Balance Sheets Lesson Plan

advertisement

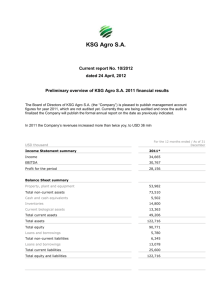

Junior and Senior level Ag Bus. Colorado Agriscience Curriculum Section: Advanced Agribusiness Unit: Agricultural Business Records Lesson Title: Balance Sheets Colorado Ag Education Standards and Competencies Colorado Model Content Standard(s): AGB11/12.03 - The student will be able to formulate and analyze financial records and use the information for evaluation and planning. Complete and analyze cash flow projections, income statements, and balance sheets. Math Standard 3: Students use data collections and analysis, statistics, and probability in problem-solving situations and communicate the reasoning used in solving these problems. Math Standard 6: Students link concepts and procedures as they develop and use computational techniques, including estimation, mental arithmetic, paper-and-pencil, calculators, and computers, in problem-solving situations and communicate the reasoning used in solving these problems. English Standard 4: Students apply thinking skills to their reading, writing, speaking, listening, and viewing English Standard 5: Students read to locate, select, and make use of relevant information from a variety of media, reference, and technological sources. Student Learning Objectives: Time: Upon completion of this lesson the student will be able to: 1. Define what a balance sheet is. 2. State the three kinds of analysis to use on a balance sheet. 3. State the three areas a balance sheet financially analyzes. 4. Compile a balance sheet from a real farm business. 50 minutes Unit 1, Lesson 4: Balance Sheets 1 Resource(s): 2005 National Farm Business Management Test Farm and Ranch Management, John Deere Instructions, Tools, Equipment, and Supplies: Italicized words are instructions to the teacher, normal style text is suggested script. *1 copy/student of the scenario found in the unit 4-6 scenario. It might even be helpful to make single sided copies so that a student can analyze several bits of information at one time. *Blank piece of paper for interest approach. *Projector and whiteboard with markers. *Blank balance sheet forms attached at the end of this lesson. Interest Approach: Have students pick a certain farm or ranch scenario familiar to your community. Once students have decided on a scenario hand out a blank piece of paper to each student. Once each student has a blank piece of paper in front of them, have them write/draw an asset or liability that would be familiar to the type of business they have picked. Each item must be stated and have a value. For example 10 head of cows - $9,000. Operating note at bank – $20,000. The interest approach will proceed from here. Hello students!! Today we are going to explore the wonderful world of balance sheets. I know you may remember these from previous years, but we are going to go into more detail to make sure you really know this skill for your own business needs one day. First, when I say go, I need you, as a class, to come up with a farm business or ranch scenario that is familiar to this community. For example, if you all want to work with a wheat farm scenario all you have to is say wheat farm. If there are several ideas we will put them on the board and vote. I am going to give you 1 minute. Go. Stop. Now that we have an idea, I am going to pass out a blank piece of paper to each of you. Once you have your piece of paper and I say go, you will have 1 minute to come up with an asset or liability that would be familiar to the farm business you have picked. For example your piece of paper may say 10 head of cows - $9,000 or operating note at bank - $20,000. If you have time you may draw a picture of your asset or liability. Are you ready? You have one minute, go. Stop. Now, when I say go, I need you all to stand up and I need you all to divide yourselves into asset and liability groups. The assets need to gather on one side of the room and the liabilities on the other. When I say go, you have 15 seconds. Go. Review and discuss why each is an asset or liability. (See if students break into the right groups and use this teachable moment to reinforce the information) Great now that you are all divided, when I say, “divide further,” I want you to, as a group, to divide into current and non-current entities. Do not mix assets and liabilities still stay separate. When you are complete we should have 4 groups. You have 2 minutes, “Divide further.” Stop student and review and discuss why each is asset or liability is current or non-current. Make corrections as you go. Great! Now when I say, “Do your math,” you have 2 minutes to add your group’s total. Unit 1, Lesson 4: Balance Sheets 2 Remember there should be four totals when we are done. “Do your math.” Stop. Now that you have done your math, when I say go I need a representative to write their groups total on the board. Make sure you label which group you are from. Go. Great! Now I need you all to sit down at your desk and each figure the net worth of this business for me. Remember the equation for net worth is assets – liabilities. You have 2 minutes, go. Stop. Let’s discuss your answers. Let’s also discuss why we have to divide assets and liabilities into current and non-current portions. What answers did you all get? Great, now I bet your wondering why we have to divide the balance sheet into current and non-current portions. You will see later today that several financial analysis procedures need to have current and non-current portions divided in order to tell what a business is doing right and what a business could do better. Let’s get out our notebooks so we can review further. Objective 1: Define what a balance sheet is. Utilize PowerPoint through lesson as it directly aligns with all note taking sections so you don’t have to write as much information on the board. I. What is a balance sheet? A. A balance sheet or commonly called “net worth statement” is a snapshot of a financial situation that lists assets, liabilities, and net worth. The accounting equation states that net worth = assets – liabilities. B. A balance sheet is further divided into current assets, current liabilities, noncurrent assets, and non-current liabilities in order to analyze a farm or ranch financially. C. Remember that current assets are those that have a useful life of one year. Example: Hay for cows. Current liabilities are those that are due within the current year. Example: Portion of term loan due this year. D. Remember that non-current assets are those that have a useful life of more than one year. Example: Tractor. Non-current liabilities are those that are due beyond the current year. Example: Portion of term loan due beyond this year. State the three kinds of analysis to use on a balance sheet. Objective 2: I. What are the three kinds of analysis to use on a balance sheet? A. Comparative analysis – Comparison of figures from the same dates each year to determine if the business equity is growing or shrinking. B. Projected analysis – This consists of making balance sheets for the future for expected farm situations and analyzing them to see probable trends. C. Ratio analysis – A tool to measure the financial condition of one farm business against another--using financial ratios. State the three areas a balance sheet financially analyzes. Objective 3: Unit 1, Lesson 4: Balance Sheets 3 I. What are the three areas a balance sheet financially analyzes? A. Liquidity – The ability of a business to generate enough cash to pay bills without disrupting business. Liquidity measures determine the ability to meet short term debt and other obligations from available cash. Ratios that help determine liquidity are as follows: 1. Current ratio = Current assets/Current liabilities. Therefore a ratio of $3.85:$1.00 means that there would by $3.85 worth of current assets for every $1.00 of current debt. This means that a business with this type of ratio would be liquid. 2. Working capital = Current assets – current liabilities. Therefore a business that has $62,550 worth of current assets and $16,254 worth of current liabilities would have a working capital of $46,296. This is also a reflection of a business that is liquid. 3. Debt Structure = Current Liabilities/Total Liabilities. The higher this percentage the more current assets will have to be used to service debt. B. Solvency – Measures the ability of all assets, if sold at market value, to cover all debts. A business is solvent if there are more assets than liabilities. Ratios that help determine solvency are as follows: 1. Debt-to-Asset ratio = Total liabilities/Total Assets. Lenders usually prefer to provide loans that are equal to or less than 50% of assets. Therefore a ratio of .50:1 or less is preferred. 2. Debt to Equity ratio = Total liabilities/Net Worth (Owner’s Equity). Lenders prefer a debt to equity ratio of less than one. This shows the owners contribution is more than the borrowed funds. 3. Equity to Asset ratio = Net worth/Total assets. A ratio of .50:1 would mean that for every $1.00 of assets there is .50 in equity. C. Equity – The owner’s share of the business. Compile a balance sheet from a real farm business. Objective 4: Students will need to complete the beginning of the year balance sheet and end of the year balance sheet in order to complete the following income statement lesson. Now that we are through discovering the ins and outs of a balance sheet let’s get some hands on experience compiling and analyzing balance sheets for Tucker Farms. Use the attached forms to pass out and utilize in compiling balance sheets. Review/Summary: Application-Extended Classroom Activity: Close class with analyzing the ratios that were discovered in compiling the balance sheets. Ask if the business is liquid and solvent. Ask what the business could do to improve. Objective 4 works well as students are asked to compile a balance sheet from information retrieved from the farm scenario previously presented. Unit 1, Lesson 4: Balance Sheets 4 Application--FFA Activity: This information was pulled from the national farm business management exam. This whole curriculum would be perfect to get a farm business management team started. Application--SAE Activity: Have students look at and analyze their own financial sheets in their own record books. Evaluation: Use the beginning balance sheet for practice. Use the ending balance sheet for an evaluation. Evaluation Answer Key: Attached. Unit 1, Lesson 4: Balance Sheets 5 Balance Sheets 2004 Tucker Farm Business Assets Current Assets 1/1/04 12/31/04 ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ Total Current Assets _________________ __________________ Non-Current Assets ______________________________________________________________________________ Total Non-Current Assets __________________ __________________ Total Farm Assets ______________ ______________ Liabilities Current Liabilities _______________________________________________________________________________ Total Current Liabilities _________________ __________________ Total Non-Current Liabilities _________________ __________________ Total Farm Liabilities _____________ ______________ Net Worth (Equity) _____________ ______________ Non-Current Liabilities Unit 1, Lesson 4: Balance Sheets 6 Balance Sheets 2004 Tucker Farm Business Assets Current Assets 1/1/04 12/31/04 Bank Balance________________________$99,661.00__________________________$117,793.00__ Savings and CD’s____________________ $56,176.00__________________________$50,000.00___ Accounts Receivable__________________$8,376.00___________________________$3,900.00____ Crops and Feed Inventory______________$163,010.00_________________________$127,965____ Market Livestock Inventory_____________$50,839.00__________________________$64,590.00___ Prepaid Expenses___________________ $19,234.00__________________________$8,257.00____ Total Current Assets ______$397,276___ _______ $372,505.00__ Non-Current Assets Machinery, Buildings, and Land________$626,546.00_________________________ $659,201.00__ Total Non-Current Assets ______$626,546.00_________________________$659,201.00__ Total Farm Assets _____$1,023,842.00_______________$1,031,706.00 Liabilities Current Liabilities Accounts Payable w/Merchants________$1,829.00__________________________$(50.00)________ Total Current Liabilities ______$1,829.00___ ______$(50.00)________ Total Non-Current Liabilities ______$0.00_______ ______$0.00__________ Total Farm Liabilities ____$1,829.00__ ____-$50.00______ Net Worth (Equity) ____$1,022,013.00__ _____$1,031,756.00 Non-Current Liabilities Unit 1, Lesson 4: Balance Sheets 7 Balance Sheet Ratios 1/1/04 12/31/04 Liquidity Current Ratio_______________________________________________________________________ Working Capital_____________________________________________________________________ Debt Structure______________________________________________________________________ Solvency Debt/Asset Ratio____________________________________________________________________ Equity/Asset Ratio___________________________________________________________________ Debt/Equity Ratio____________________________________________________________________ Is this business liquid?________________________________________________________________ Is this business solvent?______________________________________________________________ Unit 1, Lesson 4: Balance Sheets 8 Balance Sheet Ratios 1/1/04 12/31/04 Liquidity Current Ratio_____________________________217.22:1_____________________7450.10:1______ Working Capital__________________________395,467______________________372,555________ Debt Structure_________________________________1:1__________________________1:1______ Solvency Debt/Asset Ratio__________________________.002:1________________________.000:1________ Equity/Asset Ratio_________________________.998:1_______________________1.000:1________ Debt/Equity Ratio__________________________.002:1________________________.000:1________ Is this business liquid?____________________Yes____________________________________________ Is this business solvent?___________________Yes___________________________________________ Unit 1, Lesson 4: Balance Sheets 9