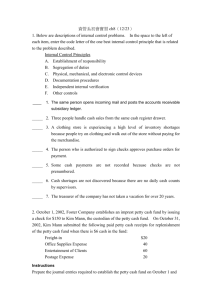

Internal Control

advertisement

Notes, Suggestions, and Other Ideas Series B Number 1 P R E S I D E N T I A L Internal Control Boards of Trustees and college administrators carry fiduciary responsibility for their organizations, and thus, need to be sure adequate internal controls are in place. In 1987, the National Commission on Fraudulent Financial Reporting launched a major research project to bring more uniformity to internal control assessment. In 1991, the United States Sentencing Commission adopted guidelines for criminal penalties in “white collar” crime resulting in a significant reduction in penalties for organizations that have in place an effective system for detecting violations of law. A. L E A D E R S H I P To be considered effective, five components must be included. 1. Control environment -- The “tone” of an organization must be healthy with emphasis on competence, integrity, and clear policies and procedures. 2. Risk assessment -- Analyzing the risk to an organization and setting objectives accordingly is a management responsibility. Smaller organizations may be less formal and rely on face-to-face contact rather than formal written reports, but an awareness concerning risk is important. 3. Control activity -- This includes setting appropriate policies and procedures over the accounting functions to assure compliance and accurate, timely reports. A S S O C I A T E S 4. Information and communication -- Systems for communicating the right information on operations, compliance, and finance is essential. Management should ensure that all employees understand that internal control is important and must be followed. 5. Monitoring -- Management needs to be sure that the internal control function is performing as expected through ongoing normal operations and through specific evaluations by the auditors. B. Internal control is the organizational plan adopted to do the following: Internal Control, continued_________________________________________ C. 1. Safeguard assets 2. Assure adherence to college policies 3. Secure efficiency in financial administration 4. Achieve accurate and reliable financial records. A good system of internal control has at least the following: 1. Ethical and competent personnel -- Compensation, training, and supervision contribute to this. 2. Separation of duties -- If responsibilities are assigned appropriately, the chance of fraud is reduced. This separation should include the following: 3. a. Custody of assets from accounting b. Authorization of transactions from custody of assets c. Operations from accounting d. Separation of responsibilities within accounting Audits -- An independent outside auditing firm reporting directly to the board is fundamentally important. 4. Records -- The use of subsidiary ledgers, prenumbered documents, and timely bank reconciliations all contribute to internal control. 5. Technology -- Today, accounting systems depend more on computer systems and less on printed documents. Thus, systems checks are important including firewall protection. 6. Budget -- A carefully developed budget with close monitoring will help identify significant deviations from the plan. If staff are required to answer for the deviation, accountability is more likely to be achieved. 7. Other -- Fireproof files and vaults, control of signature machine, bonding personnel with access to cash, job rotation, required vacations, and alarm systems are all components of a good internal control system. D. Internal control over cash 1. Students should receive receipts as transaction records. William C. Crothers * 810-653-2220 * wmcrothersPLA@AOL.com 2 Internal Control, continued_________________________________________ 2. Cashiers should not have access to accounting records. This will inhibit their ability to adjust records for cash they might embezzle. 3. Each day’s receipts should be matched with the daily bank deposit. 4. Cashiers should be bonded. Fidelity insurance does not protect against theft by an outside person, but it does protect the organization from embezzlement. A comprehensive insurance plan is important for total risk management. 5. Cash should be stored in locked vaults and the bank. 6. Employees should be rotated among jobs and required to take vacations so that if there is tampering with records the organization is more likely to discover it. 7. Petty cash funds need at least four control points: a. Only one employee should administer the fund. b. All payments should be documented with a signed petty cash ticket. c. A specific amount should be allocated to the fund and the petty cash tickets and cash should always total that set amount. d. E. The fund should be reimbursed through the normal check-writing process. Internal control over cash payments 1. Staff who handle checks and computer operators should have no access to accounting records. 2. Accountants should not handle cash. 3. Specific staff should be assigned to approve purchase documents and before checks are signed. All documentation including proof of receipt of goods should be attached. 4. Checks should be prenumbered and blank checks stored in a safe and controlled location. 5. Paid invoices should be noted to avoid paying twice. 6. Signature machine plates should be controlled and the numbering sequence on checks recorded to make sure there are not missing checks. Presidential Leadership Associates, LLC 3 Internal Control, continued_________________________________________ F. Other considerations 1. The person distributing the payroll checks should be different than the one preparing the payroll to prevent payment to fictitious persons. 2. The person responsible for write-offs of accounts receivable should not have access to the general ledger. This helps ensure that if one embezzles from accounts receivable, they cannot cover it up by doing a write-off. 3. Fixed assets should be purchased and disposed only with proper authorization. Although the accounting profession a detailed fixed asset ledger, the value of requiring a non-profit to incur the cost of the accounting is questionable. Many simply videotape all assets periodically for insurance purposes. 4. College policies must be documented, kept current, and widely distributed. 5. A well-crafted Board of Trustees policy structure can be very helpful in addressing areas of vulnerability. 6. One area that is difficult to control is in the area of gifts that are personally handed to a development officer. If the employee falsified records and opened a bank account in the name of the institution but maintained authority to write checks on that account, they could simply take the funds, send a false receipt, and not report it. This is why it is important that more than one person have a relationship with each donor. 7. When there are few people in the business office to appropriately segregate duties, careful internal control design becomes more important. The objective is to make sure no single person is in a position that he or she can perpetuate and conceal irregularities while doing their assigned duties. Presidential Leadership Associates, LLC 4