view the shares as appropriately valued on a near-term basis between $31 and $38. The shares are currently trading well above even this adjusted range. Following the company's IPO in January at a share price of $22 (up from an earlier projected price of $18), investors snapped up the shares, allowing CMG to rack up a first day gain of 100%. The shares then rose above $49 by the end of January, before retreating to the mid-$40s. In the company's IPO on January 26, 2006, the selling stockholder granted the underwriters an overallotment option because of the high demand for the stock. The company used the proceeds from the offering to repay the outstanding balance under a $30 million revolving credit line it has with McDonald's. The remainder is to be used as capital for expansion. Following the offering, McDonald's Ventures owned 65% of the common stock and controlled 87% of the voting power of CMG. Despite the current valuation of the stock, we believe that CMG will excel in the coming years in response to the growing casual dining segment and an emphasis on natural eating. We rate the stock as a BUY at market price and recommend that Smart Woman Securities invest in the entity. full financial statements You should typically include full financial statements here, including the income statement, balance sheet, and statement of cash flows. In an effort to save paper, I have omitted these pages.