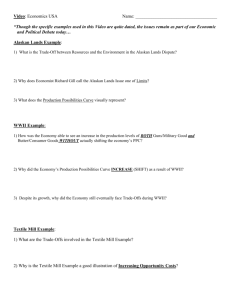

chapter 5

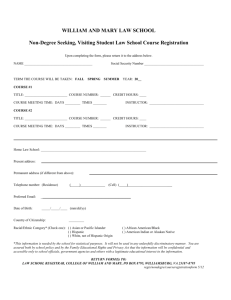

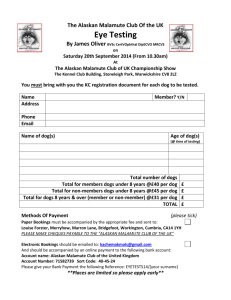

advertisement