Marketing-Project-Report-on-Measuring-success-of-New-product

advertisement

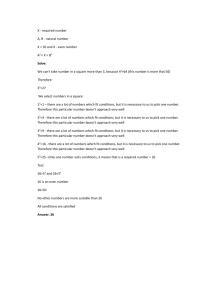

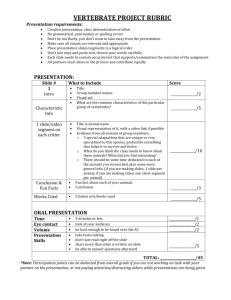

Management Research Project FINAL REPORT ON Measuring success of new product launches in the Indian automobile industry Submitted To: Submitted By: SUPERVISOR NAME COLLEGE NAME YOUR NAME Enroll No.XXXXX TABLE OF CONTENTS 1. Objectives…………………………………………………………3 2. Abstract……………………………………………………………4 3. Indian Automobile market…………………………………………5 4. Segmentation & Profile…………………………………………...11 4. New product development………………………………………...21 5. New Product: Success or failure…………………………………..23 5. Problem of measuring success of new product……………………25 6. Critical factors of success of new products………………………..26 7. Measuring Success of New Products……………………………...28 8. Measuring success for automobiles...……………………………...31 9. Market share and product portfolio…………………...…………...34 10. Buying Behavior………………………………………………….44 11. Satisfaction survey………………………………………………..52 12. Awareness………………………………………………………...56 13. Advocacy………………………………………………………….57 14. Conclusion………………………………………………………...58 Annexure- I-Questtionnaire……………………………………………61 Annexure- II-SIAM data………………………………………………65 References…………………………………………………………………………..71 Objectives To study the various new products launch in Indian automobile industry. To understand various factors that affect preference of consumers while purchasing an automobile Critical factors responsible for the success of new product in Indian automobile industry Abstract The Indian auto industry, worth US$ 34 billion in 2006, has grown at a CAGR of 14 per cent over the last five years with total sales of vehicles reaching around 9 million vehicles in 2005-06. That number is likely to see a significant boost, given that the first half of 2006-07 has already witnessed a staggering growth rate of 17.12 per cent. This project deals with a critical analysis of Indian automobile industry and its growth it has shown in past years. Even though industry has been showing good growth in numbers it is more important to see whether it is really moving up the ladder. The growth it shows should be in terms of success of new product launches. So this project is to analyze the success rate of new product launches and to see whether the growth shown in Indian automobile industry is really due to new product launches and their success. Due to exhaustive nature of the industry, the study would be confined to cars only. Now the project deals with measuring success of new product launch for cars launched in the past four years. Further, short listing of some car models have been done to make the study more specific and effective. Indian Automobile Industry History and development The history of the automobile industry in India actually began about 4,000 years ago when the first wheel was used for transportation. In the early 15th century, the Portuguese arrived in China and the interaction of the two cultures led to a variety of new technologies, including the creation of a wheel that turned under its own power. By the 1600s, small steam-powered engine models were developed, but it was another century before a full-sized engine-powered automobile was created. The dream a carriage that moved on its own was realized only in the 18th century when the first car rolled on the streets. Steam, petroleum gas, electricity and petrol started to be used in these cars. On a growth path The Indian auto industry, worth US$ 34 billion in 2006, has grown at a CAGR of 14 per cent over the last five years with total sales of vehicles reaching around 9 million vehicles in 2005-06. That number is likely to see a significant boost, given that the first half of 2006-07 has already witnessed a staggering growth rate of 17.12 per cent. Domestic car sales for the April-September 2006 period stood at an impressive 4.86 million vehicles, including cars, two-wheelers and commercial vehicles. According to industry experts, if this trend continues, sales could touch 10 million by March 2007, clocking an annual growth rate of 20 per cent. In addition, the Government’s announcement to cut excise duty on small cars will soon see India emerging as the world's largest manufacturing hub for small or compact cars. Destination India India is on every major global automobile player’s roadmap, and it isn’t hard to see why: India is the second largest two-wheeler market in the world Fourth largest commercial vehicle market in the world 11th largest passenger car market in the world Expected to be the seventh largest by 2016 Robust production India’s car production capacity is in for a US$ 2 billion boost. Auto majors have announced massive investment plans which will push the country’s car production past the psychological 2 million mark by the end of fiscal 2006-07, up 70 per cent from 1.4 million units now. Even at 2 million, India, which stood at No.11 among global car producing nations, will move two steps ahead, past UK (1.6 million) and Canada (1.35 million). It will be neck and neck with Brazil’s 2-million capacity at No.8. The automobile industry witnessed a growth of 19.35 percent in April-July 2006 when compared to April-July 2005, as is evident from this year’s production trends. Automobile Production Trends Category 2004-05 2005-06 (In no.s) M&HCVs 214807 219297 LCVs 138896 171781 Total CVs 353703 391078 Passenger Cars 960487 1045881 Utility Vehicles 182018 196371 MPVs 67371 66661 Total Passenger vehicles 1209876 1308913 Scooters 987498 1020013 Motorcycles 5193894 6201214 Mopeds 348437 379574 Total Two Wheelers 6529829 7600801 Three Wheelers 374445 434424 Grand Total 8467853 9735216 Source: Society of Indian Automobile Manufacturers (SIAM) Domestic Sales Increased affluence, wider selection and the ready availability of car loans is driving the Indian car market through the roof. During the last five years (2000-05), the production of passenger cars in India increased by more than 100 per cent. India achieved the sales of 1.11 million vehicles last year (2005). Domestic sales have been growing at a clipping pace: Passenger car sales rose by 22.84 per cent during April-September 2006, compared to the corresponding period last year. The cumulative growth of overall sales of passenger vehicles during AprilSeptember of 2006-07 was 20.73 percent. Utility Vehicle (UVs) sales grew at 12.85 per cent during the same period. Overall, the two wheeler market grew by 15.49 per cent during the AprilSeptember period of financial year 2006-07, over the same period last year. Motorcycles grew by 18.53 per cent, scooters at 0.12 percent and mopeds at about 6.53 percent over April-September 2005. Three wheeler sales grew at 19.90 per cent. Goods carriers grew by 26.16 per cent and passenger carriers grew at 15.78 per cent during the April-September 2006 period, over the same period last year. Overall, the commercial vehicles segment grew at 36.96 per cent. Growth of Medium and Heavy Commercial Vehicles was 39.92 per cent. Light Commercial Vehicles also performed well with a growth of 32.86 percent. Exports India is fast emerging as a manufacturing base for car exports. According to the Society of Indian Automobile Manufacturers (SIAM), a total of 89,338 vehicles were exported in September 2006, a 58.07 per cent jump as compared to the same month last year. While passenger vehicle exports grew at 13.15 per cent, two-wheelers and commercial vehicle exports grew at 27.80 per cent. Investments The Indian automobile sector has witnessed a slew of investments in the first half of 2006, dominated by plans for new plants and ramped up capacities. Here are some of the vehicle manufacturers dominating the headlines with their impressive plans: Punjab-based International Cars and Motors (ICML) will invest US$ 223.7 million in Himachal Pradesh to set up a plant to manufacture diesel-operated multi utility vehicles (MUVs). Nissan is set to establish its manufacturing base in Gujarat. The company, along with Suzuki, is planning to invest upto US$ 671.2 million for a 600,000 cars per annum plant. Toyota Kirloskar Motors is likely to set up its second plant near its existing facility in Bidadi, Karnataka. Hyundai Motor is set to invest an additional US$ 700 million into its Indian operations based in Tamil Nadu, to expand the company’s passenger car capacity to 600,000 units per annum from the present 300,000, as well as in a new engine and transmission unit. The Government is planning to set up three dedicated corridors for automobile companies exporting to the rest of the world. Dedicated rail corridors are proposed between Gurgaon and Mumbai port, Pune and Mumbai including JNPT and Jamshedpur and Kolkata. A dedicated highway for automobile movement is also being considered between Gurgaon and Delhi. The proposal also includes creating the last-mile, road-port connectivity at all the four ports. Foreign players in India Calendar 2006 has seen the entry of many high-end brands into the country. The Indian automobile market will see at least 30 new launches, spanning everything from affordable hatchbacks to mid-size models to super luxury high-end cars and SUVs. Mercedes, BMW, Porsche, Audi, Bentley and Rolls Royce are already here. Now, the Italian marquee Lamborghini is also planning to enter the country. The Italian marquee plans to launch the Gallardo. German luxury car maker Audi AG is preparing to drive into India a range of sporty, lifestyle cars like S8 and RS4 early next year. The year 2007 will also mark Audi's entry into merchandising in Indian car bazaar. General Motors launched Aveo this year. GM plans to bring in a sporty variant of the Chevy Optra to add to its existing line-up. The automobile companies manufacturing cars in India are : Maruti Udyog Limited Tata Motors General Motors Hyundai Motors India Limited Toyota Kirloskar FIAT Automobiles Hindustan Motors Ford Motors BMW Skoda Auto Honda Siel Mahindra Renault Daimler Chrysler Nissan Motors Volkswagen Audi A brief about some top car companies which are relevant with the project is mentioned. It also includes the segmentation of the Indian market which is on the basis of length of the car. Segmentation of the Indian Car Market Segmentation of cars in Indian markert is mainly done on the length of the car or the price of the car. Segmentation on the basis of length is done as: Passenger cars • Segment A1 (mini) – cars having a length of up to 3,400mm • Segment A2 (compact) – cars having a length of 3,401-4,000mm • Segment A3 (mid-size) – cars having a length of 4,001-4,500mm • Segment A4 (executive) – cars having a length of 4,501-4,700mm • Segment A5 (premium) – cars having a length of 4,701-5,000mm • Segment A6 (Luxury) – cars having a length of more than 5,000mm The less than US$6,500 segment or the ‘A’ class, the Maruti 800 is the only model in this segment, has received a new lease of life when most had written about its demise. The ‘B’ segment US$6,500 to US$10,900 is being powered by growing sales of Hyundai Santro and Maruti Wagon R and Alto models. It is the mid-sized or the ‘C’ segments US$10,900 to US$21,750 and the premium or ‘D’ segment US$21,750 and above which has witnessed a lot of activity in the recent past. This market insight discusses a few developments taking place in these two sub-segments. The launch of the Skoda Octavia in late 2001 started this trend. Priced at an attractive US$21,000 to US$22,500 with a luxury feel to it, the model gave its higher priced peers in the ‘D’ segment like the Honda Accord, Ford Mondeo and Hyundai Sonata a run for their money. Within a short time, this vehicle became the largest selling model in the premium end of the segment. It sold 6,019 units during the period April 2002 to March 2003 – half of entire sales in the ‘D’ segment. Following its footsteps, General Motors India launched the Chevrolet Optra. Priced at US$17,200 it power steering, safety airbags, and air filters are included in this purchase price. This vehicle is aimed at beating Skoda. There is also Tata’s mid-sized sedan Indigo, which is priced at approximately US$10,600 and has signaled new competition for the Maruti Esteem and Ford Ikon. It seems that price competition will be the new mantra going forward. Price competition will be in a segment, which many believed was relatively price inelastic. This has been disproved by the success of the Octavia. Time will tell whether the new launches will be able to match its success. What will the likely success of ‘C’ segment cars mean for the largest selling ‘B’ segment? Given the improving economic climate and easy availability of credit, some customers would certainly think of replacing their existing ‘B’ segment cars with a competitively priced ‘C’ segment model. However, it widely known that a large body of Indian consumers would still prefer the low cost of ownership of a ‘B’ segment car like Maruti Zen. Frost & Sullivan believes that the new launches in the ‘C’ segment cars could also affect the fortunes of the premium end of the market. With models like the Optra carrying a host of advanced features, some consumers would count it as a premium class vehicle. Such a model could well be the vehicle of choice for an owner of a premium end car. Activity in the ‘D’ segment is being dominated by new model launches. After tasting success with its utility vehicle Qualis, Toyota launched its Corolla and Camry models. General Motor launched the Vectra in early 2003. The Mercedes ‘C’ Kompressor priced at US$54,300 will soon be launched. Skoda has also confirmed plans to launch its Superb priced at approximatelyUS$70,000. A large part of the limelight is also been shared by new launches of sport-utility vehicles. Until recently, this segment only had the Tata Safari as part of the lineup of vehicles. With the launch of the Mitsubishi Pajero, the Chevrolet Forrester, and the Hyundai Terracan, this segment seems crowded. Given the price range of these models, their manufacturers do not expect big sales numbers. However, their launches signal that global automakers now sense an increasing level of maturity in the Indian market. Although sales have risen across the board, the current spate of developments in the passenger car segment is largely concentrated in the higher end of the market. This has coincided with the return of the ‘feel good’ factor in the Indian economy. Customers are feeling more confident about the future and automakers hope to see this translate in to greater sales of higher end cars. A brief profile of car manufacturing companies is mentioned in the following section : Hyundai Motor India Limited Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai Motor Company, South Korea and is the second largest and the fastest growing car manufacturer in India. HMIL presently markets 16 variants of passenger cars in six segments. The Santro in the B segment, Getz in the B+ segment, the Accent and Verna in the C segment, the Elantra in the D segment, the Sonata Embera in the E segment and the Tucson in the SUV segment. Hyundai Motor India, continuing its tradition of being the fastest growing passenger car manufacturer, registered total sales of 299,513 vehicles in calendar year (CY) 2006, an increase of 18.5 percent over CY 2005. In the domestic market it clocked a growth of 19.1 percent a compared to 2005, with 186,174 units, while overseas sales grew by 17.4 percent, with exports of 113,339units. HMIL’s fully integrated state-of-the-art manufacturing plant near Chennai boasts some of the most advanced production, quality and testing capabilities in the country. In continuation of its investment in providing the Indian customer global technology, HMIL is setting up its second plant, which will produce an additional 300,000 units per annum, raising HMIL’s total production capacity to 600,000 units per annum by end of 2007. HMIL is investing to expand capacity in line with its positioning as HMC’s global export hub for compact cars. Apart from expansion of production capacity, HMIL plans to expand its dealer network, which will be increased from 183 to 250 this year. And with the company’s greater focus on the quality of its after-sales service, HMIL’s service network will be expanded to around 1,000 in2007. The year 2006 has been a significant year for Hyundai Motor India. It achieved a significant milestone by rolling out the fastest 300,000th export car. Hyundai exports to over 65 countries globally; even as it plans to continue its thrust in existing export markets, it is gearing up to step up its foray into new markets. The year just ended also saw Hyundai Motor India attain other milestones such as the launch of the Verna and yet another path-breaking record in its young journey by rolling out the fastest 10,00,000th car. FORD INDIA LIMITED The very first mass produced vehicle was the model T.built in 1908, in Ford plants around the world. Ever since the company has been coming out with models with breakthrough technology. Now the company stands tall among all automobile manufacturers and now houses some of the world’s most favourite brands of cars. If there is anything that’s made this possible its Ford’s “Can Do” philosophy. The philosophy that triggered Ford’s growth worldwide. In India, this is reflected in the company’s sprawling, 350 acre manufacturing plant in Maramalai Nagar near Chennai. A project that has been set up with a investment of Rs.1700 crore. Ford India Limited is a subsidiary of Ford Motor Company, currently Ford has a 78% stake, which is going upto 92% soon.The Maraimalai Nagar Plant of Ford India Limited, located roughly 45k.m.from Chennai, provides employment to over 20000 people.The plant has the capacity to manufacture 1,00,000 vehicles per annum, equipped with state-of-the-art vehicle manufacturing technology from Ford. Presently offering seven different models, Ford India Limited (FIL) is catching up fast with the Indian consumer. Looks like FIL is all set to conquer the Indian market like rest of the world. General Motors Founded in 1908, General Motors Corporation, the world's largest vehicle manufacturer, designs, builds and markets cars and trucks worldwide. GM's vision is to be the world leader in transportation products and related services, by unveiling new products and the most exciting lineup in its history. GM's major markets are North America, Europe, Asia Pacific, Latin America, Africa and the Middle East. Its largest market is North America, where it is in its 78th year as market leader. GM cars and trucks are sold under the following brands: Cadillac, Chevrolet, Buick, GMC, Holden, Hummer, Oldsmobile, Opel, Pontiac, Saab, Saturn and Vauxhall. GM, the worldwide leader in car manufacturing, has had a long association with India – from 1928 till 1954, it used to assemble Chevrolet cars, trucks, buses and batteries for the domestic market as well as for exports. General Motors India was formed in 1994 as a 50:50 joint venture between General Motors Corporation and the C.K. Birla Group of Companies. In 1999, GM bought out its partner’s shareholding and GM India became a fully-owned subsidiary of GM Corporation. The total investment in GMI as of today is approximately US$ 252 million. GM India offers products under the Chevrolet and Opel brands in the country and has a total workforce of 1,200 personnel. GM India launched its first car model, the Opel Astra, in 1996. The next model, Opel Corsa, was launched in 2000 and two variants of this model have been subsequently launched – Corsa Swing in 2001 and Corsa Sail in 2003. In 2003, the company entered the MUV segment and launched the Chevrolet brand in India through the Forester. It also launched the Opel Vectra and Chevrolet Optra. Vectra and Forester were imported as CBUs while Optra was assembled in the Halol plant. In 2004, the company has launched another MUV model, the Tavera. With the recent launch of its new car models and a few others in the pipeline, GM India is on the road to breaking even and profitability this year. The company is targeting a turnover of US$ 375 million during the year, up by US$ 208 million from last year. Maruti Suzuki Maruti Udyog Limited (MUL) was established in Feb 1981 through an Act of Parliament, as a Government company with Suzuki Motor Corporation of Japan holding 26 per cent stake. It was entrusted the task of achieving the following: Modernization of the Indian Automobile Industry. Production of vehicles in large volumes Production of fuel efficient vehicles. Suzuki was an obvious choice because of its unparalled expertise in small cars. The Joint Venture agreement was signed between Government of India and Suzuki Motor Company (now Suzuki Motor Corporation of Japan) in Oct 1982. The company went into production in a record time of 13 months and the first car was rolled out from Maruti Udyog Limited Gurgaon in December, 1983. Market Share Till date, over 6 million (60,00,000) Maruti cars have rolled out from its manufacturing facilities. At the end of 2005-06, Maruti had a market share of about 54 per cent of the Indian passenger car market. The company sold 5,61,822 vehicles in 2005-06 including exports of 34784 units. Maruti’s cumulative exports are over 4 lakh units. Tata Motors Tata Motors Limited is India's largest automobile company, with revenues of Rs. 24,000 crores (USD 5.5 billion) in 2005-06. It is the leader by far in commercial vehicles in each segment, and the second largest in the passenger vehicles market with winning products in the compact, midsize car and utility vehicle segments. The company is the world's fifth largest medium and heavy commercial vehicle manufacturer. Tata Motors, the first company from India's engineering sector to be listed in the New York Stock Exchange (September 2004), has also emerged as a global automotive company. In 2004, it acquired the Daewoo Commercial Vehicles Company, Korea's second largest truck maker. The rechristened Tata Daewoo Commercial Vehicles Company has already begun to launch new products. Toyota Kirloskar As a joint venture between Kirloskar Group and Toyota Motor Corporation, Toyota Kirloskar Motor Private Limited (TKM) aims to play a major role in the development of the automotive industry and the creation of employment opportunities, not only through its dealer network, but also through ancillary industries. TKM's growth since inception can be attributed to one simple, yet important aspect of its business philosophy - "Putting Customer First". While managing growth, TKM has maintained its commitment to provide quality products at a reasonable price and has made every effort to meet changes in customer needs. TKM firmly believes that the success of this venture depends on providing high quality products and services to all valued customers through the efforts of its team members. TKM, along with its dedicated dealers and suppliers, has adopted the "Growing Together" philosophy of its parent company TMC to create long-term business growth. In this way, TKM aims to further contribute to progress in the Indian automotive industry, realise greater employement opportunities for local citizens, improve the quality of life of the team members and promote robust economic activity in India. New Product Development Identifying and developing a new product is always a messy, experimental process. For many companies this process is more difficult and less successful than necessary. The process of introducing new products is as risky as it is vital to the long-term success of companies. The number of new products introduced globally is increasing every year, but most of them fail. Revolutionary new products often come from upstart players or companies outside the industry whose vision is not limited by a focus on the current business and markets. To remain successful innovators, business managers must continually review their companies' to meet the three conditions for effective innovation: • Closeness to customers – Managers must know their customers and understand their needs and requirements well, • Multifunctional teamwork – Successful product innovations are almost invariably the result of people in the company working together in teams rather than independently, and, • Cross-functional communications – Innovations in most companies refer to the information flow between the key functions. One of the most important themes in innovation research has been an attempt to identify the factors that are associated with new product success. Measuring new product outcomes from innovation is also crucial for our understanding the organizational behaviors related to, and the resource allocation provided to, new product development. Although the importance of measuring new product success is widely recognized, its treatment remains elusive, partly due to the multidimensional nature of such success, the different levels of analysis that can been examined, and the multiple stakeholders who look for different things in the new product development product. This has resulted in the use of large number of measures in the assessment of new product performance. There are numerous problems in measuring new product success. Taking into consideration the importance of a new product for business performance of enterprise as a whole, it is necessary to identify both the critical success factors and the measures. A review of relevant literature indicates greater simplicity in the process of critical success factors' identification. Logically, there are some differences, depending on the character of innovation (for example, radical versus incremental innovations), business model of enterprise (market-oriented enterprises as different forms of networks versus enterprises with traditional business models), size of enterprise (big global companies versus small and medium enterprises), etc. However, the problems arise in identifying the system of new product success measures. The point is not in the deficiency of individual measures, but in imprecise definition of the subject of measures as well as in inadequacy of result interpretation. Isolated measures that are not integrated in the system of performance measures of enterprise as a whole, distort the picture of efficiency and effectiveness of enterprise. This is especially related to the new product success evaluation. Attempting to overcome the problem, the different models for valuation have been created. The authors first analyze the critical factors of new product success, especially in condition of expressed connection of different participants in value chain, and, after that, they point out some problems in selection of new product success measures. New Product : Success or Failure The experiences of a large number of enterprises show that the failure in product development, particularly related to the products representing the basis for the creation of a whole range of other, so-called product platforms, originates from the phase of the product concept definition. The risk is more pronounced in the cases of developing the products that should create the needs of consumers. In such circumstances, when completely new products of high risk are created, technological and marketing uncertainties have to be studied in order to reduce or eliminate the risk of their implementation. The enterprises that are successful in this field are characterized by the management through projects, which enables successful management of each individual project and a network of projects within the enterprise, of interactions and relations among different projects and of the relationships with the environment . The surveys of the practices of successful companies suggest that adequate approaches (methods and techniques) in the product creation and development should be selected in the conditions of abrupt technology and market changes. Different approaches may be applied. Problems of Measuring Success of a New Product • Creates a clear product course map of the enterprise where the managers, regardless of their functional location, understand the significance of the product for the enterprise. Product maps help in defining key priorities, in timely decision-making and in defining the products that shall represent the grounds for further development. This enables not only the improvement of final products but also the elimination of the lost efforts that divert the enterprise from more important activities. The product maps, as well as the processes that create them, are the central parts of the total product development process; • Develops the product strategy "without voids". Successful firms create a multitude of products in order to fill up the appearing voids in the market and satisfy new needs of their consumers. By studying the consumers and their purchasing motives, new market opportunities are identified and competition is neutralized; • Collects and uses valid information from the market and cooperates in particular with consumers and suppliers. The product creation process includes consumers-innovators, who are the first to accept the product and who appear in the role of referential groups, which facilitates not only a full satisfaction of consumers but enables the realization of the desired enterprise performances. CRITICAL FACTORS OF THE SUCCESS OF NEW PRODUCTS A significant issue related to the success of managing a new product development project is the identification of critical factors of success. This is the basis of their selection, determination of priorities and allocation of resources, starting from the characteristics of the new product project, major competencies of the enterprise and features of the market (consumers and competition, above all). Since the measures of new product success are different and each enterprise uses its own system of standards, the enterprise management should decide on the project selection criteria within the framework of a complex system of business performance measurement. Technology was formerly considered as the only factor of a new product success. A new product was the result of a proactive research and development and the application of science. Such approach is known as the technology pushing. This approach is still very successful, especially in high-technology branches, where the changes in the market are very fast and projects are extremely expensive and risky. The development cycles of such technologies, as well as of the products resulting from their application, are ever shorter. The producers of high-technology products are forced to shorten the periods of new product development and launching. The process of new product development is progressively acquiring the characteristics of a marketmanaged project. Rapid technology and market changes impose the need to coordinate research-developmental, technological and marketing strategies. Numerous empirical research projects show that the critical factors of the new product success are the following: • Definition of a new product prior to its development – the analysis and selection of a target market, identification of the benefits for potentially profitable consumers; • Integration of consumers into the process of value creation (from the idea to the realization of the product). This is a very complex process, in which the most difficult part is to provide reliable information necessary for shaping a customized offer. The application of modern information and communication technologies and the execution of online marketing research enable successful overcoming of limitations, while the costs of activities in the customization process are reduced to acceptable limits; • The product innovativeness; • The product superiority based on the quality as a strategic instrument and on the superior value delivered; • Superiority based on other elements of the offer – services offered to consumers, which eventually increase the product value; • Controlled cannibalization; • Flexibility enhancing the adjustment potentials even in the industries falling into the group of so-called mature ones. Computerized operations are the most flexible. In view of the situation in some industries and branches, particularly in certain enterprises, the levels of competence in flexible production, and therefore innovation, are varying largely. However, empirical research points out that the organizational culture is crucial for the enterprise transformation into a flexible system that reacts proactively to the market requirements; • Inter-functional coordination, technological and marketing synergy and involvement of the top management into the process of new product development, which contributes to more efficient time management; • High-quality performance of new product development activities; • Organization and guidance of the project of a new product development, launching and ommercialization by adequate strategic positioning; • Logistic activities largely restrain successful commercialization of a new product. It is not enough just to make a product fit the buyer's standards. Although the activities related to the product delivery to the buyer enlarge the value for customers, they may represent significant limitations as well. Alongside with the development of the Internet and electronic trade, that is of the appropriate marketing infrastructure, it becomes easier to solve the problems of delivering value to consumers Measuring Success of New Products New products are important for business success of enterprise as a whole. Measuring new product success and its contribution to business performance of enterprise as a whole is a very complex process. A fundamental problem when measuring new product success lies in the meaning of such success, as it has not been well defined. The interpretation of success is affected by the interest groups involved in new product development (R&R, production, marketing). Complexity of measuring comes from character of innovation radical, incremental, compatible and incompatible. Radical innovation has a high probability of failure but can be more profitable than incremental innovation. Similarly, incompatible innovation can be more profitable than compatible one. An idea is radical if it meets one or more of three tests: it changes customer expectations and behaviors, it changes the basis of competitive advantage and it changes industry economics Once you've introduced a new product or service or developed significant improvements to existing ones, you'll naturally want to do some follow-up to measure the success of the project. Whether the introduction is ultimately successful or not, you need to be able to learn from the process to achieve more success down the line. Most small companies cannot afford the complex and costly consumer tracking studies used by larger, more sophisticated competitors: usage and attitude studies that examine consumer usage and attitude about products, advertising, brand awareness, and brand image at a given point in time trial and repeat purchase tracking studies that record weekly purchases of similar products by target consumers, as well as the reasons for buying or not buying the products (this type of study is sometimes called a diary panel) simulated test marketing called "experimental primary lab research," which is usually conducted in store malls under controlled conditions controlled field testing called "experimental primary field research," which is usually conducted in a controlled group of stores advertising awareness and recall studies that examine the efficacy of print and electronic advertising on target buyers, often conducted by the Burke, Starch, or AC Nielsen market research companies But small companies can conduct low-cost or free qualitative research: Talk to buyers and consumers about product satisfaction and purchases. From a marketing research standpoint, this is biased, qualitative research without standard interview controls. But it is timely information and may be actionable. And it places you at point-of-purchase, close to your buyers (e.g., retailers) and end users. Conduct a test of advertising spending levels in different test markets or, with a single business in one location, over different time periods. It is relatively easy to vary introductory spending in each market, if you are testing a number of geographical markets. However, one should have significant spending differences of at least +/- 50 percent in each market for each spending variable. Small companies (e.g., one store) may have to vary spending levels over matched periods of time and compare sales results. For example, try increasing your local newspaper advertising spending 50 percent over the same quarter of the previous year. Examine weekly company sales receipts for new account sales, compared to receipts for reorders. This is an indirect, but free, way to measure initial purchase vs. reorder sales. There are no reconciled opinions in the literature on new product success measures. The three most important aspects to be measured are: Financial performance Market impact Opportunity window dimensions Various other measures that have been suggested by certain authors are: rate of success percent of sales profitability relative to investment range of technical success influence on sales influence on profit success in meeting sale goals success in meeting profit goals profitability relative to competition and global success. . Measuring Success for automobiles Development of a new product in case of automobiles is a very difficult job. For different markets different conditions have to be taken into account . It’s important to look at the business from the customer’s and market’s perspective. People are buying from you. The more you understand your customer’s needs and wants the more you can satisfy them. And the more you understand how they buy — that is, their buying decision process — the greater the likelihood your sales and marketing efforts will be successful. The measure of success for an automobile is very difficult. Different organizations define it in their own way. Time horizon has big say in measuring of the new product success. The time over which you want to evaluate your product success changes the the volume or amount you are expecting. But overall success for an organization should fulfill these objectives: Business acquisition/demand generation, which can include metrics such as market share gains, lead acquisition and deal flow. Product innovation/acceptance, which can include market adoption rates, user attachment and affinity, loyalty and word-of-mouth. Corporate image and brand identity, which can include growth in brand value and financial equity, awareness and retention of employees. Corporate vision and leadership, which can include share of voice and discussion, retention and relevance of messaging, and tonality of coverage . Due to exhaustive nature of the industry, the study has been confined to cars only. The project deals with measuring success of new product launch for cars launched in the past four years. Further, short listing of some car models have been done to make the study more specific and effective. Few models from varying segments and different manufacturers have been short listed .These have been introduced in the past few years and are new to the industry . Few models that have been shortlisted are : Maruti Suzuki Swift Toyota Innova Hyundai Getz Tata Indigo Ford Fiesta GM Aveo There are certain parameters on the basis of which a car is evaluated in the Indian market. Most of them include:- 1. Fitness for purpose 2. Relevance to the Indian market 3. Value for money 4. Design & styling 5. Engine, gearbox & performance 6. Ride , handling & brakes 7. Driving pleasure 8. Fuel efficiency 9. Safety 10. Ownership experience In order to determine which success factors to measure and the appropriate metrics for each, marketers must have a clear understanding of the company's goals. A young company looking to gain traction in the market is focused on different factors than a more established company wanting to improve its customer relationships. The following parameters have been selected to measure the success of new products in Indian automobile industry: Market share Awareness Repeat purchase and advocacy Customer Satisfaction MARKET SHARE The passenger car industry was dominated by Premier Automobiles Limited (PAL) and Hindustan Motors Limited (HM) before 1980. With the entry of MUL in 1982, the market structure of the passenger car industry in India changed dramatically. MUL captured a major share of the market as it offered a better product at a lower price. Subsequent to the entry of MUL, the market share of PAL and HM declined rapidly even as they were able to sustain sales in volume terms. MUL continued to strengthen its dominance in the passenger car market and faced virtually no competition till the sector was opened up in 1993. MUL's market position was not affected even after the entry of many foreign players as none of the new entrants targeted the small car segment. MUL's pricing was very competitive as it had relatively higher indigenisation levels and established vendor base besides a depreciated plant, and none of the newer players could penetrate this segment. However, in the late 1990s, Hyundai, Tata Motors and Daewoo launched Santro, Indica and Matiz respectively, in the Rs. 0.3-0.4 million range. Although MUL continued to be the market leader, its share in the total passenger car sales has been declining and stood at 50.8% in FY2003 as against 54.5% in FY2002 accounted for by its models (Maruti 800, Omni, Zen, Alto, Wagon R, Esteem and Baleno, Versa, Grand Vitara) across different price ranges. The company has been able to strengthen its market share during H1FY2004 at 50.2% (up from 48.1% in H1FY2003). In just four years since the commencement of production, Hyundai Motors India has emerged the second largest player in the Indian automobile market. Market Share of Players in the domestic passenger car market H1FY2005 H1FY2006 Profiles of Select Players in the Indian Automobile Industry Indian Name Partner DailmerChrysler India Private Ltd Collaborator Foreign Equity Year of incorporation None DailmerChrysler AG 100% 1995 None Fiat Auto SPA, Italy 100% 1997 Mahindra & Ford Motor Mahindra Ltd Company, USA 84.1% 195 100% 1995 100% 1940s 99% 1995 100% 1996 54.2% 1982 - 1942 88.9% 1997 Fiat India Automobiles Pvt Limited Ford India Limited General Motors India Limted Hindustan Motors Honda Siel Cars India Limited Hyundai Motor India Limited - CK Birla Group General Motors Corporation, USA None Honda Motor Siel Limited Company Limited, Japan None Hyundai Motor Company, Korea Maruti Udyog Government Suzuki Motor Limited of India Company, Japan Tata Group None Toyota Kirloskar Kirloskar Toyota Motor Motors Limited Group Corporation, Japan Tata Motors Limited The sales to capacity ratio for select players4 in the Indian passenger car industry has improved from 66% in FY1999 to 73% in FY2004. In most mature markets, there are around half a dozen players dominating the passenger car industry. The volumes of most players are below 100,000-150,000 units a year, the level that is considered viable in the developing economies. With low volumes, the manufacturers are not able to realise economies. Further, with the new environmental norms being proposed, the cost of compliance may add to the cost of production. Some of the critical success factors for passenger car manufacturers in the emerging scenario are indigenization levels, reach of dealer network, efficiency of after-sales service, volumes, and pricing. With the liberalization of the automobile sector in the early 1990s, most of the international players entered the Indian market through the joint venture (JV) route. While foreign manufacturers brought in the latest in automobile technology, the Indian partners contributed their understanding of the local market. This understanding of the local markets was particularly useful in building dealership and distribution networks. However, with the Indian JV partners not able to pump in the requisite capital for expansion, some JVs have been converted into wholly owned subsidiaries of the foreign parent or the foreign parent has increased its stake in the JV significantly. Ford India and Toyota Kirloskar Motors are cases in point. With leading international players demonstrating increasing commitment to their Indian ventures, the market is likely to consolidate over time. FORD FIESTA The Ford Fiesta has quickly climbed up the market share ladder. Within a year of its launch, the car has become the second largest selling family sedan in the Indian market. Ford Fiesta enjoys a market share of about 18 % in its segment.Of course, the more popular (by a big margin) of the two models — petrol and diesel — is the latter, and for obvious reasons. The Fiesta 1.4 TDCi, with its advanced, `fuel-frugal' common rail injection diesel technology engine and its diesel fuel advantage is clearly the first choice amongst fuel-efficiency conscious sedan buyers. GM Aveo The Aveo's big, deep-set grille, trapezoidal headlights and strong chin give it an imposing look that makes it look bigger than it actually is. GM has also gone all out to make the Aveo's interiors look and feel plush. It falls short in a few areas like the handling, high speed composure and gearshift, but still manages to come across as a value-formoney package.The Aveo is available in two engine capacities 1.4 and 1.6 litre petrol variants. . The sedan is priced at a nifty Rs 5.5 lakh for the base model.In the Indian automobile market, the Aveo will give primarily compete with the Honda City, Ford Fiesta and Hyundai Accent. The Aveo has quickly acquired a market share of around 5 % in a very span of time.The Aveo has given GM a push in the Indian automobile market. This is the first time GM entered the volume segment. GM wanted to be seen as volume player in India and Aveo has just given them that . Tata Indigo Tata Engineering signaled its impending entry into the mid-size segment with the naming of the indigenously developed Tata Indigo, India’s first sedan. The car derives its name from the words ‘India’ and ‘go’, as it symbolizes a nation on the move and is aimed at Indians on the go wanting to make a purposeful statement. Tata Indigo is targeted at people who exude energy, enthusiasm, ambition and the desire to succeed and are raring to go, undaunted by new challenges. Powered by a 85 bhp petrol and a 62 bhp turbo-diesel engine, the car will be launched with 14-inch wheels and a first-in-class independent three link and strut type rear suspension with anti-roll bar seen only in more premium segment cars. It has 500 litres of trunk space and 42 litres of fuel tank capacity, more than adequate for long outstation drives with the family. Currently it enjoys a market share of around 17 % in its segment. Maruti Swift Maruti Swift brings a feeling of freshness to the compact car segment. Its appealing looks, spacious interiors, and a whole lot of user-friendly features at once catch your attention. Maruti Swift comes in three variants-Maruti Swift LXi, Maruti Swift VXi, and Maruti Swift ZXi. Maruti Suzuki Swift comes with a number of safety features such as collapsible steering column, front seatbelt pre-tensioners with load limiters, and energy absorbing trim all around. Active safety technologies include dual front airbags, and antilock braking system together with electronic brake-force-distribution. Swift enjoys a share of more than 50 % in its hatch back segment and sells around 5500-6000 units per month.As a result it is giving tough competition to cars even in other segment due its big car features.. Hyundai Getz The 3810 mm long Getz is in the B plus segment in terms of length, but is truly `smack bang' in the C class in terms of interior room, comfort, refinement and performance. In terms of all these it is at least a match for the Ford Ikon, the Maruti Esteem, or the Tata Indigo and even its own sibling, the Accent. It enjoys a market share of about 20% in its segment. Toyota Innova Showing the way forward in though and execution as also a new way of motoring life is Toyota with the classy and powerful Innova, heralding a whole new category. The look is all new and refreshingly curvy and pleasing where the boxy Qualis looked like a weightlifter on skinny legs. Toyota has probably the best diesel engine in its class on offer, period. Toyota's famous D4D common rail diesel engine is a proven performer, having excelled not only in various pick-ups and SUVs in Asia but also in certain saloons in Europe. This engine has capacity - 2494cc - to begin with, has a strong dohc 16-valve top end force fed by a turbocharger and the latest generation common rail diesel injection system to make for not just a punchy and frugal prime mover but also a very refined powerplant which effortlessly meets the latest Euro III emission norms.It enjoys a market share of above 40 % in the MUV segment. Buying behavior exhibited while purchasing an automobile According to the primary research conducted emotive needs such as potency, prestige, and status account for over 50% of the car buyers in India. The study identifies the following six need segments in the Indian automotive market: Contrary to the belief that prestige and status needs are pre-dominantly among buyers of higher-end vehicles, the study clearly reveals that needs exist across vehicle segments. While prestige and potency related needs are the key motivators for entry luxury buyers, these needs exist across segments, including the cheaper small cars. The key drivers for the six need segments in India are summarized below: Potency buyers are motivated by a need to attract opposite sex and feel powerful; brand image of trendy and innovative appeals to this group. Utility buyers seek a need for basic transportation and care for family; Value for money and cost of ownership are the benefits that these buyers associate with. Prestige buyers are motivated by a need for prestige, indulge self, and exclusivity; They are least price sensitive and desirous of latest/ futuristic features in cars Adventure buyers seek fun & adventure and to increase popularity; SUV finds preference for these buyers who relate to their cars as “lover”. Status buyers want to show-off success and attract attention; Superior craftsmanship and best technology are imagery issues that this group relates to. Liberation is the smallest of the six need segments – these buyers seek increased freedom and latest technology; safety consciousness is relatively higher among them. It is apparent from the need segment drivers that a majority of motives are about what a consumer desires to communicate to the outside world based on the car he/ she uses.Therefore, it is vital to understand these underlying drivers for consumer behavior and position brands accordingly instead of solely focusing on rational elements of purchase such as fuel economy and engine power. While brands cut across different need segments due to a similar identity, the varying degrees of “fit” is determined by its soul or persona. Needs such as adventure and liberation are more expressive, while status need is more subdued. Similarly, potency need is about self-assertion and more individual oriented, whereas prestige is more about affiliation and family oriented. The two examples below further illustrate the essence of these differences. Hyundai and Maruti: At a rational-level, both these makes finds similarities on some of the rational brand drivers such as good fuel economy, easy to maintain, practical cars, and good after-sales service coverage. However, Hyundai’s persona is more expressive, while Maruti’s is more protective. For example, increase popularity and show-off success are stronger motivations for Hyundai, while basic transportation and fit-in socially is higher for Maruti. Consequently, Hyundai finds a relatively better “fit” with adventure and potency as compared to utility and status for Maruti. Honda and Toyota: Superior craftsmanship is a key similarity for both these brands at a rational-level. However, Honda’s positioning is closer to the individual oriented zone of self-assertion – reflected in one of its key motive of “feel powerful”. Toyota, in comparison, falls more on the expressive and affiliative side with motives like “feel young” and “for adventure and fun”. Key Demand Drivers Disposable income was perceived as the key factor driving passenger car demand. But over time, other factors included the need for greater mobility, non-availability of public transport services, availability of cheap finance, development of the used-car market, introduction of new technologically superior models, increasing levels of urbanisation, and changing consumer profiles. Market Characteristics Product Penetration The penetration of passenger cars in India stood at five per thousand persons as against 27 for two-wheelers in 2000. Significantly, the Indian figures are lower than even those for economies like Indonesia (14 and 62). The relatively high penetration of twowheelers in India reflects the population's need for mobility and their limited affordability. Automotive Penetration (vehicles in use per thousand persons)* Passenger Cars Two wheelers USA 478 14 United Kingdom 373 12 Japan 395 115 Germany 508 36 China 3 8 Indonesia 14 62 South Korea 167 59 India 5 27 *Source: World Bank Market Segmentation Considering that affordability is the most important demand driver in India, the domestic car market has been segmented on the basis of vehicle price till SIAM introduced the length-based2 classification of passenger cars since FY2003. The automobile industry in India is still concentrated around the mini and the compact segments which together account for around 81.8% of the automobile market in terms of units sold in FY2004. The following table presents various models in each segment of the domestic passenger car market. SIAM classification of Motor cars(Segment-Wise) is discussed in following section Mini Compact Mid-Size Executive Premium Luxury 4701-5000 >5001 Vehicle Length 3401 3400mm to 4001-4500 4501-4700 4000 Maruti Udyog Ltd. 800 Alto Zen Esteem Baleno Omni Wagon R Altura Santro Accent Hyundai Motor India Ltd Sonata Hindustan Motors Ltd. Ambassador Contessa Contessa Mitsubishi Lancer Fiat India Automobile Ltd. Palio Siena Adventure Opel Corsa Opel Corsa Sail Chevrolet Optra General Motors India Ltd. Opel Vectra Honda Siel India Ltd. City Accord Ford India Ltd. Ikon Mondeo Tata Motors Indica Indigo Mondeo DaimlerChrysler India Ltd Mercedes- Mercedes Mercedes Benz C Benz E -Benz S Class Class class Skoda Octavia Laura Toyota Kirlosker Corolla Camry superb As surveyed 44% of the people would like to change their car within 3- 5 yrs of their purchase, where as only 24 % of the people would retain their car for next 5-7 yrs.23 % of the people will retain their car for only next 1-3 yrs from the date of purchase. This percentage depends upon the age group of the people and their disposable income. People with increasing level of incomes are more willing to change their car model and upgrade to a better one. This results from their aspiration for growth in their lives both professional and personal. Hence,the new car they upgrade to must be a kind of aspiration to them and must inspire to reach for it. more than 7yrs 9% 1 to 3yrs 23% 1 to 3yrs 5 to 7yrs 24% 3 to 5 yrs 5 to 7yrs more than 7yrs 3 to 5 yrs 44% Also which came out as a surprise around 58 % of the people surveyed are attracted by the styling and performance (combined) of the car.Only 24 % people are attracted by the mileage as a first criteria for their attraction towards a car which was considered to be the main criteria by most of the companies. Also 18 % still think brand name is most important to them over other parameters when they first notice an automobile. 18% 24% Mileage Styling Performance 24% Brand name 34% Nowadays we see the automobile manufacturers advertising their new technological terms such as CRDI, Duratorq , turbo as a feature of the car which they believe will attract most customers but most of the people do not understand these terms. 21% yes no 79% When we talk about the brand names most of the people rate Japanese as better manufacturers of cars (around 36 %) where as 27 % of people still trust Germans the innovators & quality specialists as the best car manufacturers. Around 16 % and 13 % of people rate Koreans and Americans (respectively)as preferred car manufacturers. A few people still like Indians as manufacturers of automobiles. 40 36 35 30 27 Americans 25 Germans 20 15 16 13 Indians Japnese 8 10 Korean 5 0 1 While choosing an automobile, styling is very important/important to 56 % of the people, where as 68 % of the people think mileage is very important to them. 31 % of the people still think power and performance is important/very important to them while only 16 % of the people think brand name is very important/important to them. 26 % people believe that interiors and ride quality is important to them while 34 % of people believe hat after sales service is important to them. Satisfaction Survey , Awareness and Repurchase as measure As mentioned earlier satisfaction survey is one of the method to to measure the success of a car. A survey is carried out with the existing owners of the the products and they are asked to give their rating on the based if their experience with the product . Customer satisfaction can help your business achieve a sustainable competitive advantage. It's about understanding the way a customer feels after purchasing a product or service and, in particular, whether or not that product or service met the customer's expectations. Customers primarily form their expectations through past purchasing experiences, wordof-mouth from family, friends and colleagues and information delivered through marketing activities, such as advertising or public relations. If the customer's expectation isn't met, they will be dissatisfied and it's very likely they will tell others about their experience. Why customer satisfaction is important in automobile industry A high level of satisfaction can deliver many benefits, including: Loyalty: a highly satisfied customer is a loyal customer. Repeat purchase: a highly satisfied customer buys more products. Referrals: a highly satisfied customer tells their family and friends about the product or service. Retention: a highly satisfied customer is less likely to switch brands. Reduced costs: a highly satisfied customer costs less to serve than a new customer. Premium prices: a highly satisfied customer is willing to pay more for the product or service. Satisfaction surveys are an important method for collecting information about how your customers think and feel about your brand, product or service. In the automobile industry which is a high involvement product there are large no. of parameters while purchasing an automobile. Different people have different needs and they choose the product accordingly. In a car there are large number of factors such as mileage, engine power and performance, interiors, mechanical components, handling , braking etc which make an automobile . So all these components have to be equally effective or according to their weights demanded by the customer to make an automobile successful. More over the segmentation for the vehicle has to be clearly defined. Even though segmentation in Indian market is done on the length it should be done on the customer needs. Different profile or set of profile should be made and segments should be defined accordingly. A satisfaction survey can help you to understand the expectations of your customers, determine whether your customers believe you are meeting those expectations, identify new customer requirements or trends in the market and determine what areas of your business need investment. A good customer satisfaction survey will also help you to understand the causes of dissatisfaction among your customers. Once you've identified these issues, you'll be able to implement new practices to improve customer satisfaction. Each owner who takes part completes a sixteen question evaluation .They include likes and dislikes about their car, what problems they’ve had, quality of dealer service and a section on running costs. Owners rate their cars using a scale of 2 to 8(2,4,6,8) – 2 represents not satisfied while 8 is very satisfied. Then the data is divided into six categories which covers all the aspects of the car from mechanical components to after sales service. THE CATEGORIES EXPLAINED Mechanical Problems - uncovers satisfaction levels with the reliability of the car’s engine, suspension, transmission and braking systems. Interior Problems - explores satisfaction with the reliability of seats, heating, airconditioning and ventilation, sound systems, dashboard and interior. Exterior Problems - surveys body panels, paint problems, rust and corrosion and exterior lights. Vehicle Performance - looks at appeal of the car’s ride, handling, braking, engine and transmission. Dealer Service - evaluates the performance of the franchised dealer network, from the ease of booking a service to customer care. It also looks at how competent the service department is at diagnosing and rectifying faults. Ownership Costs - discloses owners’ perceptions of value for money when at the filling station, insuring and servicing the car. Finally the car is given an overall score. This takes every aspect of the car into account and is influenced most by reliability and vehicle quality, followed by vehicle appeal, then ownership costs, and finally dealer service. This pivotal figure is then expressed as a percentage and an overall rating. getz 32 indigo 35 aveo 29 Series1 innova 41 fiesta 39 swift 34 0 Findings 10 20 30 40 50 It has been founded that according to the satisfaction survey Toyota Innova tops the customer satisfaction ratings. It has achieved a highest points i.e. the 41points.This shows customers who have purchased Innova are highly satisfied with their car taking all the factors such as mechanical components , interiors , exteriors after sales service into consideration. Ford Fiesta has also reached a competitive total of 39 which sets it apart from the other vehicles in its class. Even though it got less scores in appealing , styling and interiors it got highest in the ownership costs since it delivers a highest mileage. Fiesta is followed by Tata Indigo and Swift which have achieved a score of 35 and 34 respectively.Indigo is a good car but uts engine still needs refinement.The engine delivers good power and mileage but has the shortcomings of a diesel engine. Swift is an excellent car with drawbacks only with the mileage and probably the price of the car. Also being a hatchback it should have bigger boot which it lacks. With introduction of diesel engine in swift which maruti has recently launched its sure going to be hit. Rest remaining are Hyundai Getz and GM Aveo which have achieved a score of 32 and 29 respectively. Awareness According to survey 36 % of the people come to know about the car from their friends and relatives. It is the the word of mouth that makes a car popular. 12% 34% 36% 18% Advertisements Magazines Friends/Relatives On the Road So the experience of the owner with the product has to be a satisfactory one. More than 50 % of the people said they were aware of the product before the actual launch. This clearly shows that awareness was high among them but they were just waiting for the launch and wanted a market review. Advocacy 13% 41% convince recommend 22% won't recommend negative recommend 24% 41 % of people say they would convince a person planning to purchase a car that they have purchased whereas 24 % say they would only recommend only.22% say they would not recommend anyone and would not like to influence anyone decision.13 % of people feel they would give negative recommendation. Conclusion On the basis of the parameters selected it clearly shows that Toyota Innova and Ford Fiesta have topped the rankings in the satisfaction survey. More than 72 % of Innova owners say they are willing to repurchase it if provided with subsequent developments with time . They would (around 60%) convince others to purchase this car if in the same segment.Also taking other factors that is the market share and the sales volume of the car it is clearly a success for Toyota Hence Innova has topped the group with that and the next car that closely follows it is the Ford Fiesta . Around 63 % of people owning a fiesta say they are willing to repurchase fiesta if buying a second car or changing the car. Hence , Fiesta is the runners-up.Also taking sales volume and market share Fiesta is clearly not lagging behind Innova and is sense of pride for Ford. Next car that comes up is the Maruti Swift. Swift is an excellent car wih a sales volume of around 5500- 6000 per month. With mileage being only drawback and the boot it will top rankings when diesel model is introduced.Around 54 % of people say they repurchase this car if improved mileage could be delivered. Next car is the Tata Indigo which has a higher satisfaction score than swift but is more in Taxi segment and had an good sales volume initially but with introduction of Fiesta sales volume has gone down. . In the automobile industry which is a high involvement product there are large no. of parameters while purchasing an automobile. Different people have different needs and they choose the product accordingly. In a car there are large number of factors such as mileage, engine power and performance, interiors, mechanical components, handling , braking etc which make an automobile . So all these components have to be equally effective or according to their weights demanded by the customer to make an automobile successful. More over the segmentation for the vehicle has to be clearly defined. Even though segmentation in Indian market is done on the length it should be done on the customer needs. Different profile or set of profile should be made and segments should be defined accordingly. TRENDS IN THE INDIAN PASSENGER CAR MARKET Changing Manufacturer-Customer Relationship With competition among firms intensifying and new models being launched, the Indian car industry has transformed into a buyers market. There has been an increase in the bargaining power of buyers while the power of suppliers is on the decline. This led to the industry providing technologically superior models at competitive prices and consumers getting attractive finance schemes and various cars off the shelf. Further, there are opportunities for players to spot gaps in the market and cater to particular niches like sports utility vehicles. The key strategies in the Indian car market will be offering good-quality cars that provide value for money, running innovative marketing campaigns to attract potential buyers, and providing excellent after-sales service. Companies which have a range of vehicles in all the segments of the market, will be at a significant advantage because of their ability to cross-subsidise models. Changing Face of the Indian Passenger Car Industry Annexure I Dear Respondents, The present research work is being carried out by the students of ICFAI Business School, Gurgaon as a part of their academic curriculum. The objective of this research is measure the success of new products in Indian automobile industry . Please feel free in giving your response as the information provided will be kept confidential and will be utilized only for research purpose. There is no right or wrong answers and there is no time limit to finish but try to finish it as soon as possible. Please give the following particulars: 1) Name ____________________ ________________(yrs.) 2) Gender i) Male ii) Female 3) Occupation i) Service ii) Business iii) Professional iv) Student v) Others 4) Monthly household income a) Less than Rs.5000 b) Rs.5001-15000 c) Rs.15001-30000 d) More than Rs.30000 Age 1. Car that you own ……………… (i) Swift ( ii ) Getz (iii) Aveo (iv) Fiesta (v) Innova (vi) Indigo 2. How much time it has been with your car ? (i) Less than 1 yr (ii) 1-2 yrs (iii) 2-3 yrs (iv) 3-4 yrs 3. How often do you change your car or purchase a car ? (i) 1-3 yrs (ii) 3-5 yrs (iii) 5-7 yrs (iv) more than 7yrs 4. What is the first thing that attracts you towards a car ? (i) Mileage (ii) Styling & looks (iii) Power, performance & ride quality (iv) Brand name 5. How important to you are the following while purchasing a car : Very Important Important Less Important Not Important Styling(looks) ___ ___ ___ ___ Mileage ___ ___ ___ ___ Price ___ ___ ___ ___ Brand Name ___ ___ ___ ___ Technology ___ ___ ___ ___ Ride Quality & Interiors ___ ___ ___ ___ Power & Performance ___ ___ ___ ___ After sales service ___ ___ ___ ___ 6. Rank these car manufacturers in the order you feel think they are better than the others? (i) (ii) (iii) (iv) (v) Americans Germans Indians Japnese Korean 7. Do you understand the technological terms such as CRDI, Duratorq, DICOR, Turbo etc. (i) (ii) Yes No 8. Where did you first saw/spotted or came to know about the car you are owning ? (i) (ii) (iii) (iv) Advertisements Magazine reports Friends/ Relatives On the road 9. How much you are satisfied with the mechanical components(engine, suspension, Transmission etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 10. How much you are satisfied with the interiors (seats, air conditioning ,dash board, ventilation etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 11. How much you are satisfied with the exterior (styling , body panels ,paint , rust & corrosion prob. , exteriors lights etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 12. How much you are satisfied with the vehicle performance (car ride ,handling braking etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 13. How much you are satisfied with the after sales service(dealer network,spares etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 14. How much you are satisfied with the ownership costs(mileage, insurance, spare costs,servicing etc) of the car ? Very Satisfied Satisfied Less Satisfied Not satisfied ___ ___ ___ ___ 15. A friend or relative of yours purchasing a car in the same segment as of your car you would : (i) (ii) (iii) (iv) Convince him Recommend him Won’t recommend Negative recommendation 16. If purchasing a second car or changing your car would you like to go for your current car again ? (i) (ii) Yes No References Websites www.ibef.org www.siamindia.com www.automonitor.co.in/siam.asp www.cybersteering.com www.indiacar.com Books SIAM journals ICMR Journals Magazines Autocar BS Motoring Business Today