379 Geometric, Stocks, Arithmetic v08

advertisement

n-year geometric increasing annuity

0

2

1

$K

3

n

$K(1+r) $K(1+r)2

PV

Imagine that payments increase every period by a

ratio (1+r). (beware - notation is inconsistent

between economics, business, math and actuarial

textbooks, especially once we get into inflation and

real rates of interest). Also, let’s have the first

payment of amount K (not yet increased though it’s

a year after the date at which we take the PV0). Use

PV0= K { 1/(1+i) + (1+r)/(1+i)2 + (1+r)2/(1+i)3

+…+ (1+r)n-1/(1+i)n}

= [K/(1+i)]

=K

1 – (1+𝑟)𝑛 /(1+𝑖)𝑛

1−(1+𝑟)/(1+𝑖)

1 – (1+𝑟)𝑛 /(1+𝑖)𝑛

www.utstat.utoronto.ca/sharp

𝑖−𝑟

Geom increasing annuity in actuarial notation

0

2

1

$K

3

n

$K(1+r) $K(1+r)2

PV

Being careful about the first term, rewrite as

PV0 = [K/(1+r)] {(1+r)/(1+i) + (1+r)2/(1+i)2 +

+…(1+r)3/(1+i)3 +…+ (1+r)n/(1+i)n}

= [K/(1+r)]

an (at (1+i)/(1+r)-1)

Note that in this formulation we effectively say that

payments are based on a notional time 0 amount of

K/(1+r) , which to an actuary makes intuitive sense.

But finance people tend to think of the first actual

payment of K at time 1. Both are correct.

www.utstat.utoronto.ca/sharp

Value of a stock: Gordon growth model (finance)

0

$K

∞

3

2

1

$K(1+r) $K(1+r)2

PV

PV0= K

1 – (1+𝑟)𝑛 /(1+𝑖)𝑛

𝑖−𝑟

= K/(i-r)

if the dividends go on forever. In reality we sell the

stock some time for a sale price which reflects the

present value then of the then-future dividends. This

ends up with the same answer as assuming we never

sell. The value of i might be taken as current market

Treasury bond yield rate, perhaps adjusted for risk,

and the analyst estimates next year’s dividend K and

the increase rate r. In real life this formula gets

some use as a rough-and-ready tool, maybe to

compare two stocks. Or to explain a big stock

market fall as a change in business confidence

resulting in a small change in the implicitly assumed

r.

www.utstat.utoronto.ca/sharp

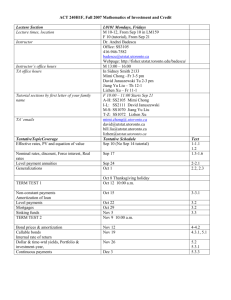

SECTION 7 - PAYMENTS FOLLOW A

GEOMETRIC PROGRESSION

SOA Exam FM/CAS Exam 2 Study Guide © S.

Broverman 2008 www.sambroverman.com 89

Example 27 (SOA): Common stock X pays a

dividend of 50 at the end of the first year, with each

subsequent annual dividend being 5% greater than

the preceding one. John purchases the stock at a

theoretical price to earn an expected annual effective

yield of 10%. Immediately after receiving the 10th

dividend, John sells the stock for a price of P . His

annual effective yield over the 10-year period was

8%. Calculate P.

www.utstat.utoronto.ca/sharp

www.utstat.utoronto.ca/sharp

PROBLEM SET 7

Exam FM/CAS Exam 2 Study Guide © S.

Broverman 2008

12. Today is the first day of the month, and it is

Smith's 40th birthday, and he has just started a new

job today. He will receive a paycheck at the end of

each month (starting with this month). His salary

will increase by 3% every year (his monthly

paychecks during a year are level), with the first

increase occurring just after his 41st birthday. He

wishes to take c% of each paycheck and deposit that

amount into an account earning interest at an annual

effective rate of 5%. Just after the deposit on the day

before his 65th birthday, Smith uses the full balance

in the account to purchase a 15-year annuity. The

annuity will make monthly payments starting at the

end of the month of Smith's 65th birthday. The

monthly payments will be level during each year,

and will increase by 5% every year (with the first

increase occurring in the year Smith turns 66). The

starting monthly payment when Smith is 65 will be

50% of Smith's final monthly salary payment. Find c

www.utstat.utoronto.ca/sharp

www.utstat.utoronto.ca/sharp

n-year arithmetic increasing annuity

0

1

• Take

PV

2

• $1

• $2

v + 2v2 + 3v3 + 4v4 + ……+ nvn

Ian =

(1+i) Ian =1 + 2v + 3v2 + 4v3 + ..…+ nvn-1

Subtract

i Ian = 1 + v + v2 + v3 + ..…+ vn-1 - nvn

Ian =

ä 𝑛 − 𝑛 𝑣 𝑛

𝑖

This arithmetic increasing annuity is less common in

real life than the geometric. But it can be useful if

e.g. regular coupon payments are accumulated in a

fund which pays interest (on the arithmetically

increasing balance) into another fund.

www.utstat.utoronto.ca/sharp

Example 33 (SOA): (Broverman FM manual):

Coco invests 2000 at the beginning of the year in a

fund which credits interest at an annual effective rate

of 9%. Coco reinvests each interest payment in a

separate fund accumulating at an annual effective

rate of 8%. The interest payments from this fund

accumulate in a bank account that guarantees an

annual effective rate of 7%. Determine the sum of

the principal and interest at the end of 10 years.

www.utstat.utoronto.ca/sharp

www.utstat.utoronto.ca/sharp

n-year arithmetic decreasing annuity

0

1

•

• PV

Dan =

2

• $n

• $n-1

nv + (n-1)v2 + (n-2)v3 ……+ vn

(n+1) an = (n+1)v + (n+1)v2 +(n+1)v3 ++ (n+1) vn

Subtract

Dan = (n+1) an - Ian

www.utstat.utoronto.ca/sharp