Outline_ACT240 - University of Toronto

advertisement

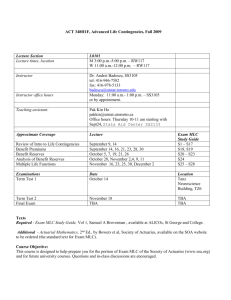

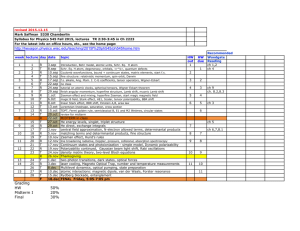

ACT 240H1F, Fall 2007 Mathematics of Investment and Credit Lecture Section Lecture times, location Instructor Instructor’s office hours TA office hours Tutorial sections by first letter of your family name TA’ emails TentativeTopicCoverage Effective rates, PV and equation of value Nominal rates, discount, Force interest, Real rates Level payment annuities Generalizations TERM TEST 1 L0101 Mondays, Fridays M 10-12, From Sep 10 in LM159 F 10 (tutorial), From Sep 21 Dr. Andrei Badescu Office: SS3105 416-946-7582 badescu@utstat.utoronto.ca Webpage: http://fisher.utstat.toronto.edu/badescu/ M 13:00 – 16:00 In Sidney Smith 2133 Mimi Chong –Fr 3-5 pm David Januszewski Tu 2-3 pm Jiang Yu Liu – Th 12-1 Lizhen Xu – Fr 11-1 F 10:00 – 11:00 Starts Sep 21 A-H: SS2105 Mimi Chong I-L: SS2111 David Januszewski M-S: SS1070 Jiang Yu Liu T-Z: SS1072 Lizhen Xu mimi.chong@.utoronto.ca david@utstat.utoronto.ca bill.liu@utstat.utoronto.ca lizhen@utstat.utoronto.ca Tentative Schedule Sep 10 (No Sep 14 tutorial) Sep 17 Text 1-1.1 1.2 1.3-1.6 Sep 24 Oct 1 2-2.1 2.2, 2.3 Oct 8 Thanksgiving holiday Oct 12 10:00 a.m. Non-constant payments Amortization of loan Level payments Mortgages Sinking funds TERM TEST 2 Oct 15 3-3.1 Oct 22 Oct 29 Nov 5 Nov 9 10:00 a.m. 3.2 3.2 3.3 Bond prices & amortization Callable bonds Internal rate of return Dollar & time-wtd yields, Portfolio & investment-year, Continuous payments Nov 12 Nov 19 4-4.2 4.3.1, 5.1 Nov 26 5.2 5.3.1 5.3.3 Dec 3 ACT 240 Fall 2007 (Continued) Texts Mathematics of Investment and Credit, 3rd. Ed., Samuel A Broverman, ACTEX Publications, 2004, plus Solutions Manual, both available in U of T Bookstore, plus Prof Broverman’s Fall 2007 manual for Exam FM, available to ACT 240 students for the cost of printing: Act Sci Club, 6th Floor SS6007. You are requested to bring the text and manual to each class – without it you will often be lost. Course Objective: This course is designed to help prepare you for exam FM of the Society of Actuaries (same texts) and for future university courses. You are expected to read and understand the descriptive portions of the text yourself. Questions and in-class discussions are encouraged. Marking Scheme: The final course mark will be determined via 2 in-class term tests, each worth 25% and a 2 hour final exam worth 50%. The tests and final exam will be entirely in multiple choice format. At least half of the marks on the tests and final exam will be from a portion of a large set of questions indicated to you in advance, with small changes such as to the interest rate. Do I Have to Write at Supersonic Speed to take Notes in Lecture No. Anything which is printed or typewritten or photographed and anything which is from the Wall Street Journal or Yahoo Finance etc. is guaranteed to be put onto the course web site, probably within 24 hours of the end of the lecture. The lectures will often be structured around extracts from the FM study manual by Prof Sam Broverman. The text is expected to be covered in the above order, though the timing may deviate from the day-to-day schedule above. Missed Term tests: Please do not take this course if you plan to be sick for the obligatory term tests. There will be no make-up tests. Should you miss a term test, you are required by faculty regulation to submit, within one week, appropriate documentation to the course instructor or the Departmental office: SS6018. Print on the documentation your name, student #, the course number and the date. We are skeptical about accepting medical certificates unless the doctor specifically indicates that in his/her opinion there was a disabling health problem on the day of the test. If your documentation is accepted, the test’s weight will be shifted such that your final mark will consist of a 1/3 weighting on the other term test and a 2/3 weighting on the final exam. If documentation is not provided or is not accepted, your test mark for the missed test will be zero. Extract from SoA Exam FM Syllabus Knowledge and understanding of financial mathematics concepts are significantly enhanced through working out problems based on those concepts. Thus in preparing for the Financial Mathematics examination, whichever of the source of textbooks students choose to use, students are encouraged to work out the textbook exercises related to the listed readings. Calculator A calculator is essential for working exercises, tests and final exam. The Texas Instruments BA II PLUS calculator is one of the calculators allowed on the Society of Actuaries examinations; it has the financial functions that would be needed for this course, and is recommended. The TI BA35 can also be used on ACT240 and for SoA Exam M. It is necessary for ACT240 that your calculator be able to solve for the interest rate i in calculations such as 10(1+i) 4 + 20(1+i)3 +30(1+i)= 160. ONLY the non-programmable calculators are allowed. Continuation in ACT There are rules regarding the minimum mark needed in ACT240, ACT245 and ACT247. It’s important to visit the actsci webpage for details (www.utstat.toronto.edu , take the actuarial program link). Emails As a new policy rule at University of Toronto, I will only answer back emails coming from the university accounts. THE DEADLINE FOR STUDENTS WHO WANT TO MOVE TO ACT230 IS ON THE 5TH of October 2007!!! If you want to receive information about jobs, presentations etc. related to the actuarial field, please subscribe to the ACT SCI club by sending a blank email at the following address: uoftactsci- subscribe@yahoogroups.com. ONLY IF you do not receive any response to your blank email, please write directly to the ACT SCI club address at uoftactsci@yahoo.ca.