A perpetuity that does not make payments for several years

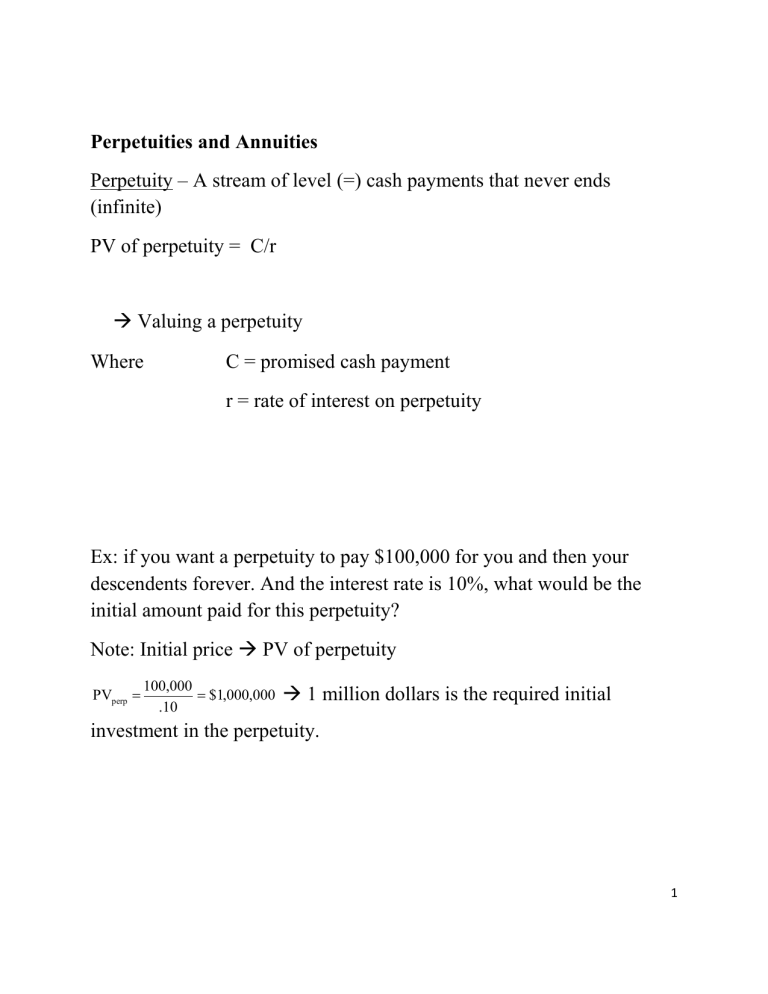

Perpetuities and Annuities

Perpetuity – A stream of level (=) cash payments that never ends

(infinite)

PV of perpetuity = C/r

Valuing a perpetuity

Where C = promised cash payment r = rate of interest on perpetuity

Ex: if you want a perpetuity to pay $100,000 for you and then your descendents forever. And the interest rate is 10%, what would be the initial amount paid for this perpetuity?

Note: Initial price

PV of perpetuity

PV perp

100,000

.10

$ 1 , 000 , 000

1 million dollars is the required initial investment in the perpetuity.

1

A delayed perpetuity – A perpetuity that does not make payments for several years

Valuing a delayed perpetuity:

Recall: In general: The discount factor

( 1

1

r ) t

Then

Accounts for discounting to find the PV of prepayments in the future

PV of a delayed perpetuity = C x 1

r (1 +r) t

In years “t” this becomes an ordinary perpetuity with payments starting the next year.

Ex: You donate $100,000 to MU to begin 4 years after graduation (with r = 10%).

1) How much will the endowment be worth in year 3?

2) What is the present value of this endowment?

1) In year 3 worth =

C r

2) PV of endowment =

100,000

.10

r(1

C

r) t

$ 1 , 000 , 000

100,000

.10(1.10)

3

$ 751 , 315

2

Valuing an Annuity:

Annuity – finite series of equal payments that occur at regular intervals

–

If the first payment occurs at the end of the period, it is called an ordinary annuity

–

If the first payment occurs at the beginning of the period, it is called an annuity due

PV of t-year annuity =

C

1

( 1

1 r ) t r

We call:

1

( 1

1 r ) t r

the annuity factor

3

Annuities and the Calculator

•

You can use the PMT key on the calculator for the equal payment

•

The sign convention still holds

–

Ordinary annuity versus annuity due → switch calculator between the two types by using the 2 nd BGN 2 nd Set on the TI

BA-II Plus (“begin” → annuity due, “end” → annuity).

–

Most problems are ordinary annuities

4

Annuities and Perpetuities – Formulas

Perpetuity:

PV = C / r

Annuities:

PV

FV

C

1

C

( 1

( 1 r r r

1

) t r ) t

1

Annuity Due:

PV

FV

C

1

C

( 1

( 1

1

r ) t r r r

) t

( 1

1

1

r ) r

5

Ex: Annuity pays $4000/year at the end of each of the next 3 years and the discount rate is 10%.

PV of t-year annuity =

C

1

( 1

1 r ) t r

=

4000 [(1 – 1/(1.10)

3

] r

= 4000 x 2.48685 = $9,947.41

Note: We could have found answer another way

PV

payment 1

(1

r)

payment 2

(1

r)

2

payment 3

(1

r)

3

=

4000

(1.10)

4000

(1.10)

2

4000

(1.10)

3

= 3,635.36 + 3,305.79 + 3,005.26

= $9,947.41

0 1 2 3

Time (years) 10% PV

1 / r

0 $4000 $4000 $4000

On the calculator:

6

Ex: Annuity – Sweepstakes

•

Suppose you win the Publishers Clearinghouse $10 million sweepstakes. The money is paid in equal annual installments of

$333,333.33 over 30 years. If the appropriate discount rate is 5%, how much is the sweepstakes actually worth today?

PV = $333,333.33[1 – 1/1.05

30 ] / .05 = $5,124,150.29

On the calculator:

Annuity: Finding the Payment (C)

•

Suppose you want to borrow $20,000 for a new car. You can borrow at 8% per year, compounded monthly (8/12 =

.666666667% per month). If you take a 4-year loan, what is your monthly payment?

$20,000 = C[1 – 1 / 1.0066667

48 ] / .0066667

C = $488.26

On the calculator:

7

Annuity: Finding the Number of Payments (t)

•

Start with the equation and remember your logs.

Ex: Suppose you borrow $2,000 at 5% and you are going to make annual payments of $734.42. How long is it before you pay off the loan?

$2,000 = $734.42(1 – 1/1.05

t ) / .05

.136161869 = 1 – 1/1.05

t

1/1.05

t = .863838131

1.157624287 = 1.05

t

t = ln(1.157624287) / ln(1.05) = 3 years

On the calculator:

8

Ex. Finding the Interest Rate: Suppose you borrow $10,000 from your parents to buy a car. You agree to pay $207.58 per month for 5 years.

What is the monthly interest rate?

On calculator:

Annuity – Finding the Rate Without a Financial Calculator

•

Trial and Error Process

–

Choose an interest rate and compute the PV of the payments based on this rate

–

Compare the computed PV with the actual loan amount

–

If the computed PV > loan amount, then the interest rate is too low

–

If the computed PV < loan amount, then the interest rate is too high

–

Adjust the rate and repeat the process until the computed PV and the loan amount are equal

9

Future Values for Annuity vs Annuity Due

•

Suppose you begin saving for your retirement by depositing $2,000 per year in an IRA. If the interest rate is 7.5%, how much will you have in 40 years?

Annuity Due

•

You are saving for a new house and you put $10,000 per year in an account paying 8%. The first payment is made today. How much will you have at the end of 3 years?

10

Effective Annual Rate (EAR) - the actual rate paid (or received) after accounting for compounding that occurs during the year

• to compare two alternative investments with different compounding periods you need to compute the EAR

Annual Percentage Rate (APR) -the annual rate that is quoted by law

APR = (period rate) x (number of periods per year)

•

To get the period rate we rearrange the APR equation:

Period rate = APR / number of periods per year

Ex: What is the monthly rate if the APR is 12% with monthly compounding? 12% / 12 = 1%

Future Value in One Year and Compounding Frequency of $100 at

12 percent

# of Period

Periods Interest Rate FV Equation

Annual 12% $100 x 1.12

1

Semiannual

Quarterly

Monthly

Daily

Hourly

6

3

1

0.032877

0.001269

FV

$112.00

100 x 1.06

2

100 x 1.03

4

100 x 1.01

12

112.36

112.55

112.68

100 x 1.00032877

365 112.748

100 x 1.0000136986

8760 112.749

11

EAR – Formula:

1 m m

Where APR is the quoted rate, and m is the number of compounds per year

When is the EAR higher than the APR?

APR Compounding Periods

5%

5

5

9

9

12

12

1

4

12

4

12

4

12

Equation

(1 + 0.05/1) 1 – 1

(1 + 0.05/4) 4 – 1

(1 + 0.05/12) 12 – 1

(1 + 0.09/4) 4 – 1

(1 + 0.09/12) 12 – 1

(1 + 0.12/4) 4 – 1

(1 + 0.12/12) 12 – 1

= EAR

5.00%

5.09

5.12

9.31

9.38

12.55

12.68

12

EVALUATING CREDIT CARD OFFERS

The first credit card charges a 16 percent APR. An examination of the footnotes reveals that this card compounds monthly. The second credit card charges 15.5 percent APR and compounds weekly. Which card has the lower effective annual rate?

Solution:

Compute the EAR of each card to compare them in common (and realistic) terms. The first card has an EAR of:

The EAR of the second card is:

13

Loan Types

1. Pure Discount Loans – borrower receives $ today and repays single lump sum in future.

•

Ex. Treasury bills (T-bills)- US govt promise to pay (1 year or less). The principal amount is repaid at some future date, without any periodic interest payments.

•

If a T-bill promises to repay $10,000 in one year, and the market interest rate is 7 percent, how much will the bill sell for in the market?

2. Interest-Only Loan- borrower pays interest each period and repays the principle at a specified time in the future.

•

Consider a 5-year, interest-only loan with a 7% interest rate. The principal amount is $10,000. Interest is paid annually.

–

What would the stream of cash flows be?

•

Years 1 – 4: Interest payments of .07($10,000) = $700

•

Year 5: Interest + principal = $10,700

•

This cash flow stream is similar to the cash flows on corporate bonds and we will talk about them in greater detail later.

14

3. Amortized Loan with Fixed Payment - Each payment covers the interest expense; plus, it reduces principal.

Ex: Consider a 4-year loan with annual payments. The interest rate is

8% and the principal amount is $5,000.

–

What is the annual payment? Use formula for PV of annuity

•

$5,000 = C[1 – 1 / 1.08

4 ] / .08

•

C = $1,509.60

Calculator: 4 =N, 8 =I/Y, 5,000= PV, CPT PMT = -1,509.60

Ex: Amortization Table

Year

1

2

Beg.

Balance

Total Payment

5,000.00 1,509.60

Interest Paid

400.00

3,890.40 1,509.60 311.23

Principal

Paid

1,109.60

1,198.37

End.

Balance

3,890.40

2,692.03

3 2,692.03 1,509.60 1,397.79

4

Totals

1,397.79 1,509.60

6,038.40

215.36

111.82

1,038.41

1,294.24

1,397.78

4,999.99

.01

15