syllabusFINE4927

advertisement

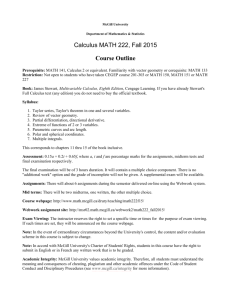

FINE 492 – INTERNATIONAL FINANCE II McGill University Prof. Art Durnev www.artdurnev.com art.durnev@mcgill.ca 514 Bronfman Building (514) 398-5394 Office hours: T, Th, 10:00 – 12:00, open door policy on W, 9-12 Course materials: Coursepack and WebCT In accord with McGill University’s Charter of Students’ Rights, students in this course have the right to submit in English or in French any written work that is to be graded. McGill University values academic integrity. Therefore all students must understand the meaning and consequences of cheating, plagiarism and other academic offences under the Code of Student Conduct and Disciplinary Procedures (see www.mcgill.ca/students/srr/honest/ for more information). L'université McGill attache une haute importance à l’honnêteté académique. Il incombe par conséquent à tous les étudiants de comprendre ce que l'on entend par tricherie, plagiat et autres infractions académiques, ainsi que les conséquences que peuvent avoir de telles actions, selon le Code de conduite de l'étudiant et des procédures disciplinaires. COURSE OBJECTIVES FINE 492 is designed to introduce students to practical applications of the global financial environment. The main objective of this class is to prepare you for valuing an international project, assessing the risks and returns of the project, and developing tools to mitigate the risks. We will cover capital budgeting issues in the international setting and methods to mitigate various risks. We will emphasize financial issues of the public-private partnership projects and governance regulations and procedures in different countries. The course is tailored to students seeking careers in the government sector, international banking and investment or with finance and strategy departments of corporations operating in the world markets. GRADING Midterm1 (Feb 8): Midterm 2 (March 15): 4 Cases (3 group and 1 individual): Final Project (includes presentation): Participation: 20% 25% 25% 20% 10% EXAMS The midterm dates are fixed. You must take the exam on these dates, even if you have other exams on the same day or in the same week. Extracurricular activities and family visits are not valid reasons to request an alternative exam date. If you miss an exam due to medical reasons, a doctor’s note should be presented. CASES Cases are an integral part of this course and constitute 25% of your grade. Cases 1, 3, and 4 are to be done in goups of up to 5 people. Case 2 has to be submitted individually. All group members are expected to contribute to the case analysis. You will be required to evaluate your teammates’ contribution. A case write-up has to contain an executive summary, the key questions addressed, and a conclusion. The case write-up must be no more than 4 pages long (exclusing references and appendixes) plus appendices with the font size of 11 and line spacing of 1.5. All tables and figures must be properly referenced in the text. Note that case studies rarely have one correct answer. FINAL PROJECT This project is to be done in groups of up to 5 people. You have to identify a specific “big” international project (business idea) you would like to start from scratch. You main objective is to obtain outside financing from international private investors and secure some state funds (sovereign wealth funds, central banks’ reserves). Examples of the scope of international projects include: space tourism, under-water transatlantic tunnel, establishing a new financial center, building a new airport, establishing a new Wikileaks-type website, establishing new housing units for economically disadvantaged people, fighting world hunger and infectious diseases, setting-up a new type of hedge fund, etc. You are expected to use your life experience. You are required to select your project, discuss it with me, and submit an interim report (2 pages long) by February 15. Your final analysis (max 10 pages long) should address the following issues: project description, capital budgeting analysis, financing (private vs. public, private-public partnership, Islamic financing), corporate governance structure, and the assessment of various types of risks (political risk, market risk, economic crisis risk). Each group is required to present their project during the last two-three classes. The number of presentation slides should not exceed 10 slides. You will be given 7 minutes per group for your presentation. CLASS PARTICIPATION You have to actively participate in class discussions to earn class participation grade which constitutes 10% of your final grade. If you are frequently absent from class, your class participation grade will be reduced. SUBJECTS (case due dates are preliminary) 1. REVIEW OF INTERNATIONAL PARITIES Courspack pp: 93 - 130 2. CAPITAL BUDGETING ISSUES IN FAST-GROWING ECONOMIES Case 1: Globalizing the cost of capital and capital budgeting at AES. Due Jan 18. Courspack pp: 247 - 274 3. HEDGING FOREIGN CURRENCY RISK: FORWARDS AND OPTIONS Case 2: Hedging currency risks at AIFS. Due Feb 1. Courspack pp: 131 - 164 Midterm 1: Feb 8 4. HEDGIND FOREIGN CURRENCY RISK: SWAPS Courspack pp: 165 - 192 5. GLOBAL CORPORATE GOVERNANCE ISSUES You have to select a project by Feb 15 and submit an interim report Articles to read: Explaining Differences in the Quality of Governance Among Companies: Evidence from Emerging Markets (A. Durnev and E. H. Kim), Journal of Applied Corporate Finance, Vol.19, Issue 1, 16-24 . 6. POLITICAL RISK Case 4: The Hermitage Fund: Media and corporate governance in Russia Courspack pp: 217 – 246. Due March 1. Midterm 2: March 15 7. PRIVATE-PUBLIC PARTNERSHIP Case 5: Dhārāvi: Developing India’s largest slum. Due March 22. Project presentations: March 31, April 5