strategic

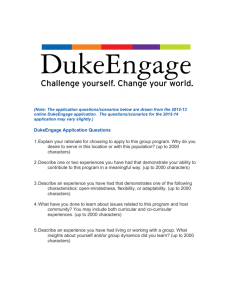

advertisement