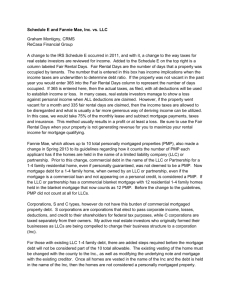

jobs in risk management

advertisement

JOBS IN FINANCE CREDIT RISK and RISK MANAGEMENT OPPORTUNITIES Summer 2002 Credit Risk Administrator USAA San Antonio, TX 3+ years in consumer credit risk management and analysis Imagine a workplace…TM …rich in culture, benefits and innovation. That's USAA! USAA has served present and former members of the U.S. military and their families since 1922 and is one of America’s leading insurance and financial services companies. Headquartered in San Antonio, Texas, with offices throughout the nation, USAA is a dynamic, Fortune 500 company with more than 4.7 million members and assets in excess of $60 billion. We made Fortune’s "Top 100 Best Companies to Work For” list from 1997-2000 and placed 12th on Training magazine’s “Top 50 Companies for Best Training Programs.” As a CREDIT RISK ADMINISTRATOR in our San Antonio, TX headquarters, you will provide strategic credit risk analysis to optimize the performance of Bank loan products, managing the risk while supporting USAA Federal Savings Bank’s market and financial goals. In addition you will prepare detailed in-depth analysis to predict, evaluate and manage the credit risk in the Bank’s various loan portfolios; work with senior management, marketing, and team members to develop, implement and validate products, programs and portfolio management strategies to minimize credit risk in loan products while optimizing financial returns. Qualified candidates will have: - 3 years’ experience in consumer credit risk management and analysis in a Bank or other Financial institution - Thorough knowledge of credit scoring and modeling systems, with experience in account acquisition and portfolio management - Must have strong analytical and computer skills with proven ability to convert large amounts of data into meaningful recommendations - Good communication skills - Experience working in a team environment Preferred candidates will have: - Leadership role in credit risk management department of a Credit Card Bank, Consumer Bank or Financial Institution with experience in Credit Risk Modeling, Scoring implementation and validation, and Portfolio management - Experience working with FDR, Adaptive, Control or TRIAD, SAS, SQL and MS Office Suite, database management software, FICO products - Track record of success in an organization committed to long term customer service In return, we offer a highly competitive salary and an impressive array of benefits, including: comprehensive health coverage, retirement and 401(k) plans, tuition assistance, on-site child development centers, annual leave, paid sick leave, company stores, casual business dress code, secured parking, on-site shuttle service and van pool, physical fitness centers and recreational facilities, on-site post office, cafeterias, investments, bonus programs and association privileges. Job Detail Asset Review Examiner The Jenn-Veasey Group, Inc. Cleveland, OH Loan work out Essential Job Functions: Forecasting of asset quality for the bank’s commercial portfolio. Involves gathering and summarizing non-accrual, allocation and charge-off information from regional managers and preparing and presenting forecast reports to senior management. Participating in Special Assets Loan review process, a key part of information gathering. Ability to identify, understand and summarize critical credit issues is required. Responsible for monitoring past due loans and processing regional nonaccruals and charge-offs and following up on general ledger to insure accuracy of transaction processed. Work closely with Credit Risk management to insure that monthly loan loss provision is reported accurately and timely. Maintain historical record of commercial loan charge-offs. Prepare various asset quality reports as requested by Senior Management. Experience/Requirements: Minimum of 5 years' experience in lending or credit administration. Strong analytical skills and proficient in use of word and excel. Knowledge of Access and a working knowledge of CL3 helpful. Quantitative and Financial Risk Analysts Swissrisk Zurich, Switzerland risk and investment management analytics Quantitative and Financial Risk Analysts Swissrisk is a leading provider of investment management related products and services in Switzerland and around the globe. Now entering an aggressive phase of growth we are looking for talented individuals to develop and further establish our position in this exciting market. In return, we offer a challenging and dynamic environment of openminded people committed to providing only the very best. Two posts are currently open: Senior quantitative analyst To support the head of product development and assist in the innovation, design and development of the latest financial analysis tools and products. Required skills include Knowledge of financial products and markets, financial risk management and analysis, data mining, manipulation and visualisation, working in English and German, mathematical proficiency, statistical analysis and data reduction, computing experience in most of the following: Windows, Unix, Excel, Visual Basic, C++, Java Financial Risk Analyst Design and prototype risk and portfolio analytics, back test and design of risk management systems, conduct financial market data research. Required skills include Bachelor degree or higher in a physical science , experience in a banking, finance or mathematical role, knowledge of financial products and markets, data mining, manipulation and visualisation, good knowledge of English, computing experience in Excel, Visual Basic, C/C++ Contact: Swissrisk AG Dr. Steven Bates Tel. +41 1 455 70 00 Head of Product Development Fax +41 1 455 70 01 Raeffelstrasse 32 Email: steven@Swissrisk.com 8045 Zürich Web: www.swissrisk.com Portfolio Manager III Bank One CHICAGO, IL Portfolio Manager III Bank One Corporation, one of the largest banks in the United States, offers a broad range of career opportunities and work settings across 14 states. With $265 billion in assets and 73,000 employees, Bank One serves millions of customers with a comprehensive range of banking services. However, we are more than just a bank. Our businesses range from investment and merchant banking to credit cards and insurance, as well as many non-bank products including financial planning, mutual funds, annuities and more. We aggressively seek talented, enthusiastic individuals who can help us achieve our mission of delivering superior financial services to businesses and consumers across the nation. We offer competitive salaries and a comprehensive benefits package. Credit Portfolio Manager will manage a segment of the Bank's overall middle market loan portfolio including monitoring individual assets and aggregate exposures. Responsibilities include managing risk/return of obligors, industries and market segments, setting appropriate risk/return pricing on new transactions and existing facilities, and developing distribution strategies through loan sales and structured vehicles. The ability to multitask while maintaining high attention to detail, the ability to work well with all types of people in a time sensitive environment, and the ability to make sound decisions within short time frames. Technical knowledge should include Word, Bloomberg, Access, Excel and other Commercial Bank systems. Individual should have a bachelor's degree with at least 7 years of capital markets or asset backed experience. MBA and familiarity with loan documentation preferable. Loan sales or portfolio sales a strong plus. Risk Analyst Senior Bank One CHICAGO, IL Risk Analyst Senior Bank One Corporation, one of the largest banks in the United States, offers a broad range of career opportunities and work settings across 14 states. With $265 billion in assets and 73,000 employees, Bank One serves millions of customers with a comprehensive range of banking services. However, we are more than just a bank. Our businesses range from investment and merchant banking to credit cards and insurance, as well as many non-bank products including financial planning, mutual funds, annuities and more. We aggressively seek talented, enthusiastic individuals who can help us achieve our mission of delivering superior financial services to businesses and consumers across the nation. We offer competitive salaries and a comprehensive benefits package. This individual will report to FVP Portfolio Analysis as a member of the Policy and Portfolio Analytics Group. (Focus of the group spans all products and businesses -- commercial, retail, credit card and investment management.) Individual responsible for leading and managing complex analysis and profiling of the overall risk position of the bank's businesses. Output supports senior management's understanding of and ability to manage that risk. Output will also drive the bank's readiness for and ongoing compliance with Basel 2 capital requirements being phased in over the next three years. This is a highly-analytical, data-driven position involving translating abstract risk principles into concrete measures and actions. Individual will need to design and test theoretical models and methodologies to measure, manage and mitigate risks and to support the determination of riskadjusted capital. The team will work closely with finance, audit and credit areas, as well as line and operational areas across the organization. Absolute requirements: high intelligence and an aptitude for mathematical modeling and analysis, combined with the ability to work semi-autonomously in a collegial, team environment. Ability to communicate complex ideas orally and in written form critical. Facility with databases and spreadsheets essential. Financial services experience strongly desired. It is the policy of Bank One and its affiliates to provide an equal employment opportunity to all applicants and employees in a harassment-free work environment without regard to race, color, religion, national origin, gender, age, disability, sexual orientation, alienage or veteran status. Credit Risk Analyst Trandon Associates New York, NY Major international bank seeks (2)individuals with 3+years Credit and Risk Management experience. The ideal candidate must have familiarity with loan pricing, portfolio analysis, expected and unexpected loss, incremental and marginal standard deviation, risk adjusted performance measurement, economic and regulatory capital and stress analysis, credit risk management, credit derivatives, market risk and special projects. Top Bonus and Benefits Salary To 90K Please e-mail resume in Word Format and include present or last salary. Scott Evans Trandon Associates, Inc. 535 5th Avenue-Suite 610 New York, NY 10017 PH:212-986-0200 FAX:212-986-0184 Recruiting@trandon.com Small Business Credit Analyst Empire Corporate FCU Albany, NY Empire Corporate Federal Credit Union, a $4.5 billion full service, wholesale financial institution has an opportunity for an individual to be responsible for analyzing the creditworthiness for small business loans to credit unions. Qualified candidate will be responsible for commonizing balance sheets, ratio analysis, structuring loan products, risk assessment and rate setting. Bachelor’s degree in Business Administration or related field. Previous credit analysis experience required. Must be able to work independently and maintain a high level of confidentiality. Excellent analytical, judgement, motivational and communication skills are required along with telephone etiquette, organizational and time management skills. Proficiency with Word and Excel. Access a plus. Our benefits include medical and dental insurance, a competitive compensation and retirement package, tuition assistance, vacation, fitness center, business casual environment and more! Qualified candidates can fax (518) 292-3799, e-mail jobs@empirecorp.org or send a resume with salary requirements to: EMPIRE CORPORATE FCU Attn: Human Resources 1021 Watervliet Shaker Road Albany, NY 12205 Mortgage Credit Risk Management Director Freddie Mac McLean, VA Please apply as per the instructions in the job description below Establish and oversee a risk management framework to increase the understanding of mortgage credit risks. and articulate risks through the design and documentation of new or revised mortgage credit policies. Direct divisional mortgage credit risk management issues. Stay abreast of mortgage market and competitor trends. design of contract credit terms and policy interpretations as needed. Support the development of mortgage cr management strategies by developing and implementing an effective process for identifying and understandi attribute relationships and results drivers. Oversee the development of routine systems for identifying, collec performance information /data. Continuously refresh information, processes and tools. Maintain inter-department/division process relationships. Oversee the deve strategy for Quality Control sampling methodology and development and maintenance of sampling and repo Promote effective implementation of the sampling policy into the QC underwriting operation. Develop conti QC underwriting findings with communication of this information to the front end to promote effective deci including both mortgage credit policies and Seller terms of business.Qualified candidates may apply via this app02g.fhlmc.com/HR/empcen.nsf/16c9eb00ea6f815985256a70004f47af/c6bba6c66fda9a2085256b840053 .Also visit us at www.freddiemac.com for more opportunities. Financial Engineer Fannie Mae Washington, DC Credit Policy Fannie Mae, a NYSE-traded Fortune 100 company, is the nation's largest source of home mortgage funds and one of the most consistently profitable corporations in America. Fannie Mae's extraordinary commitment to our employees has been recognized by numerous publications and organizations-including Fortune, Washingtonian and Computerworld magazines. Our compensation and benefits package is among the finest, and is designed to help our employees meet varying needs throughout their careers. Some of our more notable benefits include: 3-weeks' vacation to start, 12 holidays, paid volunteer leave (10 hours/month), employer assisted housing (forgivable loans for a portion of the home purchase price), employee stock purchase plan, and flexible work options (flex-time, teleworking, compressed schedule). Career growth. . . diversity. . . opportunity. . . Fannie Mae. Position Description:As a member of Credit Analytics team, this job requires the individual to work closely with members from other teams in Credit Policy, Portfolio Analytics and Research, and Single Family in developing and implementing of the new generation of credit analytics tools for managing the credit risk. The essential duties include:· Develop and implement new credit risk modeling components based on the corporate "common analytics platform" standard. · Build and maintain credit risk management applications based on the corporate sharable analytics tools and business user requests.· Build testing tools for validating and testing new credit analytics models and new credit risk management methodologies.· Support system documentation and ensure software development standard.· Interact with both internal and external group members and business users to help further understanding these new models / approaches and applying them in the business applications.· Investigate and use new technologies and tools as needed.The individual is expected to be a strong team player and be able to work on multiple projects. The individual will be accountable for the timeliness and quality delivery of the products. Position Qualifications At least 3 years experience in Object-Oriented analysis, design and C++ programming.Experience in UNIX and XML, and good PC skills. An advanced degree in a quantitative field, such as economics, finance, applied mathematics, physics, chemistry, statistics or computer science or an equivalent combination of education and /or experience.Demonstrated analytical and problem solving skills required.Demonstrated interpersonal, organizational and communication skills required.Experience in business and financial applications in secondary mortgage market highly desirable. SF Mortgage Business Fannie Mae, a NYSE-traded Fortune 100 company, is the nation's largest source of home mortgage funds and one of the most consistently profitable corporations in America. Fannie Mae's extraordinary commitment to our employees has been recognized by numerous publications and organizations-including Fortune, Washingtonian and Computerworld magazines. Our compensation and benefits package is among the finest, and is designed to help our employees meet varying needs throughout their careers. Some of our more notable benefits include: 3-weeks' vacation to start, 12 holidays, paid volunteer leave (10 hours/month), employer assisted housing (forgivable loans for a portion of the home purchase price), employee stock purchase plan, and flexible work options (flex-time, teleworking, compressed schedule). Career growth. . . diversity. . . opportunity. . . Fannie Mae. Through the use of our Credit Risk Model and other tools, provide guaranty fees for a variety of transactions including those that require credit enhancement. Provide analytical support on decisions regarding credit enhancement and new products. Responsibilities: Compute the credit risk premium for negotiated seasoned transactions and flow business. Analyze the credit risk associated with new homeownershipprograms and new mortgage products. Work cooperatively with Credit Policy to enhance our corporate credit risk pricing tool. Analyze the cash flow characteristics ofcertain transactions and determine their effect on revenue, loss, capital, and the firm's return on capital. Position Qualifications Masters degree in Finance or equivalent work experience in lieu of degree, with 3+ years of financial modeling. Spreadsheet skills with experience in programming. Derivatives & Structured Debt Trader Federal Home Loan Bank of Des Moines Des Moines, IA Analyze funding structures & execute trades We have an exciting newly created position for a qualified professional. If you have relevant experience in bank/corporate treasury or trading experience with exposure to domestic capital markets, asset/liability management, liquidity management, derivatives, swaps, and trade/settlement conventions then this might be a great fit for you. You will analyze funding structures & execute derivatives and structured debt transactions to fund 30 billion in assets. Requirements of the position are; -MS or MBA in finance, economics, or math and 3-5 years relevant experience or BS with 7-10 years relevant experience -3+ yrs using financial application systems -CFA preferred -Working knowledge of GAAP for investments, debt instruments, and fixed income derivative transactions. -Very strong quantitative background -Familiar with option pricing models and with Bloomberg, Reuters, Bridge -Strong communications & presentation skills The Federal Home Loan Bank of Des Moines is a privately owned government sponsored enterprise with $34.2 billion in assets. Our customers and stockholders are Banks, Thrifts, Insurance Companies, and Credit Unions. Our mission is to facilitate home ownership through service to our customers. Benefits include: life, medical and dental insurance; 401(k) plan with up to 100% company match; company paid pension plan; and more. Send a resume with cover letter and salary history to Human Resources, Home Loan Bank of Des Moines, 907 Walnut, Des Moines, Iowa 50309, or email to careers@fhlbdm.com. An Equal Employment Opportunity Employer. Sr Financial Analyst Fannie Mae Washington, DC SF Mortgage Business Fannie Mae, a NYSE-traded Fortune 100 company, is the nation's largest source of home mortgage funds and one of the most consistently profitable corporations in America. Fannie Mae's extraordinary commitment to our employees has been recognized by numerous publications and organizations-including Fortune, Washingtonian and Computerworld magazines. Our compensation and benefits package is among the finest, and is designed to help our employees meet varying needs throughout their careers. Some of our more notable benefits include: 3-weeks' vacation to start, 12 holidays, paid volunteer leave (10 hours/month), employer assisted housing (forgivable loans for a portion of the home purchase price), employee stock purchase plan, and flexible work options (flex-time, teleworking, compressed schedule). Career growth. . . diversity. . . opportunity. . . Fannie Mae. This position will serve as a Senior Financial Analyst in Product Development. Position will provide centralized support for product management, sales, marketing, risk management and quality control efforts of new product lines. This position will require a solid working knowledge of the internal FMIS workstations (LPP, Delinquency Tracking, Housing Goals, etc.). The ability to stratify and synthesis large amounts of data into high level summary statistics is critical. Essential Duties:Leadership:. Must possess strong leadership skills and serve as the primary contact for assigned projects.. Must be able to prioritize and manage multiple projects simultaneously. Must be able to influence and manage cross-functional projects.Strategic Thinking/Problem Solving: . Must take into consideration the corporate strategy in assessing the impact of new projects. . Develop solutions to new and complex issues. . Strong analytical and problem solving skills are required.Research/Decision Making: . Must be knowledgeable of secondary market principles, and be able to perform analysis and present well thought out options and recommendations.. Oversee sophisticated market, lender, and service provider based research projects, interpret results, devise corresponding market strategies, and present recommendations to executives. Relationship Management:. Establish and maintain contacts both internally and in lenders' organizations.. Excellent interpersonal skills are required to build productive relationships at all levels and across all departmental lines.May perform other duties as assigned. Position Qualifications Bachelor's degree in Finance, Marketing or related field, or equivalent work experience. MBA or comparable advanced degree preferred.Work Experience:. Minimum of five years of Mortgage Banking Industry experience in the secondary mortgage market.. Minimum of two years of project management experience.. Expert analytical, interpersonal, communication (written, verbal, and technical) and presentation skills. . Desire to work in a highly flexible team environment that relies heavily on crossfunctional interaction and external involvement.Working ConditionsNo unusual or special physical Sr Program Manager Fannie Mae Washington, DC Credit Policy Fannie Mae, a NYSE-traded Fortune 100 company, is the nation's largest source of home mortgage funds and one of the most consistently profitable corporations in America. Fannie Mae's extraordinary commitment to our employees has been recognized by numerous publications and organizations-including Fortune, Washingtonian and Computerworld magazines. Our compensation and benefits package is among the finest, and is designed to help our employees meet varying needs throughout their careers. Some of our more notable benefits include: 3-weeks' vacation to start, 12 holidays, paid volunteer leave (10 hours/month), employer assisted housing (forgivable loans for a portion of the home purchase price), employee stock purchase plan, and flexible work options (flex-time, teleworking, compressed schedule). Career growth. . . diversity. . . opportunity. . . Fannie Mae. 1. Support efforts to maintain and modernize Fannie Mae's Selling, Servicing, and Forms Guides, which we publish to inform lenders of our Single Family Business policies and procedural requirements. Efforts include:Actively working with business units and relevant Credit Policy staff to create new and/or revised Selling and Servicing policies. Coordinating efforts to effectively communicate Guide changes and updates to all relevant Guide users, both internal and external to the company.Assisting with efforts to modernize the Guide creation and communication process, including enhancing the look and structure of the Guides, and making the Guides more easily accessible via the web.2. Support efforts to ensure that Fannie Mae's Credit Risk Policy Committee provides the greatest possible contribution to the company's business decision making process. Efforts include:Assuring that meetings are scheduled and conducted in an efficient manner, and that Committee agendas are created in conjunction with, and to serve the needs of, the business units.Administering a reporting mechanism to document Committee activity/decisions and to assure that Committee approval contingencies are cleared in a timely and acceptable fashion.Participating in Committee-related communications to help convey Committee decisions and key issues to relevant parties throughout the company.Other duties as assigned. Position Qualifications 5+ years of experience in the mortgage industry (or related financial services) required. Knowledge of Fannie Mae policies, operations and systems preferred. Credit risk management or policy-setting experience required.Proven ability to write technical literature for publication or web-based delivery required (sample will be requested at interview). In-depth working knowledge of and hands-on practical experience with web technology, web design, and web development tools highly desirable.Excellent written and oral communication and interpersonal skills required, including the ability to interact effectively throughout the Fannie Mae hierarchy.Strong project management and execution skills required. Must possess demonstrated ability to meet deadlines and goals.Flexibility in handling tasks essential. Ability to grasp complex matters quickly and to identify salient issues a must.Bachelor's degree in Business, Economics, or related field (or equivalent work experience) required, MBA degree preferred. Fannie Mae is an equal employment opportunity/affirmative action employer that promotes work force diversity and hires without regard to race, color, religion, national origin, age, gender, marital status, disability Real Estate Accounting and Finance Trandon Associates New York, NY Our Real Estate clients are currently seeking several individuals for the following positions: Director of Accounting and Administration To 125K All aspects of accounting, finance, cost revenue and company wide administration. Combination of Controller/V.P. duties. Senior Real Estate Investment Accountant To 100K Real estate and investment accounting, asset management, foreign currencies, NAV, IRR calculations, analysis and special projects. Real Estate Assistant Controller To 90K Booming Real Estate company seeks and individual with an accounting degree and 4+years experience in Financial statements, General accounting, Budgeting,Cash Managements, MIS and Special projects. Prior supervisors experience a must. CPA a+ Tax Manager To 90K Multistate tax and accounting experience. Real estate exposure a must. REIT experience a plus. Oversee all tax research, correspondence and compliance. Property Accountant To 65K Commercial or residential property accounting exp. P&L's, cash flows and special projects. Rent Collections Specialist To 50K Collections and dispute resolutions collection and billing in commercial or retail real estate a must. Top Bonus and Benefits Please e-mail resume in Word Format and include present or last salary. Barbara Anderson Trandon Associates, Inc. 535 5th Avenue-Suite 610 New York, NY 10017 PH:212-986-0200 FAX:212-986-0184 Research Analyst Fannie Mae Washington, DC SF Mortgage Business Fannie Mae, a NYSE-traded Fortune 100 company, is the nation's largest source of home mortgage funds and one of the most consistently profitable corporations in America. Fannie Mae's extraordinary commitment to our employees has been recognized by numerous publications and organizations-including Fortune, Washingtonian and Computerworld magazines. Our compensation and benefits package is among the finest, and is designed to help our employees meet varying needs throughout their careers. Some of our more notable benefits include: 3-weeks' vacation to start, 12 holidays, paid volunteer leave (10 hours/month), employer assisted housing (forgivable loans for a portion of the home purchase price), employee stock purchase plan, and flexible work options (flex-time, teleworking, compressed schedule). Career growth. . . diversity. . . opportunity. . . Fannie Mae. Product Management Reporting: Design reports and models that contain performance information for monitoring and evaluating the effectiveness of current processes specific to new products. Work with cross-functional team to refine and enhance reports, models or processes. Design, test and implement new processes and/or enhance existing reports based on current business requirements. Risk analysis: Employ statistical methods to perform risk analysis; deliver findings to all required levels within the corporation; and advocate policy changes which impact performance. ·Data Analysis: Track and analyze market data and make risk and design recommendations. Research: Facilitate on-going research of designated products, services and processes. Ad-hoc Reporting: Create recurring and ad-hoc reports of research results. Position Qualifications Bachelor's degree in Finance, Statistics or related field, or an equivalent combination of education and experience. Three to five years of progressively responsible work experience in Research in the Mortgage and Credit Industry. Competence in conceptual or analytical skills. Excellent interpersonal and communication skills. Knowledge of SAS, MS EXCEL, Visual BASIC or VBA, and UNIX. Banking Analyst In Confidence Denver, CO Responsibilities of this position will include identifying, researching and building detailed financial models of potential stock selections for our Portfolio Management Team. Will be accountable for meeting with companies to assess earnings, private market valuation, forecast growth in sales and other potential growth factors. Will present potential stock selections to other Research Analysts and Portfolio Managers. Qualifications for this position include: Bachelor’s Degree in any field. Minimum 4 years previous experience within the financial division of a bank required. Previous experience within the treasury department of a bank strongly preferred. Strong knowledge of securitizations and an interest in the stock market a must. Must be highly analytical and able to assimilate a large amount of information very quickly. Ability to work independently in a fast paced environment and meet critical deadlines a must. Frequent travel will be required. Quantitative Analyst/Programmer Response Staffing Solutions New York, NY Equity Program Trading Desk in a midtown Manhattan bank is looking for 2 Quantitative Analysts. 1) Sr. Quant Analyst to develop quantitative models and price equity products. Must have 2+ years experience working with an equity trading desk. Experience working on a program trading desk is a plus. 2) Sr. Quant Analyst needs to have developing skills such as C/C++/Unix to actually implement and develop the models on the trading system. Will also look at an individual coming out of a "Quant Shop" with the developing experience. Candidate needs good communication skills. Salary commensurates w/ experience.