ECON 311 - Intermediate Macroeconomics (Professor Gordon)

advertisement

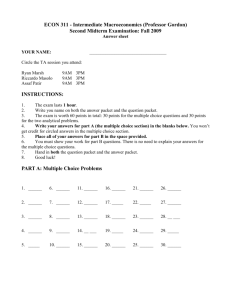

ECON 311 - Intermediate Macroeconomics (Professor Gordon) Second Midterm Examination: Fall 2008 Answer sheet YOUR NAME: ___________________________________ Circle the TA session you attend: Briana Chang Brian O’Quinn Assaf Patir 9AM 9AM 9AM 3PM 3PM 3PM INSTRUCTIONS: 1. The exam lasts 1 hour. 2. The exam is worth 60 points in total: 30 points for the multiple choice questions and 30 points for the two analytical problems. 3. Write your answers for part A (the multiple choice section) in the blanks below. You won’t get credit for circled answers in the multiple choice section. 4. Place all of your answers for part B in the space provided. 5. You must show your work for part B questions. There is no need to explain your answers for the multiple choice questions. 6. Only hand in the answer packet. 7. Good luck! PART A: Multiple Choice Problems Answer multiple choice questions in the space provided below. USE CAPITAL LETTERS. 1. __C____ 6. ___C___ 11. ___A___ 16. __D____ 21. __C____ 26. ___C___ 2. ___A___ 7. ___D___ 12. ___D___ 17. __D___ 22. __D___ 27. ___B___ 3. ___B___ 8. ___C___ 13. ___A___ 18. __C____ 23. __C____ 28. __ D___ 4. ___C___ 9. ___A___ 14. __ A___ 5. ___A__ 10. ___E___ 19. __A___ 24. __B____ 29. __C___ 15. __C____ 20. __D____ 25. __A____ 30. __D____ PART B: Analytical Problems PROBLEM 1 (15 points): Let the following equations represent the structure of a small open economy with a flexible exchange rate: C = CA + 0.6(Y-T) CA = 500-20r T = 100+0.1Y (M/P)D = 0.25Y-20r MS/P = 520 IP = 500-40r G = 1000 NX = 550-0.04Y-150e (A) Initially let foreign and domestic interest rates be equal so that r = rf and let the foreign exchange rate e equal 3. 1) Find the IS and LM equations. (4 points) k = 1/[(1-0.6)(1-0.1)+0.1+0.04] = 2 AP = 500-20r-0.6(100)+500-40r+1000+550-150e= 2490-150e-50r=2040-60r IS: Y=k*AP = 2(2040-60r) =4080-120r LM: MS/P=(M/P)D => 520= 0.25Y-20r => Y = 2080+80r 2) Find the equilibrium domestic and foreign interest rates and the equilibrium output. (2 points) Solve IS and LM simultaneously, 2080+80r = 4080-120r r= rf =10 Y = 4080-120(10) = 2880 (B) Suppose the fiscal policymakers increase government spending (G) by 150. Assume that there has been no change in the real money supply. 1) Given that there has been no change in the real money supply, compute the level of real output that equalizes the domestic and foreign interest rates. (4 points) Since there is no change in the real money supply, the LM curve is the same as part A): LM: Y = 2080+80r In a small open economy, the domestic and foreign exchange rates must be equal. So, r=10 The final true equilibrium interest rate is 10% and output Y = 2080+80(10) =2880 Notice that IS curve has to shift back in this case. You can not use the temporary IS curve to calculate to final equilibrium output. 2) Find the new foreign exchange rate that equalizes domestic and foreign interest rates. (4 points) (4 points) Since the final equilibrium is the same as part A), IS curve has to remain the same. ∆ Ap = 0 = ∆G-150 ∆e = 150-150 ∆e =>∆e = 1 e’= 3+ 1= 4 (C) Judging from the answers you gave in part B, is fiscal policy effective or impotent in changing the level of real income in a flexible exchange rate system? (1 point) Fiscal policy is impotent. PROBLEM 2 (15 points): (A) Write down the numerical SP equation using the following information. Be sure to remember that supply shocks enter into this. (2 points) A one unit change in the logarithm of the output ratio leads to a 4 unit change in the actual inflation rate Expected inflation is given by the relation: pe = 0.6p-1 + 0.4pe-1 p = pe + gŶ + z p = 0.6p-1 + 0.4pe-1 + 4Ŷ + z (B) Derive the general DG equation, Ŷ = Ŷ-1 + x̂ - p, starting from X ≡ PY. Be sure to define all new variables introduced. Recall that y-yN = Ŷ - Ŷ-1. (4 points) (C) Find p as a function of p-1, pe-1, Ŷ-1, x̂ , and z given a different SP equation p = p-1 + Ŷ + z. (1 point) p 1 p 1 Yˆ1 xˆ z 2 (D) Complete the next two segments using the following information. We now introduce an entirely new set-up for use in part D. The new expected inflation is given by the relation: pe = 0.8p-1 + 0.2pe-1 The new SP equation is given by p = 0.8p-1 + 0.2pe-1 + (1/3)Ŷ + z In period 0, the economy is in long run equilibrium with x̂ = p-1 = pe-1 = 8 and z0 = 0. The economy experiences supply shocks in periods one and two according to z1 = -4 and z2 = 2. 1. Starting from the long run equilibrium described above in period 0, assume that beginning in period 1, x̂ drops permanently to 4. Note that there are beneficial and adverse supply shocks as well as a decrease in x̂ . Complete the following table. (4 points) Period (t) p et-1 pt-1 Ŷt-1 x̂t p et pt Ŷt zt 0 8 8 0 8 8 8 0 0 1 8 8 0 4 8 4 0 -4 2 8 4 0 4 4.8 6.1 -2.1 2 2. Starting from the original assumptions in part D (that is, dropping the assumption regarding x̂ falling to 4), suppose the economy is following an extinguishing policy beginning in period 1. Complete the following table. (4 points) Period (t) p et-1 pt-1 Ŷt-1 x̂t P et pt Ŷt zt 0 8 8 0 8 8 8 0 0 1 8 8 0 20 8 8 12 -4 2 8 8 12 -10 8 8 -6 2 PART A: Multiple Choice Problems 1. If a country’s private saving is 100 and government saving is –100, domestic private investment (a) must be 200. (b) must be zero. (c) is equal to the net amount the economy borrows from other countries. (d) is equal to the net amount the economy lends to other countries. Answer: C 2. An increase in tax revenues _____ government saving and _____ national saving. (a) raises, raises (b) raises, lowers (c) lowers, raises (d) lowers, lowers Answer: A 3. Actual output exceeds the natural output when (a) the actual budget deficit is above the structural deficit. (b) the actual budget deficit is below the structural deficit. (c) the structural deficit is positive. (d) the structural deficit is negative. Answer: B 4. Which of the following terms regarding the economic situation of 2007-08 has not been used in class: (a) meltdown (b) multiplier (c) disinflation (d) under water Answer: C 5. In the course packet reading about Japan, which of the following is not recommended as a desirable policy change? (a) cutting taxes (b) fewer subsidies to farmers (c) lower tariffs on imported food (d) greater fiscal rectitude Answer: A 6. In a small open economy, when exports exceed imports, all of the following must be true except: (a) net capital outflows are positive (b) net exports are positive (c) domestic investment exceeds domestic saving (d) domestic output exceeds domestic spending Answer: C 7. The current account includes all of the following except: (a) net exports (b) net income from abroad (c) net unilateral transfers (d) net purchases of foreign assets Answer: D 8. Why is United States income from abroad positive? (a) The U.S. is purchasing more foreign assets abroad than foreigners purchase assets in the U.S. (b) U.S. current account is negative (c) The U.S. earns a higher rate of return on its assets owned abroad than foreigners earn on assets owned in the U.S. (d) The U.S. capital account is negative Answer: C 9. The purchasing power parity theory (PPP) of the exchange rate implies that the real exchange rate between two countries (a) should be constant. (b) should rise when the foreign price level increases relative to the domestic price level. (c) should fall when the foreign price level decreases relative to the domestic price level. (d) (b) and (c). Answer: A 10 Which of the following helps to explain the failure of Roosevelt’s New Deal to end the Great Depression prior to the outbreak of World War 2? (a) attempt to raise wages and prices (b) invention of Federal Deposit Insurance (c) natural employment budget was in surplus not deficit (d) job creation programs such as Works Progress Administration (e) (a) and (c) (f) (c) and (d) Answer: E 11 Which of the following does not characterize the period between July and November 2008? (a) depreciation of dollar (b) higher unemployment rate (c) lower oil prices (d) decline in payroll employment (e) positive contribution of net exports to real GDP growth Answer: A 12. With perfect capital mobility, a Fed policy that lowers the U.S. interest rate below the foreign rate causes a huge capital _______ that puts pressure on the dollar to _____________. (a) inflow, appreciate (b) inflow, depreciate (c) outflow, appreciate (d) outflow, depreciate Answer: D 13. The central bank is forced to accommodate fiscal policy under _________ exchange rates, which makes fiscal policy a ________ influence on equilibrium income. (a) fixed, powerful (b) fixed, powerless (c) flexible, powerful (d) flexible, powerless Answer: A 14. Which of the following is not a criticism of the theory of purchasing power parity? (a) Countries can each have different rates of inflation. (b) Countries can discover new natural resources like oil which is traded internationally. (c) Governments can impose tariffs on imports. (d) The price index of a country includes goods and services not traded internationally. Answer: A 15. Suppose that a British drug manufacturer develops a cure for cancer and offers it to the global market. This implies that, in the foreign exchange market, (a) this would increase demand for dollars. (b) this would decrease demand for dollars. (c) this would increase the supply of dollars. (d) this is a fundamental factor which would cause the dollar to appreciate. Answer: C 16. Under the assumption of perfect capital mobility, a small open economy (a) can control its interest rate through either fiscal or monetary policy. (b) can control its interest rate only through fiscal policy. (c) can control its interest rate only through monetary policy. (d) cannot control its interest rate through either fiscal or monetary policy. Answer: D 17. Which of the following did not deepen and prolong the Great Depression during 1929 to 1933? (a) Hoover tax increase of 1932 (b) Devaluation of British pound in 1931 (c) Federal Reserve allowed money supply to decline (d) Devaluation of U. S. dollar in 1931 Answer: D 18. Based on your course packet reading in connection with Chapter 8, on what would you blame higher inflation in 2008 (so far) as compared to 2007? (a) Bernanke-led excess monetary expansion (b) Bush-led excess fiscal deficits (c) Higher oil and food prices (d) Lower unemployment Answer: C 19. The long-run aggregate supply curve is (a) vertical at the natural level of output. (b) horizontal at the natural price level. (c) upward-sloping for all income levels below the natural level of output. (d) downward-sloping for all income levels above the natural level of output. Answer: A 20. A single aggregate demand curve records how IS-LM equilibrium output changes as _____________ changes. (a) the IS curve (b) the nominal money supply (c) government expenditure (d) the price level Answer: D 21. Because of __________ marginal product of labor, the labor demand curve slopes ________. (a) rising, upward (b) rising, downward (c) diminishing, downward (d) diminishing, upward Answer: C 22. The term monetary impotence refers to the (a) failure of firms to lower prices even when wages are falling (b) problems that an economy faces when industries are not perfectly competitive and prices do not fluctuate (c) failure of fiscal policy to drive down prices in a depression (d) inability of an increase in real balances to raise the level of output Answer: D 23. The quantity theory of money is based on the quantity equation and what key assumption? (a) wage rates are flexible (b) only cash, currency, and demand deposits are considered money (c) the velocity of money is relatively stable (d) the money supply grows at a steady rate over the long run Answer: C 24. Falling prices tend to redistribute income from ___________, which plausibly ________ the Pigou effect. (a) debtors to creditors, reinforces (b) debtors to creditors, weakens (c) creditors to debtors, reinforces (d) creditors to debtors, weakens Answer: B 25. If nominal GDP growth has accelerated permanently (assuming Y(N), is constant) (a) real GDP must keep growing until the inflation rate equals the growth rate of nominal GDP. (b) real GDP will increase by the same percentage that nominal GDP increased. (c) real GDP must keep growing until the rate of growth of real GDP equals the inflation rate. (d) the level of real GDP will be permanently increased. Answer: A 26. The growth of nominal GDP (a) can be broken down into the growth of the price level times the growth of real GDP. (b) is equal to the index of prices times the level of real GDP. (c) can be broken down into the growth of money supply plus the growth of velocity. (d) is the same as the growth of aggregate supply. Answer: C 27. In constructing the short-run Phillips curve, SP, (a) real wages are fixed. (b) expected inflation is fixed (c) nominal wages are fixed. (d) raw materials prices are fixed. Answer: B 28. “Okun’s Law” refers to (a) (b) (c) (d) the trade-off between inflation and unemployment. the relationship between real and nominal output growth. minimum wage laws and the impact of price controls. the relationship between the unemployment rate and the ratio of actual to natural output. Answer: D 29. A counterclockwise loop spiraling downward in the SP/LP diagram is the dynamic process typical of ___________ policy with inflationary expectations that ________ adjust. (a) inflationary, are slow to (b) inflationary, instantly (c) disinflationary, are slow to (d) disinflationary, instantly Answer: C 30. Which of the following are not causes of higher worldwide grain prices in 2008? (a) Indian ban on export of wheat (b) Drought cutting grain production in China (c) Economic growth in India and China (d) Legislation requiring ethanol in gasoline Answer: D