BAT - E & Y rport

advertisement

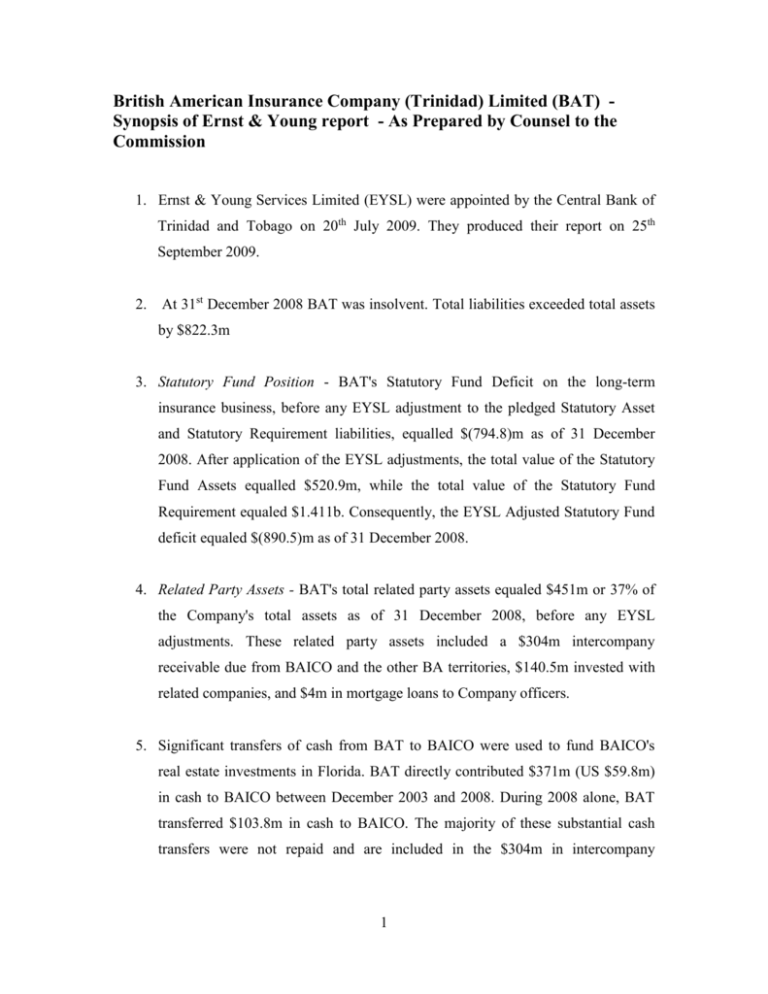

British American Insurance Company (Trinidad) Limited (BAT) Synopsis of Ernst & Young report - As Prepared by Counsel to the Commission 1. Ernst & Young Services Limited (EYSL) were appointed by the Central Bank of Trinidad and Tobago on 20th July 2009. They produced their report on 25th September 2009. 2. At 31st December 2008 BAT was insolvent. Total liabilities exceeded total assets by $822.3m 3. Statutory Fund Position - BAT's Statutory Fund Deficit on the long-term insurance business, before any EYSL adjustment to the pledged Statutory Asset and Statutory Requirement liabilities, equalled $(794.8)m as of 31 December 2008. After application of the EYSL adjustments, the total value of the Statutory Fund Assets equalled $520.9m, while the total value of the Statutory Fund Requirement equaled $1.411b. Consequently, the EYSL Adjusted Statutory Fund deficit equaled $(890.5)m as of 31 December 2008. 4. Related Party Assets - BAT's total related party assets equaled $451m or 37% of the Company's total assets as of 31 December 2008, before any EYSL adjustments. These related party assets included a $304m intercompany receivable due from BAICO and the other BA territories, $140.5m invested with related companies, and $4m in mortgage loans to Company officers. 5. Significant transfers of cash from BAT to BAICO were used to fund BAICO's real estate investments in Florida. BAT directly contributed $371m (US $59.8m) in cash to BAICO between December 2003 and 2008. During 2008 alone, BAT transferred $103.8m in cash to BAICO. The majority of these substantial cash transfers were not repaid and are included in the $304m in intercompany 1 receivable. This funding and subsequent non repayment contributed to BAT's liquidity constraints and insolvent position. 6. BAT also provided cash to the territories which was subsequently routed towards the funding of the Florida investments. During 2008 alone, BAT either transferred cash to or made payments on the territories' behalves that amounted to $173m. Therefore, the funding provided to the territories also contributed to BAT's insolvency position. 7. The source of these cash transfers to BAICO from BAT was primarily the premium receipts received from the sale of annuity policies offered by the Company. These annuity products, which included the FPA, FPA II and EFPA, provided guaranteed interest rates as high as 12.7% during 2008 with maturity periods of three to five years. BAT also introduced short-term annuities with maturities of less than one year in 2008 with an average interest rate of 6.5%. 8. BAT's business model was heavily dependent on the relatively high rate of rollover or reinvestment of these policies upon maturity. This rollover rate averaged 89% during 2008 but declined to less than 30% subsequent to the January 2009 Memorandum of Understanding ("MOU") announcement by the Government of the Republic of Trinidad and Tobago ("GORTT"). The total mortgage balance as of December 2008 equaled $115.8m while the Investment Property balance equaled $176.5m. 9. In contrast, the returns the Company earned from investing these premium receipts in 2008 averaged 6.3%. This mismatch between the interest offered on the annuities and the returns generated also contributed to BAT's insolvency position, as asset growth has not matched the increase in liabilities. Most of these funds were used to finance the real estate developments in Florida, the largest 2 being the Green Island investment. There was no cash flow or investment yield from this investment. 3