TS CAS Manager product enables companies to

advertisement

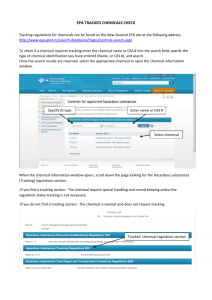

Press Contact: Jenny Swift, Rivercalm. Tel: 0044 207 665 1636 Email: swift@rivercalm.com Tradeshape launches new solution to deliver control of the post trade environment ● TS CAS Manager product enables companies to ‘know their traded world’ London, United Kingdom and Cork, Ireland – 23rd May, 2007 – Tradeshape (www.tradeshape.com), an innovative provider of cash and liquidity management solutions, today announced that it has launched TS CAS Manager, a new solution to empower financial institutions with the ability to better manage their capital once a trade has been executed and thus to ‘know their traded world’. The information required for any company to have an accurate and up to date position of its cash and liquidity is actually stored in multiple systems, departments and locations and often collated manually. Until now, there has not been a solution that is purely focused on extracting and making productive use of that data. However, TS CAS Manager from Tradeshape can combine data from all relevant sources to provide up to the second stock and cash positions. This enables more efficient liquidity management and allows users to monitor and prioritise the flow of transactions irrespective of asset class, be alerted to bottlenecks and transaction process failures and to run on-line real-time reports and analysis of transaction flows. Tradeshape was founded by executives with over 60 years of experience in financial messaging, cash management and automated transaction processing. Developed on open standards and written in Java, the solution is platform independent which ensures it can run in any environment and interface with any system, regardless of technical architecture. “We are piloting TS CAS Manager with early adopters and product partners from several well known financial institutions. The reaction we have had when demonstrating the solution has been extremely positive. Companies appreciate that this is a dedicated solution that was built for a specific task and as a result it will allow users to make better, more informed business decisions which will have a critical impact on profitability and at the same time save on manpower,” said Siobhain Hayden, Managing Director, Tradeshape. TS CAS Manager is targeted at fund managers, wealth managers, and hedge funds. Initially Tradeshape will target the UK and European region but in the longer term the company plans to move into the North American market. “Tradeshape is a young, dynamic company backed by people with a tremendous amount of experience in the financial services industry. It is poised for rapid growth based on solutions that deliver increased liquidity control and better financial transaction processing and analysis,” concluded Hayden. -endsAbout Tradeshape Tradeshape is an innovative provider of cash and liquidity management solutions that empower financial institutions with the ability to better manage their capital once a trade has been executed and thus to ‘know their traded world’. The solutions are targeted at fund managers, wealth managers and hedge funds. Tradeshape was founded by executives with over 60 years of experience in financial messaging, cash management and automated transaction processing with the aim of delivering increased liquidity control and better financial transaction processing and analysis. Tradeshape is located in Cork, Ireland, and London, United Kingdom. For more information see www.tradeshape.com.