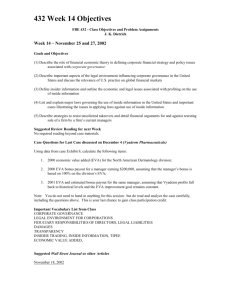

Financial Techniques Workshop

advertisement