requests for vendor information

advertisement

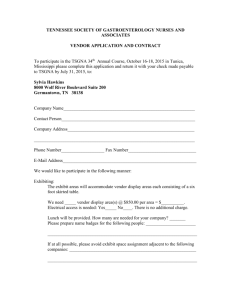

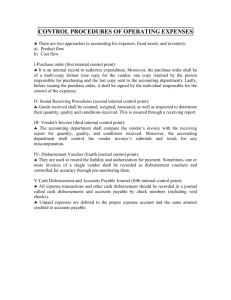

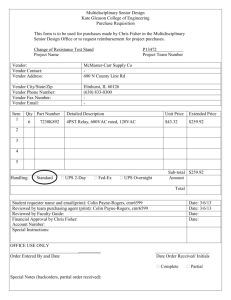

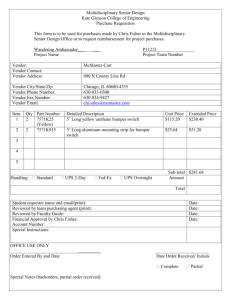

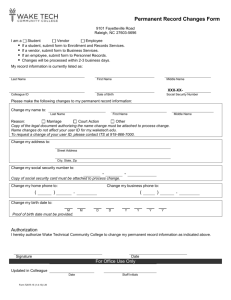

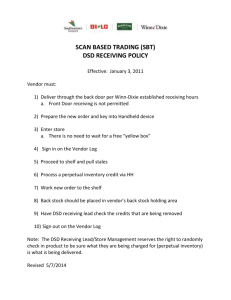

REQUESTS FOR VENDOR INFORMATION Revised May 2015 Objective: To ensure prompt and accurate set up of new vendors and resident referrals as well as providing answers to your requests timely and efficiently. Section B - Contents Completion of a Request for Taxpayer Identification Number form.............2 Setting up a New Vendor in Onesite..............................................................5 Certificate of Insurance Requirements...........................................................6 Vendor IDs’ for Resident Referrals ...............................................................7 Vendor Payments ...........................................................................................8 Security Deposit Refunds ..............................................................................10 Blank Vendor Information Request Form .....................................................11 Sample Vendor Information Request Form ...................................................12 1 REQUESTS FOR VENDOR INFORMATION Completion of a Request for Taxpayer Identification Number form Objective: Completion of a Request for Taxpayer Identification Number form to ensure accurate compliance with the IRS. Effective Date: May 2015 Procedure: The first step to having any new vendor (i.e., painter, plumber, roofer, etc.) created in our system is to supply the vendor with a Request for Taxpayer Identification Number form (Our version of a W-9 form; see page 4 of this section or it can found on the Intranet). The vendor must complete and sign this form or a comparable W-9. No work may be performed by the vendor until this form is received by the Accounts Payable department, the tax ID number is checked for validity and a vendor ID has been created. You can check with your Accounts Payable Representative to see if a national vendor (vendor not just local to your area) has already been set up in the system prior to obtaining the required tax information. If so your Accounts Payable Representative can set up the vendor from the existing information already in the system. You may still be asked to obtain the tax information if it is not current. Upon receipt of the completed form from the vendor, the next step is to email your Accounts Payable Representative both the Request for Taxpayer Identification Number form and the Vendor Information Request form. See Page 5 of this section for instructions on how to complete the “New Vendor ID Needed” area of the Vendor Information Request form. Note: The validity of the vendors’ tax ID number must be checked by your Accounts Payable Representative using a website provided by the IRS. We can no longer assume that the tax ID or reporting status provided by the vendor is correct. If the vendor’s tax information is rejected by the IRS you will need to get a corrected Request for Taxpayer Identification Number form from the vendor. Resubmit the form to accounts payable to be rechecked with the IRS before the Vendor ID is set up and before any work can be performed by the vendor. Your Accounts Payable Representative will notify you by email when the vendor has been set up. 2 The following are exceptions to this rule: 1. 2. 3. 4. Employees Petty cash reimbursement care of manager or other Resident referrals Federal or State agencies Once a vendor has been created, please notify your Accounts Payable Representative of any changes affecting that vendor. For example if a vendor’s name changes then you need to treat this vendor as a new vendor and get a completed and signed Request for Taxpayer Identification Number Form. Email the form along with the Vendor Information Request form to Accounts Payable. If other vendor information changes, for example, the remittance address, account number, etc. then email Accounts Payable with those changes. Do not make these changes in Onesite Purchasing. The information does not flow back to Onesite Accounting. 3 4 REQUESTS FOR VENDOR INFORMATION Setting up a New Vendor in Onesite Objective: New Vendor ID’s must be set up at the corporate level and they will download into Onesite Purchasing on a daily basis or on demand as needed. Effective date: May 2015 Procedure: In order for a new Vendor ID to be set up in Onesite Purchasing certain information must be provided to your Accounts Payable Representative. The Vendor Information Request form can be located in the Intranet under Accounting/Accounting Forms. See the blank copy of this form on page 11 and a sample form is also located on page 12 of this section. Please fill out the following information when requesting a new vendor to be set up: 1. 2. 3. 4. 5. 6. 7. Full vendor name (who the checks are payable to) Full vendor remittance address Phone number Fax number E-mail address Our account number supplied by the vendor Vendor Insurance Certificate (if applicable) Email this form to your Accounts Payable Representative along with a completed and signed Request for Taxpayer Identification Number form completed by the vendor (e-mail these together, not in separate e-mails). Accounts payable will verify the vendor with the IRS, set up the vendor in Accounting and run a Site Data Exchange. The vendor will be available for selection in Onesite Purchasing later that day or early the following day. NOTE: It is acceptable to send this information in a regular email and not on the Vendor Information Request form. We just ask that you include all the information above so accounts payable does not have to go back and forth requesting additional information. If you were notified that a vendor has been set up and you are unable to pull up that vendor then contact Accounts Payable. The vendor may have been marked as inactive by the system and it is a simple matter to fix by Accounts Payable. The Request for Vendor Information AND the signed Request for Taxpayer Identification Number forms MUST BOTH be received by your Accounts Payable Representative before any vendor information can be checked with the IRS and created in the system. The vendor cannot perform any work until you have been notified by your Accounts Payable Representative that the vendor has been set up. For those vendors that work on property, a certificate of insurance must be provided before those vendors can be set up in the system. See page 6 for more details on insurance certificates. 5 REQUESTS FOR VENDOR INFORMATION Certificate of Insurance Requirements Objective: Vendors must have adequate insurance to safeguard their people, our people and our assets. Effective date: May 2015 Procedure: Before any work begins on the Community, a vendor or contractor must provide the following proof of insurance: General Liability – With limits of liability to $1,000,000 for each occurrence with a $2,000,000 aggregate. Workers Compensation – With limits of liability not less than $100,000 for each accident, $100,000 for each employee and a $500,000 disease limit. If the vendor does not have the minimum requirements listed above on the certificate of insurance, the Regional Manager or National Maintenance Supervisor must approve the vendor prior to any work being completed. The legal name of the community as well as Benchmark Management of (State) Inc. should be listed on all insurance certificates as Primary Additional Insured, on a non-contributing basis. (Our insurance agent highly recommends this language be used under the Description of Operations section on the certificate.) Copies of insurance certificates should be provided to your Accounts Payable Representative at the Corporate Office. The original can be kept in alphabetical order on site in a binder. Accounts Payable will review the certificates before entering the insurance expiration dates in Onesite Accounting, along with other pertinent information. This information will download into Onesite Purchasing. If the vendor’s insurance has expired, you will not be able to enter a purchase order until a new certificate has been received and updated in the system by Accounts Payable. At the beginning of each month Accounts Payable will email each Regional Manager and Community Manager a copy of the Vendor Insurance Report. This report is run out of Onesite Accounting. The report will contain insurance certificates that will expire within the next couple of months as well as vendors whose certificates have already expired. This will help the Community Manager to be proactive in obtaining the certificates prior to expiration, so as not to hold up any work that needs to be completed 6 REQUESTS FOR VENDOR INFORMATION Vendor IDs’ for Resident Referrals Objective: Vendor ID’s for resident referrals must be set up at the corporate level and they will download into Onesite Purchasing on a daily basis. Effective date: May 2015 Procedure: In order for a Vendor ID to be set up in Onesite for a resident referral, certain information must be provided to your Accounts Payable Representative. In the forms workbook (excel) provided by Corporate or on the Intranet, you will find a form labeled Vendor Information Request. Blank form & sample on page 11 & 12. Please fill out the following information when requesting a new vendor to be set up for a resident referral: 1. Full name of Resident - as they file on their tax return 2. Complete Address 3. Social Security Number - A tax form is not required because the validity of the social security number has been checked during the application process. Email this form to your Accounts Payable Representative. They will set up the vendor in accounting and run a Site Data Exchange. The vendor will be available for selection in Onesite Purchasing later that day or early the following day. NOTE: It is also acceptable to send this information in a regular email and not on the form. We just ask that you include all the information above, so accounts payable does not have to back and forth requesting additional information. If you were notified that a resident referral Vendor ID has been set up and you are unable to pull up that Vendor ID, then contact your Accounts Payable Representative. That Vendor ID may have been marked as inactive by the system and it is a simple matter to fix by accounts payable. Please see Section C, page 11 of this manual for more on resident referrals. 7 REQUESTS FOR VENDOR INFORMATION Vendor Payments Objective: A Vendor Information Request form must be filled out for any vendor payment questions if the information can not be located in Onesite Purchasing. Effective date: May 2015 Procedure: Before contacting the Accounts Payable Department, regarding payment to a vendor, check the Payments Tab in Onesite Purchasing. This tab is updated every evening with payments made that day and it will provide you with the following information: vendor name, dollar amount, check date and check number. If you click on the view button next to each payment, the invoice number will also be displayed. Check Registers are also emailed to each Community Manager at the beginning of the month for the prior month’s activity. The check register not only shows payments to vendors but provides additional information needed for you to complete your Replacement Reserve report. The status of an invoice shows as “Transmitted” in Onesite Purchasing until the invoice is paid. At that time the status will change to “Paid”. There may be some invoices that never change to a “Paid” status. This is because one of three possible changes has occurred in Onesite Accounting: Invoices are changed due to incorrect vendor ID, incorrect invoice number or incorrect dollar amount. We try to keep changes to a minimum to ensure as much information as possible flows back to Onesite Purchasing. Those invoice payments can still be located on your monthly check registers. At this point if you still cannot locate a specific payment, please fill out the information below on the Vendor Information Request form located in the forms workbook (excel) provided by Corporate and on the Intranet. Email the form to your Accounts Payable Representative upon completion (See sample on page 12 of this section): 1. 2. 3. 4. 5. 6. Vendor ID Full vendor name Invoice number Invoice date Invoice amount Community name (only necessary if the check was to be cut off of a 8 community other than your own) NOTE: It is also acceptable to send this information in a regular email and not on the form. We just ask that you include all of the information on the previous page so accounts payable does not have to go back and forth requesting additional information. If you see that the payment has been made to the vendor 10 or more days ago and the vendor claims they have not received the check, please provide Accounts Payable with the following information. 1. 2. 3. 4. 5. Vendor name Vendor address-in case the check was lost in the mail due to incorrect address Check number Check date Check amount The Accounts Payable Department will verify the status of the check with the bank and will email you back with one of following three responses: The check has cleared our bank and a copy of the cancelled check is attached. The check has cleared our bank and a copy of the cancelled check can be provided within a day for a small fee charged by the bank. The bank will only charge a fee if a copy of a current month’s check is needed. If the check is from a prior month and the bank statements have been received, then we have the cancelled checks on a CD at the Corporate Office. At that point no charge is necessary. Note: Depending on the bank we may have access to cancelled checks right away. The check has not cleared our bank. A stop payment will be issued and upon confirmation of the stop payment (24 hours) a replacement check will be issued. . 9 REQUESTS FOR VENDOR INFORMATION Security Deposit Refunds Objective: A Vendor Information Request form must be filled out for verification of payment of any security deposit refunds. Effective date: May 2015 Procedure: Security deposit refunds upload into the Onesite accounting software whenever the Accounts Receivable (A/R) date is advanced in Onesite Leasing and Rents. Dates should be advanced daily and kept current. Accounts Payable will cut these checks on a weekly basis to ensure timely payment of the refunds upon receipt of the printed Final Account Statement (FAS). Send these FASs’ to the “Accounting A/P” email address per instructions located in Section C page 6 of this manual. To determine whether a security deposit has been paid, please fill out the information below on the Vendor Information Request form located in the forms workbook (excel) provided from Corporate. Email your request to your Accounts Payable Representative. 1. 2. 3. 4. 5. Resident name or who the check was payable to if not the resident Resident address Apartment number Date vacated Amount due NOTE: It is also acceptable to send this information in a regular email and not on the form. We just ask that you include all of the information above so accounts accounts payable does not have to go back and forth requesting additional information. Please keep in mind that it can sometimes take up to three weeks from the time the check is cut for the resident to receive a refund, depending on how long the post office takes to redirect the former resident’s mail. 10